While coming back from the Arizona Bowl in Tucson, I noticed an airport bathroom sign says, “Do not Flush While Seated on Toilet.” The pictures that popped into my mind about the unintended consequences of not understanding the environment became graphically clear.

With the budget session of the Wyoming Legislature upcoming, a lack of understanding of just what our politicians are promising might end up with equally dire unintended consequences.

Oftentimes, politicians to tell voters what they want to hear, not what they need to hear. Some politicians depend on folks’ ignorance and unwillingness to ask the difficult questions when a subject is complicated.

The Wyoming budget is full of complicated facts and figures. This column addresses some of the high notes and shares food for thought. The time is now for us to put on our thinking caps and understand what is important and what is nonsense.

Wants Vs. Reality

As a former politician myself, I know the easiest message to attract voters in Wyoming is to say we need to lower taxes and cut the size of government. Who doesn’t like that message? Discussing the realities of the situtation gets a little harder.

Unfortunately, to live in a civilized society, consitutional taxes are a necessity. As my old friend John Hines (hardly a tax-and-spend liberal) says, “No one wants to pay taxes.”

He’s right. But neither does anyone want to have their house burn down, police not respond to a robbery, die a preventable horrible death because we don’t have health care, have our kids poorly educated, or drive on unpaved roads.

So, we mutually pay consitutional taxes.

The best way to ensure representative democracy though informed voters is to learn as much as we can about the subject about which they are talking. Then, we can applaud when they are right and call B.S. when they are blowing smoke.

How The Mooching Works

In that vein, understanding Wyoming’s finances is important for us to become educated voters.

Wyoming is a very unique state because it figured out a long time ago how to make people from out of state pay our essential taxes. In other words, we mooch off of other taxpayers to pay our bills.

