Energy

News

Federal Court Rejects Climate Change-Based Challenge To Wyoming Drilling Permits

A federal court on Tuesday rejected environmental groups’ effort to overturn thousands of oil and gas drilling permits in Wyoming and New Mexico. The court said they couldn’t show how drilling in Wyoming would directly impact polar bears in the Arctic.

David MadisonJuly 16, 2025

Small Army Of Cybersecurity Warriors Trains To Digitally Defend Energy Industry

As Wyoming aspires to be an energy powerhouse, a new generation of cybersecurity defenders is training in Wyoming and at the Idaho National Lab. As AI booms, so does the need to protect that critical infrastructure from digital threats.

David MadisonJuly 16, 2025

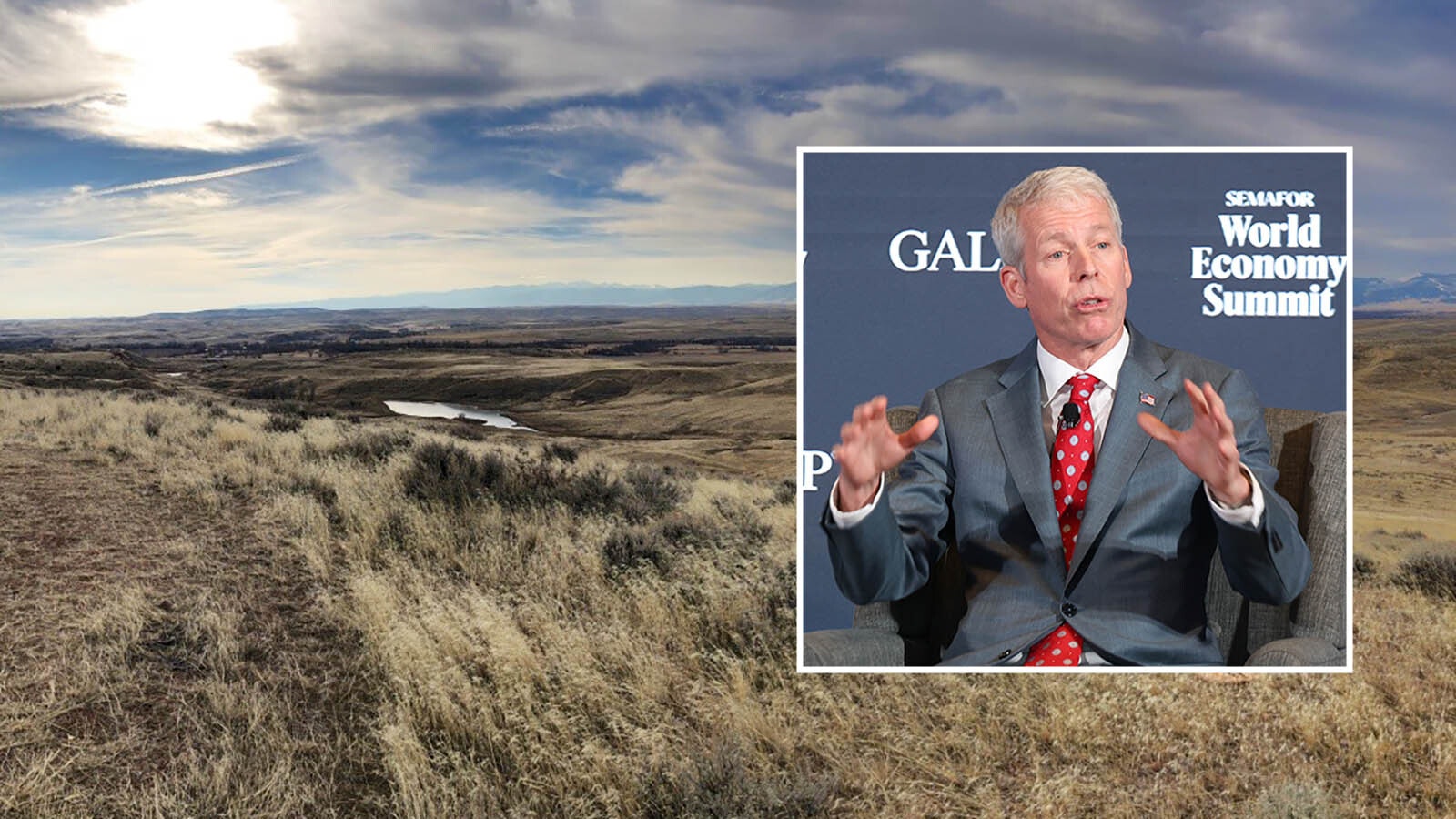

Energy Secretary Wright Says Wyoming Coal Is Still America’s Energy Future

Along with opening the first new rare earth mine in the U.S. in 70 years last week, U.S. Energy Secretary Chris Wright says Wyoming is key to President Trump’s agenda. While on a decade-long downturn, he said Wyoming coal is America’s energy future.

David MadisonJuly 15, 2025

Montana Follows Wyoming In Push To End Biden-Era Coal Lease Rules

Following Wyoming’s lead, Montana’s congressional delegation is pushing to reverse Biden-era BLM rules that would end coal mining in the Powder River Basin.

David MadisonJuly 14, 2025

First U.S. Rare Earth Mine In 70 Years Opens In Wyoming

U.S. Energy Secretary Chris Wright was in Ranchester, Wyoming, on Friday for the ribbon cutting to open the first U.S. rare earth mine in 70 years. He said the Brook Mine and Wyoming are critical to breaking China’s stranglehold on rare earth processing.

David MadisonJuly 11, 2025

Wyoming’s Exploding Rare Earth Industry Attracts 21 Claims From New Player

Wyoming’s exploding rare earth industry continues to attract attention. The latest is Argyle Resources Corp., which has filed 21 mineral claims in the Bear Lodge Mining District of northeast Wyoming.

David MadisonJuly 09, 2025

