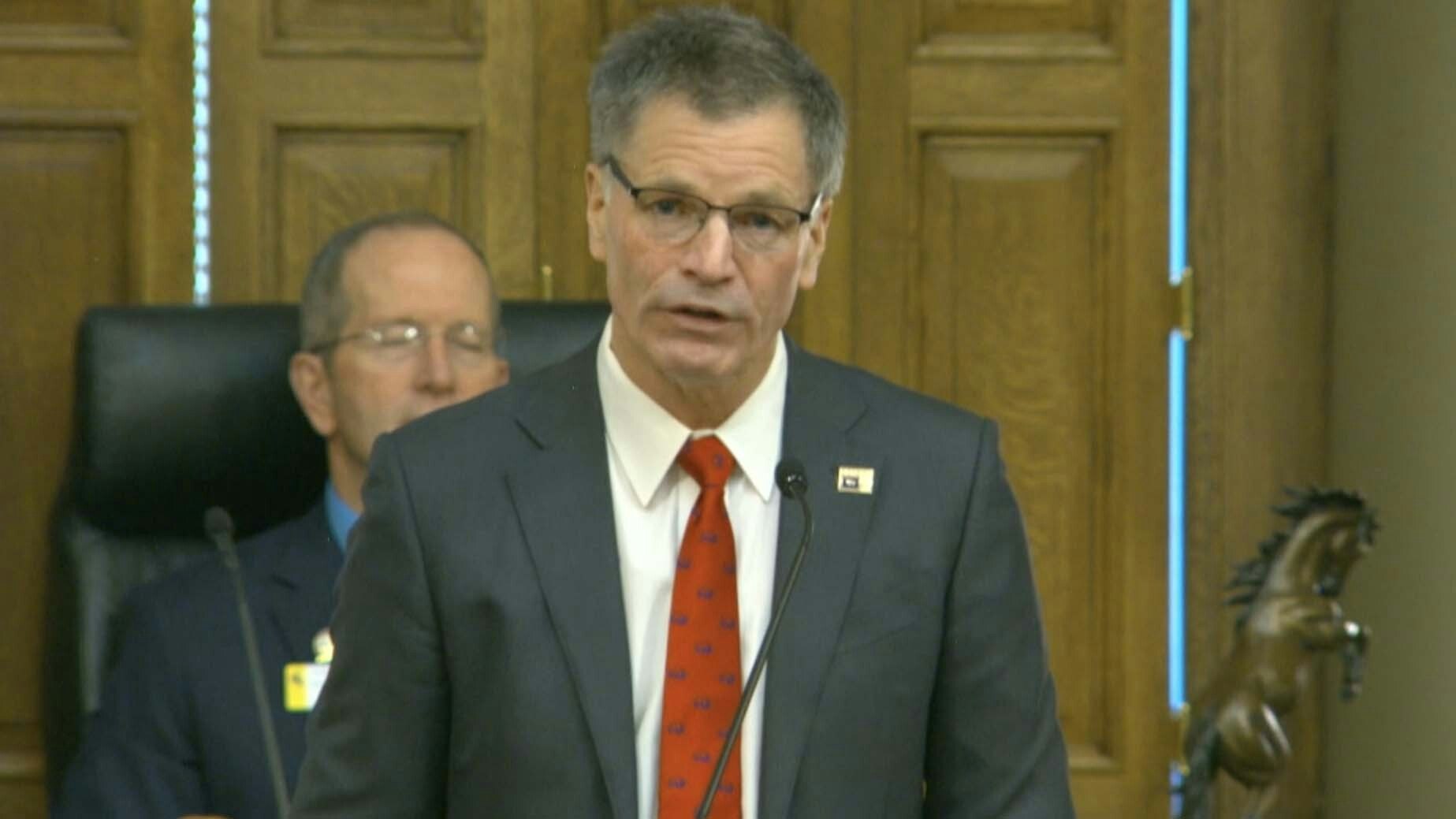

By Governor Mark Gordon, House Speaker Steve Harshman, Senate President Drew Perkins, and State Senator Eli Bebout

That is wise advice that we took to heart when we first became aware of a once-in-a-lifetime opportunity to bring lands in Wyoming into Wyoming hands. Occidental Petroleum recently acquired Anadarko Petroleum Corporation, a company that owned most of the original Union Pacific Land Grant (lands that were granted to the railroads during the Civil War).

