The state of Wyoming is considering a tax on electric vehicle charging.

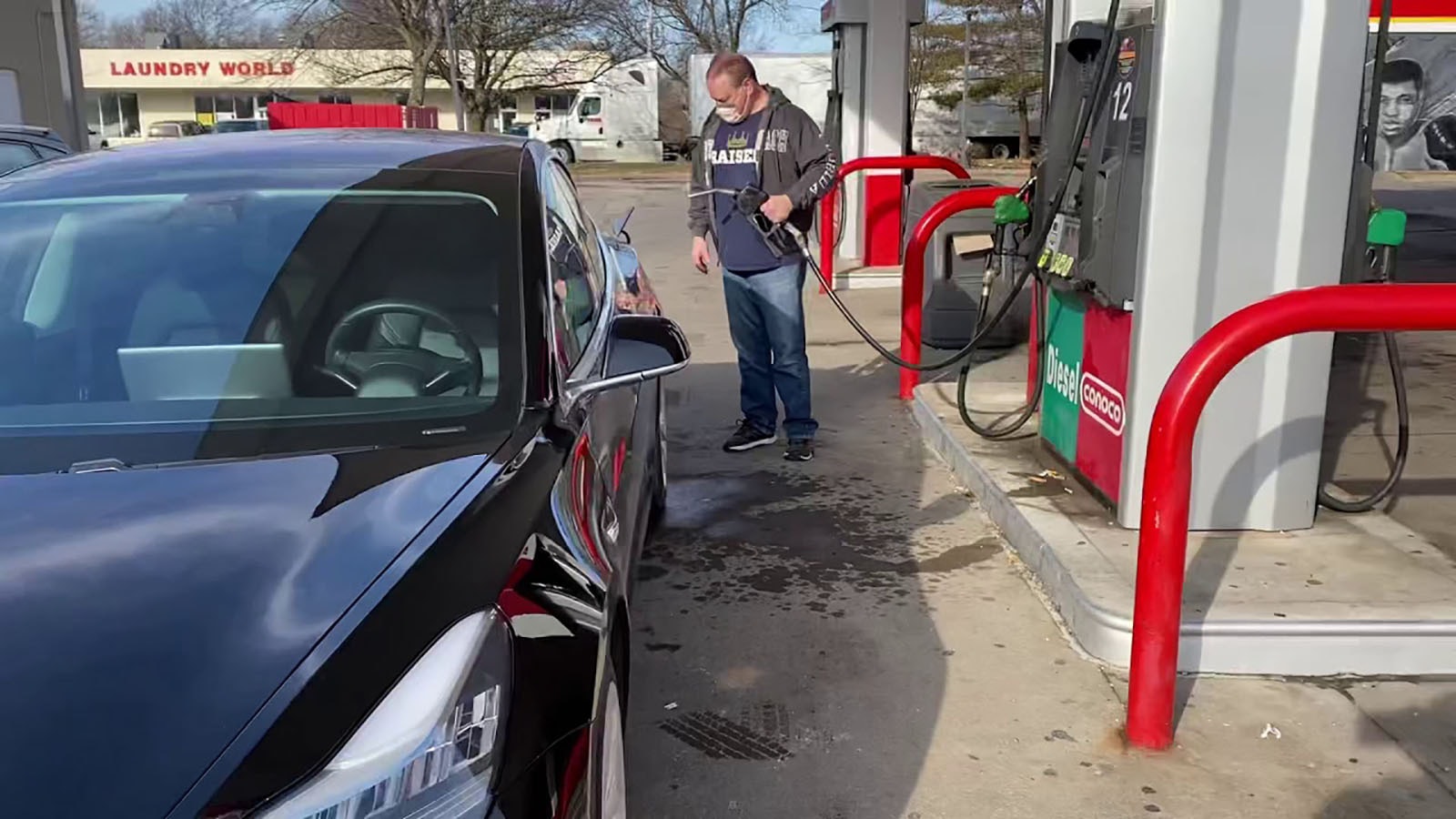

Taxes on liquid fuels support Wyoming Department of Transportation operations and road maintenance, but electric vehicle drivers don’t pay those taxes.

As more EVs cross Wyoming highways, the state is looking at ways to generate revenue from EVs that are using Wyoming roads.

The Joint Transportation, Highways and Military Affairs Committee heard proposals for several approaches to a tax on the energy EVs use last week. The first taxes could go into effect as early as December.

“We are fuel tax people looking to get into the business of EV taxation,” said Wayne Hassinger, who heads the WYDOT fuel tax program.

Tricky Problem

Taxing gallons of gasoline and diesel at the pump is a pretty straightforward process, but taxing electricity that EVs use is more difficult.

