Energy

News

Wyoming Drilling Crew Hopes To Find Huge Uranium Deposit In Powder River Basin

A Wyoming company will start drilling dozens of holes in the Powder River Basin this month to explore potential to mine uranium. A group that includes companies from Canada and Australia hopes to find a huge uranium deposit.

David MadisonJuly 02, 2025

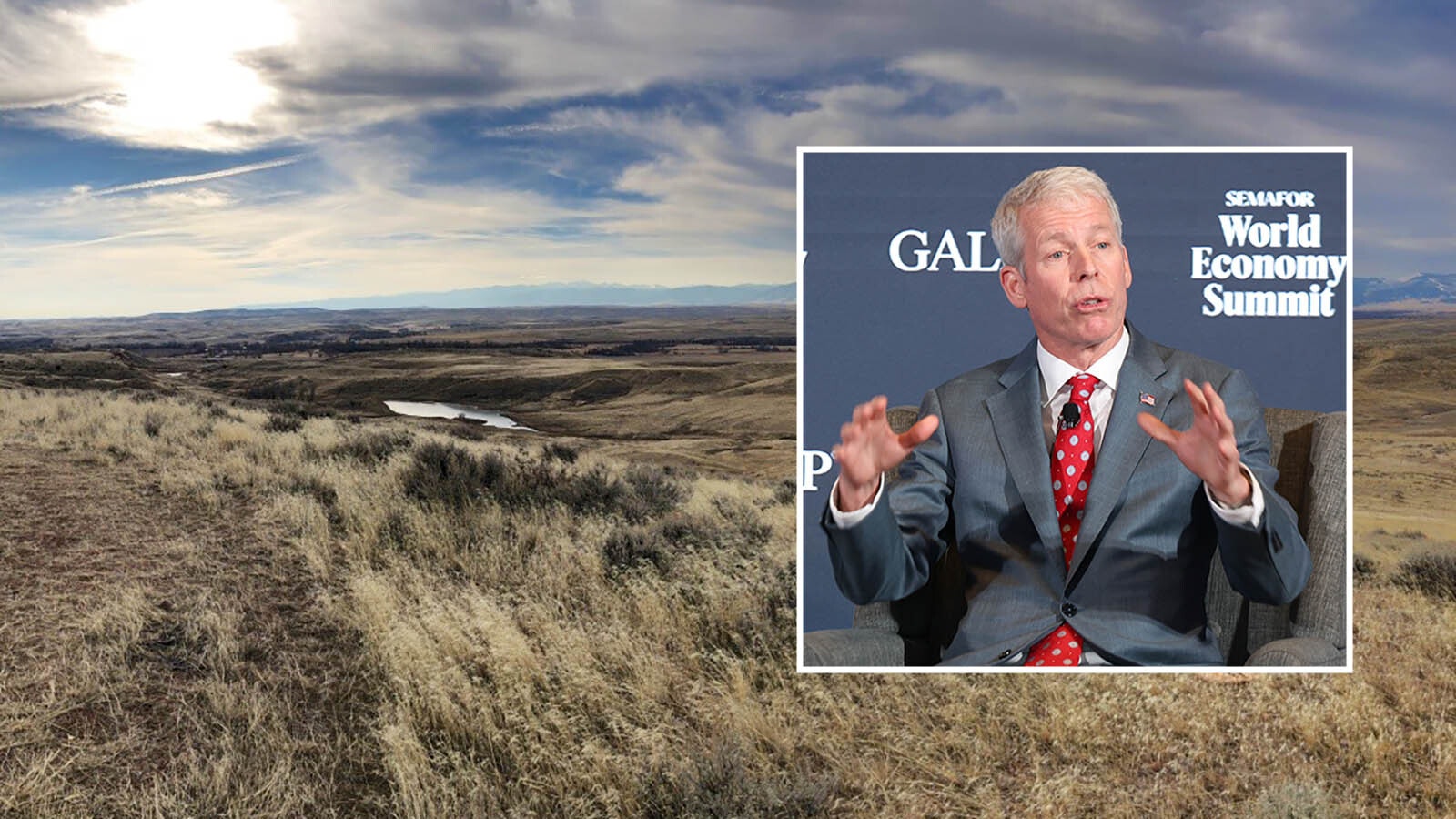

Energy Secretary To Visit Site Of Massive Rare Earth Find In Ranchester, Wyoming

U.S. Secretary of Energy Chris Wright will be in northern Wyoming for the July 11 groundbreaking of the Brook Mine in Ranchester. Ramaco Resources believes it holds the largest “unconventional” rare earth deposit in the U.S.

David MadisonJuly 02, 2025

Midwest Power Plant Operator Wants $22M From BNSF For Not Delivering Wyoming Coal

The operator of a pair of Midwest power plants wants $22 million from BNSF Railway, according to recent documents filed with the Surface Transportation Board. The company claims the power plants couldn’t get their full orders of Wyoming coal.

David MadisonJuly 01, 2025

Coal A Big Winner After Marathon Senate Session on Big Beautiful Bill Act

A dramatic marathon weekend session in the U.S. Senate elevated coal as a high priority among lawmakers who hammered out amendments to President Donald Trump's One Big Beautiful Bill Act.

David MadisonJune 30, 2025

Another Wind And Solar Project Triggers Opposition In Eastern Wyoming

A proposed 450-megawatt wind and solar project in Goshen and Platte counties would create 300 jobs and mean about $150 million in tax revenue. Even so, locals are opposed, with Torrington’s mayor saying a gas- or coal-fired power plant would be preferred.

David MadisonJune 30, 2025

Gillette’s Cyclone Drilling To Do Wyoming’s First 3-Mile Well And 4-Mile Well Is Next

Cyclone Drilling in Gillette is the region's go-to specialist for drilling the deepest and longest oil and gas wells. It’s going to drill Wyoming’s first 3-mile lateral well — and is already planning to go 4 miles and beyond.

