Plant-based Beyond Meat is having a hard year, which is raising doubts that the company’s products can in the long run compete with a thick, juicy beef steak.

Just two years ago, the alternative meat industry seemed to be making serious inroads into the food budgets of average Americans. Companies scrambled to produce their own versions of plant-based, meat-like protein and formed partnerships with major fast-food chains.

Burger King made a huge financial investment in pushing its Impossible Whopper, made with Impossible Foods-brand plant-based meat. And McDonald’s reportedly did well overseas with its McPlant, made with Beyond Meat, but discontinued it in the United States after a test run at select restaurants.

Beyond Meat has received celebrity endorsements from Snoop Dogg, Kim Kardashian and Leonardo DiCaprio, as well as Gates, who provided venture funding to the company. Gates also invested in Beyond Meat’s competitor, Impossible Foods Inc.

Overdone

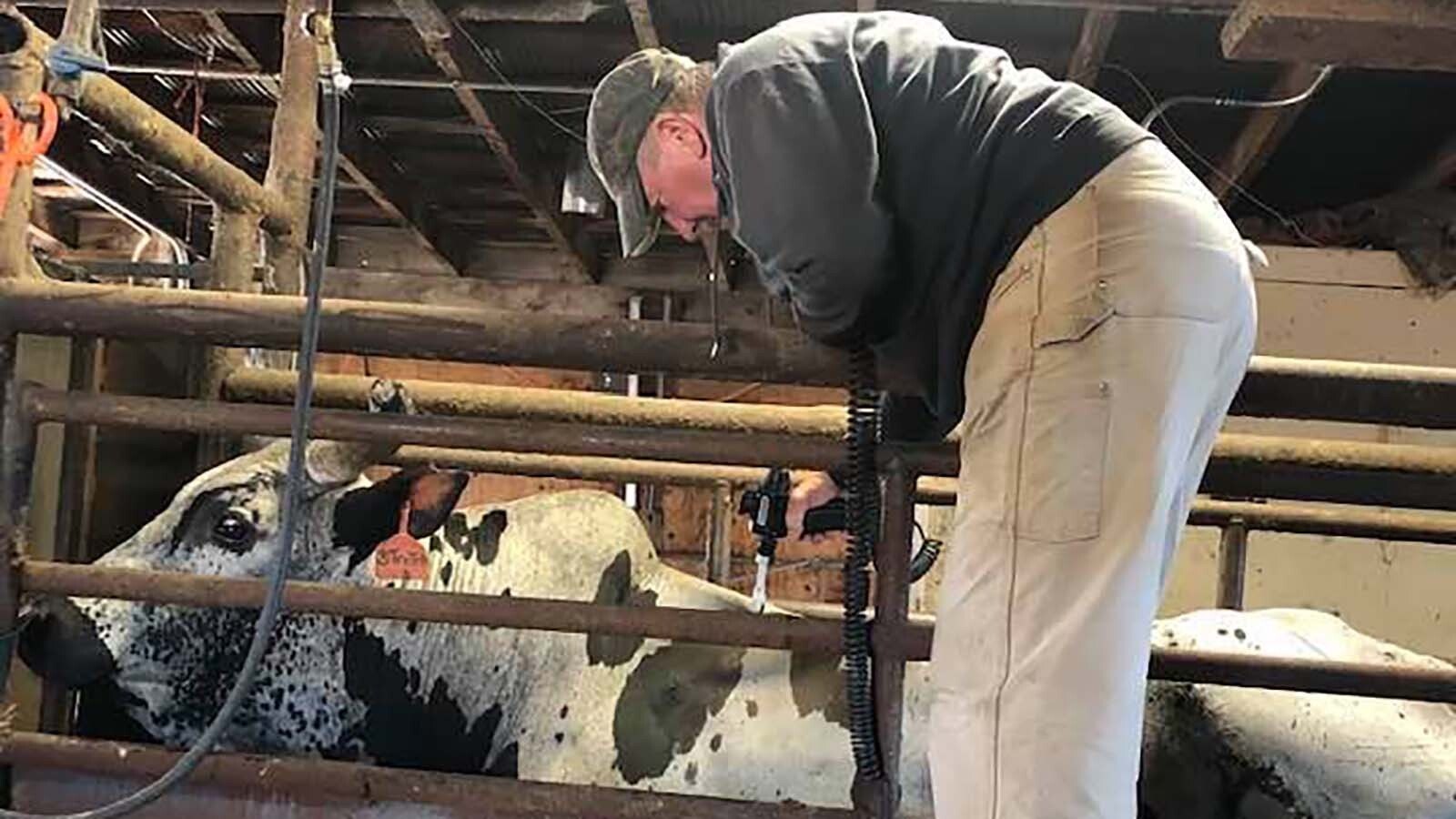

Wyoming’s cattle ranchers have been monitoring the new competitors vying to please Americans’ palates for meat, and the pandemic also created a lot of turmoil for Cowboy State producers.

