Pennies still find use at the Diamond Horseshoe Café in Cheyenne, where some of the clientele prefer to pay their breakfast and lunch tabs in cash.

The use of pennies is in spite of the fact that owner Kendra Scott has rounded her menu to the nearest nickel in hopes of avoiding them. But when her payment system calculates the sixth penny sales tax, that invariably injects at least a few pesky pennies into the transaction.

That has Scott wondering what a business world without pennies actually looks like for her breakfast and lunch cafe, particularly when the final transaction adds up to something like say, $6.36.

“Am I going to take the loss? Or am I going to take $6.40 from the customer?” she said.

It’s a question she might need to answer sooner, rather than later, with a bill now circulating in Congress that seeks to make the production of money-losing pennies a thing of the past.

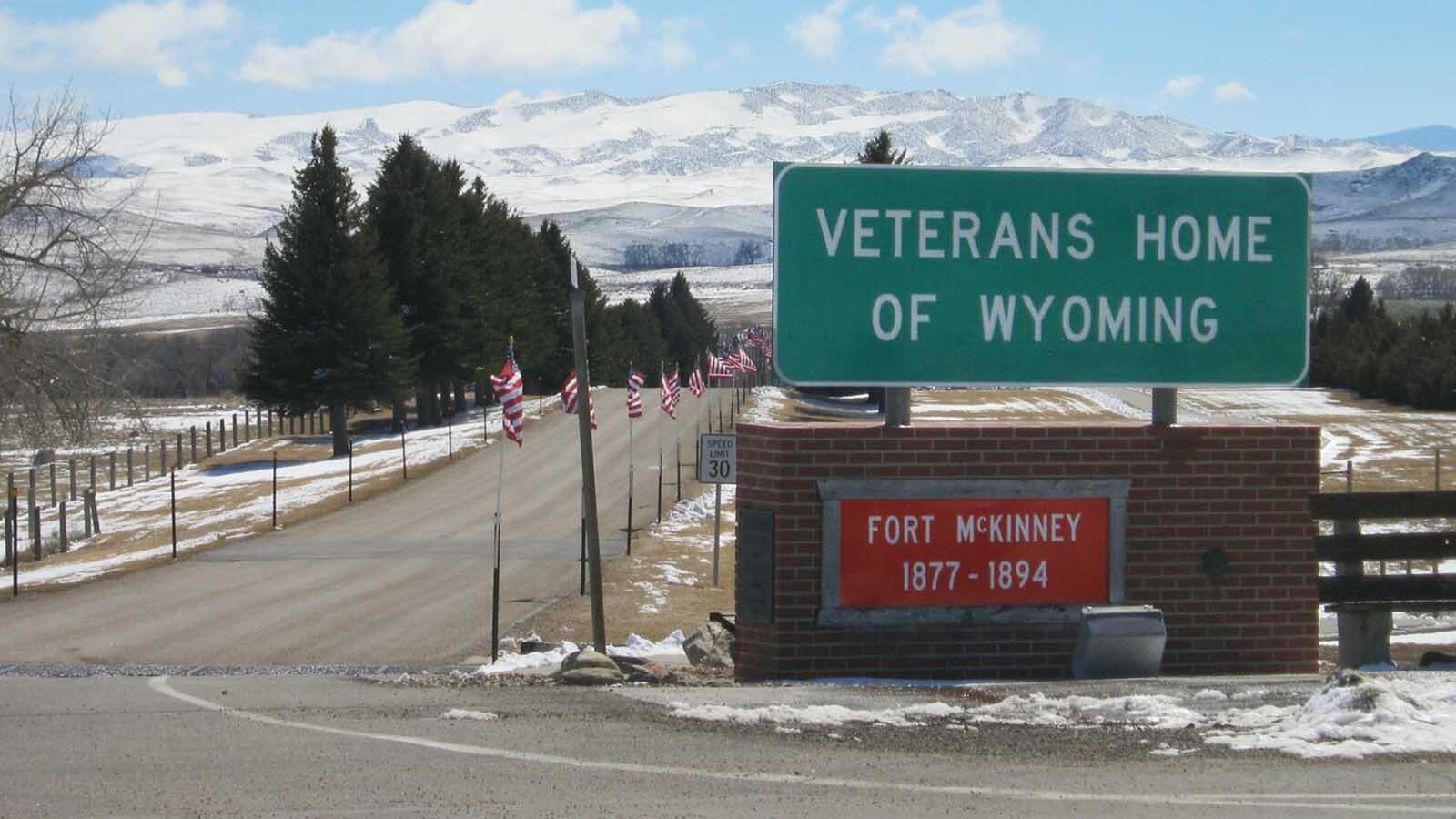

Sen. Cynthia Lummis, R-Wyoming, has announced a bipartisan bill to stop producing pennies, working with New York’s Democratic Senator Kirsten Gillibrand, as well as U.S. Reps. Robert Garcia, D-California, and Lisa McClain, R-Michigan.

