The Powder River Basin’s largest private oil and gas operator is about to get a whole lot bigger.

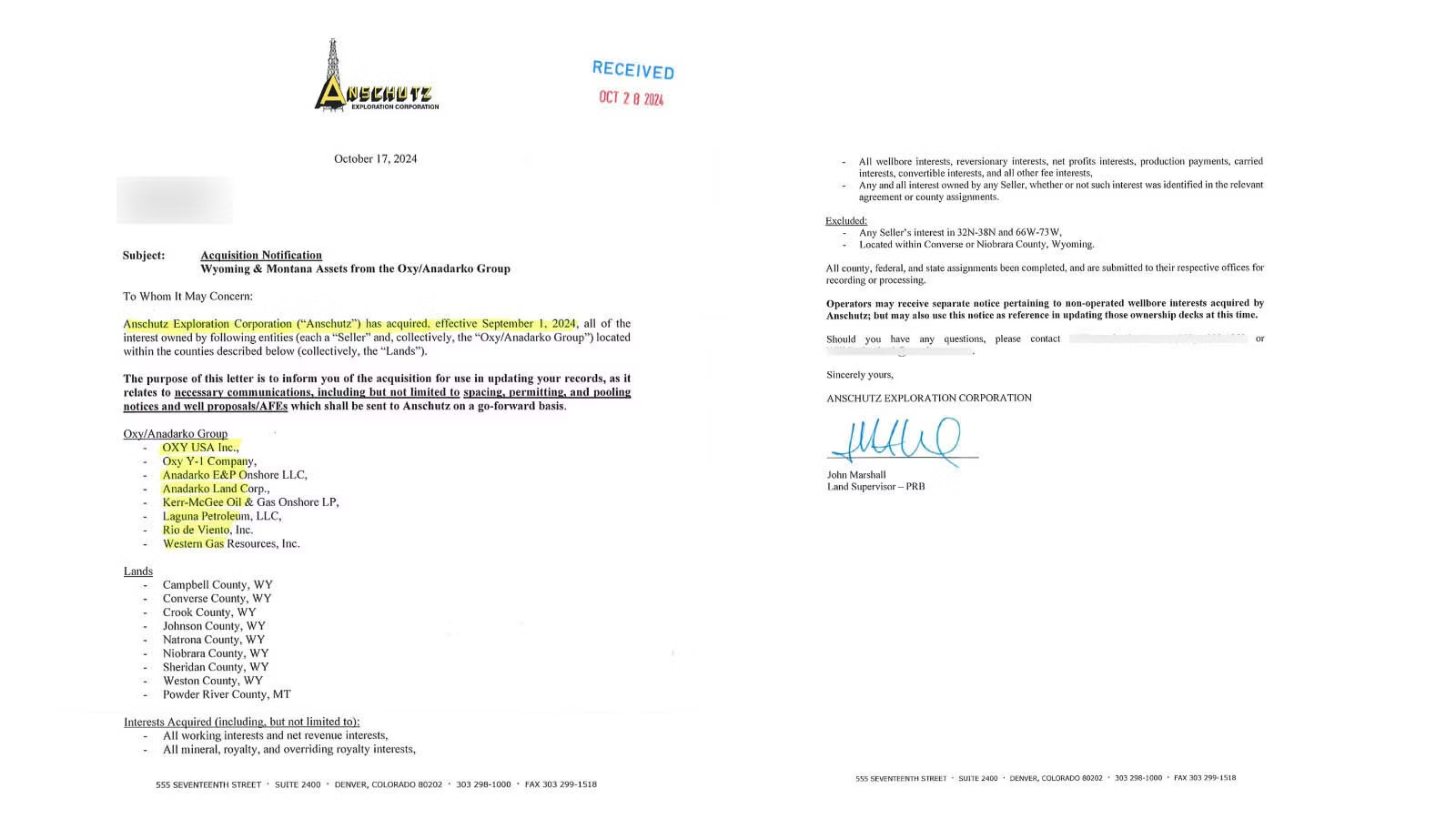

Denver-Based Anschutz Exploration Corp. has acquired a significant portion of the interests owned by the Oxy/Anadarko group in northeast Wyoming's Powder River Basin spread across multiple counties, according to a notification letter obtained by Cowboy State Daily that was sent to multiple operators in the basin.

