A bill that would provide a 25% property tax cut to Wyoming homeowners is officially headed to Gov. Mark Gordon’s desk after both the House and Senate approved it Thursday night.

But the final approval of Senate File 69 in the Senate didn’t come without some major opposition from state Sen. Larry Hicks, R-Baggs, who didn’t hold back in lambasting his colleagues over passing cuts he said will hurt local governments and schools while also failing to deliver the 50% tax cut they had previously passed.

‘Fertilizer’

Hicks, who was part of a coalition that ran against the current Senate leadership last fall, didn’t mince words when it came to his thoughts on the negotiating efforts made by his fellow Senate members, Vice President Tim Salazar, R-Riverton, Troy McKeown, R-Gillette, and Mike Gierau, D-Jackson.

After Gierau issued a ringing endorsement of the agreement the Senate and House came to during a Joint Conference Committee (JCC) meeting that morning, Hicks spoke up.

“I’ve been in agriculture most of my life and I do recognize fertilizer when I see it,” Hicks said. “That was just a lot of fertilizer that was spread out there.”

Hicks started to change the subject, but not before Sen. Tara Nethercott, R-Cheyenne, interrupted him, calling a point of order. Points of order can be called in the Wyoming Legislature when a member believes another has violated the rules of decorum.

“I don’t think that honors the decorum of the Senate to refer to another senator’s debate on a bill as manure or fertilizer,” she said. “I would ask for Senate decorum, and I would ask for that here.”

Nethercott also pointed out that the end of the session is nearing, with many of her colleagues feeling the fatigue of seven weeks of long days and nights.

Hicks said the fact that SF 69 provides no make-up funding, known as a backfill, for special districts, is concerning. He doesn’t believe the Legislature is having an honest conversation with these groups about what’s at stake.

“They’ve already budgeted, they know what they have to have,” he said. “They got to pay their personnel, they’ve got to buy emergency ambulances, fire trucks, all that stuff. They’ve got expenses for employees.”

He also questioned why the Senate’s Joint Conference Committee members didn’t defend their chamber’s position on the bill. The original version of SF 69 that came out of the Senate contained a 50% cut with no backfills.

“What I heard was, ‘Well, the other side didn’t like it.’ I didn’t hear what we got in concessions from the other side,” Hicks said. “I’d still like an explanation why our committee did not defend the position of the Senate.

“What I heard was we just caved in and gave in to the other side.”

‘The Best We Could Get’

One concession the Senate did get from the House was having no backfill money attached to the property tax bill, which McKeown called out.

“They wanted huge backfill, there were trades made,” he said.

Salazar said the JCC members worked as hard as they could to get everything they could in what he described as a “Senate bill.”

“I love perfection, she’s so attractive, so beautiful, she sings,” he said. “But she kills the good. This is good, it’s the best we could get.”

Attaching a backfill to the bill could have doomed its fate as Gov. Mark Gordon has expressed deep concern for any property tax bill that has backfill attached to it. He vetoed a similar bill last year for that reason, calling it “socialistic.”

McKeown also said months could have been spent debating the bill, but the final version was “the horse” the Senate JCC chose. He believes the final legislation prioritizes people over the government.

“What’s your priority?” McKeown questioned.

Gierau thanked those who supported the agreement and gave a special shoutout to Hicks.

“His spirited defense of the Senate position — his drive, his zeal to make sure that the sanctity of the Senate is confirmed — just fills my heart with joy,” Gierau said. “We did the best we could, we worked hard.”

