By Coy Knobel, Cowboy State Daily

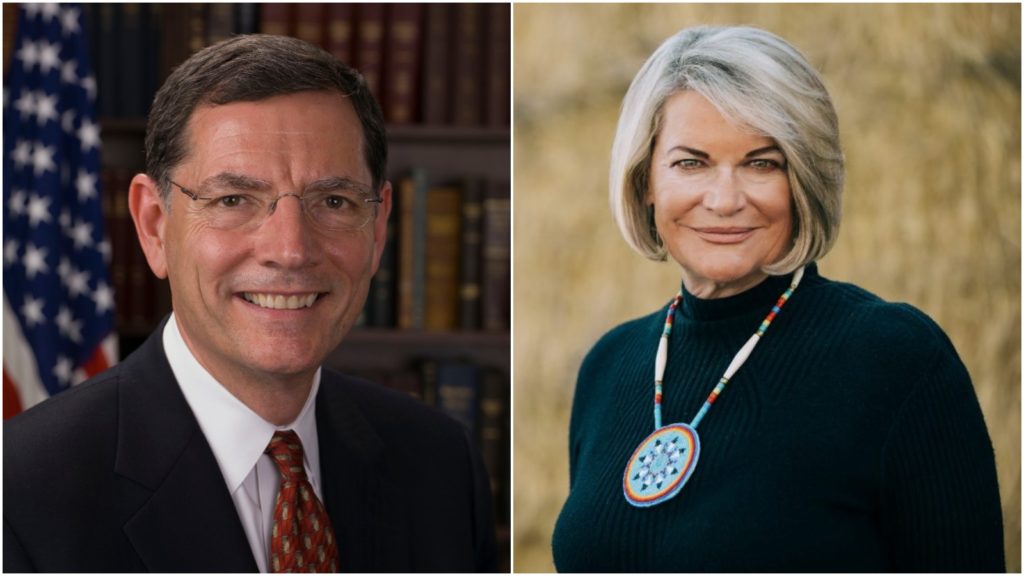

Wyoming taxpayers should prepare for an onslaught the likes of which they’ve never seen before. An army of 87,000 IRS agents is at the gates, freshly funded by President Joe Biden’s Inflation Reduction Act. This is according to GOP congressional leaders, including Wyoming U.S. Sens. John Barrasso and Cynthia Lummis.

Not so, says Biden and Democrat congressional leaders.

They say the IRS has been woefully underfunded for years, and the $80 billion authorized to be spent over the next 10 years will serve to replace personnel who have retired or moved on. These “transformational investments” in the IRS will result in much-needed improved customer service and technological updates.

Proponents of the IRS funding say it will make tax collecting more fair because the agency will have the resources to go after wealthy, profitable corporations that don’t pay their share and the increased revenue brought in from this enforcement will help with the national deficit.

Who To Believe

Who’s right? Only time will tell, said one expert, but Congress maintains the ability to oversee the IRS to ensure it is using the money provided as intended.

“Whether there are rogue members of the agency that have an agenda — there is always a risk for that in any government agency. But Congress has provided the IRS with boundaries on how the money must be used,” Bart Massey told Cowboy State Daily. “Congress has the ability to monitor and provide oversight as to whether the IRS stays within its designated lanes.”

Massey, a CPA with the wealth management firm Keel Point in Washington, D.C., knows both the IRS and Congress. He served as a senior advisor to former IRS Commissioner Chuck Rettig. Before his stint at the IRS, Massey was legislative director and tax policy aide for former Wyoming U.S. Sen. Mike Enzi.

“The IRS cannot use the new funding for whatever it wants,” Massey said. “There are boundaries and guidance established by the Inflation Reduction Act.”

How Much And What For?

The Inflation Reduction Act includes about $3 billion for improvements to taxpayer services.

The act designates more than $45 billion over 10 years for tax enforcement. About $25 billion over 10 years is for operations support such as rent, printing, postage, security, research and more. Almost $5 billion over 10 years is to be used for systems modernization, including development of callback and other technology.

Smaller amounts have been provided for the IRS tax court and treasury offices, the treasury inspector general and other expenses.

IRS Asked Not To Target People Making Less Than $400K

Steps have been taken to ensure that no family or small business making less than $400,000 a year will see their taxes go up, according to a statement from the Biden White House.