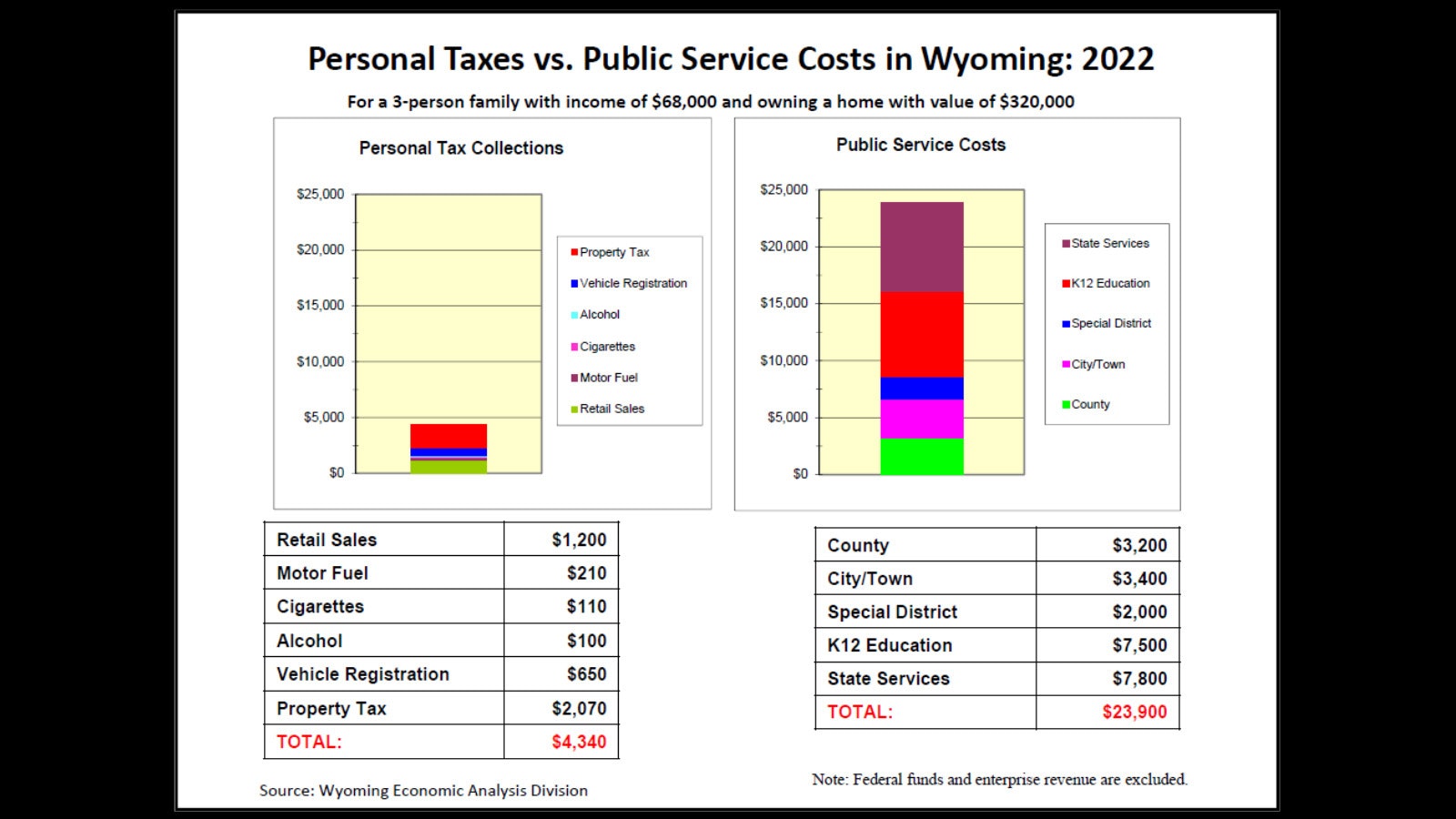

Here’s how the mooching works. According to a 2022 analyis by the Wyoming Economic Analysis Division, a three-person family with an income of $68,000 and owning a home with a value of $320,000 pays about $4,340 in taxes, including sales tax, fuel tax, tobacco tax, alcohol taxes, vehicle registration and property taxes.

That same family recieves about $23,900 in local and state government services.

In other words, Wyoming people pay about 1/5 of the bill for the government services they receive. Who, then, pays the rest of the taxes?

The folks who pay Wyoming’s taxes are the people who purchase and consume Wyoming minerals and fossil fuels.

Industry in Wyoming pays the bulk of taxes, and their customers in turn make it possible for industry to pay those taxes. On the other hand, if taxes are cut, out-of-state corporations, many of which are headquarted in St. Louis and Houston, are going to get the biggest benefit of tax cuts. They then use the benefits of those tax cuts for bonuses, dividends and other corporate finance.

The High Points

Knowing that Wyoming residents are getting a largely free ride on the backs of other people and industries is key to understanding the state of Wyoming’s budget.

Who supports the bulk of Wyoming’s budget?

Decribing the Wyoming Budget in detail in an online column is nearly an impossible task. Let’s just hit some high points to ponder. If you want to examine the Wyoming budget in detail, visit the state Budget Department online.

