Sen. Dan Dockstader, R-Afton, got a note from his assessor a week or two ago that had some disquieting news about property taxes.

“Hang on, it’s going up again,” Dockstader told fellow senators during floor debate Friday on House Bill 99, one of few remaining property tax relief bills still living this legislative session. “That’s in addition to all the increases we’ve had.”

Dockstader added that he feels “very disappointed” in what the Legislature has accomplished this year with regard to property tax relief.

“If there was one thing that we came down here for, it was to find some property tax relief,” he said.

House Bill 99 narrowly passed the Senate on Friday with an 18 to 13 vote, and passed concurrence on Monday with 50 votes. Concurrence is where lawmakers from the originating house agree on any amendments added by the other house. That makes House Bill 99 the first — and so far only — vehicle for immediate tax relief headed to the governor’s desk.

The bill, as amended, will expand an existing, state-funded tax refund program by allowing people with slightly higher income levels, up to 125 percent of median household income for your county or state, whichever is highest. It also offers a slightly larger refund, as long as it’s no more than 75 percent of the prior year’s property tax.

A “circuit breaker” amendment, brought by Rep. Liz Storer, D-Jackson, that kicks in whenever the tax due exceeds 10 percent of a person’s annual income, would allow those who have saved assets for retirement to still qualify for assistance. That amendment has survived.

Legislative Shooting Gallery

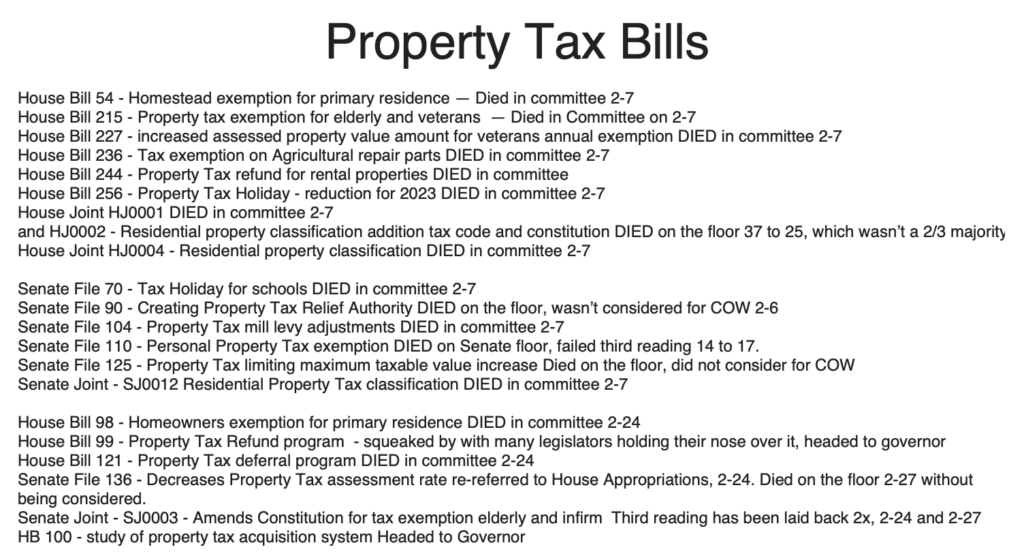

No less than 21 bills entered the Legislature this session with sponsors seeking to provide either some type of property tax relief, or property tax reform, down the road.

House Bill 98 was one of six bills that made the crossover deadline, which is where bills travel from one chamber to the other, but died in a Senate Committee. It would have lopped off $50,000 from fair market values, or up to 25 percent of a home’s value, as a means of returning some of the windfall the state has reaped from double digit tax increases. Senate File 136, another bill that made crossover, sought to reduce the property tax rate from 9.5 to 7.5%.

Others, like Senate Joint Resolution 12, were more ambitious long-term. That bill would have posed a constitutional amendment to voters, to pull residential property out of the “other” category where it now sits with commercial and agricultural property.

This would eventually have allowed lawmakers to target relief to homeowners, without affecting the other two property types in “Other” which include agriculture and commercial. Previous attempts to do that have all failed the constitutionality test.

