Wyoming’s schools will receive $200,000 from a national settlement with stock trading and investment application Robinhood. The money will be deposited into the state’s Public School Fund, according to the Wyoming Secretary of State’s office.

Last April, Robinhood Financial agreed to pay up to $10.2 million in penalties to state securities regulators over severe outages on its platform in 2020, and for a long-term practice of failing to perform due diligence when approving customers for risky stock trading that many state officials say harmed investors.

The settlement was the result of a multistate investigation into the operational problems Robinhood experienced during the beginning of the COVID-19 pandemic in March 2020. While financial markets were suffering a swift decline in the beginning of the pandemic, Robinhood suffered multiple days of outages that left clients unable to trade stocks, options or cryptocurrencies.

Although not a part of the settlement, Robinhood in early 2021 experienced similar problems during the meme-stock trading frenzy when the online brokerage temporarily restricted customers from buying shares of several companies, including high-flying stocks like GameStop.

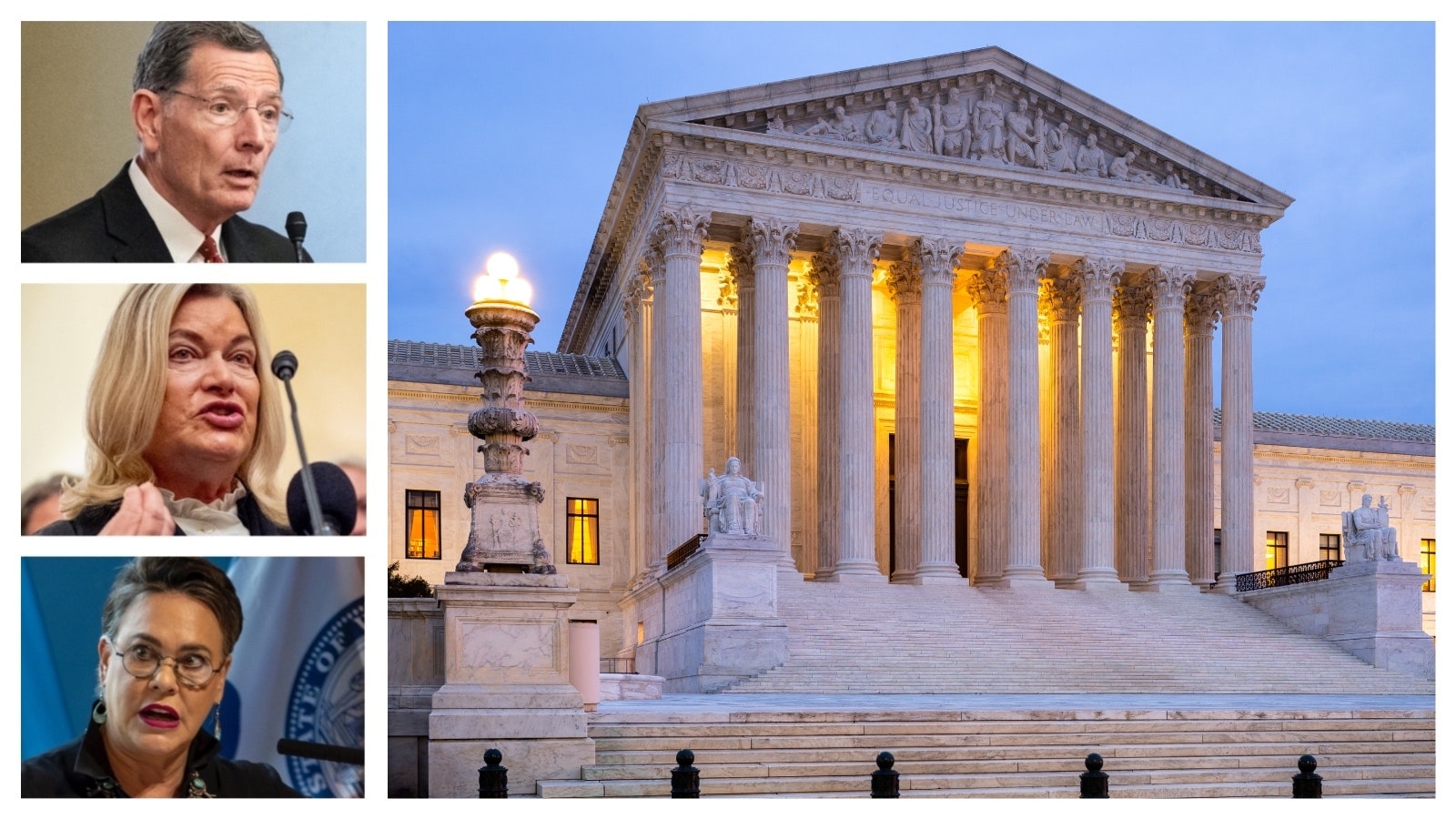

Secretary of State Chuck Gray joined the multi-state settlement last week.

“Today’s agreement represents justice for many main street investors in the state of Wyoming and across the nation,” Gray said in a Tuesday press release. “While Robinhood’s conduct captured the attention of the nation when it halted trading of GameStop stock on its trading app in January 2021, the investigation into Robinhood’s practices demonstrate a much more longstanding and repeated failure to serve its clients.”

How Did It Happen?

The state investigation was led by regulators in Alabama, Colorado, California, Delaware, New Jersey, South Dakota and Texas, along with the North American Securities Administrators Association.

Individual Wyoming investors who held stock through Robinhood at the time of the outage also are to be compensated through the settlement.

“This settlement makes clear that Robinhood must take its customer care obligations seriously and correct these deficiencies in the future,” Gray said.

Shoddy Tactics

Robinhood has touted itself as a low-cost, easy-to-use trading application that allows its users to buy and sell stocks for much less money invested than other firms.

The probe into Robinhood found violations regarding platform outages, options and margin approvals, and customer support. Regulators also found Robinhood gave customers inaccurate margin and risk information, failed to conduct proper due diligence before approving certain accounts, and was deficient in supervising its technology that provided broker-dealer services and fielded customer complaints.

Robinhood neither admits nor denies the findings as set out in the settlement.

The company has already had to pay $70 million in fines and restitution related to the 2020 incident with the Financial Industry Regulatory Authority Inc.

The Wyoming Secretary of State’s office is charged with regulating securities and protecting consumers in the state. Those with questions or concerns about their investments or financial professional should contact the office’s Compliance Division, at 307-777-7370 or email investing@wyo.gov.

Leo Wolfson can be reached at leo@cowboystatedaily.com.