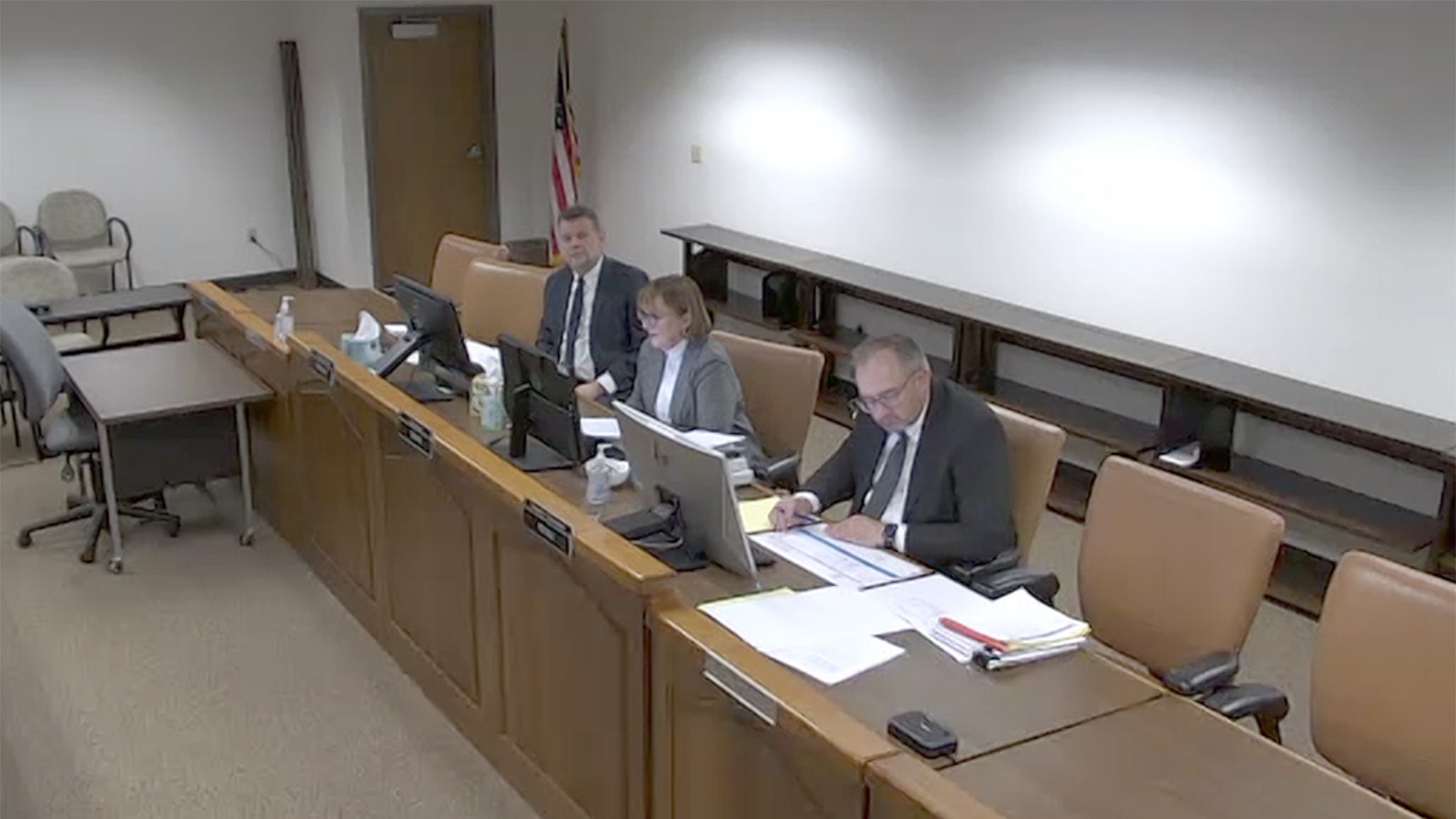

Customers of Rocky Mountain Power who hoped for easy answers to what their electric rates are going to be come Jan. 1 didn’t get them Tuesday as the Wyoming Public Service Commission ended its deliberations of Rocky Mountain Power’s proposed rate hike of almost 30%.

The commission wrestled with lots of numbers and complicated concepts on multiple policy points before concluding its daylong deliberation with a resolution that gave nobody all of what they wanted in the case.