David MadisonJune 28, 2025

Counties Look To Regulate As More Wind, Solar Projects Eye Northeast Wyoming

Crook County doesn’t have regulations for local permitting of solar and wind projects, and hasn’t needed them — until now. As more wind and solar development is planned for northeast Wyoming, local governments are drafting new rules.

David MadisonJune 25, 2025

One Of Wyoming’s Largest Oil Producers Drilling Its First 3-Mile Well

Anschutz Exploration Corp. is already one of the largest oil producers in Wyoming. Now it’s pushing the industry by drilling Wyoming’s first 3-mile lateral well on a pad in Johnson County.

David MadisonJune 24, 2025

Congress Spotlights Wyoming’s Rare Earth Industry As Vital To US Supply

Wyoming and Montana took center stage at a congressional hearing Tuesday about fast-tracking rare earth processing in the U.S. New tech to extract rare earths from coal waste could help break China’s stranglehold on the critical minerals.

David MadisonJune 24, 2025

Idaho National Lab Wants To Keep Building Wyoming’s Nuclear Industry

The same laboratory that has supported Wyoming’s emerging micro nuclear reactor sector is now inviting more companies to submit proposals. The move comes as Wyoming continues to position itself as a hub for small nuclear reactor development.

David MadisonJune 22, 2025

Despite Opposition From Bar Nunn Residents, Natrona County OKs Nuclear Project

Natrona County commissioners got an earful from locals opposed to Radiant Nuclear’s planned project near Bar Nunn. Then they voted to support the company getting a $25 million grant from the Wyoming Business Council.

David MadisonJune 20, 2025

Black Hills Energy Spending $540M To Connect North-South Wyoming Power Grids

A pair of large-scale Black Hills Energy projects will connect northern and southern Wyoming power grids while adding more natural gas generation. Together, they represent a $540 million outlay.

David MadisonJune 19, 2025