Wyoming will receive no coal lease bonus money to help fund its schools and their construction needs in the next two years, a loss of hundreds of millions of dollars compared to past budget cycles.

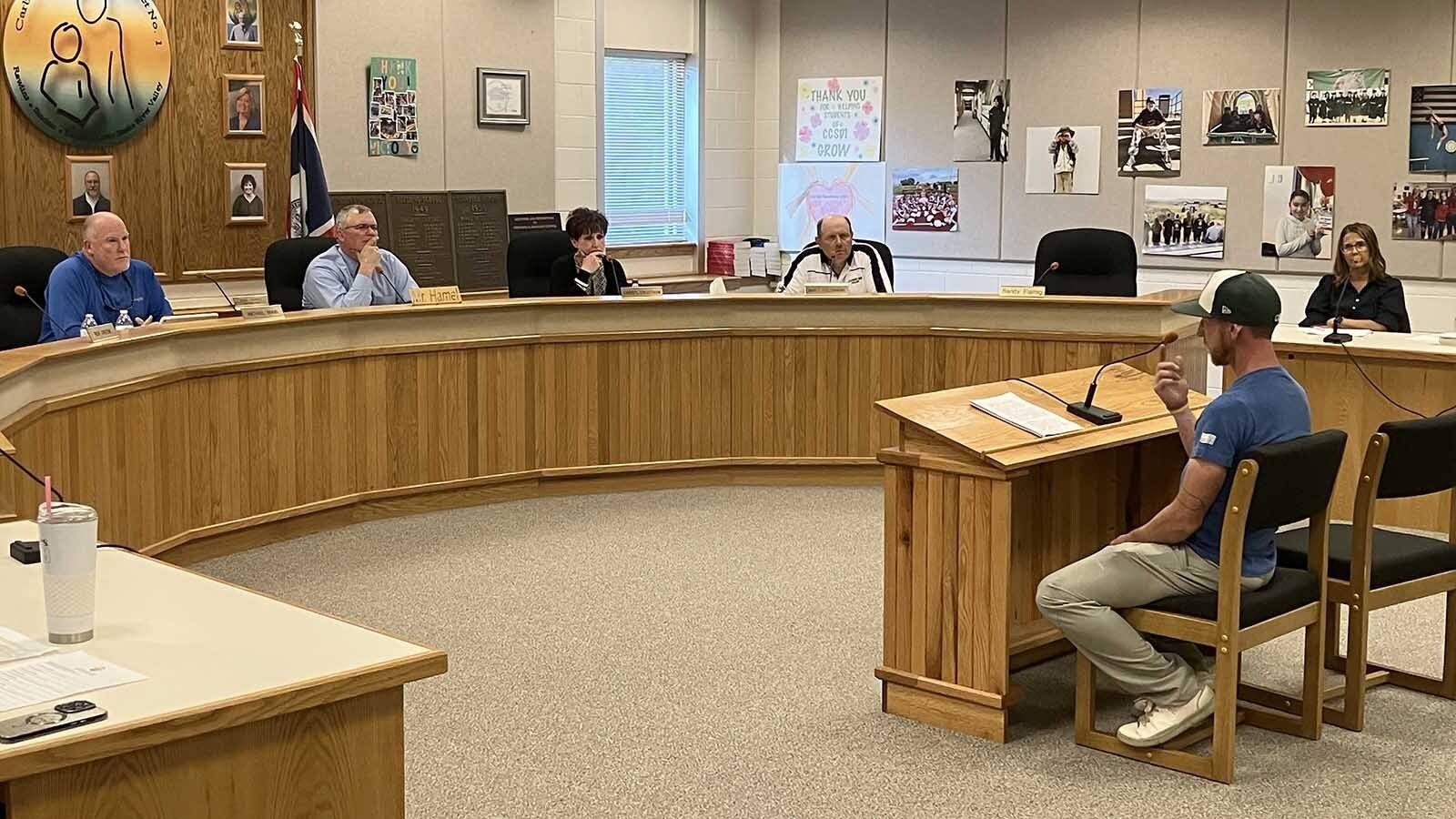

And income from other minerals isn’t looking good either, Matt Wilmarth, education expert with the Legislative Service Office, told the Legislature’s Revenue Committee.

“Coal lease revenue is gone,” said Wilmarth, who was presenting figures from the Consensus Revenue Estimating Group’s latest report.

