The environmental, social and governance (ESG) movement, sometimes called “woke investing,” has had a detrimental impact on Wyoming’s key energy industries by scaring away investment in oil, gas and coal, but the state still can’t figure out what to do about it.

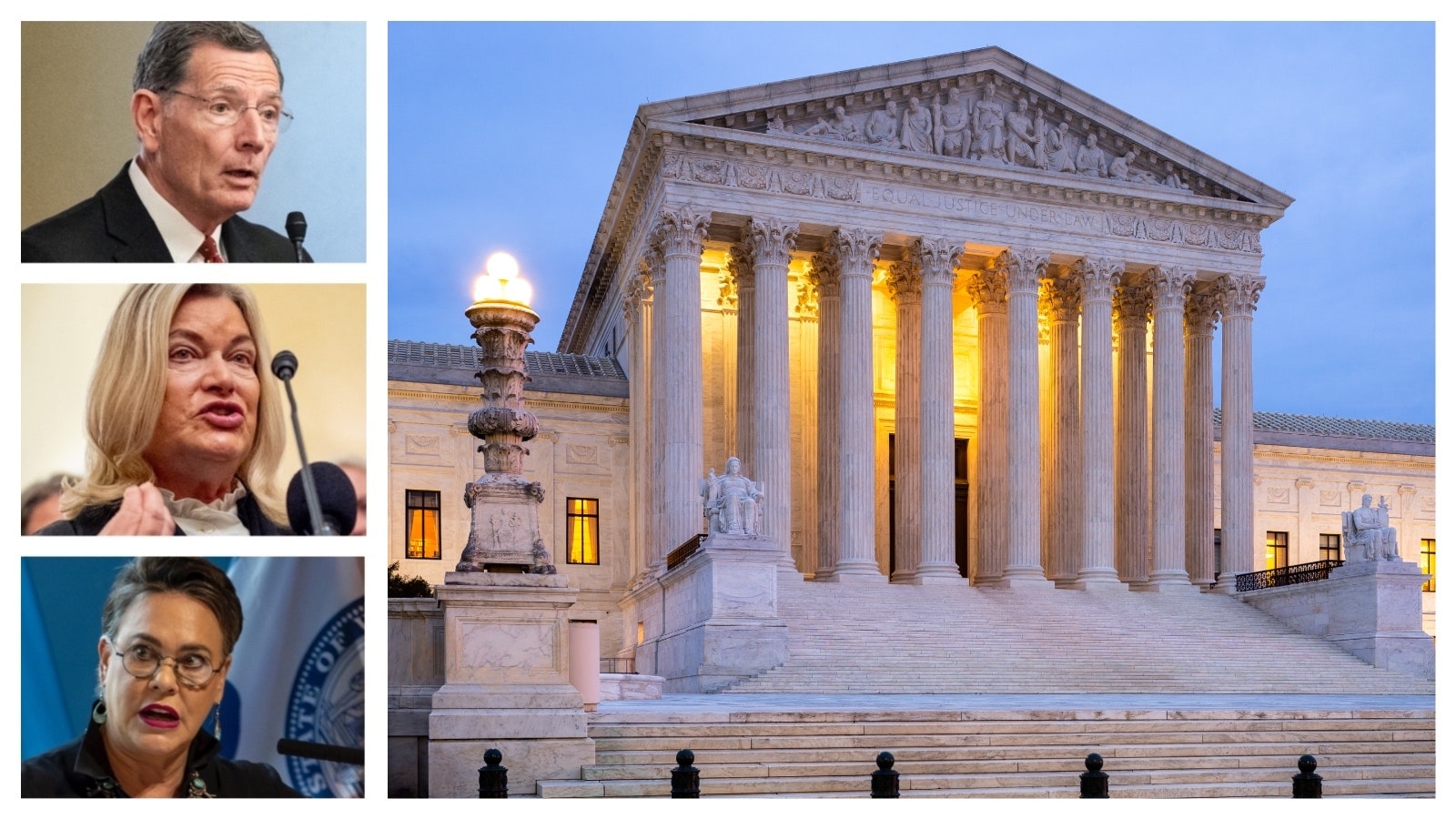

Wyoming Treasurer Curt Meier on Tuesday presented the Joint Appropriations Committee a draft of the proposed updates to the state's investment rules, which led to a robust debate on how to address the issue.

What Limits?

ESG measures rate funds on various markers of progressive-friendly policies related to protecting the environment, diversity in the workplace and community relations. Any association with fossil fuel industries quickly gets a fund rated down, but timber industries, gun manufacturers and agricultural businesses also face pressure from the movement.