It’s not clear from the letter how many leases or how much production is involved in the Powder River Basin transaction, but the Oxy/Anadarko group had owned 350,000 acres of mineral interests stretching from Powder River County, Montana, in the north to Natrona, Converse and Niobrara counties.

Anschutz had 460,000 net acres according to literature it was passing out last year, which would make its new holdings potentially up to 810,000 net acres.

The acquisition notice is dated Oct. 17, but says the acquisition was effective Sept. 1.

Representatives of Anschutz, which is a privately held company, did not respond to emailed inquiries about the purchase, and a representative of the company hung up on Cowboy State Daily as soon as the individual heard the word “reporter.”

Inquiries have also been sent to Occidental Petroleum, which trades as Oxy on the stock market, about the sale, but had not received a response at the time this story was posted.

Occidental And Debt

No SEC filings have yet been made on the transaction by Occidental Petroleum, but the company has been talking for a long time about divestitures to de-risk its $12 billion purchase of CrownRock in the Permian Basin in Texas last year.

The story of Occidental’s Anadarko purchase, however, begins long before that, in 2019.

The assets appeared to be headed to Chevron, but Occidental President and CEO Vicki Hollub pulled off a stunning coup thanks to a $10 billion check from investor Warren Buffet, which helped the company outbid Chevron.

That acquisition doubled Oxy in size but saddled the company with a huge debt that totaled nearly $50 billion. Hollub appeared to be banking on oil prices remaining high, but just six months after the deal closed, the COVID-19 pandemic walloped the oil and gas industry, and prices all but collapsed.

Suddenly the coup looked like Waterloo instead.

But Hollub hunkered down and plowed the company’s cash flow into aggressive debt reduction, halving its debt by 2022. It alsoposted one of its most profitable years on record that year, with an annual net income of more than $12.5 billion.

The company realized about $1 billion in additional proceeds from its CrownRock acquisition, but also planned to sell assets totaling between $4.5 billion to $6 billion.

It sold some of its Western Midstream Partners to raise about $700 million and sold its Barilla Draw assets in the Permian to Permian Resources for $818 million.

It had looked like Occidental was going to get the rest of the money it needed for its debt reduction program through a deal with Ecopetrol in Columbia, which was going to buy a $3.6 billion state in Occidental’s Texas shale-oil assets. But that company’s board reneged on the deal, saying it had required too much debt.

Hollub, however, blamed Columbia’s anti-oil and gas president, saying he had played a role in squashing the deal.

The Anadarko assets in the Powder River Basin could certainly make up a good portion of the $4.5 billion target Occidental is angling for.

It’s not known at this point how much the deal with Anschutz is worth, but Hollub said in the company’s second quarter earnings call in August that the company had a “clear line of sight” to meeting its debt reduction targets.

Now An Even Bigger Dog

Publicly traded EOG Resources had been the second runner-up for dominance in the Powder River Basin with 420,000 net acres, followed by No. 3 player Continental, which had 385,000, based on an information sheet Anschutz provided Powder River Basin service companies last year.

But the new purchase puts Anschutz far ahead of both companies, at up to 810,000 or so net acres.

The staggering size could reflect the scale needed to be in the Powder River Basin, which has to date been an underplayed resource, even though estimates of the resource have been huge.

The Mowry alone, one of about a dozen oil-bearing formations, has an untapped resource estimated in excess of 200 million barrels of oil.

“There’s certain formations in the Turner and Parkman (formations in the Powder River Basin) that can be quite economic,” Enverus analyst Andrew Dittmar told Cowboy State Daily. “But they are limited in scale. And the Niobrara and the Mowry haven’t been quite as competitive when it comes to driving the returns that companies are getting in the Eagle Ford, Permian and Williston Basins.”

A big part of the reason for that is not the asset’s quality. It’s the cost of production. With fewer operators, infrastructure has not reached the critical mass needed to help logistical costs to come down.

“So you need a big operator like Anschutz to make the investments and the infrastructure scale to bring costs down,” Dittmar said.

Renée Jean can be reached at renee@cowboystatedaily.com.