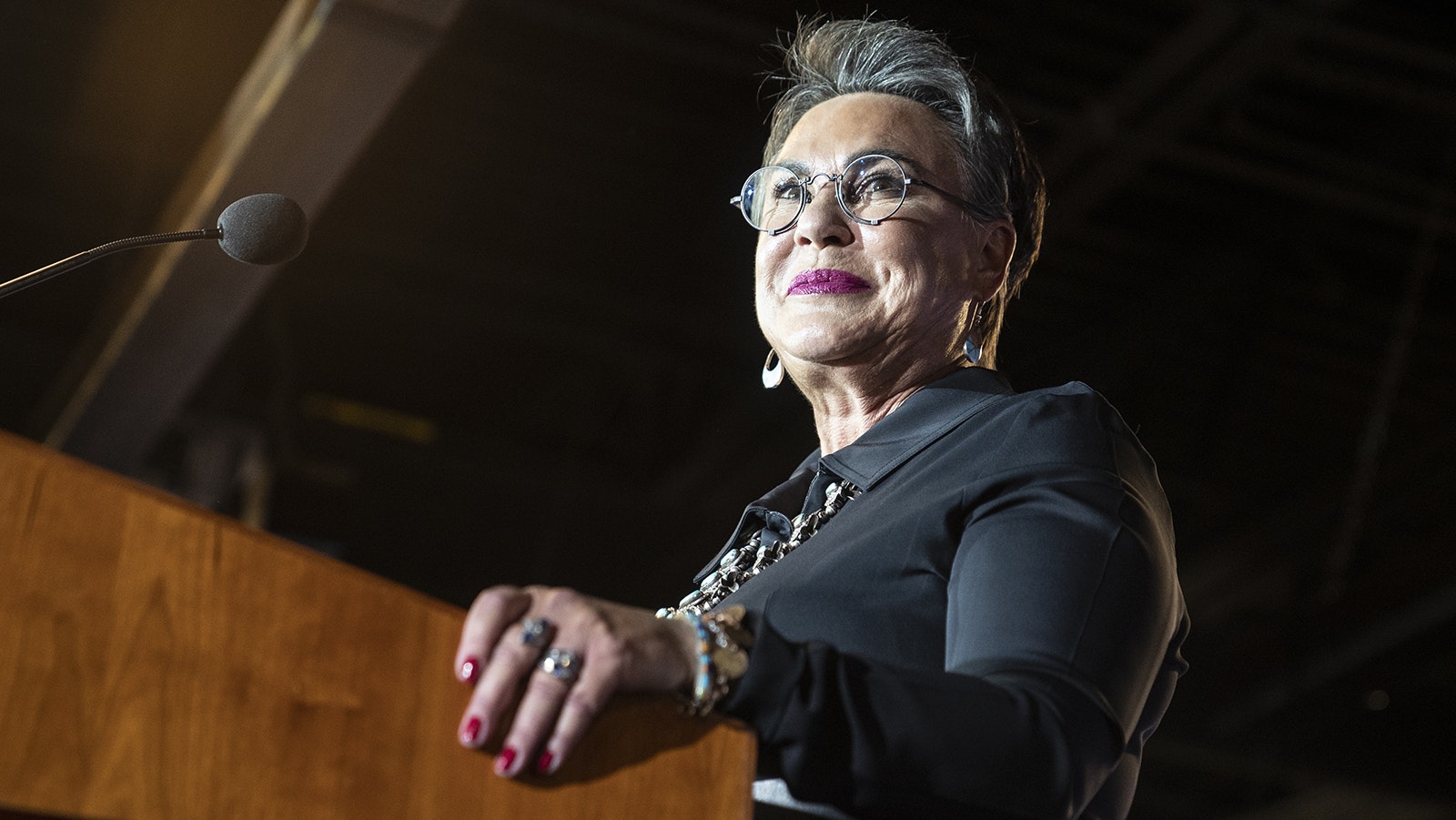

A bill that would take away the tax-exempt status of nonprofit organizations that support terrorists in America is quickly moving through Congress with Rep. Harriet Hageman’s support.

