The U.S. Energy Information Administration (EIA) has released its latest data evaluating the amount of subsidies that the federal government dishes out to energy producers for fiscal years 2016 through 2022.

In fiscal year 2022, coal, natural gas, oil and nuclear received just under $3.6 billion. Renewables, which includes wind, solar and hydroelectric, received nearly $15.6 billion.

Conversely in 2022, 79% of all energy was produced by fossil fuels, whereas renewables produced 21%.

The Institute for Energy Research (IER), a free-market energy research nonprofit, noted that subsidies for renewable energy more than doubled between fiscal years 2016 and 2022.

These subsidies do not include any from the Inflation Reduction Act, which is estimated to be around $1.2 trillion, nor do they include any state and local subsidies, mandates or incentives.

According to the IER, these can be quite substantial.

Shooting In The Dark

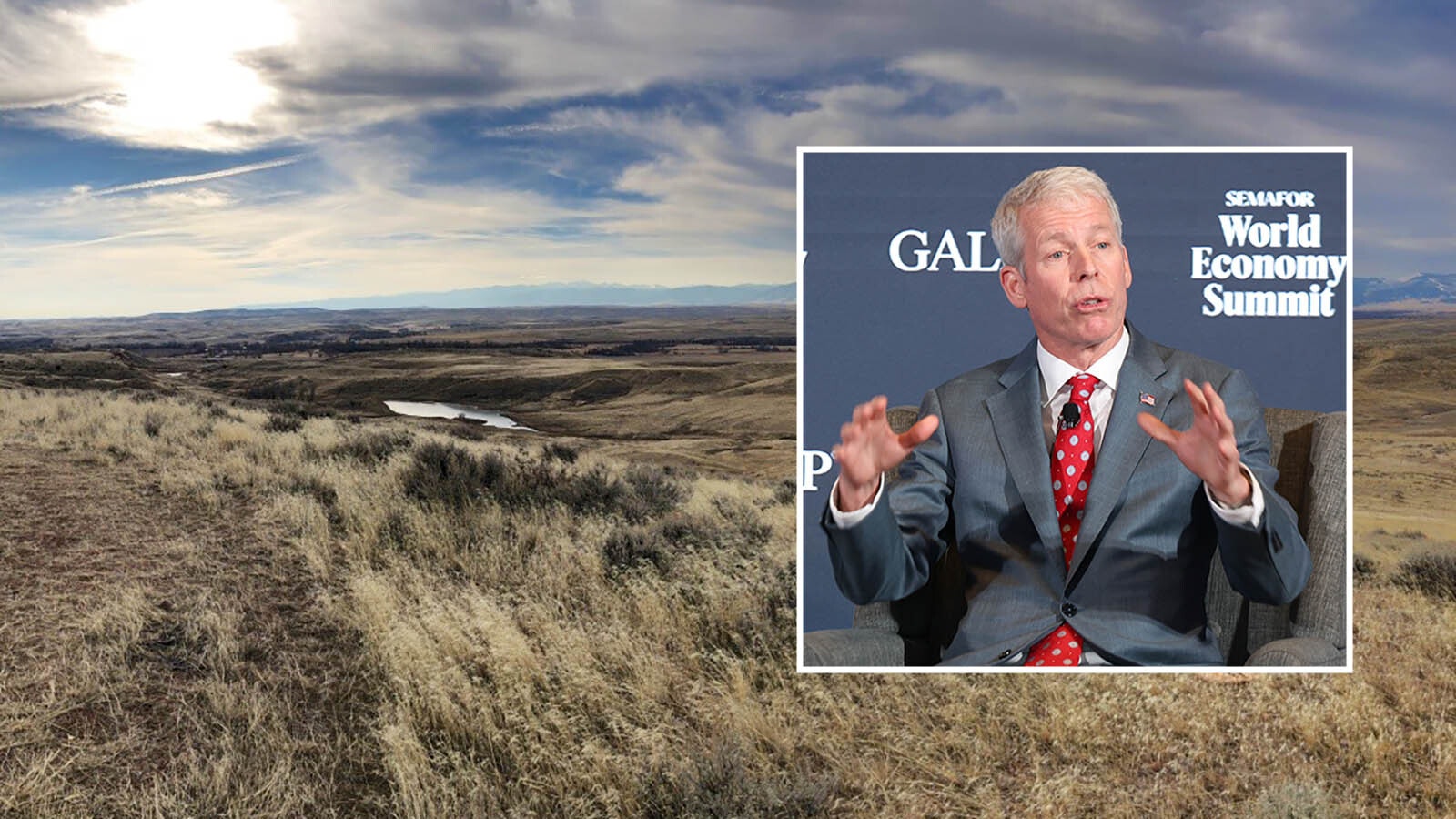

Alex Stevens, manager of policy and communications for IER, told Cowboy State Daily that the Energy Information Administration used to publish this report annually, and then a few years ago it stopped. So, this is the first such report since that time.

Stevens said that pouring so much taxpayer support into politically favored energy sectors leads to bad energy policy.

“Policymakers don’t have skin in the game. They don’t pay the cost of bad decision making,” he said.

It’s also next to impossible to predict what technological innovations will arise to produce the best results. So, policymakers don’t always pick the technologies that will produce the best results.

“They’re kind of shooting in the dark,” Stevens said.

When private funding is involved, the calculation of risk is more carefully considered, and investments are made for financial reasons rather than political ones.

Ultimately, Stevens said, this undermines the drive to innovate.

‘Giant Scam’

Tyler Lindholm, state director for Americans for Prosperity in Wyoming and a former state lawmaker, told Cowboy State Daily that the subsidies the industry is receiving don’t always produce anything.

The production tax credit, which is one of the key subsidies that wind and solar receives, is given in some cases where no electricity was produced.

If a wind developer buys 5% of the project and puts the wind turbines in storage, they receive production tax credits on the stored turbines, Lindholm said.

On top of the subsidies they receive, some states grant wind and solar companies property tax exemptions.

“It’s a giant scam,” Lindholm said.

While all energy sectors receive these subsidies, the wind and solar industries never grew without them. Lindholm said that, even though it’s not a popular stance here in Wyoming, he thinks the production tax credit needs to end.

“If it’s truly a good technology, it shouldn’t need production tax credits to survive,” he said.

Vicious Cycle

While wind and solar are often reported as being the cheapest form of energy, utilities continue raising their rates. When all the costs of putting wind and solar farms onto the grid and making it reliable are included in the total, wind and solar are among the most expensive forms of energy.

Lindholm said that energy policies that favor wind and solar for subsidies are ultimately hurting the poor, who are the least able to absorb increased energy costs.

“That’s who we’re hurting the most,” he said.

The second largest recipient of subsidies, according to the latest EIA figures, are end use, which are programs that provide support for lower income Americans struggling to pay utility bills.

Stevens said that it becomes a scenario where the government creates a problem that the government then tries to solve. Wind and solar drive up energy costs, and then lower income Americans need subsidies to help them pay their utility bills.

“It’s a vicious cycle,” Stevens said.