By Renée Jean, Business and Tourism Reporter

renee@cowboystatedaily.com

Some sectors of Wyoming’s economy are posting sales and use taxes that exceed pre-COVID levels, but the gains are not even across the board, and it’s hard to say how much of the gain is inflation and how much is improved economic activity.

Wyoming’s 4% sales and use tax collections were a little more than $1 billion for fiscal year 2022, an increase of 10.1% year over year.

That is near the record levels of fiscal year 2015, Wyoming Economic Analysis Division’s Chief Economist Dr. Wenlin Liu said, but it’s still 19.5% less if measured in inflation-adjusted dollars.

Back To Pre-COVID

There are some categories, however, that have rebounded to above pre-COVID levels, Liu told Cowboy State Daily, while other sectors still have not completely recovered.

“The retail trading industry is a lot higher than pre-COVID,” he said. “That economic activity is also related to, you know, since COVID, too much federal dollars invested into the economy.”

Retail trade, excluding motor vehicles, is the state’s largest sector in terms of sales and use tax collection. It’s up 15% over 2021 for a total of $338 million collected by the statewide 4% sales tax.

Online sales also increased during the pandemic, and those are habits that have persisted, helping keep that number healthy, Liu said.

Leisure and hospitality also is above pre-COVID levels, Liu said. It was up 30% to $101.4 million.

Extraction Up The Most

Minerals and extraction, meanwhile, was up the most year over year for fiscal year 2022, at 57.5%. But collections still remain below pre-COVID levels, Liu said. The state collected $74.9 million in that category from 4% sales taxes for fiscal year 2022.

The next largest percentage increase was Education and Health Services, which jumped 52.6% to $448K. Manufacturing was up 29.6% to $23.1 million.

Down Areas

Categories showing a drop for fiscal year 2022 in the 4% sales and use tax Wyoming collects include:

• Utilities, down 1% to $36.3 million.

• Wholesale trade dropped 24.6% to $50.7 million, Information dropped 8.2% to $11.7 million.

• Other Services were down 23.7% to $30.2 million.

• Public Administration dropped 1.5% to $85.5 million.

How Counties Fared

Most Wyoming counties experienced an upward trend for sales and use tax collections.

Eighteen counties posted an increase, led by Campbell up 36.5%.

Next highest was Platte, up 30.6%, and Teton, up 29.3%. Johnson and Sublette collected 20% more each.

The increases were from rebounding mineral activities, booming outdoor and recreational tourism or both, Liu said.

Counties that were down in collections for the state’s 4% sales tax include Carbon County down 4.3%, Converse down 8.2%, Niobrara down 10.7% and Weston down 11.8%.