Both Senate Joint Resolution 12, and a similar bill from the House that includes caps on tax rate increases, failed. The House bill died in committee, while the senate bill made it to the floor, but failed to get the required two-thirds majority.

Aside from House Bill 99, just two of the 21 bills still remain:

• House Bill 100 — a study bill that will look at whether Wyoming should switch from a property tax system based on fair market values to one based on purchase price. This bill won’t bring any immediate relief. And lawmakers are not required to act on any of the study findings.

SJ Resolution 3 — An exemption for the elderly and the infirm. This is on its third reading in the House, but has been twice “laid back,” which refers to delaying a vote on the bill. This is sometimes done to work on amendments to the bill to rally more support.

Property Tax Relief A Priority For Many

Dockstader was not the only legislator voicing frustration on the Senate floor during debate of House bill 99.

Property tax relief had been his top legislative priority, Sen. Tim Salazar, R-Riverton, said.

“Mr. Vice President, you yourself said at the beginning of the session or thereabouts that we had a lot of bills, but what you were concerned about was that at the end, we may not have anything, and now we have almost nothing,” he said. “And I just want to echo the sentiments of my colleague next to me.

“We’re sitting on an incredible surplus, and we could not deliver property tax relief to the vast majority of our constituents in this state. The very thing, at least in my Senate district, that people wanted.”

Salazar said House Bill 99 was the wrong answer, earning it a no vote from him.

“The answer was broad property tax relief,” he said. “And I know that we went through constitutional issues of why certain bills could not be voted for. I’m just very disappointed that at the end of this session, the very people who we wanted to help, we could not help.”

Senator Bo Biteman, also in the “no” camp, said trying to draw a dividing line between those who should and should not get a tax cut is offensive.

“We had a record surplus this session of well over a billion dollars,” he said. “Money we took in above and beyond what our government needs to function. And we’re sitting here in the House of Lords talking about who is worthy of a tax cut. Who deserves a tax cut. Who doesn’t deserve a tax cut? It’s offensive to the voters who demand us to come down here and give everybody tax relief on property taxes.”

Balancing Relief

Sen. Mike Gierau, D-Jackson, among lawmakers in the “yes” camp, said he understood and even agreed with the desire to give more broad-based tax relief.

But, unfortunately, most such bills had already died, some in committees, never even getting to a floor vote.

“If we would have done 285 or 210 percent of average median income, we could have hit the whole state, and we could have given that tax break to everyone,” he said. “But we didn’t do that. We tried to work in a targeted, measured way, because we heard through the process, don’t spend too much. We can’t go too far. So, this is the vehicle in front of us.”

Gierau said the choice at this point is, for all the could haves and should haves being raised now, a simple one.

“We can go home and say, well, it didn’t give you enough, we tried our best,” he said. “Or we can say we did our best and we got the people who needed it most something, and then we can come back and build on that.”

Good Enough For Now

Other lawmakers in the “yes” camp expressed similar sentiments.

Sen. Chris Rothfuss, D-Laramie, said the bill probably doesn’t deliver on very many of any given legislator’s ideals, including his own.

“I know it doesn’t get everyone, I get that, but not everyone is in as dire of need,” he said. “Not everyone is feeling it the same way. This is a case where perfect is the enemy of good. We might not get universal tax relief. But at least being able to bring this home, look in the eyes of our constituents, those most in need, and being able to say, ‘Hey, we did bring relief home as you asked. We focused on those most in need.’”

Senator Bill Landen, R-Casper, suggested the bill fell well short of the Legislature’s best, even though he was voting for it.

“Sometimes we have to take what can happen, and at least on this one we are directing the money to those who need it the most,” he said. “Maybe we can step back in here and correct things that were pointed out, but today, I think this is a good bill, and I think it’s worth passing.”

For Dockstader, it was about good enough for today.

“We better walk out of here with some solutions, or you’re gonna go home and hear about it,” Dockstader said. “This is one method of doing it. It’s not my favorite, but I’m going to put this in the briefcase with an aye vote and take it home.”