A ballot initiative to provide dramatic residential property relief tax in Wyoming is drawing some vocal political backlash.

Multiple members of the Wyoming Caucus, a group of Republican state legislators, blasted the proposal during a press conference at the state Capitol in Cheyenne this week.

State Rep. Clark Stith, R-Rock Springs, said he believes if the ballot initiative passes, it has the potential to eventually lead to a state income tax to support Wyoming’s public schools. Wyoming is one of eight states without a state income tax.

“I never want to see a personal income tax levy here in the state of Wyoming, so I’m against it to ward off that eventuality,” he said.

The initiative, if it qualifies for a statewide ballot and voters approve it, would allow homeowners in Wyoming to have their property taxed at 50% of its assessed value.

One of the leaders of Wyoming Voter Initiatives, a group organizing the ballot initiative, is Sheridan resident Brent Bien. Bien lost to Gov. Mark Gordon in the 2022 Republican primary, getting 29.7% of the vote to Gordon’s 61.7%.

Bien said lawmakers and state officials are giving Wyoming residents a false narrative that the tax initiative will drain the state’s finances.

“It couldn’t be farther from the truth,” he said. “There’s a lot of stuff out there that people are throwing against the wall.”

‘Terrible Tax Policy’

The property tax division of the Wyoming Department of Revenue estimated in December that the initiative, titled “People's Initiative to Limit Property Tax in Wyoming through a Homeowner's Property Exemption,” would cause a $143 million hit to total revenue statewide in its first tax year of 2025. By 2026, that would increase to $147 million.

If passed, homeowners would still have to apply to receive the 50% assessment as it would only apply to people who have lived in the state for at least a year and have Wyoming as their primary residence for at least six months of the year.

The state Department of Revenue has estimated this would lead to about 175,000 applications statewide, which would be fielded by local assessor offices.

Sweetwater County Assessor David Divis is against the initiative, which he called “terrible tax policy” that would severely hurt local governments.

First off, managing it “would be a huge, huge lift for the assessors and would likely require us to hire a few more employees,” he said.

Bien said the purpose of the initiative is to bring tax relief to people in Wyoming after several years of taxes jumping by leaps and bounds for many homeowners.

One misconception Divis believes Voter Initiatives is promoting is that property tax revenue goes into the state’s general fund.

“It’s not accurate,” Divis said. “Whether it’s intentional or not, you can decide, but they’re not right.”

Local, Not State

The majority of funding goes directly to local counties and municipalities to support governmental functions and local districts for functions like emergency services.

“Do you want the sheriff to show up when you call 911, do you want the ambulance to show up when you call them?” Crago questioned. “I’m quite worried and concerned about that initiative because I think it will do much more damage than good.”

If it passes, Crago believes the state will still end up backfilling the deficit created with more taxpayer money.

The state now is in a relatively strong fiscal position with an $870 million surplus projection through 2026.

“That money is the people’s money,” Bien said.

The remaining allotment of property tax revenue goes to the state’s School Foundation Program Account, which is money redistributed from higher valuation school districts to lower valuation school districts.

Bien described concerns of educational funding as fear-mongering because, independent of however property is taxed, the state has a legal requirement to fully fund its schools.

Local Spending

If the ballot initiative were to pass, it would cost Sweetwater County $5.6 million in its first year alone, of which $3.4 million would have gone to local education, Divis said.

Despite the concerns of some about the proposed initiative, there’s a strong sentiment around Wyoming that property taxes are too high and something has to be done about it, Bien said. If voters decide to limit or reconfigure the state’s property tax system, it’s up to elected and paid government officials to make that work.

Bien said local governments must learn to live within their means and deal with the same kind of fiscal constraints that homeowners have been dealing with as their property taxes have gone up exponentially. He mentioned how every Wyoming county has millions of dollars in reserves. Sweetwater County, for instance, has about $40 million.

“Before the Legislature gives the counties extra money, they (counties) have to spend their money first,” Bien said. “All entities should have to sit down and decide what are necessary and unnecessary services.”

But Divis said there is relatively no fat in Sweetwater’s budget and those reserves don’t represent a slush fund or big pile of extra money. That money is earmarked for important and unexpected capital construction projects. In a boom-and-bust mineral dependent county like Sweetwater, Divis said a financial reserve is essential in helping the county get by during lean years.

What About The Legislature?

Lawmakers considered 21 property tax reform bills during their 2023 session and passed two, and a number of bills have already been released for the upcoming 2024 session.

Crago and the Joint Revenue Committee has brought two bills that would create a 5% year-to-year tax cap.

Bien said this isn’t enough and would still allow for increases of up to a collective 25% over five years, and that “it’s not going to go back and do anything to reduce taxes from years before.”

One bill that passed last year expanded the eligibility group to the state’s property tax rebate program, which is income-based. Bien touts the ballot initiative as being “very non-discriminatory.”

“It’s so un-American to sit there and punish people for their success,” Bien said.

Divis disagrees, countering that billionaires and new transplants shouldn’t be entitled to property tax relief.

“We need to help people that need the help,” he said, adding that if the initiative passes, “we’re going to be giving billionaires and out-of-staters tax breaks.”

Bien said he has no faith that the Legislature will pass any meaningful tax reform in the upcoming session, and even if it does, he thinks Gordon will veto it.

“I don’t see Mark Gordon helping the people with this,” Bien said.

Gordon has proposed increasing funding for the tax rebate program by $20 million.

“All we’re trying to do is keep people in their homes,” Bien said. “It’s not just a conservative issue, it affects everybody in the state who owns a home.”

Many who have clamored for property tax relief over the past year have claimed that people are being forced out of their homes because of escalating taxes. Divis said this is mostly untrue. A U.S. Department of Revenue survey of 20 state treasurers in June found that in the last five years, 48 people in those 20 states have lost home ownership due to a nonpayment of property taxes.

