Wyoming homeowners may no longer have to fear large, unexpected increases on their property taxes after the Wyoming Legislature sent three more property tax relief bills to the governor’s desk for consideration Friday, the final day of the 2024 session.

House Bill 45 puts a 4% cap on all year-to-year property tax increases. After originally drafted with a 5% cap, the bill was later amended down to 3% in the Senate.

The House didn’t agree with this change when it received the bill back on concurrence from the Senate on Thursday, so the chamber voted it down 36-25.

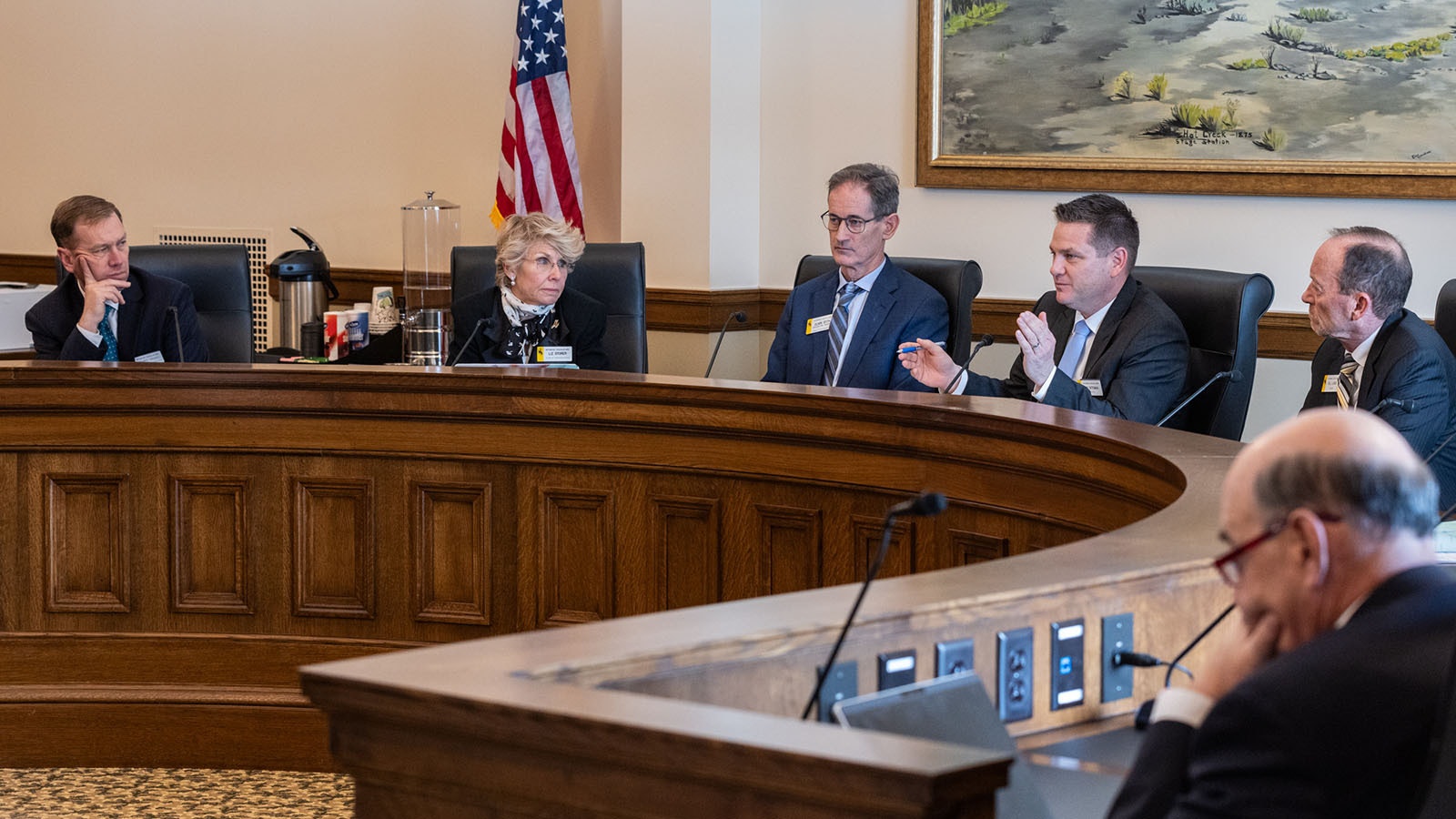

On Friday, a Joint Conference Committee convened to iron out the final version of the bill, with a compromise that splits the difference at 4%. Even though the Senate voted down an amendment from state Sen. Eric Barlow, R-Gillette, to make the 4% cap, the JCC had no qualms on the compromise.

