State Rep. Steve Harshman, R-Casper, may have taken a few gambles Tuesday afternoon to save his blockbuster property tax reform proposal that would have eliminated property taxes for about 97% of Wyoming residents. In exchange, the state sales tax would’ve been hiked 2%.

House Bill 203 had narrowly passed its first and second readings, but that was as far as it got. The House killed it on its third reading Tuesday, but not before Harshman tried to keep it afloat even after it was diluted Monday.

Harshman told Cowboy State Daily he didn’t view his efforts to resurrect the original version of his bill as a gamble. It was necessary to try and keep the original intent of his bill alive, he said. He sensed the major opposition was its challenging of the status quo.

“The status quo is always protected,” he said. “It’s just hard to change things.”

HB 203 would have removed $1 million of fair market assessed value for all single-family residences in Wyoming, thus completely eliminating property taxes on about 97% of Wyoming homes. It also would have increased the state sales tax rate from 4% to 6%.

The bill was significantly softened Monday to have the assessment exemption reduced to $200,000, and sales increase lowered to a 1% spike. Harshman said this reduced exemption rate would cover all property taxes for around 30% to 40% of Wyoming homes.

Stars Didn’t Align

The bill would have been a radical change for Wyoming’s property tax structure and the state’s revenue outlook. Although it wouldn’t have benefited anyone who doesn’t own a residential property in Wyoming, it would have benefited all demographics of homeowners in Wyoming.

“The stars don’t always align,” Harshman said, adding that “the people of Wyoming are the big losers today.”

For Harshman, HB 203 was all-or-nothing when it came to offering property tax relief for Wyoming residents. That’s why he introduced amendments on its third reading to restore the bill to its original version.

“I wasn’t going to run the thing unless I do it for all Wyoming people,” Harshman said. “I’m trying to solve a problem.”

Gambling

The first move Harshman made Tuesday was reverting the bill back to its original form with the $1 million exemption and 2% sales tax increase, which passed by a large majority.

Next, he teamed up with fellow Casper Republican Rep. Jeanette Ward, who brought an amendment ensuring the $1 million exemption would remain in place until 2034, which also passed.

But when it came to vote on the bill as a whole, the feeling of the chamber had clearly shifted from the day before, voting 47-14 against it.

Most Democrats, certain members of the Wyoming Caucus and Freedom Caucus all voted against it.

HB 203 passed 31-29 vote on its first reading in the House and a 34-27 on its second.

Harshman’s gamble to take away what helped his bill earn a soft, but larger, margin of support Monday did not pay off.

House Speaker Albert Sommers, R-Pinedale, said he voted against HB 203 because he thought it would attract too many people to Wyoming seeking the lack of property tax. He also thought it might price young people and workers out of homes in his county.

“Too many unintended consequences,” Sommers said.

Many Amendments

In total, 20 amendments were proposed to be added to HB 203 in the House by the time it got to its final reading.