Lummis cited the cost of making pennies — 3.07 cents per penny — as her reason for getting behind the bill.

“I agree with President Trump that the time has come to fully end production of the penny and save American taxpayers money,” she said in statement. “The fiscal reality is undeniable: the U.S. Mint spends three cents to produce each one-cent coin.

“With a $36 trillion national debt, we have to implement meaningful opportunities to reduce costs, update our currency system, and codify the elimination of government inefficiencies. It just makes cents!”

Gillibrand, meanwhile, said the penny is outdated and inefficient — not the currency for the future.

“By suspending its production we can reduce government spending, streamline transactions, and move toward a more practical financial system,” she said. “It’s time to invest in a future that works for the 21st century economy, and that starts with suspending production of the penny.”

Inflationary Creep

It could take a while for pennies to disappear from circulation, depending on how the matter is handled.

When Canada stopped minting pennies in 2012, for example, they had citizens turn pennies in to their banks, in an effort to more quickly remove them from circulation.

Lummis’ office told Cowboy State Daily the bill doesn’t call for actively removing pennies from circulation. So, pennies might still circulate for a long time.

But once pennies do disappear, the likeliest outcome, according to one of Wyoming’s longest serving state senators, Charlie Scott, is price creep.

“Presuming we keep nickels,” Scott said. “You can expect that merchants, when you buy something, are going to tend, whether they’re dealing with cash, to round up to the next highest nickel. So, I think you can expect to see some level of price increase because of that. It will be mildly inflationary.”

Scott said he doubted most business owners would round down and take the loss themselves if customers can no longer make exact change. He expects that any difference between sales tax and the item’s sales price would likely be pocketed by the merchant.

As far as the so-called sixth penny sales taxes that adds pennies to so many cash register receipts, Scott doesn’t believe eliminating pennies will affect those taxes over the long term. That’s important, because those sixth penny sales taxes are doing millions of dollars of work for Wyoming’s municipalities and counties.

“It’s just an expression,” Scott explained. “The sixth penny sales tax is really just a percentage.”

Scott pointed out those paying with a credit card or check would still be able to handle exact change, without any actual currency changing hands.

“But if you’re paying with cash, I think you’re going to pay a little extra,” he said.

More Nickels

Justin Schilling, deputy director for the Wyoming Association of Municipalities, told Cowboy State Daily he doesn’t believe eliminating pennies would affect the sixth penny sales taxes that help fund municipalities across Wyoming.

One thing he does expect, though, is that the move could push more people to cashless transactions — a trend that’s already happening.

“A lot of people are using Apple Pay or Google Pay, these kinds of things where they just tap their phone to the terminal,” he said. “They don’t even pull cards out of their wallet. I think there’s more and more adoption of those kinds of technologies. Coins just aren’t being circulated or touched and put back into circulation as often.”

However, to the extent that lack of a penny means more nickels are needed in circulation, Schilling wonders if stopping penny production will save as much money as expected.

That’s because nickels are actually a much bigger money loser than pennies. While it takes 3.07 cents to make a penny, according to the U.S. Mint, each nickel costs 13.78 cents to make.

Lummis’ office did not respond to a question from Cowboy State Daily about whether the nickel is a problem, too, given how much more money it loses than pennies.

The Mint decides how many coins to make each year based on demand forecasts from the Federal Reserve. The latter orders coins on a monthly basis, based on what their member banks say they need to satisfy customer transactions.

Armored cars and trucks then take the newly minted coins from either the Philadelphia or Denver Mint to one of the Reserve Bank’s 28 branch offices or to one of more than 200 private sector coin terminals.

From there, they are distributed to banks as needed, entering general circulation that way.

Renée Jean can be reached at renee@cowboystatedaily.com.