What Are Its Chances?

To qualify for the November ballot, members of Wyoming Voter Initiatives must gather 29,730 total signatures statewide, including 15% of the number of residents who voted in each county in the 2022 election in at least 2/3 of Wyoming’s 23 counties. The deadline to get these signatures submitted is Feb. 12 when the Legislature convenes, but Bien said his group may argue it has until early March when the body adjourns.

“It’s going to be nonstop until the end,” he said of the group’s efforts to get its initiative in front of voters.

Bien said he’s “pretty confident” about their chances of getting enough signatures, but admitted there’s been some challenges along the way. One is the state’s voter rolls that his group depends on to find where voters live. He said this system is littered with inconsistent address descriptions and other discrepancies.

The last initiative to qualify for a ballot election in Wyoming was about term limits in 1996. That initiative failed. It wanted to make candidates running for legislative office in Wyoming to have a statement next to their name on the ballot indicating their support of congressional term limits by past votes or a signed pledge, and instruct them to call for a federal constitutional convention.

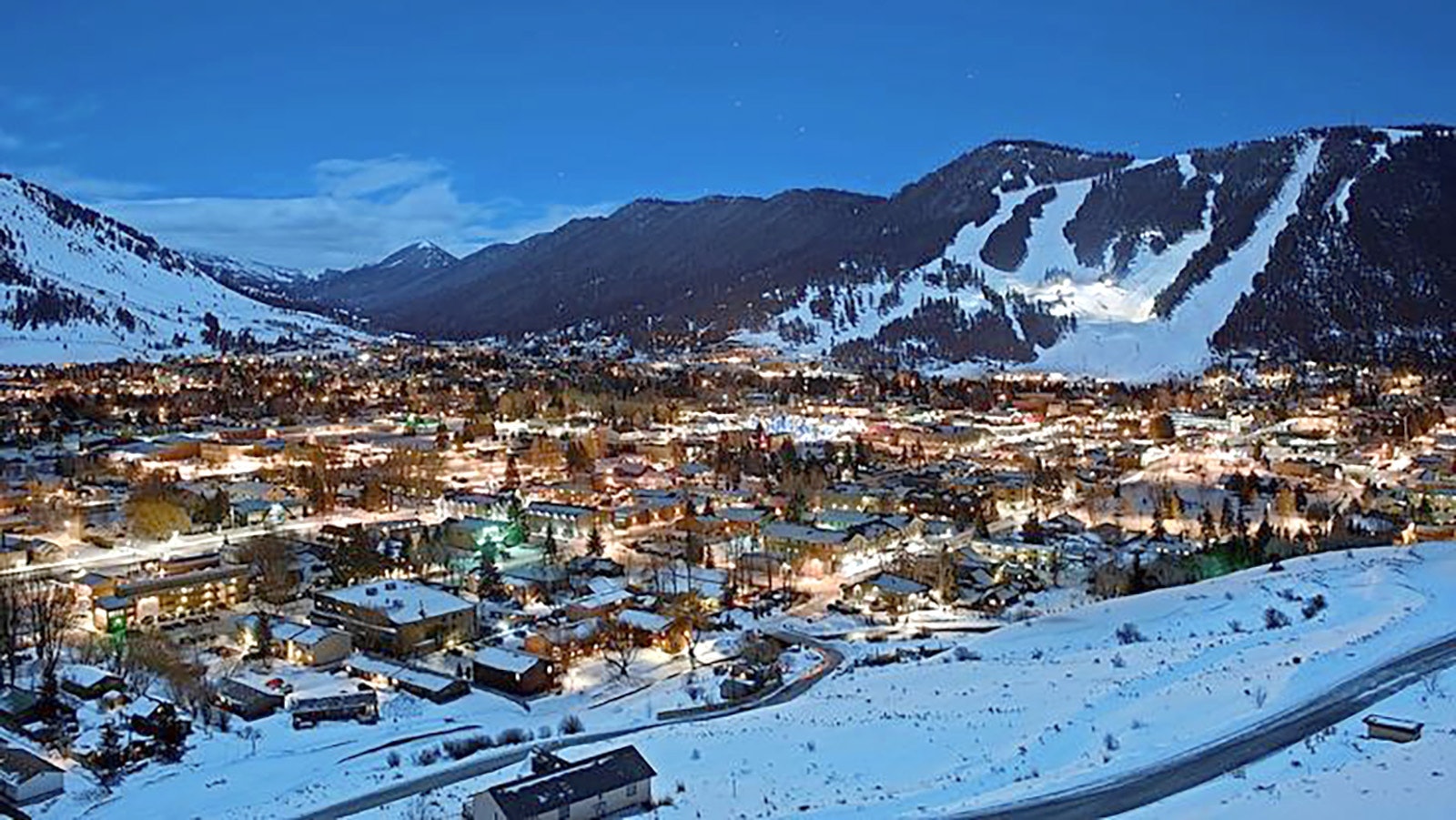

The Voter Initiatives group has been busy collecting signatures around the state since getting its petition drive certified in late September. On Wednesday, the group held an event in Teton County, where Bien said he is sure his group will get enough signatures. This weekend, they will be in Cheyenne and Cody collecting more.

“Whether it’s a level playing field or not, it’s a tough process,” Bien said.

He also expressed disappointment that some organizations he thought would back the cause haven’t yet, such as groups with the words “freedom” and “liberty” in their names.

“Their silence has been deafening,” he said.

Bien said if the initiative doesn’t get enough signatures, that won’t end the push and the effort will pivot to focus on the 2026 ballot.

Leo Wolfson can be reached at leo@cowboystatedaily.com.