Trump Opens Floodgate For Wyoming Coal, But Will Producers Buy New Leases?

Trump’s budget bill opens a floodgate for federal coal leases in Wyoming, but will producers buy them? Experts are mixed. Some say a decade of decline can’t be solved by leasing more area for mining and others that it can spark new activity.

David MadisonJuly 08, 2025

TerraPower’s Kemmerer Nuclear Plant In Fast Lane With Accelerated Permit Review

The Nuclear Regulatory Commission will complete its review of TerraPower's construction permit application for its Kemmerer nuclear plant by the end of the year. That’s six months early and has local officials scrambling to keep up.

David MadisonJuly 04, 2025

Wyoming Drilling Crew Hopes To Find Huge Uranium Deposit In Powder River Basin

A Wyoming company will start drilling dozens of holes in the Powder River Basin this month to explore potential to mine uranium. A group that includes companies from Canada and Australia hopes to find a huge uranium deposit.

David MadisonJuly 02, 2025

Energy Secretary To Visit Site Of Massive Rare Earth Find In Ranchester, Wyoming

U.S. Secretary of Energy Chris Wright will be in northern Wyoming for the July 11 groundbreaking of the Brook Mine in Ranchester. Ramaco Resources believes it holds the largest “unconventional” rare earth deposit in the U.S.

David MadisonJuly 02, 2025

Midwest Power Plant Operator Wants $22M From BNSF For Not Delivering Wyoming Coal

The operator of a pair of Midwest power plants wants $22 million from BNSF Railway, according to recent documents filed with the Surface Transportation Board. The company claims the power plants couldn’t get their full orders of Wyoming coal.

David MadisonJuly 01, 2025

Coal A Big Winner After Marathon Senate Session on Big Beautiful Bill Act

A dramatic marathon weekend session in the U.S. Senate elevated coal as a high priority among lawmakers who hammered out amendments to President Donald Trump's One Big Beautiful Bill Act.

David MadisonJune 30, 2025