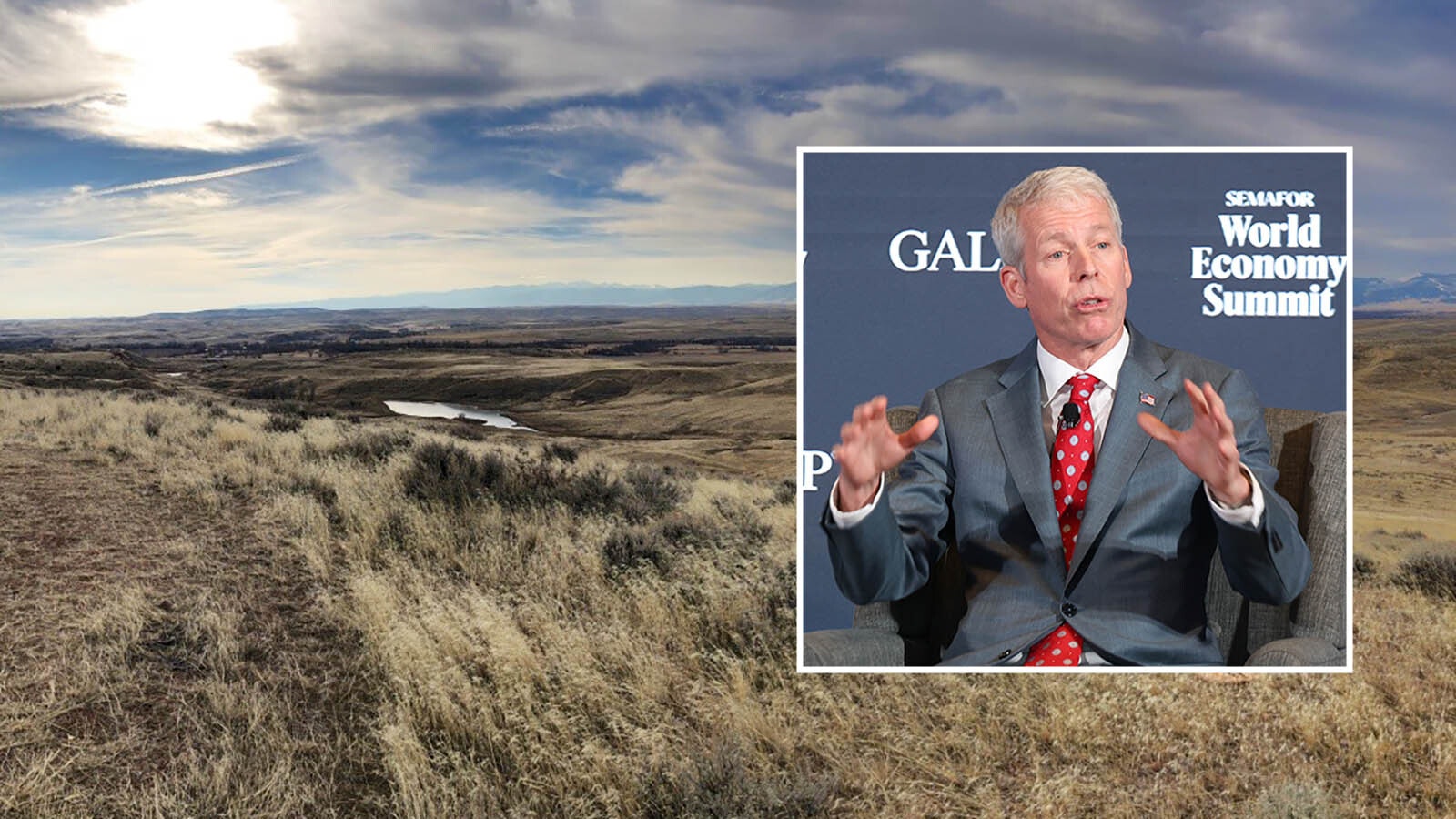

A global mining business says it has found significant deposits of uranium in Wyoming’s Red Desert.

GTI Resources discovered a likely source of raw uranium, or yellowcake, through a first-time exploratory drill program called the “Thor” project in the Great Divide Basin, said Bruce Lane, GTI Resources director.

Lane added the geological and political landscapes would appear to encourage development.

“We’re confident we have established there’s a mineralized system here,” Lane told Cowboy State Daily.

Lane hoped to release an official report by mid-April that will detail how much uranium the area might contain.

Wyoming’s geologic structure, said the director, is ideal for in-situ leach mining – a relatively “clean” process using water and baking soda to pump uranium deposits from drilled holes.

The next step, said Lane, will be for GTI to “follow this drilling program with another drilling program of higher intensity” to further identify the yellowcake presence and develop an “economic model” around it before tackling the official permitting process.