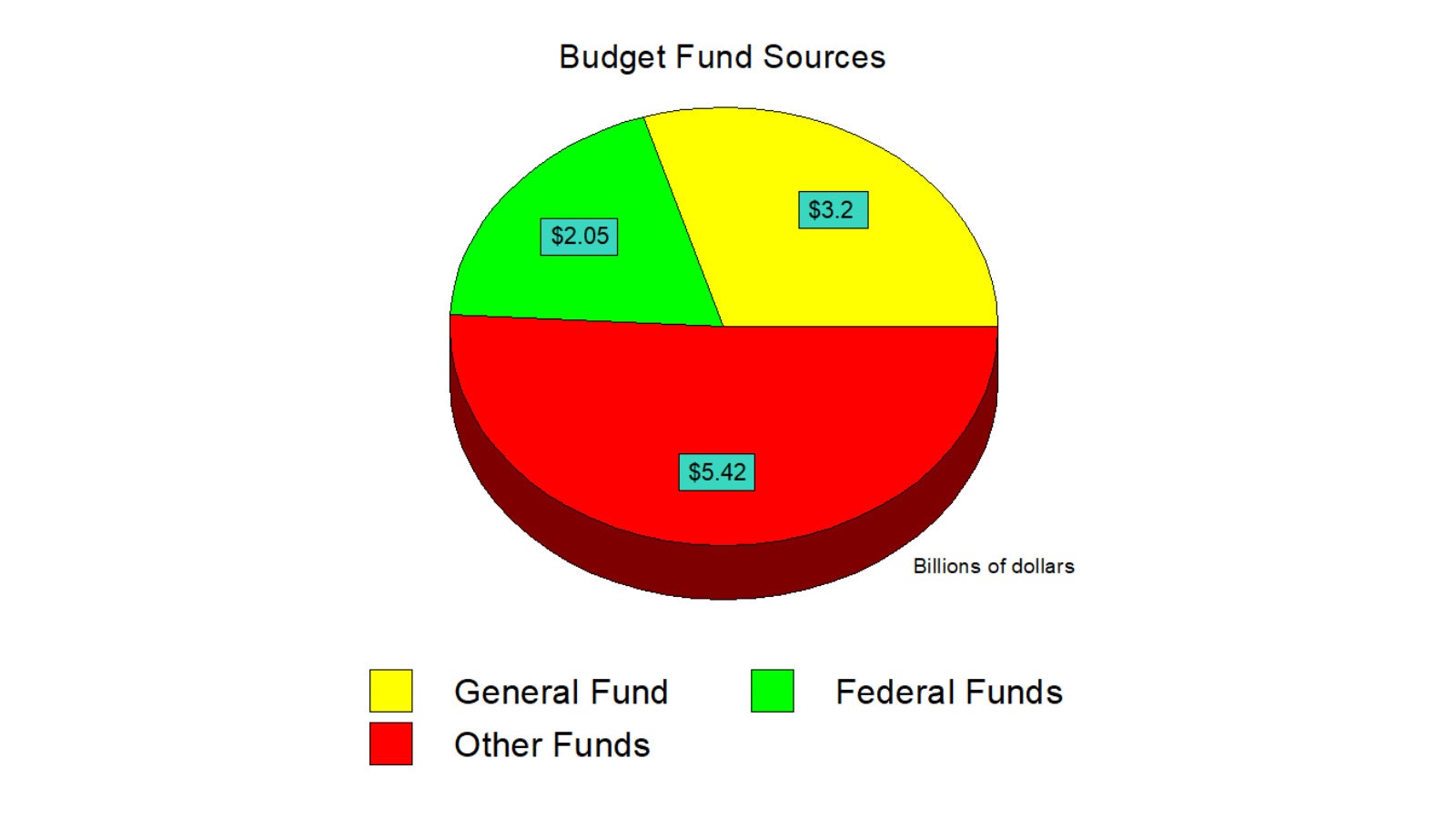

In fiscal year 2023-24, Wyoming’s total budget was $10.68 billion. Income to the state of Wyoming arrives in several different ways. Surprisingly, the largest single funder of the state is the federal government.

Yes, that’s right. According to a 2022 study on SmartAsset.com, Wyoming receives $1.36 in federal funding for every $1 of income tax paid by Wyoming people and entities. Wyoming makes a 36% profit on the taxes its residents pay to the IRS.

About 1/3 of Wyoming’s budget is financed by the federal government. The money comes to the state as federal fund payments and also as federal mineral royalties (which are classified as part of “other funds” in the graph. If one combines the federal mineral royalties with the $2.05 billion in federal money the state receives, according to Moneygeek, Wyoming’s budget is comprised of nearly 31.87% federal funds.

