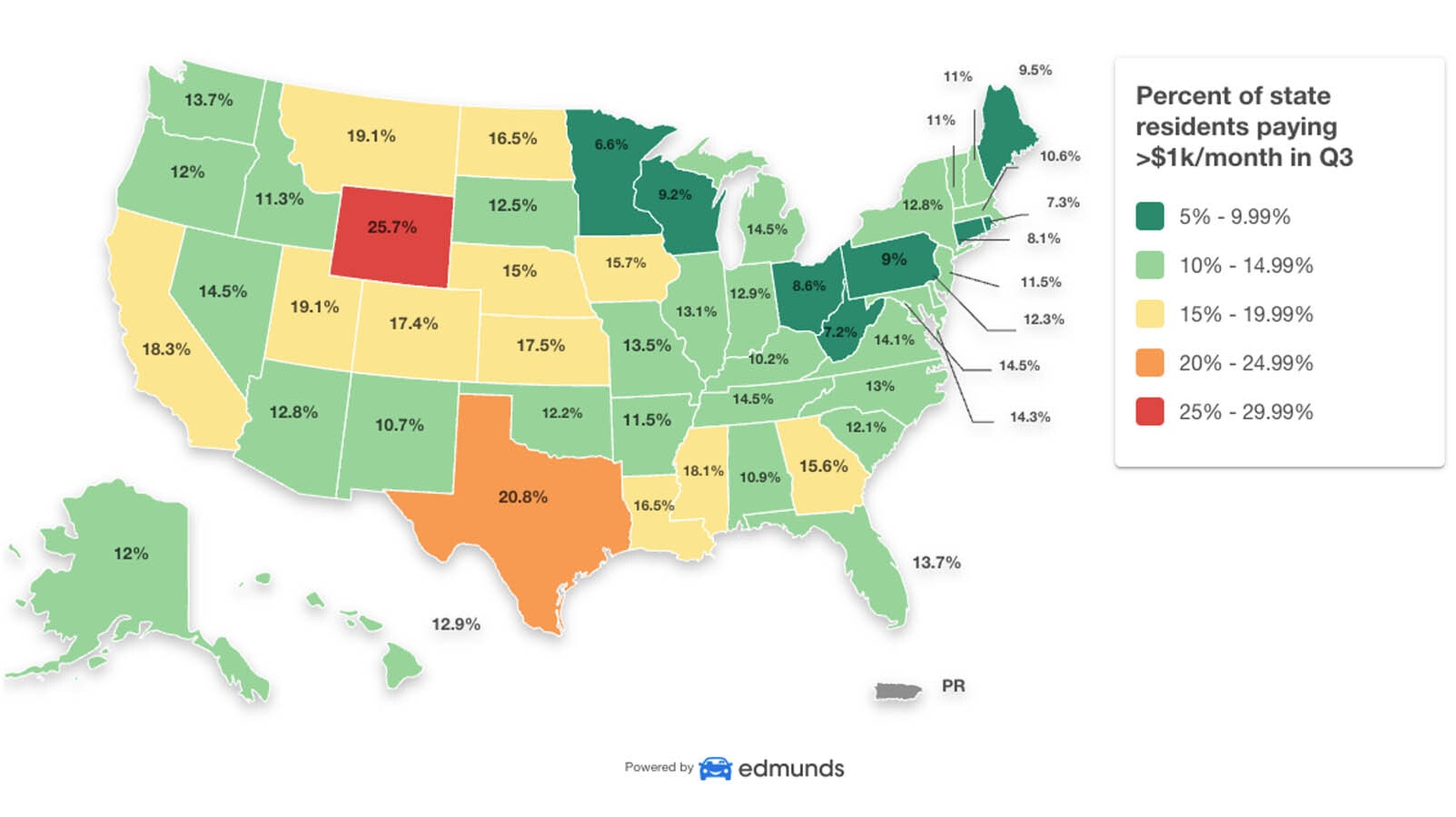

Between July 1 and Sept. 30, more than one in four Wyomingites financed a new car purchase with payments over $1,000 per month, according to research by Edmunds, an online car shopping resource. That’s the highest ration in the nation.

High prices and interest rates are part of the reason, but it’s also the popularity of big trucks that put the Cowboy State in the highest position.

Temporary Inventory

Buying a new car has been a challenge this year because inventories are slim, which also has kept prices high.

Chris Shelledy, new car manager at White’s Frontier Motors in Gillette — a Buick, Chevrolet, GMC dealership — said the company has 18 trucks on the lot currently, up from three last month.

Shelledy said new trucks are always in demand and typically don’t stay on the lot long.

“They’re typically sold before they get here. Somebody has a hold on it, puts a deposit on it and wants it as soon as it arrives,” Shelledy said.

Scott Larsen, marketing director for Yellowstone Motors LLC in Powell, a Toyota dealership, said the inventory there is “incrementally better.”

As with many dealerships, demand is ready to pounce on any supply.

“We have some new Toyotas on the lot, and we expect that to be a temporary situation,” Larsen said.

He said auto inventories are nowhere near the levels they were three years ago before the pandemic scrambled supply chains.

“Yeah, inventories are up, because when your inventory is zero, everything’s up from there,” Larsen said.

Big Truck States

Texas had the second highest rate, at 20.8% of new car purchases with monthly payments over $1,000, and Utah came in third at 19.1%. Like Wyoming, consumers in Utah and Texas like large trucks.

Rhode Island had the lowest percentage in that category.

Across the nation, 14.3% of consumers agreed to $1,000 monthly payments for their new car purchases during the three-month period, which was the highest percentage ever recorded in Edmunds’ data. Whether consumers are buying a new F-150 or a Nissan Leaf, prices and interest rates are up for everyone.

Average 72-month APR in Wyoming for October was 6.33%, which was about average for the nation. Nationally, the rate was up from 5.1% in May.

Despite the high interest rates, purchase price and gas prices, Americans want big vehicles.

“In the past decade, we’ve seen Americans embrace a bigger-is-better mindset by gravitating toward larger vehicles with more creature comforts, technology-heavy features and, more recently, electrified powertrains — but that all comes with added cost,” said Jessica Caldwell, Edmunds’ executive director of insights, in a statement on the report.

Makes And Models

The Ford F-150, Ram 1500 and Chevrolet Tahoe topped the list of models by market share of all vehicles with monthly payments over $1,000 on new purchases.

The BMW X5 was the top of the list for the percentage of the model in which new purchases were financed at the $1,000 per month mark, followed closely by the Chevrolet Suburban.

When it comes to models in the $1,000 club, Porsche topped the list, followed by Land Rover.

According to Edmunds, the $1,000 per month payment on new car financing is likely to become the new normal.

“With few lease or finance incentives expected from automakers in the coming months, and yet another rate hike by the Fed anticipated in November, we expect that monthly payments topping $1,000 will become even more common,” said Ivan Drury, Edmunds’ director of insights.