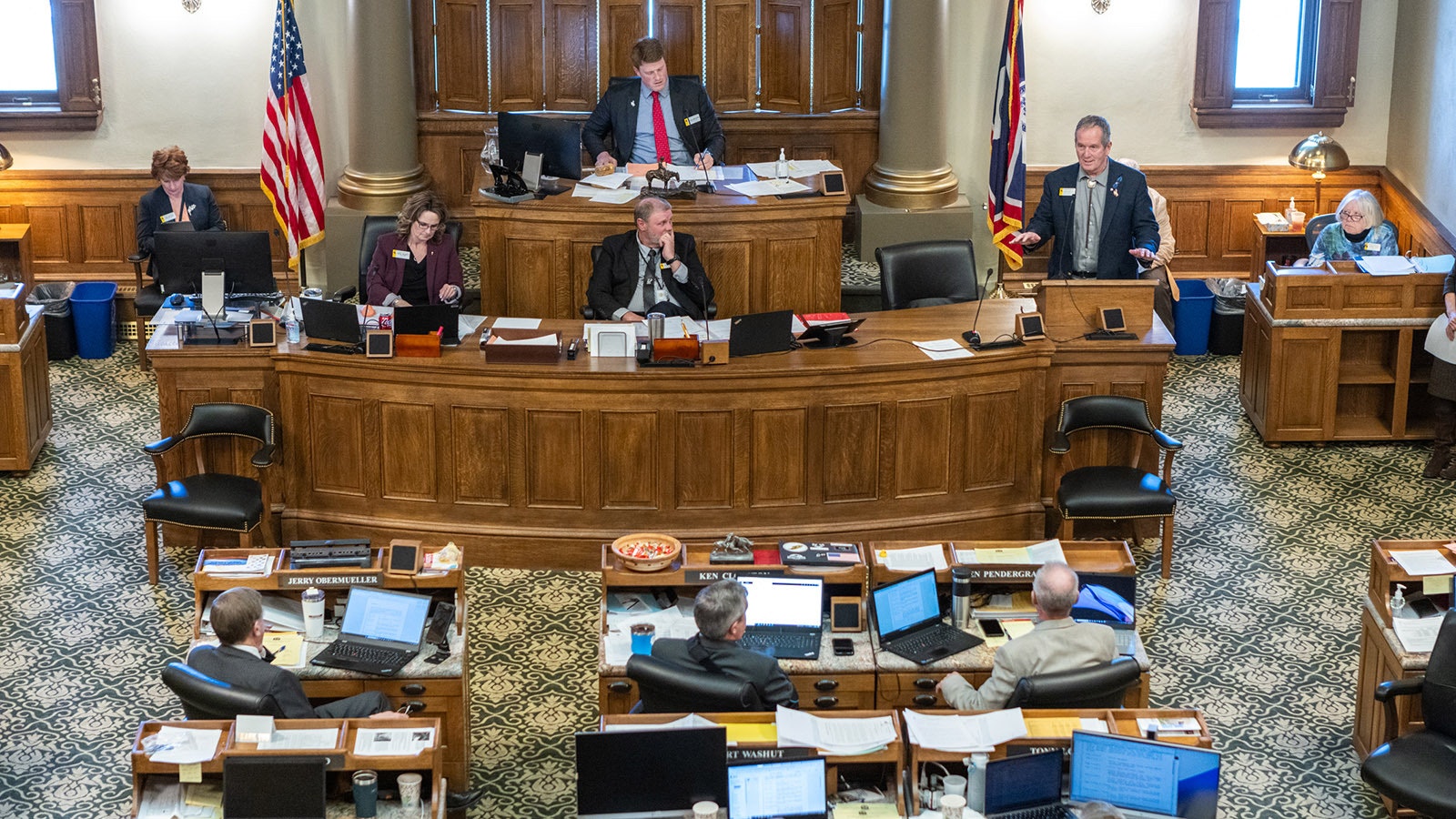

Rep. Ken Pendergraft, R-Sheridan, said he saw that as a major red flag.

“Could someone please explain where this bill stands at this time?” he questioned.

Rep. Clark Stith, R-Rock Springs, successfully brought an amendment Tuesday that would have exempted industrial facilities from the sales tax increase. Stith later still voted against the bill.

Other Property Tax Bills Still Alive

Although the House declined to support HB 203 on Tuesday, it did vote to support three other property tax relief bills that will advance to the Senate.

The first was House Bill 103, legislation brought by Rep. Lane Allred, R-Afton, that would lower the assessment rate from 9.5% to 8.3% on residential property in the event that a constitutional amendment is passed by voters this fall to create a new taxation class for residential real property. The House passed HB 103 on a vote of 55-7.

The House also passed House Bill 134, sponsored by Rep. Martha Lawley, R-Worland, which increases the amount of taxes that can be deferred in the Department of Revenue’s tax deferral program, revises the calculation of interest, and makes deferral of taxes contingent on the homeowner’s availability of funds, for that program. This bill passed 44-18.

Receiving some of the longest debate Tuesday was House Bill 52, legislation sponsored by Sommers that would establish a homestead exemption of $100,000 to $150,000 for the primary residences of people age 64 and older in Wyoming. The bill would only be in effect for the current tax year.

In total, Sommers successfully added three amendments to his bill that passed on a 55-6 vote.

Although he voted to support all three of the measures, Harshman said he views them as insufficient.

“The bills we have left are more of a band-aid,” he said. “I don’t even know if it has Neosporin on it.”

Three property tax bills passed out of the Senate on Tuesday that will now be considered in the House.

Leo Wolfson can be reached at leo@cowboystatedaily.com.