It's Obvious, Right?

Some politicians are running around and saying Wyoming should just stop taking federal funds. The obvious question, when faced with the above numbers, is how are you going to replace $3 billion per year when the state stops taking that money?

Before one answers that we don’t need those funds, it might be prudent to see where the state of Wyoming spends those federal dollars.

Remember, some of the funds are direct federal payments that are labeled “federal funds” in the graph above. The federal mineral royalties are included in the “general fund” as well as “other funds,” which are appropriated differently.

Combined, the “federal funds” and “other funds” contributions equal 31% of the state’s budget.

By Department

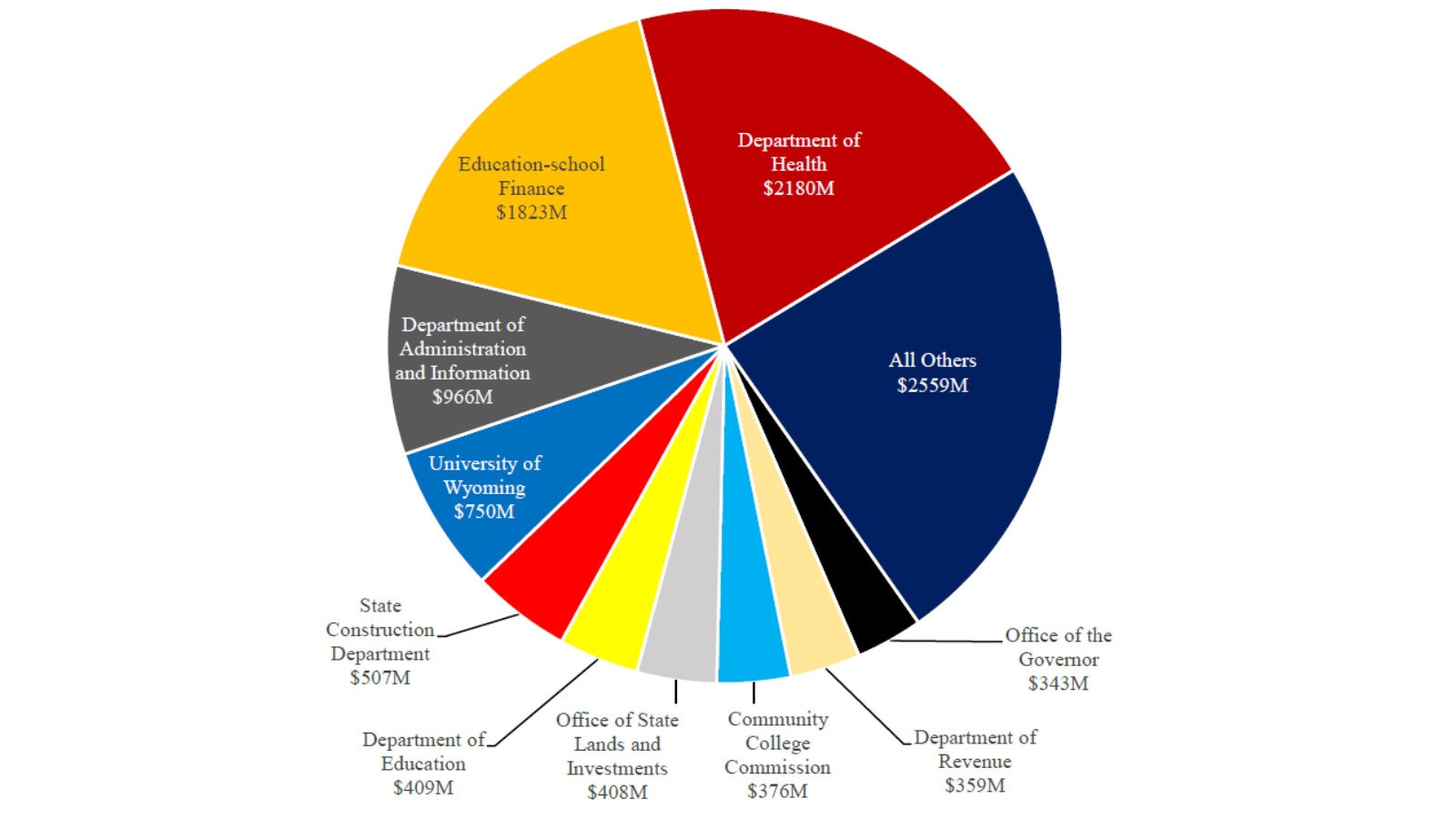

According to information published in the the Wyoming Legislative Service Office’s Data Book, the “federal funds” appropriation of $2.05 billion was spent on primarily on health care and education.

The Department of Health federal monies are used, in large measure, to pay for indigent heath care for youths, deliver babies, mental health and substance abuse treatment and taking care of our indigent sick and elderly.

So, when walking away from those funds, one should ask who’s going to pay for the destitute grandparents with Alzheimer’s disease who have used up all their assets paying for their care?

While the example is admittedly extreme, for those families who are faced with the $9,200 per month in average nursing home costs, it is an all-too-real crisis.

To my way of thinking, dumping our disabled elderly on the street is not an option. Nor is denying prenatal coverage to an indigent young mother.

The Department of Education grants are self-explanatory. Those funds pay for things like school lunches, education of chidren with disabilities and providing for mental health assistance as well as defraying some of the costs of education.

The Wyoming Military Department receives federal funds to support its mission to defend our country. Operation of the National Guard is an essential function of our state government, and is supported, in large measure, by the federal government. Wyoming’s military department would largely cease to function without federal funds. Walking away from those funds would be just irresponsible.

The Department of Family Services receives federal money to support needy children and families and for protection of children who are the victims of abuse and neglect, child support enforcement and low income food assistance.