Big meat packers, which process 80% of the meat in America, had to shut down some plants because of COVID-19, greatly limiting processing capacity. Supply chain and labor issues also made ranchers’ jobs more difficult. The rising popularity of plant-based meat alternatives at the time was another threat to their already-slim financial margins.

“There was a lot of concern that it would take off and really go,” said Dennis Sun, a fourth-generation Wyoming rancher and publisher of Wyoming Livestock Roundup.

Jim Magagna, executive vice president for the Wyoming Stockgrowers Association, said that initial popularity of plant-based products sparked a greater interest in the industry to do more advocating for itself.

“It was something that we took seriously as a concern. Maybe it’s a little stronger of a word than I would use, but as an industry that was a wake-up call to us that we needed to more aggressively discuss not only the flavor of real meat, beef or lamb, but also the the nutritional values that are in the real product,” Magagna said.

Medium Staying Power

It appears that the initial interest in alternative meats is failing to grow or sustain itself.

Citing research conducted by Information Resources Inc., Bloomberg reports that sales of refrigerated meat alternatives declined more than 10% in the past year. Beyond Meat’s stock has dropped 75% since the start of the year, and according to CNBC, the company’s market value is down more than $12 billion over the last three years.

The company had to revise its earlier sales projections for 2022 down by about $100 million, now estimating it will finish out the year with sales somewhere in the range of $470 million to $520 million. To reduce costs, the company announced last month it was cutting its global workforce of 1,000 by 40 employees.

This year McDonald’s initiated a test run of its McPlant burger, which was part of a partnership with Beyond Meat, but it just wasn’t catching on with consumers. The product was quietly removed from the menu in American restaurants.

Waning consumer interest comes along with shake-ups within Beyond Meat’s executive board. Last week, COO Doug Ramsey was suspended after he was arrested for allegedly biting off part of another man’s nose, and this week the company announced its chief supply chain officer would be stepping down.

Rare Challenge

Impossible Foods partnered with Cracker Barrel Old Country Store to sell its non-meat breakfast sausage. The announcement on Facebook was met with some praise and considerable criticism.

“Not in a billion years am I eating this. The only thing impossible will be how to recover from this mess,” one commenter wrote.

Others mocked those who were so offended by the offering, but the reaction suggests an analysis by Deloitte Consulting was correct. The firm suggested that many consumers are turned off by the perceived “woke” nature of the product. The firm also did a survey in July that found that fewer consumers see alternative meats as healthier and better for the environment.

The founder of Beyond Meat told Entrepreneur magazine in 2018 his main motivation for starting the company was to fight climate change. Switching to a plant-based diet would result in small reductions in greenhouse gas emissions. In the U.S., the agricultural sector, according to the Environmental Protection Agency, accounts for 11% of annual emissions, but livestock are a small portion of that at about 2%.

Bjorn Lomborg, director of the Copenhagen Consensus Center and author of The Skeptical Environmentalist, is a critic of those who advocate a vegan diet as a means to fight climate change.

Lomborg has said he’s a vegetarian for ethical reasons, but he points to a systematic survey of peer-reviewed studies published in Journal for Cleaner Production that found that the average person in the developed world would cut his or her emissions down by 4.3% by switching to a non-meat diet.

There are far more effective measures to address climate change, Lomborg said.

Beyond Meat did not respond to a Cowboy State Daily request for comment.

Well Done?

Magagna said the decline in consumer excitement has a lot to do with how plant-based meats taste.

People were initially enthusiastic because it was something new to try, Magagna said. Once they tried it, they found that it didn’t quite live up to the real deal.

“It just doesn’t give them the same satisfaction as that juicy beef steak,” Magagna said.

As inflation continues to elevate food prices, consumers also are likely scrutinizing their grocery bills a little more closely. With alternative meat products often costing more than natural meat, consumers also may be choosing cheaper options.

All this bad news for the alternative meat industry might not be the end for the niche food products. Impossible Foods CEO Peter McGuinness told Bloomberg that the company’s retail sales have increased 70% this year.

McGuiness said that consumer awareness is key to further growth.