Lodging

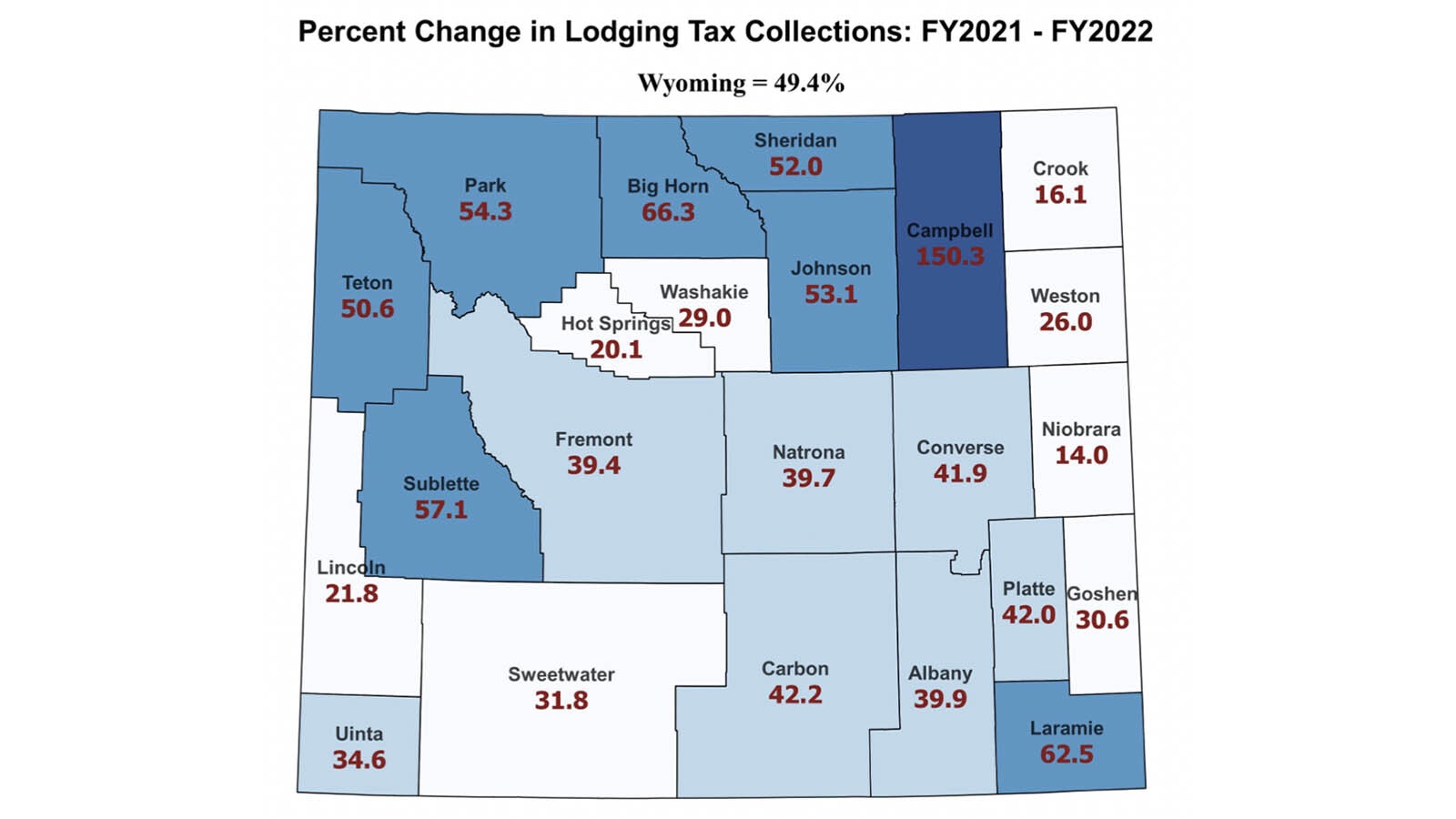

Lodging taxes, meanwhile, not including the state’s newly implemented 3% addition, were up substantially from the previous year, posting a 49.4% gain from the $18.8 million collected the previous year, for a total of $28.1 million for fiscal year 2022.

Taking out the tax rate increase implemented in Campbell County, for comparison’s sake, only drops that favorable percentage to 47.

Record-breaking outdoor recreation and park visits in 2021 are responsible for that increase, Liu said. These fiscal year 2022 figures also pre-date the closing of Yellowstone due to flooding.

The state’s newly imposed 3% lodging assessment for fiscal year 2022 added $30.9 million to the overall kitty, with Teton County alone contributing $16.6 million, or 53.8% of that. The 2% collections from areas that did not have a local lodging tax prior to January 2021 totaled $200,000 for fiscal year 2022.

On a county-by-county basis, collections in Campbell County were up 150.3%, largely because of that county’s new rate increase, from 2-4%.

Aside from Campbell County, the counties posting the biggest gains were Big Horn, up 66.3%, and Laramie, up 62.5%. Five other counties also posted gains of more than 50%. They were Johnson, Park Sheridan, Sublette and Teton.

Teton County’s collections increased 50.6% from fiscal year 2021 to fiscal year 2022. They also collect the largest amount of lodging tax in the state, over $11 million, since they include Yellowstone and Grand Teton National Parks.