While it is unfortunate there are people who needs these funds, the alternative is to turn these children and families out on the street.

One of my favorite federal appropriations is to the Attorney General’s office to support the Division of Internet Crimes Against Children.

If you don’t know what these folks do, look them up. While there are those who claim they are protecting children by persecuting librarians, these public servants are doing amazing work protecting children against exploitation.

There are pretenders and there are battle-hardened paladins. These folks are paladins doing very difficult task of interdicting disgusting efforts to exploit and blackmail our children via electronic an other means. Walking away from these federal funds would be a vote in favor of child exploitation.

Not So Easy, Right?

From these few examples, a picture starts to develop that federal funds are important to the day-to-day operations of the state of Wyoming.

Walking away from them without a tanible substitute in place would be silly and dangerous. When confronted with walking away from federal dollars, we have to ask the hard question and what ifs.

Otherwise, we end up flushing the airplane toilet while seated.

I often hear political types say, “We’ll just kick the federal government out of Wyoming, and we’ll be fine.”

Those who make that statement also often say, “And when we do, we’ll just take over F.E. Warren Air Force Base, and we’ll be a nuclear nation.”

Those statements exemplify kakistocracy at is finest. I’m sure the Air Force will just wink and give the Wyoming Legislature the nuclear codes.

When I hear that nonsense, I often think of a movie I saw as a child as at film festival called “Bambi Meets Godzilla.”

Like It Or Not, We Need Federal Money

Whether we like it or not, federal funds are an integral part of Wyoming’s reality. Before we go around chatting about divorcing the state from federal funding, and the strings that come with it, we should consciously weigh what we are giving up.

Those spouting the political rallying cry that we should give up federal funds should have a concrete plan for all the things the state of Wyoming is giving up. Failure to do so while contemplating such an action is legislative malpractice.

Some political types run around telling us that Wyoming has the greatest number of government employees per capita. (A true statement). They contend Wyoming should reduce the number of state employees so they can lower everyone’s taxes.