Sen. Bo Biteman, R-Ranchester, said although 3% more broadly reflects the historical rate of annual inflation, he still supports the compromise position.

Reeling Them In

HB 45 was sponsored by Rep. Barry Crago, R-Buffalo, as a way to reel in more predictable property taxes increases across Wyoming.

Wyoming has some of the lowest property tax rates in the country in addition to its lack of state income tax, but in recent years, some homeowners saw their property taxes double, and most counties saw an average annual increase of more than 10%.

“By passing this bill, we curb out-of-control property tax increases that affected the residents of Wyoming the last few years,” Crago said. “Homeowners can now have the certainty of knowing their property taxes will not increase by more than 4%.”

Many of the property tax discussions during the 2024 session centered on the value of reducing existing property taxes for residents versus creating predictable increases for the future. Creating predictable increases is considered a safe approach for local Wyoming governments and education coffers, but doesn’t provide as noticeable an impact on a homeowner’s individual property taxes.

"To say we're going to cap property taxes and see where we are today, and what we've saved in Wyoming, that is cool," said Rep. Ryan Berger, R-Evanston. "That is a long-term solution."

Exemption

The JCC also passed Senate File 54, which exempts 25% of property taxes off homes valued $2 million or less. Those with homes worth more than $2 million will still get 25% of that amount of value from their home.

Entering the meeting, the House had passed an amendment to the bill providing a 25% exemption for homes worth $3 million or less. Knocking the cap down to $2 million will cost an estimated $6 million per year less to the state.

The committee struck a balance between this and the original Senate proposal that would have exempted 25% of a home’s value up to $200,000 of assessed value.

Rep. Liz Storer, D-Jackson, urged the committee against considering a flat rate approach such as this as she said it could lead to drastically different property tax breaks between people with high-value homes and cheaper residences. She mentioned how her constituents in Lincoln and Teton counties have seen their property taxes double over only a few years.

“People on the lower end will get a better benefit because their houses are (worth) less, but people on the higher end will see a much different (result),” she said.

A $100,000 exemption equates to about $$635 in tax relief, while a 25% exemption on a $2 million home results in a $3,267 exemption.

Biteman said he sees the value of the equity argument, but also that he believes it disproportionality benefits people in high-value homes.

The bill will be funded with $125 million in state money and any extra costs will be supported by the Legislative Stabilization Reserve Account.

The exemption is limited to single-family residences and won’t include barns or detached garages.

The bill will go into effect immediately and expire in 2026.

There was some consideration Friday to only have the exemption last for one year, but Biteman said that would be a “slap in the face to the taxpayers,” and the committee eventually agreed on a two-year duration.

The committee also passed House Bill 4, which expands Wyoming’s property tax refund program to people who make up to 165% of the median income for the state or their local county. The only change made to this bill on Friday was the addition of optional audits of the program.

Gordon will also consider House Bill 3, which would establish a tax exemption for long-term homeowners, and Senate File 89, which would increase the annual ad valorem tax exemption for veterans in Wyoming from $3,000 to $6,000.

What It All Means

There was an increase of $256 million in property taxes paid in Wyoming from 2019-2023.

If Gordon signs most or all of these bills into law, every Wyoming homeowner will likely see some kind of relief on their property taxes.

Even though five property tax bills made it through this session, the property tax discussion in Wyoming is far from over.

Many questions remain about whether the structure of the property tax system itself needs to be revised, a topic that will likely come up during the upcoming interim session.

Also, voters will consider a constitutional amendment in the fall to add a fourth class of taxation specifically for residential properties.

"I'm excited for people to go to the polls and get that constitutional amendment," Berger said. "Just so we make these changes more permanent."

Leo Wolfson can be reached at leo@cowboystatedaily.com.