And, while the tedious weighing of RMP’s proposed rate increase is now over, it’s going to take awhile to crunch all the numbers to total up how much Wyoming customers will pay for their electricity.

Despite still having to calculate the overall rate increase, the commission did make one thing clear: Wyoming isn’t going to pay for Washington state’s climate mitigation policies.

With legislators and other parties urging the commission to simply deny the entire rate increase, Chairman Mary Throne took pains to explain that the commission is duty-bound by law to accept not only prudently incurred costs, but a reasonable return on the company’s investment — one that’s commensurate with similarly situated enterprises.

“Failure to follow these principles and to allow appropriate recovery in rates could result in a finding of a taking,” Throne explained. “In simple terms, when the evidence supports a rate increase, the commission lacks the authority to deny the application for such rate increase.”

This interpretation has been bolstered by case law in the legal system.

That legal system does not prescribe any particular method that the PSC must follow, and it does put the burden of proof on the utility company. But the legal language also says that rates must be “just and reasonable.”

That concept applies not just to ratepayers but to compensation for the utility company’s costs.

Base Net Power Costs — Door 1, 2 or 3?

Deliberation of the rate case started with discussion of what the base net power cost should be.

Net power costs make up 95% of Rocky Mountain Power’s total rate request, which has two components. One part is a 21.9% overall increase, which is the subject of the current rate case. The other part is a 7.6% temporary increase to cover unexpectedly high fuel costs. Together they are an almost 30% rate hike.

Throne proposed adopting a base net power cost of $298.7 million for Wyoming’s allocation of costs on parent company PacificCorp’s integrated system, with no sharing band, up to an amount to be determined by commissioners. Throne's initial recommendation was for $320 million, though there also was discussion of extending that up to the company's Aurora model prediction of $354 million.

The idea behind the sharing band is to incentivize the company to produce accurate forecasts. Earnings that far exceed the company’s forecast, for example, can result in revenue sharing with consumers, and expenses far above forecast can mean some costs the company cannot recoup.

Rocky Mountain Power has been pushing to eliminate sharing bands for a while now, and it’s something that the PSC has so far rejected.

That was less than Wyoming Industrial Energy Commision’s proposed number of $307 million and Office of the Consumer Advocate’s proposed $299 million.

The compromise figure was proposed by Rocky Mountain Power during rebuttal and was something Throne said she’d initially dismissed.

“Right now, I’m just trying to get to the amount that goes in base rates on Jan. 1,” Throne explained. “Because that’s what people are going to see immediately. The 2023 ECAM (Energy Cost Adjustment Mechanism), they won’t see until sometime in 2024. So, the benefit, to me, of using that number is, I wouldn’t really call it rate mitigation, but it maybe reduces rate shock.”

But Commissioner Mike Robinson and Deputy Chairman Chris Petrie were not willing to let the sharing band go on any amount of the base rate, saying that would remove incentives for the company to make sure it hits its target expenses.

Down The Jargon Garden Path

That led to a line-by-line examination of each policy point in a 25-page document — a head-spinning path of jargon that include phrases like day ahead-real time adjustments or DART corrections, weighted average cost of capital or WACC, and energy cost adjustment mechanism or ECAM, and so on.

Commissioners rejected some late-filed data that came through rebuttal testimony, such as adjustments on the forward-price for delivery points of natural gas.

While Commissioner Throne suggested the company had done a good job of explaining that particular point, Petrie and Robinson both said the company should be encouraged not to wait for rebuttal testimony to file such information.

Rebuttal testimony “is never a vehicle to amend the application,” Robinson said. “And if we have to change our rules, then we should do so, but I strongly believe that if they wish to amend the application, they need to file an application, an amended application.”

Petrie agreed.

“We don’t want an applicant recalling a witness right before closing arguments, letting everybody know that there’s a new number to think about,” he said. “And I’m deliberately exaggerating but, yes, we can’t tolerate updates on the fly. It’s not fair for the parties.

“I’m not questioning the company’s motivation at all. It’s just, it is a question of fairness to the parties and to our staff, and to the public, to be able to give notice.”

No Washington CCA In Wyoming

Commissioners were unanimous in saying they do not want to see anything in Wyoming rates for Washington’s Climate Commitment Act.

