It’s one thing to cut money going to a budget, but it’s a whole other task to figure out what money doesn’t need to be spent on anymore.

That’s the puzzle legislators at the Wyoming Legislature are trying to figure out in their pursuit to cut property taxes, which significantly increased in certain parts of the state after the COVID-19 pandemic but have since returned to historical norms.

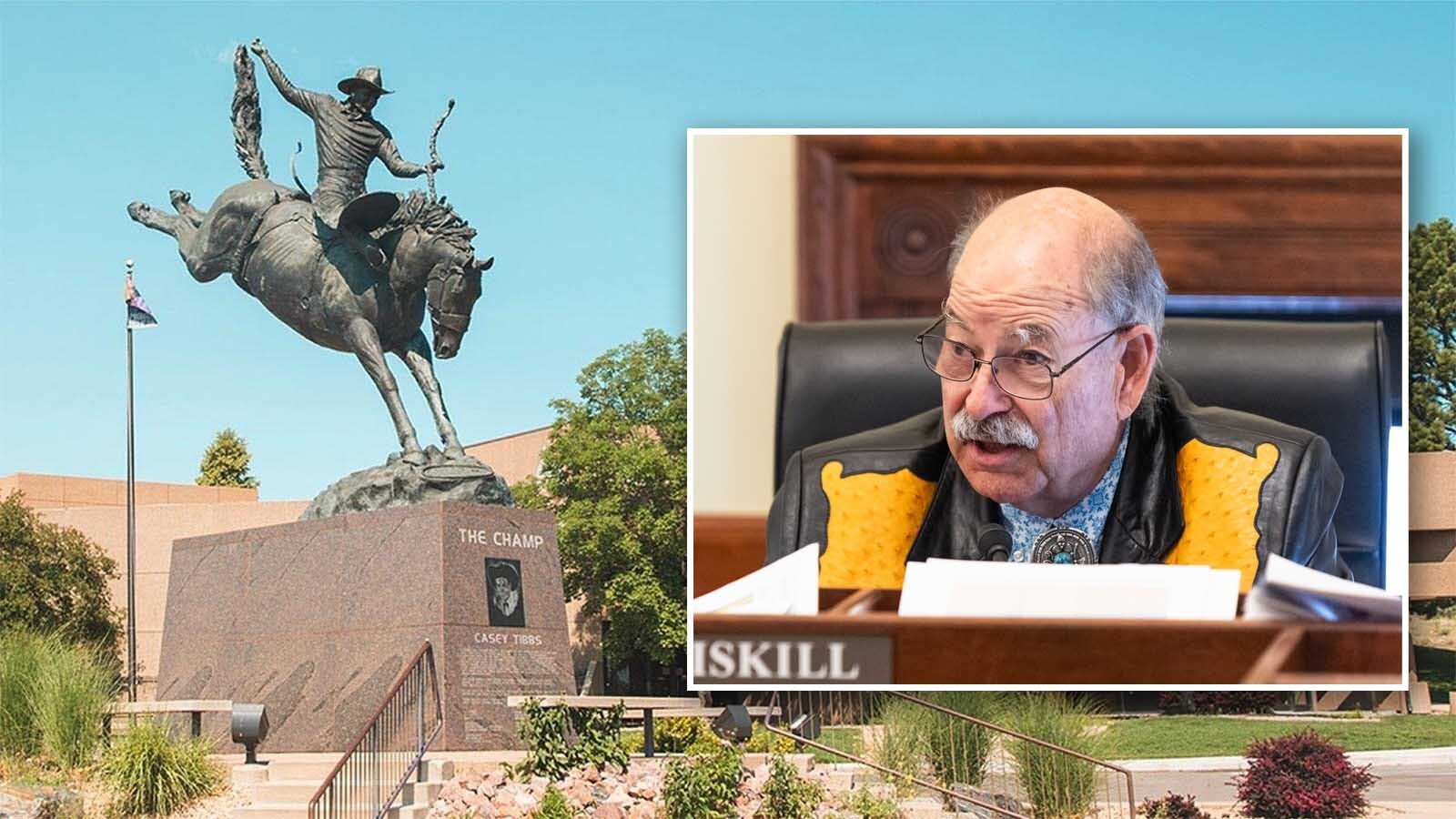

State Rep. J.D. Williams, R-Lusk, is very concerned that his fellow lawmakers aren’t considering Wyoming’s future generations with the way they are making property tax cuts in this year’s legislative session.

