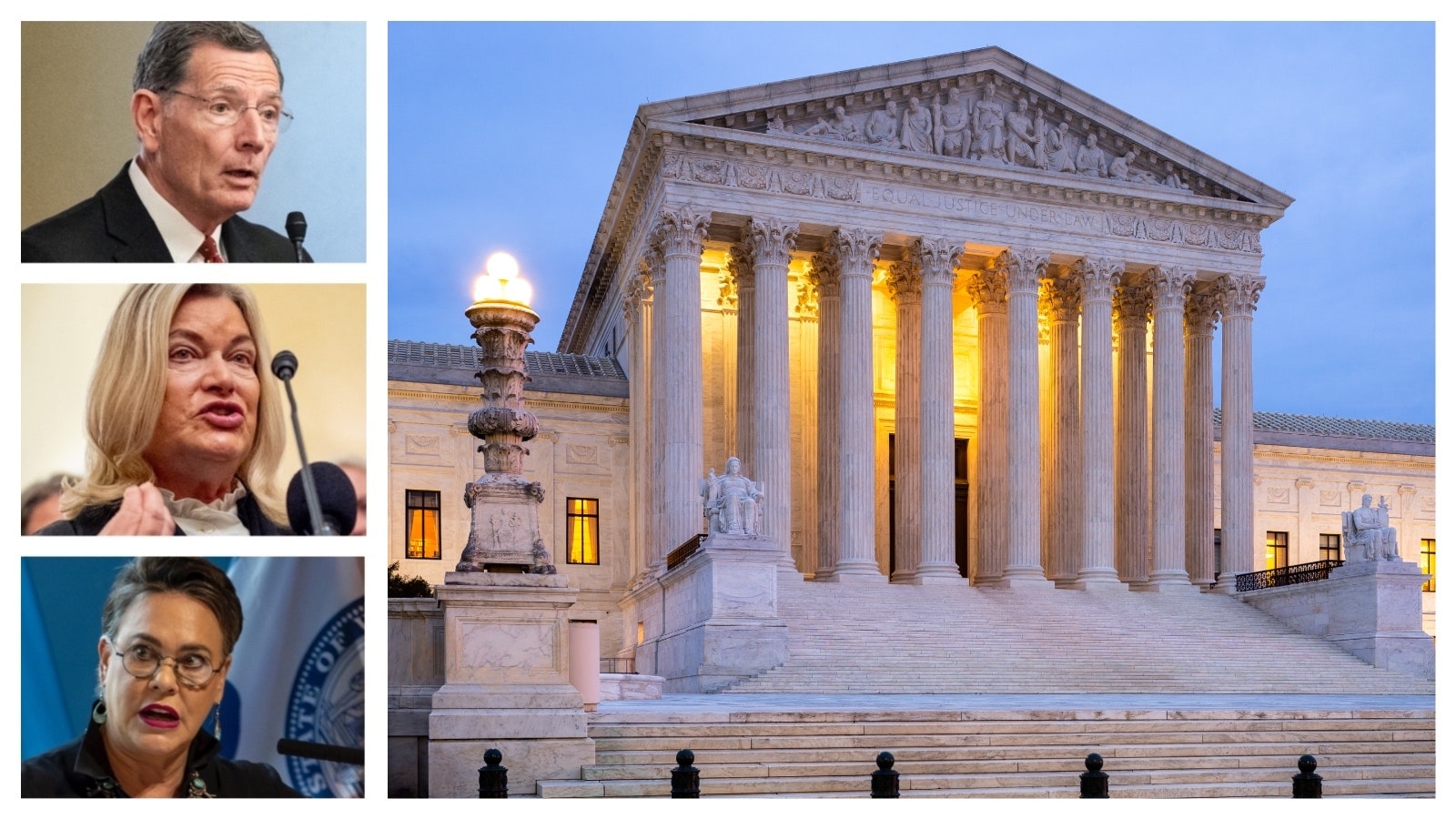

The Wyoming Supreme Court rejected an appeal Tuesday in which the Wyoming secretary of state’s father tried to challenge Converse County’s assessments on his vacant lots in Glenrock.

The Converse County assessor demonstrated substantial evidence to uphold the rates at which she taxed Jan Charles Gray’s vacant lots in Glenrock from 2016 to 2020, the Wyoming Supreme Court ruled Tuesday.

Gray is the father of Wyoming Secretary of State Chuck Gray.

“Mr. Gray presented no cogent argument demonstrating how the county assessor’s valuation is not in accordance with law or not supported by substantial evidence,” reads the ruling, adding that Gray also failed to show that the Converse County Board of Equalization (a reiteration of the county commission), wouldn’t let Gray show evidence in his case.

It’s been a long-fought challenge, with Gray appealing the assessor’s valuations multiple times and challenging the taxation from four years: 2016, 2017, 2018 and 2020.

“I’ve been fighting my entire life for fair property tax valuations,” said Gray, referring Cowboy State Daily to a 1995 case where he took on the Wyoming State Board of Equalization. He said he’s done so “because the mass appraisal system has huge problems that have spread statewide in the last few years. Voters and taxpayers need to unite against the unfair mass appraisal system.”

Secretary of State Gray echoed this sentiment in his own Wednesday comment to Cowboy State Daily.

“I’m proud of my father for standing up to the out-of-control property tax increases that are crippling our state,” he said in a text message. “It is so important that we reform the mass appraisal property tax system, because it is no longer working. It’s forcing the elderly and those on fixed incomes out of their homes. It must be fixed.”

