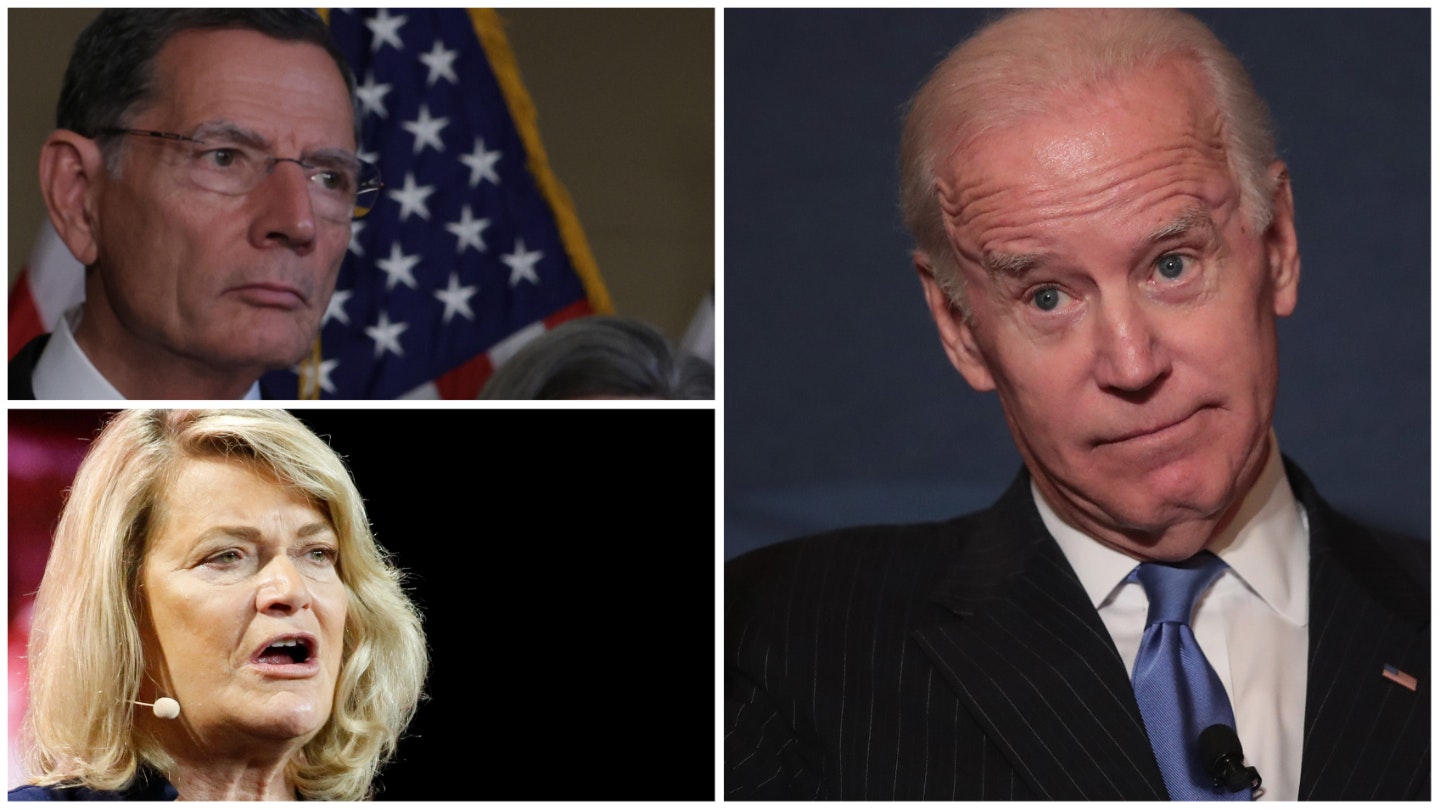

U.S. Sens. John Barrasso and Cynthia Lummis have signed on to an effort to rein in the IRS from using Inflation Reduction Act money to audit middle-class Americans.

In a Thursday email to Cowboy State Daily, Lummis said Senate Bill 4817 would ensure that “everyday, hardworking American citizens are protected from gross IRS overreach.”

The bill aims to prevent the IRS from using an “unprecedented” nearly $80 billion “infusion of new funds” on audits of taxpayers making less than $400,000 a year, according to the bill text.

The Democrat-backed Inflation Reduction Act that passed Congress on Aug. 12 contains ambitious revenue goals and billions in funding to beef up IRS staffing and technology.

Barrasso has called the move an attack on working Americans.

“President Biden and the Democrats want to empower the IRS to squeeze as much money as they can out of hardworking Americans,” said Barrasso in a Sept. 14 email to Cowboy State Daily. “In addition to facing record-high inflation, (multiplying IRS audits) would make it even harder for families, farmers and small businesses to get by.”

Barrasso said S. 4817 would stop the IRS from using “supersized funds” on middle-class audits.

“The people of Wyoming and across the country want nothing to do with the Democrats’ plan to run the middle class dry,” he said.

Lummis also called the bill “commonsense legislation.”

“The hardworking people of Wyoming should not be subjected to frivolous audits to help pay for the Democrats’ reckless tax and spending spree,” she said. “The IRS should never have received this massive increase in funding.”

‘Not The Best Policy In The World’

One of Wyoming’s most prominent Democrats called the bill an exercise in favoritism.

“I’d like that provision because it would protect me,” said former Wyoming Gov. Dave Freudenthal with a laugh, in a Thursday interview with Cowboy State Daily. “But on the other hand, I don’t know that we ought to start favoring one set of taxpayers over another.”

Freudenthal said the bill comes across as “symbolic, as opposed to substantive.”

“I guess they’re saying only people who make more than $400,000 would ever cut corners on their taxes – and I doubt that that’s empirically true,” said Freudenthal.

The former governor expressed concern that legislation like this could “create a favored class.”

“That’s probably not the best policy in the world,” he said.

Republican Co-Sponsors

Only Republicans co-sponsored the bill.

Barrasso and Lummis were accompanied by the following co-sponsors:

Republican Co-Sponsors

Only Republicans co-sponsored the bill.

Barrasso and Lummis were accompanied by the following co-sponsors:

Sen. Chuck Grassley, Iowa

Sen. John Cornyn, Texas

Sen. John Thune, South Dakota

Sen. Richard Burr, North Carolina

Sen. Patrick Toomey, Pennsylvania

Sen. Tim Scott, South Carolina

Sen. Bill Cassidy, Louisiana

Sen. James Lankford, Oklahoma

Sen. Steve Daines, Montana

Sen. Rob Portman, Ohio

Sen. Todd Young, Indiana

Sen. Ben Sasse, Nebraska

Sen. Shelley Moore Capito, West Virginia

Sen. Mike Braun, Indiana

Sen. Marsha Blackburn, Tennessee

Sen. James Inhofe, Oklahoma