Wyoming is angling to set up a $10 million fund to incentivize carbon storage for enhanced oil recovery projects using a Biden administration tax credit.

The net effect of the fund is to throw more money into the state’s coffers even as federal clean air policies have handcuffed the oil and gas industry’s efforts to expand.

The fund is not yet a done deal as the Wyoming Legislature must approve the gambit when lawmakers begin meeting Feb. 12.

The fund would take advantage of complicated tax credits offered in the federal Inflation Reduction Act that President Joe Biden signed into law in August 2022, and could stimulate a several-fold payout in tax receipts collected by the state, said Rob Creager, executive director of the Wyoming Energy Authority (WEA).

“It’s a great opportunity,” said Creager, whose organization would administer the new fund should the Legislature approve it.

More Production, More Money

In effect, the fund would initially draw from energy tax receipts held in a “rainy day” fund – technically known as the Legislative Stabilization Reserve Account, or LSRA.

As the tax credits kick in for businesses that store carbon for enhanced oil recovery, the Enhanced Oil Recovery Stimulus Account could grow richer through increased energy production realized throughout the state, Creager told Cowboy State Daily.

LSRA has close to $1.8 billion in its piggy bank and is occasionally tapped to help Wyoming weather cyclical downturns in coal and oil and gas prices without taking a knife to the state budget.

