Wyoming lawmakers on Tuesday advanced a state Constitution amendment proposal that, if enacted and approved by the voters, would remove the Constitution’s structures for property taxes.

Looking back two days later, the legislative Joint Revenue Committee’s two chairmen say that draft takes the call for property tax reform too far. They said they will seek to ratchet back the proposal at the committee’s August meeting.

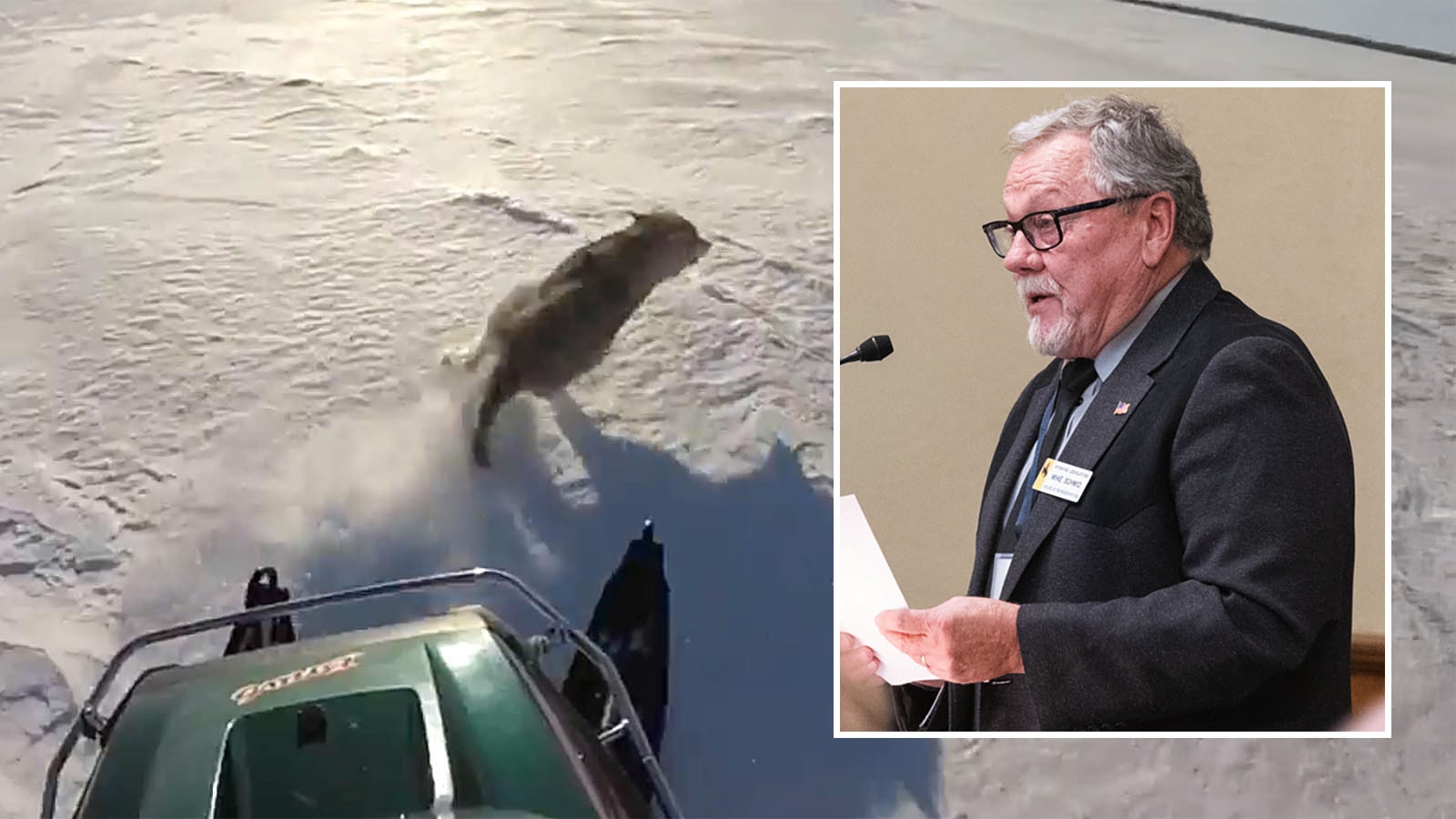

Sen. Bob Ide, R-Casper, called for the constitutional amendment draft at the end of Tuesday’s meeting in Gillette, after lamenting the myriad caps and exemptions the state recently passed to reduce residential property taxes for homeowners.

“We’ve got layers upon layers of exemptions, you know,” Ide said during the meeting. “We’ve got caps. We’ve got refunds. We’ve got sunsets (expiration dates for laws). We’ve got primary residence (requirements).”

Ide continued to list specifications in the law.

“For the common person to understand what their property taxes are, you’d have to hire teachers,” he said.

Ide bemoaned what he called a policy of inflation from the national level of governance, driving home values unpredictably and with them, property taxes.

He made a motion “to eliminate, repeal, Section 15 of the (Wyoming) Constitution entirely.”

Legislative Service Office senior staff attorney Josh Anderson asked Ide if he meant Article 15 of the Wyoming Constitution and if Ide would rather just repeal the portions of that article referencing property taxes.