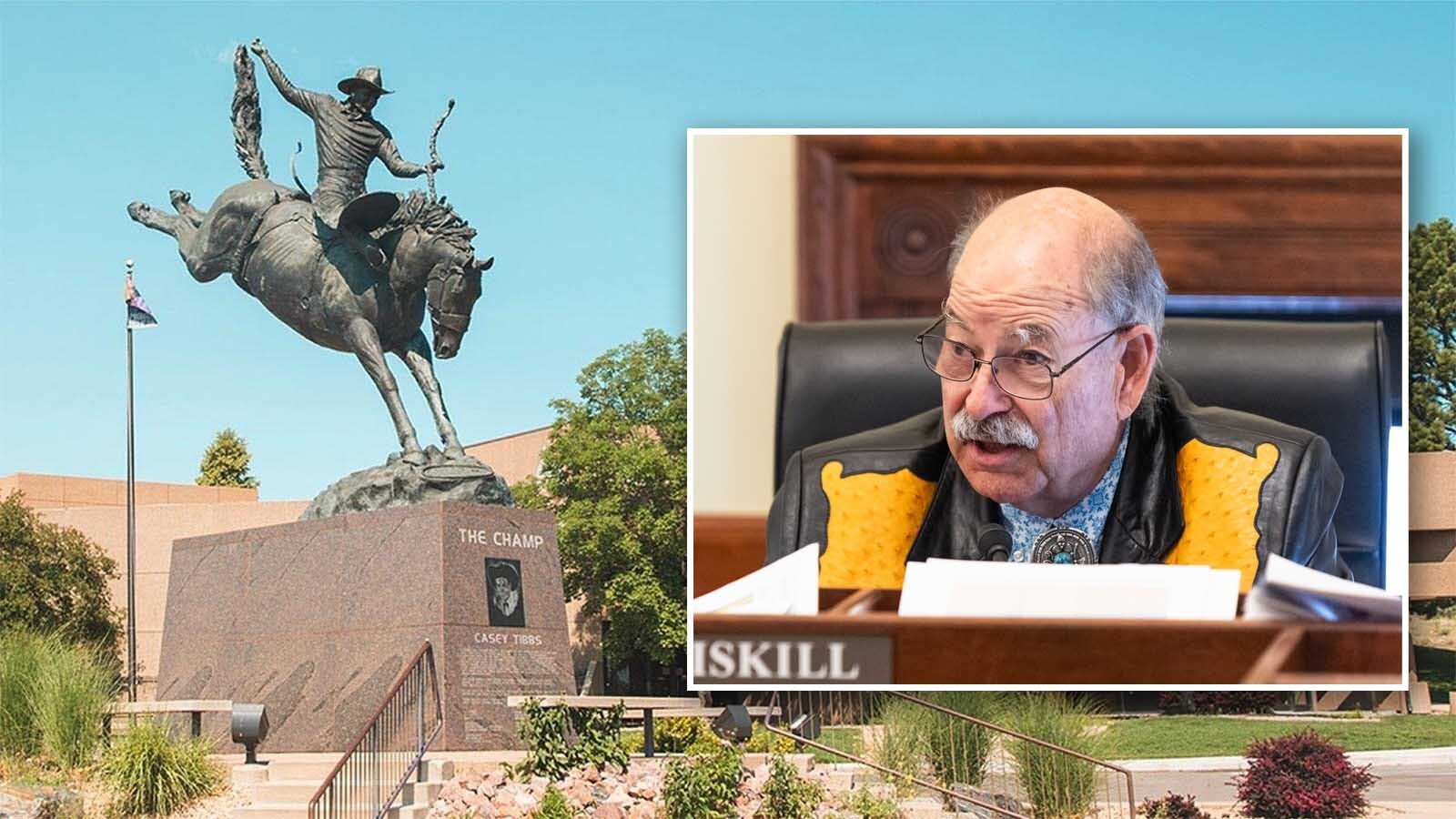

Driskill said although he didn’t like the final deal and wouldn’t have arranged it himself, he believes it’s time to walk away and offer some level of property tax relief rather than nothing. He said no one got everything they wanted in the tax cut negotiations, but everyone got at least a little of what they did want.

“If you want to vote to kill this, then go back home to your constituents and tell them we’ve brought you nothing again,” he said. “This is the unholy compromise we all make at the end of every time.”

No one rose to Hicks’ defense while numerous members spoke in support of the bill, and the final version passed on a 26-3 vote. Sens. Chris Rothfuss, D-Laramie, and John Kolb, R-Rock Springs, also voted against it in addition to Hicks.

Kolb explained that Sweetwater County didn’t see the large tax increases that were seen in other parts of the state after COVID-19. Although he didn’t fault the compromise, he said the cuts will hurt his local services.

“It does have consequences for us,” he said.

Although Rothfuss said he held no faults against the tax cut compromise that was struck, none of his concerns about what the bill does from a policy perspective have been alleviated. He admitted that some members of his community are asking for it, but said it’s not worth giving when considering the impact and hardship it will cause to local governments, special districts and schools.

The House voted to support the bill on a 49-7 vote with Reps. Elissa Campbell, R-Casper, Ken Chestek, D-Laramie, Karlee Provenza, D-Laramie, Mike Schmid, R-LaBarge, Trey Sherwood, D-Laramie, Liz Storer, D-Jackson, Mike Yin, D-Jackson, voting against it.

SF 69 will impact all fair market home values up to $1 million and has no expiration date.

School Choice Bill Headed To Governor’s Desk

The Senate and House also approved Thursday the final version of House Bill 199, a bill that will bring universal school vouchers to Wyoming.

The main point of contention in the JCC meeting on this bill Thursday was the pre-K portion, which a majority of members of the House have opposed. The pre-K aspect was added by a large majority vote on the Senate side.

After a tense meeting between representatives of the chambers on Thursday, the JCC agreed to $7,000 per child for pre-K parents who make 250% or less of the federal poverty line and mandatory assessment tests for all participants in the voucher program. All other grade levels will have no income requirements.

Superintendent of Public Instruction Megan Degenfelder supports the assessment tests, but many members of the House do not.

Although the bill sponsor Rep. Ocean Andrew, R-Laramie, admitted this compromise wasn’t perfect, he told the House later in the day it was acceptable in order to get the bill across the finish line.

House Speaker Chip Neiman, R-Hulett, announced Friday that members of President Donald Trump’s administration were talking to Andrew about the bill over the phone that morning.

Leo Wolfson can be reached at leo@cowboystatedaily.com.