Anyone living in Wyoming knows that our state’s economy is in the process of systemic change. Systemic change occurs when change reaches all or most parts of the economy, thus affecting the general behavior of the entire economic system

That Wyoming has experienced systemic economic change, is not debatable. The change has been so radical and so rapid, that published statistics are not capable of providing accurate and useful information.

However, some recent data points reinforce the proposition that Wyoming’s economy is experiencing, “systemic change”.

In an article on January 15, 2021, the Casper Star Tribune reported that since 2019 Wyoming has lost over 14,000 jobs, a decline of 5%. In November 2020 alone, 6,000 mining jobs vanished, a “staggering 29% decline from a year ago”.

Despite the recent recovery of oil and gas prices, the article noted that there were only 6 rigs working in Wyoming last December, compared to 21 the previous December. According to a March 19th Baker Hughes report, there were only 5 rotary rigs currently drilling in Wyoming, compared to 20 a year earlier.

The collapse of the energy economy has had a concomitant effect on Wyoming’s tax revenue. According to the January 15th article, “mining companies contributed $6.7 million less in taxes” in December, 2020, compared to the previous December and a decline of $11 million in sales and use taxes in November 2020, compared to November 2019.

In response to the drastically reduced revenue streams, the state budget has been slashed and slashed again.

Although “systemic change” describes the trending Wyoming economy, the question that needs to be answered is whether Wyoming state government has experienced change. Put another way, are changes to Wyoming’s economy mirrored in changes to the state government?

Understandably, Wyoming policy makers have framed their reaction to the radical and rapid changes in our economy, in terms of a binary choice.

Simply put, raise taxes (Wyoming House) cut the state budget (Wyoming Senate). While cutting the budget is most certainly a necessary reaction, the services and programs to be cut and the degree and the amount of those cuts are subject to debate.

Most would agree that tax increases should be a last resort and only considered after all alternatives have been found wanting. Has Wyoming reached the point where it has no alternative but to raise taxes? I believe the answer is, “NO”.

There are two alternatives that need to be addressed by our elected leaders before any taxes are raised. These alternatives, “good government” reforms, are long overdue. The reforms relate to the “mission” of state agencies and whether the mission is still material to Wyoming’s well-being, and if so, whether that mission is being efficiently, effectively and economically pursued. Let’s examine.

First, “mission”: State leaders need to take a “deep dive” into a needs assessment and determine whether the state government we have designed, built and that the taxpayers have financed over the past fifty years, is the state government Wyoming needs at this time in its history. Where it is found an agency’s, mission is still relevant and material, any “mission creep” should be identified. In addition, recommendations for discarding non-essential services and functions should be made.

Second, “efficiency”: The legislature, the governor and the taxpayers, all need to know that services and functions that are found to be essential, are being efficiently, effectively and economically delivered.

The absence of any mechanism for determining the efficiency, effectiveness and frugality of the agencies, departments and commissions that make up Wyoming state government is troubling. Agencies and Departments of the Federal government have oversight, not only from Congress, but from a plethora of oversite entities whose job it is to critically review the performance of executive branch agencies. An example, are the inspectors general of the various federal departments and agencies.

Would it not be of great benefit to Wyoming, to know whether, how, and how much money, could be saved by increasing efficiency in a particular agency or department? Would it not be of importance for the public to know if there is abuse, waste, fraud or inefficiencies in the expenditure of state money?

I believe it was Milton Friedman who once remarked that government work is mostly correcting government mismanagement. Is there mismanagement in any of our state agencies? The point is, we don’t know, and we should.

Answers to the questions posed above can be provided by implementing systematic performance auditing. A great benefit of performance auditing is the ability to suggest changes, if needed, in an agency’s procedures that can result in better efficiencies and economies. These suggestions should be made to the agency or department manager, but would also be available to the governor, the legislature and the public.

What is a “performance audit”? It is an independent analysis of a program’s effectiveness, economy and efficiency It is designed to aid in decision making by leaders responsible for overseeing and implementing corrective action. The results of a performance audit should be transparent and available to the public. Above all, it should be based on an independent review of criteria developed by the auditor, not the auditee. It should contribute to public accountability.

Wyoming has a department of audit within the executive branch of state government. It’s mainly concerned with bank examinations and financial audits of state agencies, units of local government and tax paying entities.

The State Department of Audit is empowered to, “conduct performance measure reviews”. The standards by which the department of audit conducts its “performance measure reviews” are developed by the entity being reviewed. Under this statutory scheme, the agency tells the auditor what measurements to use.

The Department is also empowered to, “conduct management studies of school districts including program evaluation and performance audits, on issues identified by…” an advisory committee in the department of education related to the school funding model.

These are not “performance audits” as that term is widely understood.

The audits performed by the State Department of Audit are confidential and not available to the public, thus defeating one of the purposes of performance audits – public accountability. The fact that the State Department of Audit is an executive branch agency under the general supervision of the governor also raise independence concerns.

The Wyoming State Auditor’s duties are not identified by the Wyoming State Constitution. That document says the auditor shall have such duties as the legislature, “may prescribe”. Under current law, the Wyoming State Auditor performs duties usually performed by a comptroller and does little or no auditing.