“Because there are provisions in there that are not related to the property tax,” said Anderson.

For example, Section 8 of that article prohibits people from making profits from public funds.

Ide confirmed that he only wanted to address property taxes.

He did not narrow his directive to just residential property taxes, so as it stood, Ide’s draft would also seek to repeal the Wyoming Constitution’s call for taxation of industrial, mineral and other property.

Ide did not immediately respond to a Thursday phone message request for additional comment.

The committee’s two co-chairs, Sen. Troy McKeown, R-Gillette, and Rep. Tony Locke, R-Casper, both voted in favor of Ide’s draft. It advanced by an 11-3 vote with only Sens. Cale Case, R-Lander, Stephan Pappas, R-Cheyenne, and Rep. Liz Storer, D-Jackson, opposed.

Looking back, neither co-chair intended to take it that far, they said

“I don’t think we really did exactly what we were intending to do,” Locke told Cowboy State Daily on Thursday, adding that it was late in the day and the committee’s discussion had been tunnel-focused on residential, not industrial and other kinds of property taxes. “(It was) literally not my intent to remove property taxes from the constitution.”

Locke’s goal, rather, is to remove constitutional constraints on legislative reform of residential property taxes so lawmakers can have more freedom to craft those structures, he said.

Still, added Locke in a follow-up interview, he believes the initial draft is a way to open the discussion. The Legislature’s next session doesn’t start until Feb. 9.

McKeown said eliminating Wyoming’s property taxes is “not the goal.”

At the committee’s Aug. 21-22 meeting, “we’ll go through each section of Article 15” and narrow that draft, he said.

McKeown’s goal is to get rid of residential property tax and convert it to a consumption-based tax, he said.

Free-Wheeling

Sen. Cale Case, R-Lander, appeared aware of the initial bill draft’s potential ramifications, and he derided them, both in the meeting and in his Thursday interview.

No, removing the constitution’s call for property taxes doesn’t outlaw collection of them, Case noted. But it could open Wyoming up to drastic taxation overhauls that haven’t been well analyzed, he said.

If the intent is to equalize counties’ revenues, there’s no promise that shifting to a consumption-based tax would do that, he added.

“And just to say, ‘Well, take the words out of the Constitution,’ (will spark) a popular bandwagon for this,” Case said in an interview Thursday. “People would love (eliminating property taxes), but what will they get in its place? They have no idea.”

He also theorized the new structure wouldn’t be as deferential to local governance:

County governments pull industrial and mineral property taxes from the industries that operate in their counties. Without the Constitution’s framework, said Case, it would be a hard sell for the Legislature to get a county that’s hosting oil wells or wind turbines in its backyard to share its revenue from those property taxes with the rest of the state.

Lastly, said Case, removing property taxes altogether to address the current, confusing state of their many exemptions is “an enormously naïve way to approach legislation… Poor work leads to poor work.”

The Numbers

Wyoming doesn’t have an income tax.

Property tax collections in the state for fiscal year 2024 were $2.057 billion, according to a presentation the Wyoming Department of Revenue submitted to the committee.

Wyoming’s sales and use tax collections from that year were roughly $1.3 billion, the presentation says.

Severance tax collections amounted to $748.3 million - a figure that includes taxes on gas, coal, oil, trona, uranium and other valuable deposits.

Lodging taxes amounted to $63.8 million.

Gasoline taxes raised $77.9 million, special fuels raised $91.4 million, cigarette, tobacco and liquor taxes raised $39.6 million; and wind generation taxes raised $4.4 million, the presentation says.

The Confusion

Property tax reform was a top voter issue ahead of the 2024 General Election. Also in that election, voters approved a Constitutional amendment letting the Legislature treat residential property taxes as their own category.

The Legislature in 2024 passed a law giving a residential property tax exemption of 50% of the assessed home value for long-term homeowners over 65 years old, who have paid property taxes in Wyoming for 25 years or more. It passed another law expanding the application of the property tax refund program, and another giving a property tax exemption for residential structures and land – exempting any amount of assessed value comprising more than a 4% jump in value from the prior year.

The state passed another law increasing the amount of the property tax exemption for veterans.

In 2025, Wyoming revised its personal property valuation and exempted the first $75,000 of business property in any county from taxation.

It established a homeowner property tax exemption of 25% of the first $1 million in a home’s fair market value. That exemption, starting in 2026, will only apply to a single-family residential structure where the person claiming the exemption actually lives there for eight months of the year, according to another Department of Revenue document presented to the committee.

Second Homes, Richest County

Rep. Gary Brown, R-Cheyenne, asked for a bill draft removing the eight-month requirement. The committee advanced that draft, over Storer’s objections.

The resident of Teton County, which is the state’s wealthiest county and averages $5 million home values in its county seat of Jackson, worried that Wyoming would be giving a break to vacation homeowners with that change.

“So essentially we’re giving tax breaks to people who don’t need them,” said Storer. “I just don’t really understand it.”

Rep. Ann Lucas, R-Cheyenne, made another motion to remove the sunset date from the long-term homeowners’ property tax exemption.

That exemption is set to expire July 1, 2027, if Lucas’ bill draft doesn’t become law.

The committee also advanced her draft.

Clair McFarland can be reached at clair@cowboystatedaily.com.