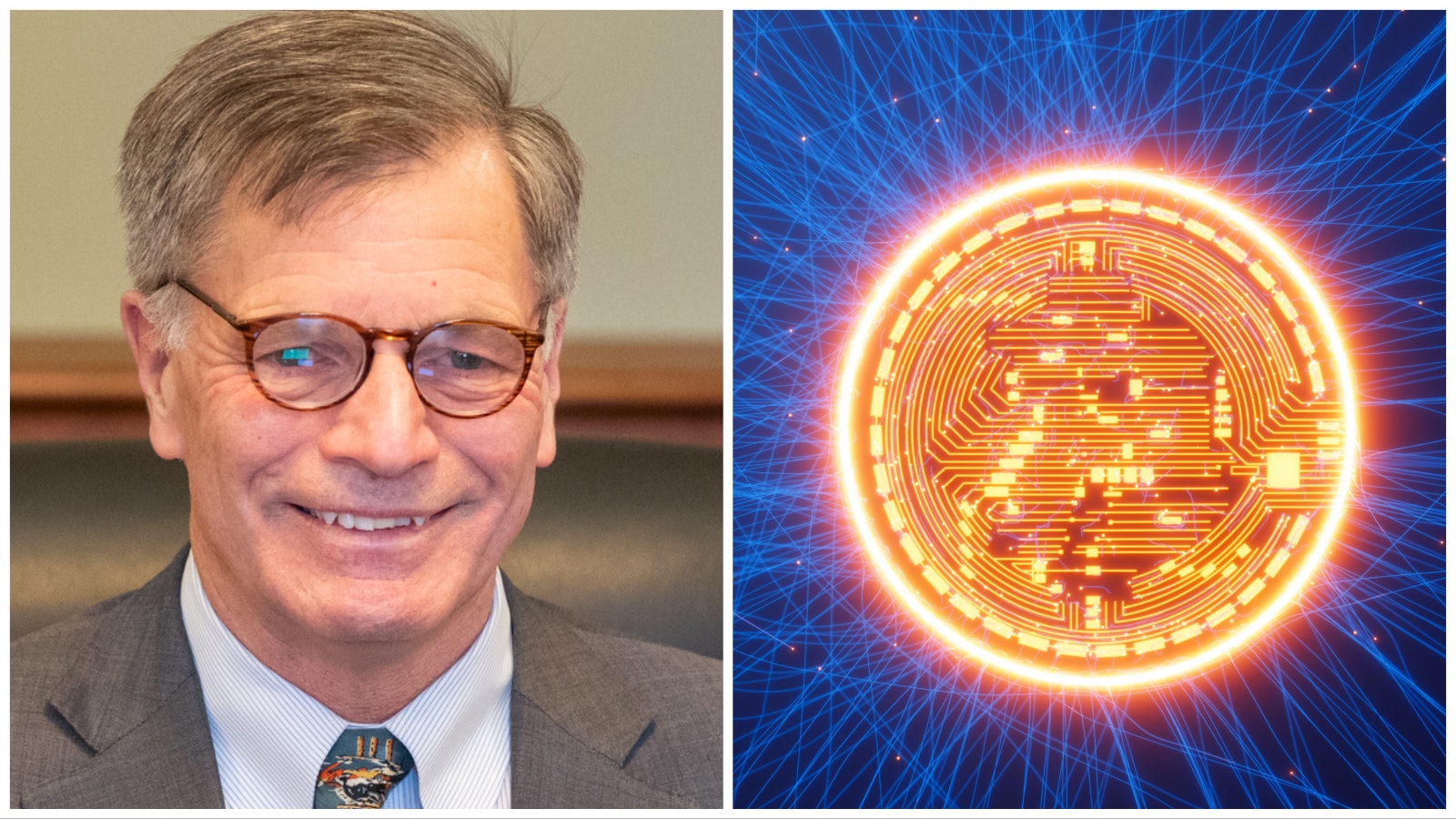

Wyoming’s stable coin is set for a second go-round with Gov. Mark Gordon’s desk, and it is anyone’s guess whether it will leave that desk with a signature this time around.

But lawmakers on Friday weren’t talking about the state’s digital token. Emails to Sen. Chris Rothfuss, D-Laramie, weren’t returned. Emails to his colleagues, Rep. Mike Yin, D-Jackson, and Sen. Chris Western, R-Big Horn, referred Cowboy State Daily to Rothfuss.

Yin, however, did say in his email that he and his colleagues have worked hard to ease the governor’s concerns around stable tokens this time around, in hopes he will decide this second time is the charm and sign the bill into law.

Gordon’s office was silent on the matter as well, and did not return an email asking for comments about how the future looks for the state’s digital assets, amid a crypto crackdown sparked by the recent meltdown of FTX, which was using customer deposits illegally to buy real estate and make campaign contributions.

Swing And A Miss

In rejecting a Wyoming stable token last year, Gordon said the effort had been too rushed and would burden the Wyoming Treasurer’s Office.