People don’t have gas pumps at home, but that’s where most EV are charging their vehicles.

Some chargers are at hotels, businesses and RV parks, and those aren’t always metered separately from the businesses’ overall use. Installation of those meters can be several thousand dollars.

WYDOT now charges a $200 EV decal fee when electric vehicle owners register them. That higher fee acts as a road tax in lieu of gas taxes. However, the fees don’t charge out-of-state drivers for their highway usage.

One proposal discussed at the Transportation Committee hearing was charging EV drivers based on the miles they drive. However, to implement it fairly, the government would have to track EV drivers movements, including when they drive out of state, which creates privacy issues.

“They don’t want the government tracking their locations,” said Josh Fisher, director of state affairs for the Alliance for Automotive Innovation.

Fair Taxation

Besides figuring out the point of taxation, the other challenge is figuring out what tax to charge that would be comparable to the fuel taxes that drivers of gas-powered cars pay. The per-gallon fuel tax is based on an average number of miles a vehicle would go on that gallon.

The goal for Wyoming’s EV taxation strategy is coming up with a tax that works the same for EVs, but based on kilowatt hours or some other measurement.

As Ken Pendergraft, R-Sheridan, pointed out, EVs are heavier than their gas-powered equivalents, which adds wear and tear to the road. So that needs to be factored in.

“That's certainly what we want to have as an outcome, is fair taxation,” Hassinger said.

Phase One

The proposal put forth from WYDOT at the Transportation Committee hearing comes in two phases, beginning with what can be done without a change to state law.

In the first phase of the EV tax adoption, the state would also begin licensing and collecting a tax at Level 3 and metered Level 2 public EV charging stations. The tax would be based on a gasoline gallon equivalent.

Hassinger noted that much of the tax will be collected between April and September.

“A lot of these charging stations have very little traffic when it's windy, snowing, and crappy outside,” Hassinger said.

Phase Two

The proposals of the second phases of the EV tax adoption would require new laws to go through the Wyoming Legislature.

These include licensing unmetered Level 2 charging stations and transitioning a tax from the gallon gas equivalent to kilowatt hours.

Electric vehicle owners would continue paying the $200 registration fee.

In the second phase, the state may adopt a refund program for Wyoming EV owners who use public charging stations. If Wyoming residents are paying for the EV decal and then paying a tax at the public charging station, they’re being taxed twice for their road usage.

The refund program would avoid that issue.

Not The End

Patrick Lawson, owner of Wild West EV, which operates five charging stations in Wyoming, told Cowboy State Daily that WYDOT has been including owners of charging stations in the discussion as these proposed taxes and licensing fees are being developed.

Lawson said he understands why the state is adopting these taxes and doesn’t think it’s unreasonable that EV drivers contribute to the state’s highway maintenance.

“It’s not the end of the world,” Lawson said.

However, Lawson said that if the state charges a tax on the electricity at public charging stations, in addition to current sales tax on electricity, it ultimately becomes a double tax.

Sales taxes go into the general fund, whereas the fuel taxes and registration fees go to WYDOT.

The issue came up at the Transportation Committee hearing.

Kristin Gunther, vice-president of strategy and partnerships for OtterSpace Electric Vehicles said the Department of Revenue had directed OtterSpace to charge sales taxes at the charging stations it operates.

Gunther said OtterSpace was supportive of a tax adoption of some sort for EV drivers.

“We agree with and support the need for EV drivers to pay their way,” Gunther said.

More EVs Coming

Aaron Turpen, a Cowboy State Daily automotive writer and supporter of electric vehicles, said that he’s supportive of a tax structure for EVs other than the normal Wyomingite objection to taxes in general.

Turpen said that the tax will have the effect of encouraging Wyoming EV drivers to charge more at home so they can avoid taxes at charging stations, but it will help generate revenue for Wyoming highways from out-of-state EV drivers, which Turpen said are going to become more common in the coming years.

“If the federal government keeps pushing them as hard as they are, we're just gonna see more of them,” Turpen said.

He said that the refund system for the registration decal doesn’t make a lot of sense. Wyoming residents who own EVs, including himself, are rarely using public charging stations, and he doubts they’ll go to the trouble to try to get a refund for that usage.

“It seems like a pain to fill out a bunch of paperwork to try to get that money back,” Turpen said.

Draft Bill

The committee concluded the discussion with a directive to WYDOT to develop some more precise figures on taxes that would approximate for EV drivers an equivalent to what the state charges drivers of gas-powered vehicles for their fuel.

The committee also directed the Legislative Service Office to draft a bill with numbers blank so that something can be ready when those figures come in.