The permitting process for uranium production, said Lane, is “onerous – as it should be” to address environmental concerns.

Lane said this initial discovery of sandstone-embedded uranium in southern Wyoming comes amid the industry’s first optimistic phase in more than a decade.

“Uranium mining in the States has really collapsed in the last decade, so in the last few years there’s been no mining at all,” said Lane, noting that Kazakhstan flooded the global market nearly two decades ago with cheap uranium which, at about $20 per pound, drove out established producers and stalled Wyoming ventures.

Lane also bemoaned the 2010 sale of Uranium One assets to Russian nuclear power giant Rosotom – a move that was approved by then-U.S. Secretary of State Hillary Clinton which transferred 20% of U.S. uranium reserves into Russian control.

“It’s quite incredible to think… somebody decided in the administration that that was a good idea,” said Lane.

With the transfer, Russia took over much of the global uranium enrichment services for turning raw yellowcake into refined uranium, Lane said, adding that now there is “some enrichment in the U.S.”

A Trump-era report by the National Nuclear Security Administration stated the U.S. in 2019 did “not have domestic uranium enrichment capability,” prompting the Navy to use national stockpiles for the propulsion of its nuclear-powered vessels.

Foreign Chaos

But the tides turned in January, when civil unrest in Kazakhstan prompted Russia-aided communications and travel shutdowns that quelled both civilian protests and uranium production in the small central-Asian country. Kazakhstan had been producing more than 40 percent of the world’s uranium supply.

Prices surged to $45 per pound in January and $55 on Wednesday evening.

Consumers, or “utilities,” said Lane, may find it “better for them to seek uranium from a more politically stable place than Kazakhstan.”

The Russian-Ukraine conflict now waging, Lane added, could further cement “the strategic issues with buying out of the Russian block, and Chinese-block-aligned suppliers.”

Kazakhstan, Russian, and Uzbekistan accounted for 47% of the total uranium purchased by U.S. civilian operators in 2020, according to the U.S. Energy Information Administration. Canada and Australia together were the second-largest sources for American buyers, providing about 34% of the supply.

America’s export rate was not as voluminous or as lucrative:

U.S. buyers bought 39.6 million pounds of uranium from foreign sources at an average $33.79 per pound in 2020 – but domestic producers only sold 9.9 million pounds, at an average price of $29.57 per pound, the EIA reported.

Energy Independence

Russia’s invasion of Ukraine provoked criticism and calls by Wyoming’s three Congressional delegates for bans and sanctions on Russian products.

“Now you’ve got Liz Cheney banging the desk and demanding that Russia be sanctioned, and that uranium be sanctioned as well, and oil and whatever else,” said Lane.

Shifting that pressure to meet the demand for uranium back onto American suppliers, he continued, is a “wakeup call, that the U.S. domestic uranium supplier used to be the world’s leading supplier business – and it’s been decimated, and effectively collapsed.”

“But I believe there’s a renaissance underway,” he added.

Clean Power

Lane referenced an increasing demand for clean energy.

“Emissions-free electricity can’t all come from windmills and solar power,” he said, due in part to their intermittent nature and “network issues.”

India, France, South Korea, Japan, and many other jurisdictions are “doubling down” on nuclear power, Lane added.

Uranium mining is not without its environmental risks, he said, as some producers will use harsh chemicals to extract the yellowcake. But Wyoming’s sandstone-hosted deposits, he said, allowed for the cleaner alternative of in-situ extraction.

Wyoming Hands on Deck

Australia-based GTI Resources, said Lane, is employing Wyoming workers.

“We don’t have exploration staff and filed staff employed in the U.S., so we work with partners in the U.S… (and) we absolutely would use and would prefer to use local, Wyoming expertise. I don’t imagine why we would want to bring anyone in from out of state,” he said. “These guys are trustworthy and reliable.”

Lane also praised the Wyoming Legislature for its exploration-friendly policies.

“I’ve worked in a number of different jurisdictions across the world, and it’s really good to work with people in your part of the world,” said Lane. BRS Engineering, which is based in Riverton, helped GTI choose exploration targets in Wyoming and in Utah.

“For the Thor project,” said Doug Beahm, principal engineer for BRS, “we planned and permitted the drilling through the (Wyoming Department of Environmental Quality) Land Quality Division and (Bureau of Land Management).”

With permits in place, BRS managed drilling, completing 100 exploratory drill holes on the Thor project this winter.

“We did not get the permit until late November 2021 and had to complete the drilling prior to March 15,” said Beahm, due to seasonal wildlife restrictions pertaining to sage grouse.

But the project was completed on time.

“GTI has additional claim groups in the Great Divide Basin of Wyoming and we will be evaluating whether to continue the drilling program at Thor or expand the program to the other claim groups or do both,” Beahm said.