Treasury Secretary Janet Yellin sent a letter to the director of the IRS outlining the administration’s intentions for the additional money.

“Specifically, I direct that any additional resources — including any new personnel or auditors that are hired — shall not be used to increase the share of small business or households below the $400,000 threshold that are audited relative to historical levels,” Yellen said. “This means that, contrary to the misinformation from opponents of this legislation, small business or households earning $400,000 per year or less will not see an increase in the chances that they are audited.”

Barrasso and Lummis want to ensure that is the case. They cosponsored a bill, S. 4817, with bill author Idaho Sen. Mike Crapo. This legislation would prevent the use of Internal Revenue Service money added in the Inflation Reduction Act from being used for audits of taxpayers with taxable incomes below $400,000.

The bill has been referred to the Senate Finance Committee. Crapo and the 19 senators cosponsoring the bill are Republicans.

“The promise to not tax anyone earning less than $400,000 will be broken,” Crapo wrote in a recent column.

The IRS funding authorized in the Inflation Reduction Act will result in national deficit reduction by increasing revenue, according to the White House. The new IRS funding will allow it to crack “down on large, profitable corporations with more than $1 billion in annual profits that currently get away with paying little to no federal income tax … ensuring that the ultra-wealthy and large corporations pay the taxes they already owe.”

Crapo said this is not a credible claim.

“Advocates argue the enforcement funding will be used to close the tax gap — the difference between taxes owed and taxes paid — and then claim it is only about ‘wealthy tax cheats.’ Yet, the data tell a different story,” said Crapo. “Democrats will not achieve their desired tax revenue goals without also targeting the middle class, small businesses and taxpayers earning under $400,000 per year.”

Election Issue

Election day is Tuesday, and the increased funding for the IRS has been an issue in campaigns across the country. A TV political ad in Iowa paid for by the National Republican Campaign Committee shows IRS agents coming out of a cornfield onto what could be a baseball field.

“If you pass it, they will come … after you,” a whispery voice says in the ad. It’s a take on the 1989 movie “Field of Dreams,” where a man played by Kevin Costner builds a baseball field in an Iowa corn field for long-dead baseball players because he hears a voice that says, “If you build it, they will come.”

Wyoming’s senators support the Crapo bill in the U.S. Senate to limit the IRS’ use of the new funding. In the U.S. House, GOP Leader Kevin McCarthy, R-California, said the IRS funding also is in his sights. McCarthy, who could become speaker of the House with a GOP takeover, said if the GOP wins the House majority in the election, the first bill would be to repeal the IRS funding provided by the Inflation Reduction Act.

Massey believes the new IRS funding is here to stay, at least for now, regardless of the outcome of Tuesday’s election.

“The likelihood of a change in law or funding seems unlikely in the short term, since the current presidential administration will continue,” he said.

Opportunity For Improvement

Massey said Wyomingites are generally independent, hard-working and law-abiding and they want, expect and appreciate “a government that doesn’t overly interfere with the responsibilities they already have in their lives.”

“One of the IRS’ greatest priorities should be helping taxpayers voluntarily comply verses creating taxpayer burdens associated with examinations,” he said.

“I often see taxpayers and their advisors respond to IRS notices in a timely fashion, but the IRS cannot update its system quickly enough to prevent another round of notices automatically generated and sent out,” Massey said. “Folks feel somewhat helpless in resolving these issues and the IRS should provide stronger avenues for taxpayers to communicate with the agency and easily settle disputes.”

Whether the new IRS funding will “finally allow the IRS to modernize in a way that it more effectively can provide ‘customer service’ to taxpayers and administer the tax system” will be shown in Americans’ future experience and interactions with the agency, Massey said.

Changes in Congress and/or a presidential administration could alter the IRS’ course in different ways, he said.

“If for some reason, the IRS begins to generate tax assessments and notices for wealthy taxpayers and there continues to be an infrastructure that doesn’t facilitate efficient resolution of contested issues, that will certainly create new and perpetuate existing frustration with the agency,” Massey said.

He said an IRS that is more modern and better equipped to perform routine duties for processing tax returns in a timely manner and provides assurance of compliance would help Wyoming and all taxpayers. Whether that turns out to be the case depends on how the IRS uses its new resources and the actions of the political leaders who oversee the agency.