Assessor’s Job

The older Gray owns about 115 lots of vacant land in the Sunup Ridge subdivision in Converse County. They all have infrastructure for water, roads and sewage, says the ruling.

The Converse County assessor valued Gray’s lots for property taxes in 2016 at $3.30 per square foot.

In 2017 and 2018, she valued the lots at $3.50 per square foot.

In 2020, that value jumped to $4 per square foot, but she adjusted two of the lots downward for topography or their building potential, reducing one lot to $3.49 per square foot and another to $3.80.

Gray appealed the assessments for the four years to the county Board of Equalization.

The county held a hearing to scrutinize the valuations from each year, and upheld all four years – essentially holding that the assessor had done her job.

Gray then appealed to the State Board of Equalization, which stood by the assessor, then the District Court, which did so also.

He appealed to the Wyoming Supreme Court in March and filed his argument with it in June.

Going There

Gray’s challenge claimed that in 2020, vacant land values in Converse County went down for everyone except him, and that the assessor did not properly inspect his lots.

Converse County Assessor Dixie Huxtable said she did physically inspect the property in accordance with state rules, and ensured the lots’ characteristics remained unchanged.

Huxtable testified during Gray’s hearing at the county level that she individually expected every lot in 2016.

“She testified she rode in a vehicle around Sunup Ridge and physically viewed all 115 lots to see if any structures had been erected on the lots,” the ruling recounts.

Huxtable had also testified that an employee from her office individually visited each of the 115 lots in 2014, and in 2020.

The state rule says the assessor must inspect property at least once every six years to keep up with each lot’s valuing traits.

A Feeling In 2016

Gray also challenged the methods by which Huxtable valued his land, arguing his tax valuation increased while other properties decreased.

The Wyoming Department of Revenue in many cases recommends assessors use the sales comparison approach – checking recent sale values of at least five similar parcels in the region.

The department also allows other techniques, called “allocation, abstraction, anticipated use and capitalization of ground rents methods.”

Huxtable in 2016 valued Gray’s lots from 16 comparable sales of vacant lands from the prior three years in that same region, according to her testimony. That led her to a median value of $3.47, but she went “conservative” and valued Gray’s lots at $3.30, which was still within the recommended zone of deviation, the ruling says.

To challenge this, the legal burden was on Gray to prove the assessor was wrong. He called Jared Rude, an avid land buyer in Natrona and Converse Counties, to testify in his favor.

Rude said he believed Gray’s lots had declined 10%-15% due to declining oil and gas values. This was because of a “generalized feeling,” the high court recounted from that testimony.

“Mr. Gray presented an expert witness who admittedly testified his opinion is based on a ‘generalized feeling,’” reads the ruling, which then upheld the 2016 valuation.

Realtors In 2017

In 2017, Huxtable increased the taxable value of Gray’s lot’s to $3.50 per square foot.

She said she based this on seven comparable sales, six from 2015 and one from 2014.

She also looked at residential sales to deduce comparable land values, which would have valued Gray’s properties even higher at $3.87.

To dispute that valuation, Gray called for testimony by Paul Richardson, another avid real estate buyer and seller.

Richardson said the vacant lots were outside his area of expertise, “so he reached out to other unidentified real estate agents to determine the value,” the ruling says.

The county board determined this wasn’t enough evidence to overcome the presumption in favor of assessors the Wyoming Legislature has codified.

Contractor In 2020

The Converse County Assessor did not adjust the fair market value of Gray’s lots from 2017 to 2018, keeping the $3.50 value. Huxtable said she based this on the six vacant land sales from 2015 and a fair market analysis.

Gray disputed this as well, calling on himself to testify. He said he valued his lots at $8,000 per lot, based on a conversation with a contractor currently building on lots within the Sunup Ridge, says the ruling.

The county board determined Gray’s testimony to be insufficient evidence.

The high court agreed.

Won’t Hear It In 2020

Gray’s property valuation jumped to $4 per square foot in 2020, which Huxtable said was below the $5 or $4.51 values the assessment methods actually recommended.

This time, Gray’s challenge was “a copy and paste of the argument from his appellate brief” from his earlier tax appeals, the ruling recounts. “The argument in his brief contains no citation to the record for the 2020 contested case hearing, no cogent argument and no relevant authority. We therefore decline to consider Mr. Gray’s argument any further.”

The high court cited 2021 case law in which it had declined to hear someone’s appeal for lack of a cogent argument.

Won’t Hear These Two

The Wyoming Supreme Court declined to consider two more of Gray’s arguments: that the county board did not file a written transcript of his tax hearings in the appeal, and that the county wouldn’t let him expose evidence properly

State rules require the person who wants the transcript of tax audio recordings from tax hearings be the person to pay for and arrange for them, the ruling says.

Gray apparently did not arrange for someone to transcribe the audio recordings of his tax hearings. The high court wouldn’t hear his complaint that there was no transcript.

In his discovery argument, Gray claimed he was not able to expose all the evidence in his case.

He said the county assessor answered his interrogatories in a “defiant and cursory way” when he questioned her in 2018.

Yet, “He fails to point us to any portion of the record supporting his (lack of evidence) claims or present any argument other than conclusory statements,” the ruling says.

Clair McFarland can be reached at clair@cowboystatedaily.com.