Williams said in a Monday Facebook post after conducting a recent town hall, he found that many of his constituents believe property tax relief to be more of an election year talking point than something that will help their local communities.

Property tax revenue goes to local schools and governments, including special districts that support local hospitals and ambulance services, weed and pest and cemeteries, among others. Williams said seniors came to his meeting, inquiring about the future of their local senior centers.

Backfill Trickle Down

A number of different backfill options have been proposed to partially support these entities if any of the property tax bills pass into law. Tax cut detractors have argued that backfills are unsustainable in the long run.

Williams said his constituents determined that “backfill is not sustainable and is only a Band-Aid on a very large, self-inflicted wound of property tax cut.”

In addition, none of the backfill options proposed will go to support local schools.

“These rural schools are big employers in small towns, it’s a social gathering place for the whole community,” Williams told Cowboy State Daily. “It’s a lack of understanding of our culture when you attack that.”

Williams also pointed out that legitimate property tax relief measures were passed during the 2024 session, such as a 4% cap on year-to-year tax increases. During the November election, voters also passed a constitutional amendment allowing lawmakers to reduce the tax assessment rate.

“People do need property relief but we can do that without saddling the future generations with an increased tax burden,” Williams said. “It’s almost as if some are more concerned with their next election. We’re talking about the next cycle. We’re not talking about grandkids.”

Finding a way to replace the lost revenue from tax cuts will likely have a trickle down effect that will cause a hit to the state’s Permanent Mineral Trust Fund, which generates money for the state based on investment income earned off mineral industry profits.

“Most people understand the long-term trend in mineral revenue,” Williams said. “Are we trading smart decision making for short-term political points?”

Political Opportunism?

Williams also said people asked him if the majority in the House is really interested in addressing property tax relief or is it being used as a political bludgeon to help them stay in power.

“Good question,” Williams said in response.

This is in reference to the Wyoming Freedom Caucus, a group Williams is not a member of that has urgently pushed for the property tax cuts.

Rep. Bill Allemand, R-Midwest, a member of the Freedom Caucus, said he’s no fan of wide-sweeping tax exemptions as he believes they pick winners and losers. But he also pointed out to the fact that all of the major property tax bills being considered this session will expire in two years.

He said concerns about property tax revenue issues will be resolved through broader changes to the overall tax structure and pointed to a bill that would make property taxes based on the purchase price of a home as an example of long term reform.

“That’s real reform,” Allemand said. “Why do we need all these other exemptions when all we need is real reform?”

What About Spending?

Allemand believes one of the best solutions to the property tax puzzle would be to cut state spending and the taxes put on mineral companies as well.

“We’ve got to reform our spending and reform our taxes, but they’ve got to go together,” he said. “You can’t do one without the other.”

Many Freedom Caucus members like Allemand have also criticized how much money the state has been putting into savings while property taxes continued to increase.

“When we’re putting $1 billion in the bank, we’re taking money from somebody we shouldn’t, because we shouldn’t be putting that much money in the bank,” Allemand said.

During the 2024 legislative session, the Legislature stashed $700 million into savings after putting in $1.4 billion the year before.

Williams believes money put into savings will be invaluable for funding the state into the future as mineral revenues continue to decline.

“There’s been a lot of conversation around saving too much, but it’s generally keeping wealth for upcoming generations,” Williams said.

Wyoming has long played host to a boom-and-bust cycle, highly dependent on the whims of the minerals industry. The Legislature has taken the approach of saving significant funds for hard times, seen most notably in 2020 and 2016.

“We have a long-standing tradition of investing in future generations here in Wyoming,” Williams said. “That’s how you act as good stewards of mineral fund health for the next generations to come.”

Most of the members of the Freedom Caucus who have pushed for the cuts were not in the Legislature during these recessionary events, but Williams wasn’t either.

His district is in an unusual position because his region of the state hasn’t experienced nearly as large property tax increases as other parts of Wyoming and doesn’t have the mineral wealth to fall back on for its savings. As a result, a 50% tax cut in Niobrara County would be a huge blow for Williams’ local government, as it has not substantially increased its budget because of tax increases.

Leo Wolfson can be reached at leo@cowboystatedaily.com.