Today, Wyoming has a unique opportunity to acquire them. These lands could be a strategic investment that will add income to the state and unprecedented multiple-use access for the public.

Over the next few years, Wyoming will face some hard choices about how we fund our schools and senior centers, how we maintain infrastructure like our sewer systems or irrigation canals, and how we continue to provide critical services.

It’s no secret that Wyoming has seen a significant dip in coal and natural gas production, illustrating how precarious our revenue streams are. Our latest estimates project state revenue dropping another $156.3 million over the next two years, and it is anybody’s guess where it will go from there. The state could see its existing deficit grow by $200 million. So why would we want to buy more land and minerals at this time? Well, because it could be an amazing investment, inflation hedge, chance to better secure our state’s future and can be bought at a particularly advantageous time.

Yes, Wyoming faces big challenges – challenges that must be met with big ideas and thoughtful solutions. Bills in the House and Senate that were introduced last week are meant to begin a thorough examination of a potential opportunity that might prove to be extraordinarily beneficial for Wyoming and her citizens.

The lands and minerals that President Lincoln granted to Union Pacific in 1862, six years before Wyoming became a Territory, helped finance construction of the Transcontinental Railroad and they play an historic role in how Wyoming became a state. They were and are some of the most mineral-rich lands in our country and they helped provide the resources to power locomotives across the West.

This railroad land grant surrounded the lands where train tracks were to be laid. Odd-numbered sections were given to the railroad while the federal government kept even-numbered plots. This checkerboard pattern extends 20 miles on either side of the Union Pacific railroad as it traverses the southern part of the state.

Today, this checkerboard pattern makes land management challenging and can hinder access, both for multiple-use and mineral development. Sections owned and managed by the federal Bureau of Land Management are intermingled with sections owned by Occidental Petroleum and other private landowners. The purchase we are considering seeks to acquire only the Occidental Petroleum lands that are for sale – no other private lands or federal lands are involved, as they are not for sale.

The asset totals around 1 million acres of surface lands and about 4 million acres of mineral ownership. It includes a majority mineral ownership underneath the world’s largest naturally occurring soda ash deposit, a bedrock of Wyoming’s economy. It also includes proven developed and undeveloped oil, gas and coal resources, significant grazing operations, potential for renewable energy development and future exploratory opportunities in everything from lithium to rare earth minerals. It is also home to some of our state’s most iconic game.

Activities on this land already provide current income and the promise for future revenue, which could yield stable cash flow and help diversify Wyoming’s revenue picture. A steadier income stream would be good for our schools and communities.

Wyoming is not looking at this purchase to try to become a developer or a mining company; rather, we see the land grant opportunity as a way for the state to expand the areas where we already have expertise: land and mineral management.

This opportunity is not just about the money. This acquisition has enormous potential benefits for multiple-use that are valuable to all citizens of Wyoming, giving us the opportunity to assemble one of the largest contiguous pieces of public land in the continental United States. One that will benefit wildlife, hunters, fishermen and outdoor recreationists while achieving responsible development of rich natural resources.

This potential acquisition, though, like any investment, is not without risk and we must weigh that risk carefully. Significant questions involving county property and ad valorem tax must be thoroughly explored. There is a lot to consider, and as of today there is still much to learn about the prospect.

The bills being considered by the Legislature lay out a process for the state’s elected leaders to thoroughly evaluate this opportunity and determine if it is a prudent investment. It will require significant due diligence and outside appraisal of the lands in question. If the investment doesn’t make sense, we will not proceed. Nothing is determined at this point.

We also recognize opportunities like this will not last forever. Passage of these bills will allow us to advance this unique opportunity if a purchase seems fiscally prudent. It is important to remember that a potential purchase of this magnitude must have legislative oversight and approval.

Opportunities like this don’t come along very often. The land grant has only changed hands twice in its 150-plus year history. It’s likely that this would be the largest government purchase of private land since the United States purchased Alaska. That’s a big deal.

But thinking big is nothing new to Wyoming. In 1968, Gov. Stan Hathaway and the state’s leaders stepped forward and levied the first severance tax on mineral production. In 1974, they did it again and created the Permanent Mineral Trust Fund.

These examples of big thinking paid off for Wyoming, and it made us the envy of the nation. Now, we have the chance to do it again by making the best investment of all – in ourselves.