But he recommended studying the matter during the interim, and said the bill had many strong points.

“I believe it is in our state’s best interests to continue to lead the pack as the world begins to transition to new forms of currency and settlement, and new means of transferring assets,” Gordon wrote in a letter explaining his veto. “Nevertheless, we must do so thoughtfully and with care, as this new realm of virtual currency is still something of a frontier, which can present significant and perhaps also unanticipated challenges. There is value in being first, but more so in being long-lived and reliable.”

The new bill developed during the interim and now on Gordon’s desk, seeks to allay the governor’s previous concerns by setting up a new authority, similar to Wyoming Energy Authority, that would oversee the coin.

The stable token authority would include a representative from the governor’s office, the auditor’s office, and the treasurer’s office, as well as up to four subject matter experts on the topic of virtual currency and financial technology.

Yin also added amendments during the final floor debates this year that would require fingerprints from both board members and employees, so that the FBI may conduct criminal background checks.

Still The Same

Several aspects of Wyoming’s stable token won’t be changing.

It will still be a digital representation of a U.S. dollar, held in trust by the state, backed by investment in short-term treasuries.

“You know that it’s going to be there when you need to pay your bills and when you cash it,” Rothfuss told Cowboy State Daily during the interim.

Funds used to purchase Wyoming stable tokens won’t be used for anything but investment in treasuries. The interest that accrues from the treasuries will be held in the trust account until there’s at least 102 percent of the value of all tokens on reserve.

That way, there will always be enough excess cash on hand to redeem tokens.

Anything above and beyond that 102 percent would be sent to the school foundation program account on a quarterly basis.

A $9 Billion Question

The potential payday for Wyoming, if it’s successful with its token, could be in the billions according to Scott Moeller, who represents American CryptoFed Dao.

Moeller has been working with the Merchant Advisory Group, which represents a number of the nation’s largest merchants, on setting up a frictionless payment system that could bypass credit cards. That would make it cheaper for businesses and consumers to buy things in a way that remains secure and convenient.

Moeller brought American CryptoFed to Wyoming because of its regulatory framework for digital assets, and has been among advocates of the stable token, which it believes could facilitate its goals.

The Merchant Advisory Group’s members account for more than $4.8 trillion in annual sales at more than 580,000 locations, Moeller told lawmakers during the interim.

As a first mover, if Wyoming could capture just 5 percent of those transactions with its stable token, the return based on one-month T-bills at 3.86 percent returns is around $9.3 billion annually, Moeller said.

The Merchant Advisory Group had submitted a letter of support for Wyoming CryptoFed Dao as part of the interim testimony surrounding Wyoming’s stable token.

Some Signs Point To No

Despite all the revisions, and the enormous payday advocates say is at stake, Gordon’s Deputy Chief of Staff and General Counsel Betsy Anderson testified early on during the legislative session that her boss still has lingering concerns about the bill.

Among these new concerns were questions about whether Wyoming is setting itself up to compete with the private sector, as well as the more nebulous, reputational damage, should the state’s stable token fail.

Amid fall-out from the collapse of FTX and other large cryptocurrency firms, Anderson said the governor worries whether a failure here could damage the progress the state has made with its digital asset sector.

“The state has made great strides in the virtual currency world,” she said. “And specifically, the speedy banks that we have set up.”

Speedy banks refers to Special Purpose Depository Institutions, SPDIs.

Uncertain Future For Digital Assets

The crackdown on crypto has so far not been kind to Wyoming’s emerging digital asset sector. Wyoming’s speedy banks were dealt a huge blow when the Federal Reserve rejected Custodia Bank’s application for access to the federal banking system, saying its safeguards against money laundering were inadequate.

Custodia is a state-chartered bank, however, and know-your-customer rules aimed at preventing money laundering and support of terrorism are part of its framework. Gordon, who used to be a member of a Federal Reserve board for the Kansas City Fed was instrumental in writing Wyoming’s SPDI laws, and the Cowboy State worked hand in glove with the KC Federal Reserve District in drafting its laws.

Initially, Custodia was told by the Fed there were no “showstoppers” in its application for access to the Federal Reserve system. But then, something happened, and the bank found itself waiting nearly three years for action on its application for a master account.

After the Federal Reserve rejected its account, Custodia amended its complaint against the Fed, pointing to language in statute that says the federal reserve shall issue a master account to duly chartered state banks.

That suit recently survived a motion from the Federal Reserve to dismiss. A hearing date has not yet been set.

American CryptoFed DAO, meanwhile, has been fighting with the SEC over whether it must register its two tokens as securities. As the first legal DAO, or Decentralized Autonomous Organization, in Wyoming, this case, too, is likely to be precedent-setting for all of Wyoming’s 500 DAOs.

American CryptoFed has argued that its business model doesn’t fit any of the SEC’s forms.

The judge hearing the case has so far signaled some understanding of that situation, suggesting the DAO could be making some headway. A final ruling in that case has not yet been issued.