“To me, this raises real questions on the continuing viability of the multi-state protocol,” Robinson said. “Those are questions that aren’t being answered today, but it is something I think we really need to look at because, frankly, if this is not a state specific initiative, nothing is.”

Petrie called it an invitation for attacks across state lines, which would challenge the creativity of the Legislature and could hurt both customers and power companies alike.

“I don’t think that a future with mechanisms of this sort across the company’s service territory would be a workable situation,” he said.

Throne, meanwhile, said the situation has been building now for a while.

“I’ve thought for years, since 2020, that the MSP is on thin ice, has been on thin ice, and may fall through the ice here at some point,” she said. “In my mind, the CCA, Washington’s program, is akin to anything in the existing MSP, it’s akin to a renewable portfolio standard, because the objective of the CCA is to reduce the use of thermal fossil fuels.”

Commissioners accepted WIEC’s position on the Real Time DART Adjustment, rejecting Rocky Mountain Power’s July update, which commissioners said became less and less clear to them as it flowed through the company’s Aurora model.

They also accepted WIEC’s position on market capacity limitations.

“I would just remind the company that certainly in future rate cases they can make a case for adjusting anything we decide today, but they can’t really do it just by fiat,” Throne said. “There has to be justification through the record.”

The Whole Motion Enchilada For Those Who Are Wondering

In the final motion, commissioners adopted a base net power cost of $307,105,283, and kept the 80-20 sharing band in place.

“The company’s use of the Aurora model in this case did not carry the company’s burden of proof to justify a base net power cost of $354,577,253,” Chairman Mary Throne said, reading from the proposed motion. “And that as the company’s rebuttal number, future use of the model for any purpose before the commission must be transparent with enhancements or adjustments fully supported in the record.”

Costs of converting the Jim Bridger coal-fired power plant to natural gas will not be included in the sharing band, which was a point proposed by the Office of the Consumer Advocate.

Costs associated with the Washington Climate Control Act should not fall to Wyoming ratepayers and are to be stripped from the proposal.

“Shifting to a weighted average cost of capital, we have agreed to an imputed capital structure of 51% debt, .01% preferred stock, 48.99% equity, a cost of debt of 5%, and a return on equity of 9.35%,” Throne said, which, she added, is a 7.25% weighted average for cost of capital.

Several costs totaling $700,000 that were introduced in rebuttal were removed, Throne said, adding that the annual incentive package was approved — albeit over her own strong objections.

Some Denials

Commissioners are denying the incremental insurance premium proposed by the company and its generation maintenance and inflation escalator.

WIEC’s request to terminate the Carbon Plant Obsolete and Supplies Inventory adjustments, which were approved in a 2020 general rate case, was denied, as was the company’s request to recover deferred depreciation costs.

The company’s calculation and estimates of residential revenue were accepted, while a WIEC proposal to employ flow-through accounting for different state income taxes was denied. Commissioners agreed it should be explored at a later date.

The Sierra Club’s proposal to explore a competitive bidding process was denied as inappropriate to this particular rate case.

Aggregate billing will be accepted, the motion concluded, but not aggregation of tariffs.

Rocky Mountain Power was asked by commissioners to make a compliance filing that incorporates all of the decisions that commissioners reached into the Joint Allocation Model or JAM.

Throne acknowledged the conclusion of the PSC’s deliberation would likely be frustrating to a general public seeking answers on how much more they will be paying come Jan. 1.

“I want to stress for the public who may be listening that we are done with our proceedings, but we don’t have a number until all the numbers we have discussed today are sent through the model and calculated,” Throne said. “So, to the extent that anybody listening, or members of the public expected us to have a precise number, we don’t have that. But it will be forthcoming and, of course, once it’s available we will issue it.”

Read more

7 Days, 400 Exhibits And 8,000 Comments: What Now For 30% RMP Rate Hike?

Soaring Coal Prices A Big Part Of Rocky Mountain Power’s 30% Rate Hike

Companies Say RMP’s 30% Rate Increase Would Clobber Wyoming Oil And Gas

Rocky Mountain Power Claims Astonishing 30% Rate Increase Not Due To Renewables

Wyomingites Say They Can’t Afford Rocky Mountain Power’s 30% Rate Hike

Renée Jean can be reached at renee@cowboystatedaily.com.