If the bill passes into law, it would allow the U.S. Treasury secretary to label a group as terrorist supporting if it’s determined to have provided material support or resources to a terrorist group within the past three years.

“The authorities outlined in this bill would be used to eliminate tax-exempt status for nonprofits that have provided material support to known terrorist organizations such as Hamas while maintaining clear, legally defined safeguards to prevent abuse and weaponization,” Hageman told Cowboy State Daily.

What is determined to be a terrorist-supporting organization would be up to the discretion of the Treasurysecretary.

The accused organization would have 90 days to “demonstrate to the satisfaction of the secretary” that it isn’t actually “terrorist supporting.” U.S. district courts will also have exclusive jurisdiction to review a final determination with respect to an organization’s designation as being terrorist supporting.

If the organization can’t prove it’s not a terrorist-supporting organization, the nonprofit would be designated as such and have its tax-exempt status revoked.

The bill passed the House last week mostly on party lines along with 15 Democrats joining Hageman in supporting it. Only one Republican, Libertarian-learning Thomas Massie, R-Kentucky, voted against it.

Some Groups Worried

The American Civil Liberties Union believes the bill provides far too broad discretion of power and it could easily be weaponized.

“This legislation would have granted the secretary of Treasury the unilateral power to investigate and effectively shut down any tax-exempt organization — including news outlets, universities and civil society groups — by stripping them of their tax-exempt status based on an unilateral accusation of wrongdoing,” the ACLU says in a response.

The Wyoming Democratic Party expressed similar concerns, urging constituents in a Facebook post to “protect free speech, dissent, and democracy itself” by telling Hageman to vote against the bill.

Some of the commenters on the post expressed doubt that Hageman would listen to perspectives from Democrats about the bill, but the party said it’s still important to make their voices heard.

“It's extremely important to call and voice your opinion, regardless of what she ends up doing!” the party said in a comment responding below the post. “Her job is to listen to her constituents. We don't exercise our rights as constituents because we think our elected officials will agree with us, we do it because holding our leaders accountable is how we protect and strengthen our democracy.”

Hageman said she also voted for the bill because “The United States should use all legally available avenues to end the influence and aggression of terrorists.”

Neither Barrasso nor Lummis responded to Cowboy State Daily’s request for comment on how they might vote on the bill.

Context

Although in most instances it’s likely pretty obvious whether a group supports terrorist organizations or not, in others there could be more of a grey area as far as what qualifies as support.

For instance, many American-based pro-Palestine groups have been accused of supporting terrorism because of the terrorist group Hamas that controls Palestine, even though some of these groups have said they don’t support Hamas.

Similarly, a 2020 police guide suggested that Black Lives Matter activists should be treated as terrorists.

Left-wing, anti-war group CODEPINK asked Hageman last week about what she was doing to support Palestinians, to which she responded that she doesn’t engage with groups that support terrorists.

“You guys are disgusting, I don’t engage with terrorist sympathizers,” she said.

And as much as Republicans may be excited and confident about the future presidency of President-elect Donald Trump, political power shifts could occur in future elections allowing Democrats to return to power and take over deciding which groups qualify as terrorist organizations.

When asked if she has concerns about a future Democratic presidential administration's use of this potential law, Hageman said the text of the bill provides a clear definition for what qualifies as “terrorist supporting organizations,” as an organization that specifically provides material support or resources to legally defined terrorist organizations or activities.

“The term ‘terrorist supporting organization’ cannot be applied haphazardly by federal officials as the law is clear on what criteria needs to be met for such a designation,” she said.

Federal law already prohibits knowingly providing material support to foreign terrorist organizations, and the IRS has a process in place to revoke an organization’s tax-exempt status.

The IRS defines a terrorist organization as a group that is designated or identified as supporting or engaging in terrorist activity.

To revoke tax-exempt status, the IRS says it conducts an examination of the organization, issues a letter to the group proposing revocation, and then allows the organization under investigation to “exhaust the administrative appeal rights that follow the issuance of the proposed revocation letter.”

The bill also postpones certain tax-filing deadlines for Americans and their spouses who are wrongfully detained or held hostage abroad.

Leo Wolfson can be reached at leo@cowboystatedaily.com.