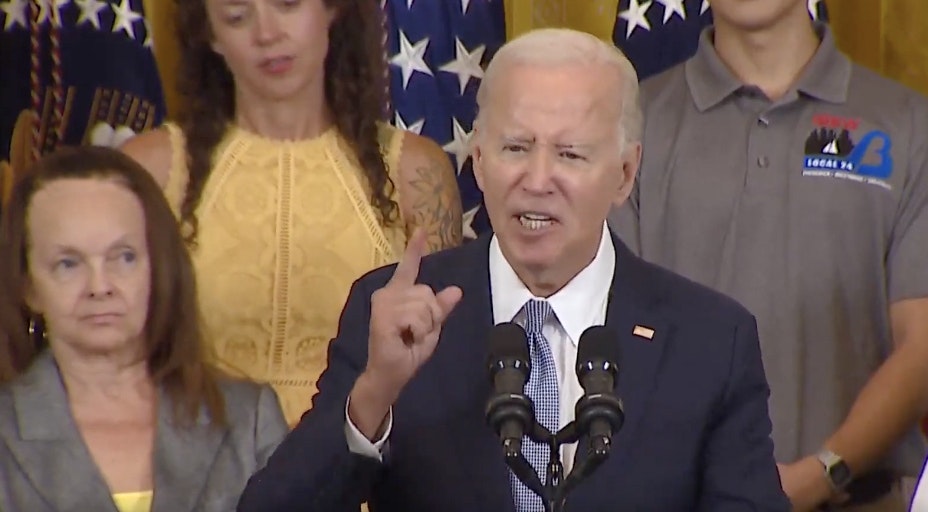

It’s been a year since President Joe Biden signed the Inflation Reduction Act (IRA) into law.

At an event marking the anniversary, Biden lost his temper over people saying the country is failing.

"Name me a single objective we’ve ever set out to accomplish that we’ve failed on,” the president shouted. “Name me one, in all of our history. Not one.”

While the law was touted as landmark legislation to address climate change, critics point out it suffers from the same problem all lofty federal initiatives do — unintended consequences.

In pushing for electric vehicles, wind and solar, the law’s proponents didn’t hesitate over how much of the critical minerals market is controlled by China.

Counterproductive

“Where Green Meets Red,” a new report from Power The Future, an energy advocacy group, explains how the IRA leaves the U.S increasingly dependent on China, which controls 40% to 80% of the key minerals needed for EVs, wind turbines and solar panels.

Power The Future Alaska State Director Rick Whitbeck, who also does work in Wyoming, told Cowboy State Daily that the amount of critical mineral production and processing that China controls gives it a strategic dominance roughly double the market share that OPEC, an intergovernmental organization of petroleum-producing countries, has in oil.

While the IRA provides support for development of the U.S. domestic supply in minerals, Whitbeck said the Biden administration’s actions run counter to that goal.

Biden’s Army Corps of Engineers and EPA revoked a Clean Water Act permit for a mine in northeastern Minnesota that could produce nickel, copper, cobalt and platinum-palladium resources. Previously, the Biden administration blocked the Twin Metals mine, also in Minnesota.

“For all of the Biden administration’s talk about ‘going green’ and establishing a domestic supply chain of components for that goal, they haven’t shown any willingness to walk their talk,” Whitbeck said.

Rising Demand

While the administration is blocking U.S. mines, it’s driving up demand for minerals with tax incentives and subsidies.

A new report by S&P Global predicts that the IRA will create serious supply shortages of critical minerals.

The demand for lithium will be 15% higher by 2035, according to the report. Nickel demand will be 14% higher, cobalt demand will be 13% higher, and copper demand will be 12% higher.

If the IRA’s requirements are realized, the report estimates that lithium demand will be sufficiently supplied domestically, and copper has great potential. Nickel and cobalt will be more difficult.

However, according to the report, “lengthy and complicated regulatory and permitting processes along with litigation risks inhibit the development of this endowment and, more broadly, mineral development in the United States.”

Train Wreck

David Blackmon, a longtime energy analyst and author of “Energy Absurdities,” told Cowboy State Daily that proponents of the IRA gave some consideration to these supply chain problems in constructing the bill.

“But the reality is that there’s never an adequate amount of real thought that goes into any regulations related to energy in Washington,” Blackmon said.

Writing in Forbes, Blackmon said he’s talked to a half dozen CEOs of technology companies who doubt the availability of critical minerals to support their ventures. Blackmon said the problem was developing well before the IRA.

“Since the Trump administration, we’ve been headed for a train wreck,” he said.

He said the problem is that policymakers don’t know a lot about the industries, but they are picking who the winners and losers will be.

“They rely on activists and lobbyists who reinforce their preconceived notions,” Blackmon said.

The lawmakers get input from the National Resource Defence Council, as well as nuclear, petroleum and renewable energy lobbyists.

The end result, he said, is a “conglomeration of subsidies for a lot of different things, but there’s no real plan.”

Rising Costs

When supply can’t meet demand, prices rise. This means the energy transition, which is expected to carry an enormous price tag, is going to get a lot more expensive.

Lithium prices are up seven-fold from what they were two years ago, Blackmon said, which is the one the S&P report is least worried about.

This rise in price could be a boon for the CK Gold Project, a copper and gold mine planned west of Cheyenne. The project is on state and private land, so it won’t have to go through the federal government.

However, the total potential mineral it could produce is fairly small, so it won’t satisfy the expected future demand.

Whitbeck said that most mines in the U.S. will not get the permits they need, no matter how badly the country needs minerals.

“The Biden administration doesn’t care if the lands are federal, state or even privately-held. They’ve refused to process permits, used bureaucratic shenanigans to delay projects, and even invoked an EPA pre-emptive veto on a mine in Alaska that’s entirely on state lands,” Whitbeck said.

Subservient

Ultimately to meet the goals of the energy transition as laid out in the IRA, the U.S. will be dependent on foreign countries, particularly China.

“We’re going to end up subservient to China for our energy security needs,” Blackmon said.

The Power The Future report says that this problem doesn’t seem to faze the Biden administration. Biden’s Department of Energy conditionally approved a $200 million grant that went to Microvast, a lithium-ion battery company that primarily operates in China, under the Infrastructure Investment and Jobs Act, another massive spending bill.

Sen. John Barrasso, R-Wyoming, took the department to task for the funding, and the funding wasn’t granted.

However, with the path the IRA is taking the U.S., the nation will be buying plenty of what China produces.

“While Team Biden delays, China builds, mines and strengthens its chokehold on the rest of the world when it comes to ‘green’ energy supply chains,” Whitbeck said.