The State Auditor is an elected official and therefor is independently accountable to the people of Wyoming. But the Auditor is not accountable to, nor under the control of, the head of the executive branch, whose agencies and departments would be the subject of performance audits. Thus, independence would not an issue if the state auditor was directed by the legislature to audit performance and efficiency.

It is important that a performance audit be independent, non-partisan and conducted by an entity that itself is accountable and insulated, as much as possible, from political pressure. To meet those criteria, the legislature could establish an independent inspector general for state government. The Wyoming State Auditor could also meet the above criteria.

Cutting the budget and raising taxes are two of the tools in Wyoming’s fiscal toolbox, but there is one more: Better efficiency.

Until we know that we are not wasting resources on missions no longer important to Wyoming, and until we know that no more efficiencies and no more economies can be squeezed out of state government, raising taxes should not be an option.

The Wyoming Legislature would be doing itself and the people of Wyoming a great service by directing the implementation of a systematic program of publicly available performance audits for all agencies and departments of state government.

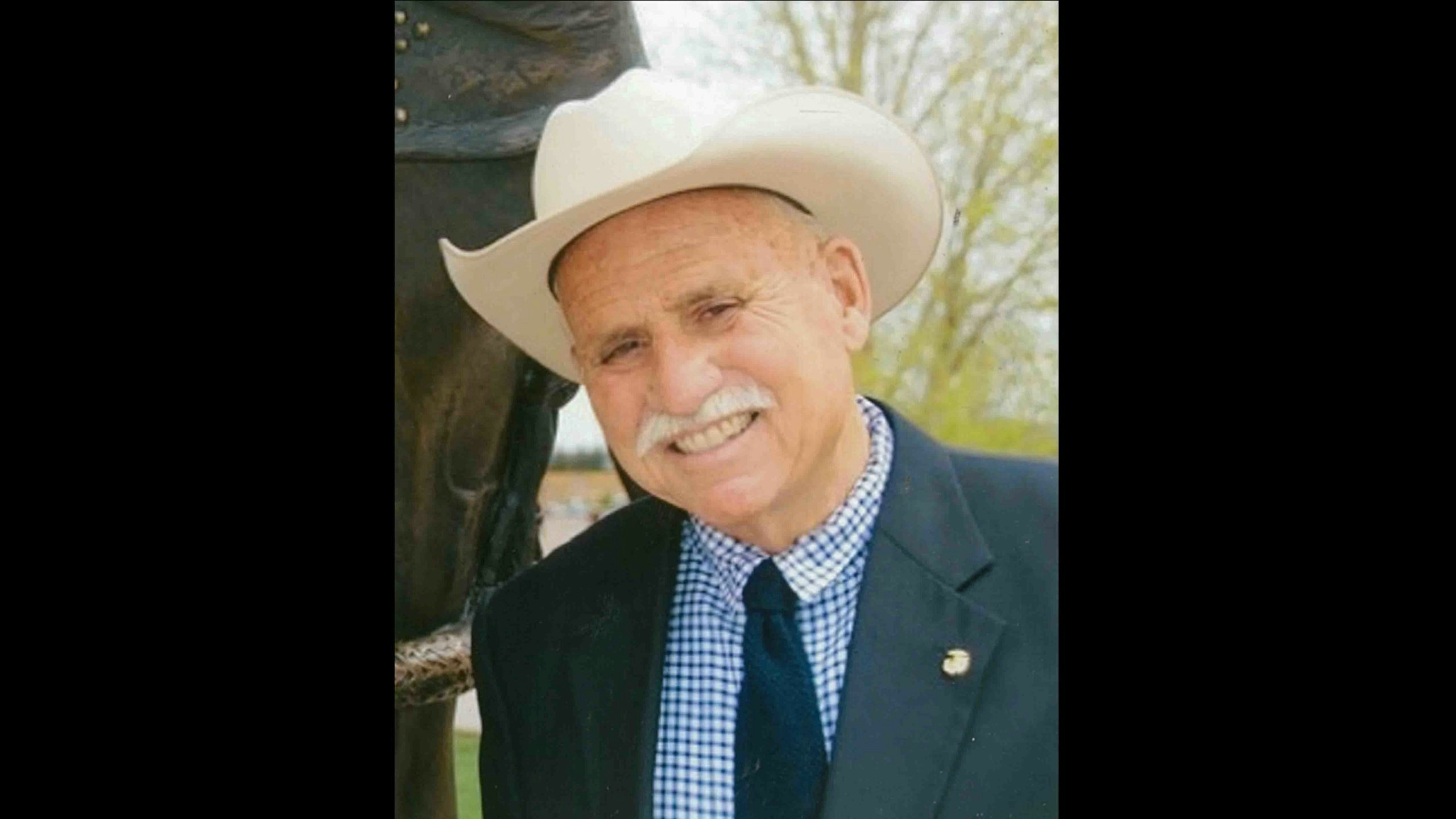

TAG: Ray Hunkins is a retired attorney and agriculturist who was the Republican nominee for Governor of Wyoming in 2006.