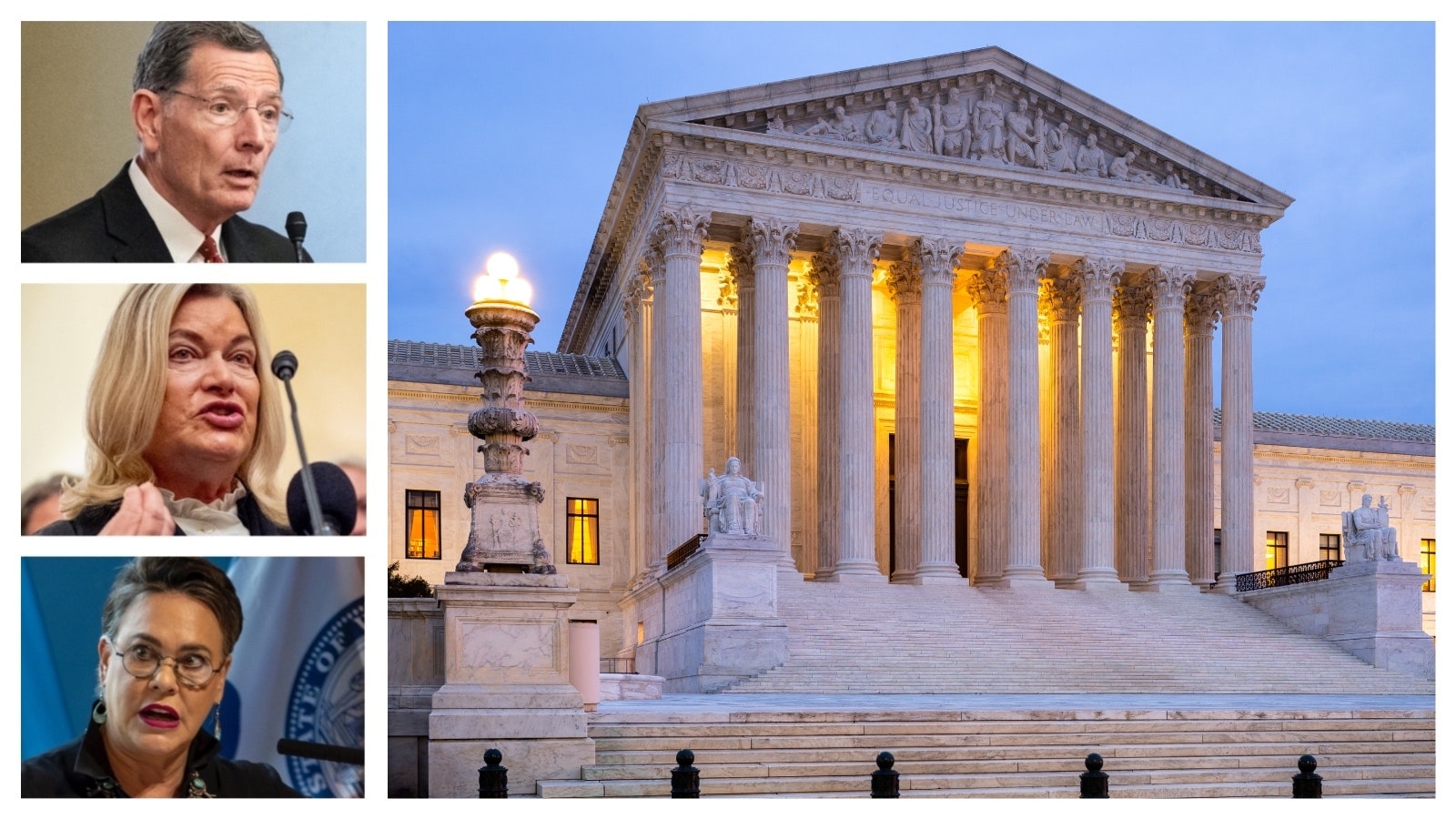

Secretary of State Chuck Gray wants Wyoming to cut financial ties with China.

He told the State Loan and Investment Board on Thursday he’d like Wyoming to completely divest from the Communist nation.

“I think we need to get a tee-to-green strategy on completely removing, including the active investment from China,” Gray said.

Gray made his comment while SLIB was discussing a recommendation from the Wyoming Treasurer’s office to shift state investments in China to a more direct, hands-on approach.

Because of ongoing uncertainties related to China’s physical and geopolitical posturing in recent years, Gray said Wyoming’s “clear pecuniary interest” is to completely divest from China.

“I don’t think there’s any way for anybody to evaluate that situation,” he said.

Difficult Request

Although he acknowledged that investing in China is “problematic,” Gov. Mark Gordon warned Gray that divesting from China could be a very long process.

The state’s Investment Funds Committee (IFC) recently discussed the idea, and didn’t recommend divesting, but did agree to take a different approach with the state’s China funds.

IFC member Tom Chapman cautioned against divesting from China for purely political reasons when it could cause the state significant losses and future investment trouble but said the IFC would support that decision if it can be done strategically. He and Gordon said there is a growing negative perception regarding China at the moment around the world, so the matter should be discussed further by the IFC.

Gray further questioned how the state could start the process to “segregate China” while not negatively impacting its other investments. State Treasurer Curt Meier said that process could take about five years.