Critics of ESG say it uses the financial process to push progressive political and social agendas, which circumnavigates any democratic process.

While the Wyoming Legislature generally aims to protect the industries that contribute heavily to the state revenues and economy, questions remain about what policies would keep politics out of the state’s finances and where those limits are.

Rep. Trey Sherwood, D-Laramie, said that the U.S. Congress hasn’t ratified the elimination of discrimination against women. Policies that direct companies doing business in Wyoming to leave out any political considerations in the course of businesses, she said, wouldn’t be able to take this problem into account.

“So, as is, you’re stating that Wyoming would prefer vendors that do not adhere to the implementation of eliminating discrimination against women and girls,” Sherwood said.

Angry Folks

After two anti-ESG bills in the last legislative session failed, the State Land and Investment Board (SLIB) took up the anti-ESG torch and has been developing rules to include in the Investment Policy Statement.

The draft presented Tuesday is being revised and will be considered at the SLIB’s meeting in August.

Sen. Bo-Biteman, R-Ranchester, sponsored both bills. They had passed the Senate, but then the House Appropriations Committee substituted Biteman’s bills without notice to the public or Biteman. Then, it voted a recommendation of “do not pass,” and the bills were never considered on the House floor as a result.

Rep. Tim Salazar, R-Fremont, said he’s had town hall meetings with constituents since the legislative session, and attendees expressed a lot of dissatisfaction that the bills failed and how it all went down.

“I've dealt with some very angry folks in my constituency with regard to this issue,” Salazar said.

Poison Pill

Meier had opposed both bills because, he argued, no investment manager would work with Wyoming if they passed.

The bills stated that any investment managers the state contracts with that were found to be acting according to ESG guidelines would have been fined three times their salary.

“That was a poison pill for us because we couldn’t hire anybody,” Meier said at Tuesday’s committee hearing.

Sen. Tara Nethercott, R-Cheyenne, said if the bills would have passed, they would have prevented Wyoming from investing in companies that appeared to be acting according to ESG ideals. However, ESG policy statements are standard practices for most corporations, including oil, gas and coal companies.

Nethercott said that under those laws, the state wouldn’t have been able to do business with oil companies like EOG and ExxonMobil.

Cowboy State Daily reached out to Biteman for comment, but didn’t receive a response.

Conscientious Investing

The draft Investment Policy Statement that SLIB is considering requires any company or individual working with the state to make decisions in the best financial interest of the state, without regard to ideological interests.

The statement goes to state that acceptable factors to be considered in state business do not include the furtherance of ESG or ideological considerations.

Rep. Tom Walters, R-Casper, said the language calling out ESG are “simple opinions.”

“Those are weak statements. Those, in my view, don’t belong in the investment policy statement,” Walters said, before asking why it was included in the draft.

Meier said he understood where Walters was coming from.

“But what I’m trying to do is get this out of a five-member policial board,” Meier said.

Sen. Mike Gierau, D-Jackson, called the draft a “formal political statement” and wanted to know what it would cost Wyoming.

Meier said that the language tries to get at the heart of ESG, as proponents of the movement are trying to rebrand it as “conscientious investing” and other names.

With that language in the state’s Investment Policy Statement, then it would cover political actions at odds with financial responsibility.

Shareholder Resolutions

Pete Obermueller, president of the Petroleum Association of Wyoming, testified on ways the Legislature could help Wyoming’s oil and gas industry.

Every publicly traded company, he said, has an ESG policy, which makes it hard for lawmakers to craft bills that wouldn’t hurt Wyoming’s investment options.

Obermueller presented on activist actions using proxy voting to advance political causes that hurt oil and gas companies. These activist groups, such as the Sierra Club, buy shares in the companies so they can advance shareholder resolutions that govern how the companies operate. Many of these resolutions organizations have tried to pass set emissions reduction targets.

Some of these involve what are called Scope 3 emissions, which are emissions related to the end use of the product. So, any emissions stemming from the use of petroleum products would count as Scope 3 emissions.

Target reductions on those would effectively prevent oil and gas companies from selling their products.

Proxy Monitoring

Nethercott asked Obermueller if the association was asking for legislation.

“Not yet,” Obermueller answered.

He said a lot of the issue with proxy voting can be handled at the treasurer’s office, which is in the process of hiring a proxy manager who would specifically monitor the state’s votes on these shareholder resolutions so that Wyoming’s money isn’t being used against the industries that support its economy.