By Elyse Kelly | The Center Square contributor 6 hrs ago

Wyoming’s mining industry lost 4,900 jobs — a 25.3% reduction — from March 2020 to March 2021, according to a recent report by the Wyoming Economic Analysis Division.

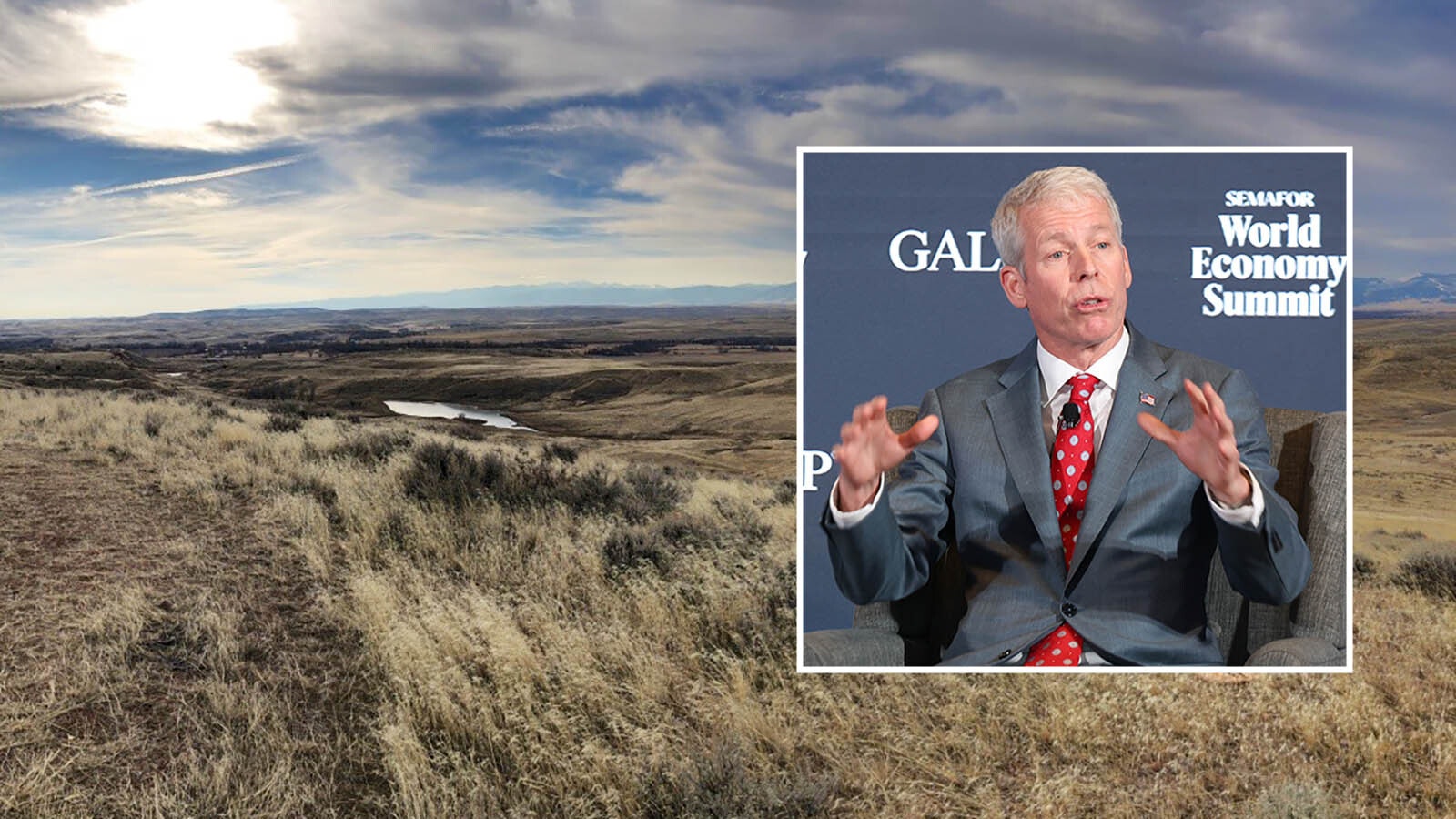

But those numbers are a bit misleading, according to Wyoming Mining Association Executive Director Travis Deti, who said they also include employment losses for oil and gas.

“When you’re talking about mining in Wyoming, we’ve got what you call our four big sectors and those are: coal, uranium, bentonite and trona,” Deti told The Center Square. “Those are actual mining jobs and outside of oil and gas. When you’re looking at those particular numbers, we lost just shy of 700 jobs in the past year.”

Broken down individually, coal lost approximately 570 jobs, 95 were lost in the bentonite sector, 20 jobs were lost in trona, and uranium actually added 15 jobs, according to Deti.

Losses in coal were exacerbated by the pandemic, but also reflective of the sector’s continued decline since 2012 due to market pressure from a decline in coal usage by utilities, along with low natural gas prices, coal’s biggest competitor, according to Deti.

“Analysts say they are predicting an uptick in coal production so we expect some of those jobs to come back, probably not all of them, I would say, but some of those jobs are going to come back,” he said.

There is no doubt in Deti’s mind that bentonite will recover as it has been dubbed “the clay of 10,000 uses.”

Much of it is used in the drilling process, in addition to cat litter and cosmetics.

“So our bentonite industry is around for a long time — we’re not going to be stopping mining bentonite,” he said.

Trona’s losses were directly attributable to the pandemic and the economic shutdown, Deti said. The product goes into different kinds of glass, including auto glass.

“So with the shutdown of the automakers in the Midwest, that took a tremendous impact on the trona industry,” he said. “Our production fell over 40% at the height of the pandemic.”

As the economy opens back up, however, trona will recover quickly, he added. Currently, trona operators are looking to expand, a symptom of that sector’s strength.

While uranium did add a few jobs, overall the price for uranium has been artificially deflated thanks to Russia, Kazakhstan and China flooding the market with state-subsidized production, making it economically unviable to mine uranium in the U.S.

Deti hopes for a “big boost” from the federal government in the form of a program started by the Trump administration.

“The Trump administration did a study and called for a domestic uranium reserve, to where the government would buy a certain amount of uranium every year,” he said. “We haven’t seen a lot of movement on that yet. We don’t believe that concept is dead under President Biden, and we’re hopeful that will come to fruition.”