Patrick Fleming, chief investments officer for the state, said the IFC decided two years ago to increase the state’s investments in China because of the country’s quickly growing economy. He said prohibiting this income would inhibit the state’s investment opportunities.

“To be excluded from that, I’d say would be problematic from that sense,” he said. “Having a rule set in stone at any one point in time is very problematic.

Fleming advocated against completely divesting from China because of the substantial income it has produced for Wyoming. Over a three-year period, international investments have produced $289 million in income for Wyoming. From this investment pool, the China stocks produced a higher rate of growth than the group average.

“There’s no question, having investments in China has produced a positive impact for the people of Wyoming,” Fleming told Cowboy State Daily.

Gray poked a hole in this number, saying it isn’t known what kind of revenue the state could have realized if that money were invested elsewhere.

“For all we know it could have been a higher return in another location,” he said. “You can’t test a hypothetical.”

Fleming responded, telling Gray that “actually you can.”

He said the state’s investment managers also study the growth of alternate investment opportunities it doesn’t pursue.

Moneymaker

Superintendent of Public Instruction Megan Degenfelder lived in China from 2012-2014 while attending graduate school at the University of International Business and Economics in Beijing.

She agreed with Gordon and said she’s open to having a discussion about completely divesting from China but didn’t think Thursday’s meeting was the time to do it.

China has the world’s second largest economy, which IFC member Russell Read said is potentially growing into the largest economy in the world. About 7.5% of the total revenue on the S&P 500 comes from China.

“We’re never going to be able to totally divest from China,” said IFC member Sam Masoudi.

Read said China is simultaneously an important trading partner to the U.S. and a geopolitical rival. In recent years, the country has escalated tensions in its relationship with Taiwan, a country America has vowed to back in the event it is attacked.

“It is very difficult to gauge what are all the potential risks involved,” he said.

Because of these tensions, Read said the IFC, after much spirited debate about how to manage the state’s funds, found it prudent to study Wyoming’s risks by investing in China.

By taking a more hands-on approach, Read said the state can take a more responsible and lucrative approach to its Chinese assets. He mentioned how General Motors in a recent period made most of its profits in China.

“China is, it just has a big footprint,” Read said. “It is absolutely an integrated part of the world economy. But the geopolitical realities we face do call for a different approach.”

Different Approach

Fleming said after conversations with numerous economists, he arrived at a consensus that the way President XI Jinping is managing the Chinese economy creates certain unknown risks for those who have invested in it, like the state of Wyoming.

“I just think this pertinent to bring to the board’s attention,” Fleming said.

Fleming recommended the board approve a more hands-on approach for the state’s investments in China to reduce exposure.

“We are looking for the highest risk adjusted return and by keeping active management, we would clearly have a higher return,” he said.

Gordon said divesting completely from China would be “an incredibly difficult task,” and said he supports Fleming’s recommendation.

“Considering they have a reach into so many developing economies,” he said.

Out of the international countries Wyoming invests in, China makes up the third most investment at 8.5% of the international index pool.

Fleming said the state’s investment managers “love the China growth story” as an investment opportunity. He said the state can protect itself better by investing in countries that are strongly tied to the Chinese economy.

Although his proposal involves more risk, Fleming believes this would be outweighed by a higher rate of return.

In contrast, by passively investing in China, Read said Wyoming leaves itself much more vulnerable to the turbulent state of that country. The state can take an active approach by having its investment managers analyze each investment stock by stock.

“By eliminating China from the passive benchmark, do we materially reduce the risk that we unintendedly expose ourselves to China? That’s the part we kind of like,” Read said.

Fleming made it clear his testimony was not a political statement against China or a comment on environmental, social, and corporate governance (ESG) credit scores. The mandate of his office is to achieve the highest return for Wyoming.

“When you are not 100% confident on some of the risks, I think that’s something that needs to be addressed,” he said.

Diversification

Fleming said if Wyoming were to remove China from its investments, it would cost the state in fees through its investment plan and prohibit the state from investing in Hong Kong and India, per the rules of that plan.

Read said it also would concentrate the state’s investment risks, and Meier said trying to get Wyoming staff to individually study countries like India would not be an efficient use of resources.

“That would remove a significant amount of alpha and additional money to the state,” Fleming said.

Gray expressed skepticism about this theory.

“You have $80 trillion of economic activity outside of China. How could we not maintain a diversified portfolio without having that exposure?” he questioned. “I think it’s more than possible.”

Gray also said tying in Wyoming to investment arrangements with other countries invested in China increases the state’s risks.

“I think it is important … that we unwind that aspect of the active investing, in terms of the interaction that we have, to have with China, to do anything in India, to do anything in any other market,” Gray said.

Read said the state could attain a diversified portfolio without investing in China, but it would come with a smaller set of investment opportunities. He said since 2000, the opportunity set for emerging markets has taken on a higher prevalence.

“The way we want to take advantage of that is active management,” he said.

Fleming said the state doesn’t have the money to actively analyze China and Jinping’s economic decisions, so it must rely on its China-based investment managers to perform these duties.

But he also said Jinping hasn’t shown any inclination to restrict overseas investment profit.

“We’re not going to be able to sit there and go, ‘Oh we feel Xi Jinping is going to disallow profitably in education,’” he said.

In January, the Ontario Teachers' Pension Plan, a Canadian fund that manages $181 billion of assets, paused direct investing in private assets in China due to geopolitical risks.

Contact Leo Wolfson at Leo@CowboyStateDaily.com