But before we embark on a massive cut in Wyoming government services, we should look to see where the money is spent. Total appropriations in Wyoming consist of general fund appropriations (taxes mostly paid by industry), federal funds and other funds.

The “other funds” consist of enterprise funds (charging for services like game tags), investment income (a surprisingly large portion of Wyoming government is funded by income off of Wyoming’s multiple trust funds) and forty-eight percent of the landowner’s royalty paid as a result of production on federal minerals located in Wyoming.

Where To Cut?

If we are going to cut our state budget, we should understand where the funds are currently being spent. The nearly 50% percent of the state’s budget supports the Department of Health, K-12 education, the University of Wyoming and Community Colleges.

The largest number of government workers in the state of Wyoming are educators. The next largest number of government employees are health care workers.

If the state is going to reduce the number of employees, these are the areas where the employees exist. To cut government workers, teachers and health care workers would be on the block. If a politician says they are not, the politician either does not have a plan, or is not serious about cutting government workers.

The next largest group of state government employees is law enforcement. Law enforcement funding is included in funding to cities, towns and counties in the “All Others” category.

When someone tells you we need to cut the number of government employees, ask them which teachers, doctors, nurses or law enforcement people they intend to fire.

If they give you the political two-step, ask again. Have them tell you which government employees they want to fire. Make them tell you which government services they intend to curtail. If they cannot give you specifics, it is because they are just blathering a party line and they have not thought through the consequences of their blather. They are just telling you what you want to hear to get your vote.

Trickle-Down

Here is another thing to think about. One of the unanticipated economic consequences of cutting state jobs is the ripple effect throughout the local communities.

Government spending does not exist in a vacuum. When the government spends $10 on a schoolteacher’s salary, for example, that schoolteacher might save 25% and spend the other 75%.

Assume the teacher buys food. The food dealer now has $7.50 of the teacher’s money (75% of the $10 salary). The food dealer saves 25% of his money and spends the other 75% on a truck. He spends $5.62 of the teacher’s salary on the truck.

Then the truck dealer does the same thing and so forth. Multiplier factors vary by community and assumptions, but the rule of thumb I was taught was that $1 of spending multiplies by seven times when it is spent.

The converse is true when the government does not spend the money. Assume the teacher gets laid off. The fired teacher moves to Texas because that is where most everyone is moving. The teacher does not buy food, which reduces the food dealer’s income, which in turn reduces the truck dealer’s income and so forth. The budget cut ripples through the community.

So, before you let political folks damage local economies, ask the hard questions.

All the folks who want drastic reductions in government employees never talk about the consequences of the multiplier effect. The multiplier effect may not even come into their consideration. It should. Talking about complicated economic realities is not good for telling folks what they want to hear. Understanding economic consequences is important for policy making, though.

As I have said before, when perception hits reality, reality always wins. So, political types can spout these placating theories, but when the rubber hits the road, it is going to be the people of the state of Wyoming who bear the undiscussed consequences of the political platitudes we have been hearing.

I have said this before as well: We deserve more than political slogans and fancy historical flags flying at rallies. We deserve intelligent discussion, which takes into consideration the realities of and consequences of political acts.

What we do not need is discussions that devolve into political labeling. When a politician is backed into a corner (remember, I used to be one), the easiest way out of the corner is to call the opposition a name.

If the discussion degenerates into name-calling, you know the politician does not have an answer. The politician might call himself a “true patriot,” implying that you are not, because you dare not respect his authority.

The politician might call you a name. Either way, you have gotten the information you need. When the discussion degenerates into name-calling, the politician does not have answers to the hard questions. They are just telling you what you want to hear to get your vote.

We are at a crossroads in our state. We must insist on thoughtful analytical folks with discernment to make our policy decisions. Our needs are far beyond simple political platitudes.

If we settle for slogans, we are going to get our private parts sucked into a toilet at 34,000 feet.