CREG is a group of state economic analysts who quarterly predict what the state’s income will look like.

When the legislative Revenue Committee met Wednesday to hear a breakdown of K-12 education funding sources, one thing was noticeably absent from the 2023-24 projected makeup of the “capital construction” or school building and major repairs account: Coal.

Coal leasing bonuses dropped out of Wyoming’s school funding in 2019 and haven’t come back. School building and major maintenance projects are expected to receive no money from coal leasing bonuses by the end of this biennium (2021-22) or throughout the next one.

A coal leasing bonus is an amount paid to the state or other landowner by a mining tenant when its lease is secured.

Wilmarth noted that the report could change when the state reassesses markets in October.

Courts Made Us Do It

From 2005-2018, coal leasing bonuses funded a huge majority of school construction in Wyoming, ranging from about $400 million in 2005-06 to $100 million in 2017-18.

In this biennium and the next, the entire account is budgeted at about $170 million – a fraction of its nearly $500-million volume during the building-busy years of 2005 and 2013-2016.

When the Wyoming Supreme Court beginning in 1995 mandated school districts to provide a uniform experience to students regardless of their county’s affluence, coal, said Wilmarth, allowed the state “to respond to court decisions, to build schools.”

Why No Coal?

Sen. Tom James, R-Green River, asked why coal bonuses have dried up.

Travis Deti, Wyoming Mining Association executive director, said there are “a couple companies” exploring leases right now, but they are looking at smaller tracts than before the industry’s slump began.

“Right now demand has gone down,” added Deti.

James was concerned that coal port embargoes in other states had contributed to the decline, but Deti said a large majority of Wyoming coal is consumed domestically, and “domestic utilities have been shifting away from coal.”

A lack of startup bonuses now, said Case, indicates a lack of revenues in the future.

Federal Minerals Royalties

On the “school foundation program,” or operational and staffing side of school funding, Wyoming’s share of federal mineral royalties on commodities such as oil and natural gas was cut nearly in half in recent years.

Royalties are paid after production begins on a parcel of land.

Every two years, beginning in the 2005-06 biennium, Wyoming’s schools have received about $541 million, or 41% of their total foundation funding, from federal minerals royalties.

Compare that to 2021-22, when Wyoming’s K-12 schools are running on $382 million, or 25% of their total foundation endowment.

Investment

Committee Co-Chairman Sen. Cale Case, R-Lander, noted that both natural gas and coal revenues have decreased by 50% in the past decade. He said the market should compel Wyoming to “find other sources of revenue” and plan better to retain the energy wealth that does remain to invest it in other pools.

“The racehorse that’s been working for us (recently) is the investment earnings,” said Case. “So, keeping our mineral wealth and investing it for the future, and using it, is going to be really, really important.”

“It may not be a good time to reduce the severance tax on coal,” he said, “but I guess we just did that.”

Case was referring to a severance tax reduction approved by the Legislature during its recent budget session.

Case emphasized that although he wasn’t saying he agreed with the change, “we’re living in a more carbon-conscious world” and should recognize “the implications of that.”

‘Most Valuable Real Estate in the World’

Declines in the coal and mineral industries also affect the state’s 3.5 million acres of federally-entrusted school-trust lands, which are designed to provide income for state schools.

Sales, activities, and investments on those lands yielded about $253 million to K-12 schools in Wyoming in 2020 – which is far higher than its yields of roughly $100 million the early 2000s.

Wilmarth said the profitability of activities on those lands can fluctuate with oil, natural gas, and coal markets as well.

The Legislature has been responding to coal funding declines by doubling down on investment projects, said Wilmarth, which “backfill” losses, but do “not make up for the loss of coal lease bonus money” on the construction side.

“The value of our state lands is incredible,” said Committee Co-Chair Steve Harshman, R-Casper. “There are six sections in Teton County, of school (trust) lands that are priceless. They’re not $40 million parcels. Add more zeroes.”

Harshman said the school trust lands in Teton County may be the “most valuable real estate in the world” and Wyoming needs to recognize their value as it uses or sells them.

Marguerite Hermann, a member of Advocates for School Trust Lands, urged the committee to follow lands investment opportunities closely.

Harshman agreed, and encouraged Herman to bring some ideas to the Committee in the near future.