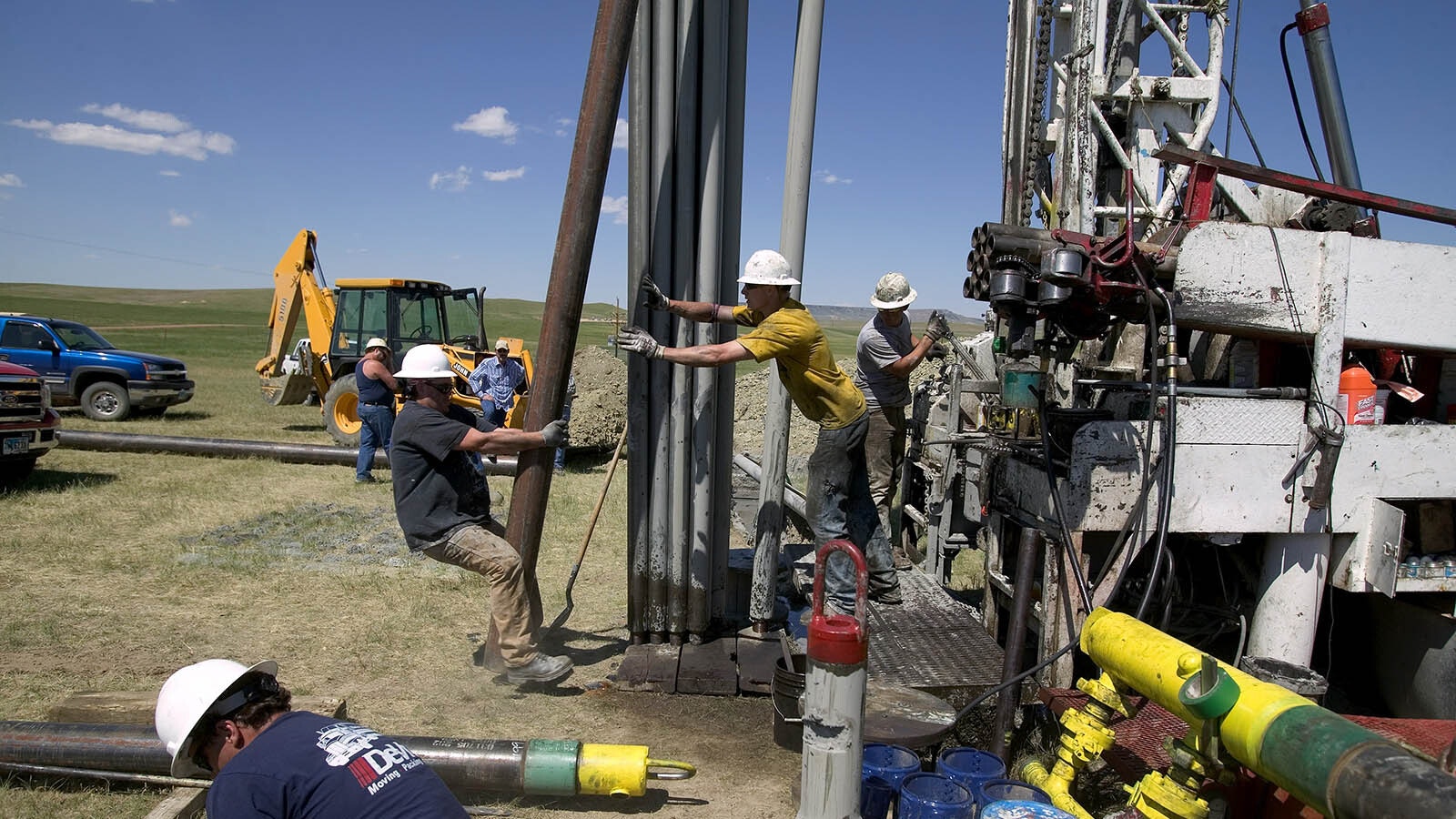

The $10 million infusion targeted for enhanced oil recovery projects could touch off a new rush in the state for carbon storage with new players, or some existing ones.

Bigger Piggy Bank

The inflation reduction law was the largest ever investment in clean energy projects across the United States, an area Wyoming could benefit from should these efforts focused on oil and gas catch on.

A key aspect of the new fund are features that take advantage of how investments are made in the federal government’s complex tax code. Those changes are outlined the Internal Revenue Code — the bible to America’s tax laws — that incentivizes the capture of carbon dioxide stored underground for enhanced oil recovery projects.

One economic analysis provided by the University of Wyoming’s Enhanced Oil Recovery Institute found that incentives provided to four unidentified carbon capture projects for enhanced oil recovery in Wyoming could generate $800 million in additional money for the state.

Those projects already involve an aggregate investment of $1.5 billion and cumulative production of 200 million barrels of oil.

“The fund would help the state create more revenue,” said Lon Whitman, director of the University of Wyoming’s Enhanced Oil Recovery Institute in Laramie.

The fund’s directive is to get energy projects to store more carbon for recovery of oil, Whitman said.

He noted, however, that there is some concern the state could run short in the future on carbon dioxide for enhanced oil recovery. This is why Wyoming is looking at the tax credits to incentivize carbon storage.

The analysis prepared by UW’s institute stated that tax revenue generated from enhanced oil recovery projects through carbon capture technologies generates roughly $26 million a year in Wyoming. These projects account for about 6% of the state’s oil production, though substantial upside is possible with the creation of the $10 million fund, according to the analysis.

Other Initiatives

Separate from the enhanced oil recovery fund, the state has moved on other fronts to spark interest in a garden variety of energy projects through its Energy Matching Funds program.

That program is aimed at spurring innovation and bring energy projects to Wyoming.

In 2022, the Legislature appropriated $100 million to Gov. Mark Gordon’s office to provide matching money for private or federal funding for projects that range from carbon dioxide transportation to lithium processing and battery storage.

The Legislature kicked in an additional $50 million in 2023.

Two weeks ago, six Wyoming-based projects received more than $157 million in matching money from federal, state and private sources. Nearly $38 million of that came from the state.

Awards for these six energy projects went out this month to a team of Black Hills Energy, the electric utility unit of South Dakota-based parent Black Hills Corp.; Ohio-based energy technology company Babcock & Wilcox Enterprises Inc.; Colorado-based Cowboy Clean Fuels LLC; Casper-based Flowstate Technologies LLC; Membrane Technology and Research Inc., which is building a carbon capture pilot project at Gillette’s Wyoming Integrated Test Center; the University of Wyoming School of Energy Resources; and Oklahoma-based energy giant Williams Cos. Inc.

The first award in the energy matching funds program was made in August for $19.1 million to research nuclear technologies and carbon storage.

“There have not been any matching funds granted on enhanced oil recovery projects yet,” said Creager, noting that about $65 million in matching funds remains to be awarded in late March or early April.

Pat Maio can be reached at pat@cowboystatedaily.com.