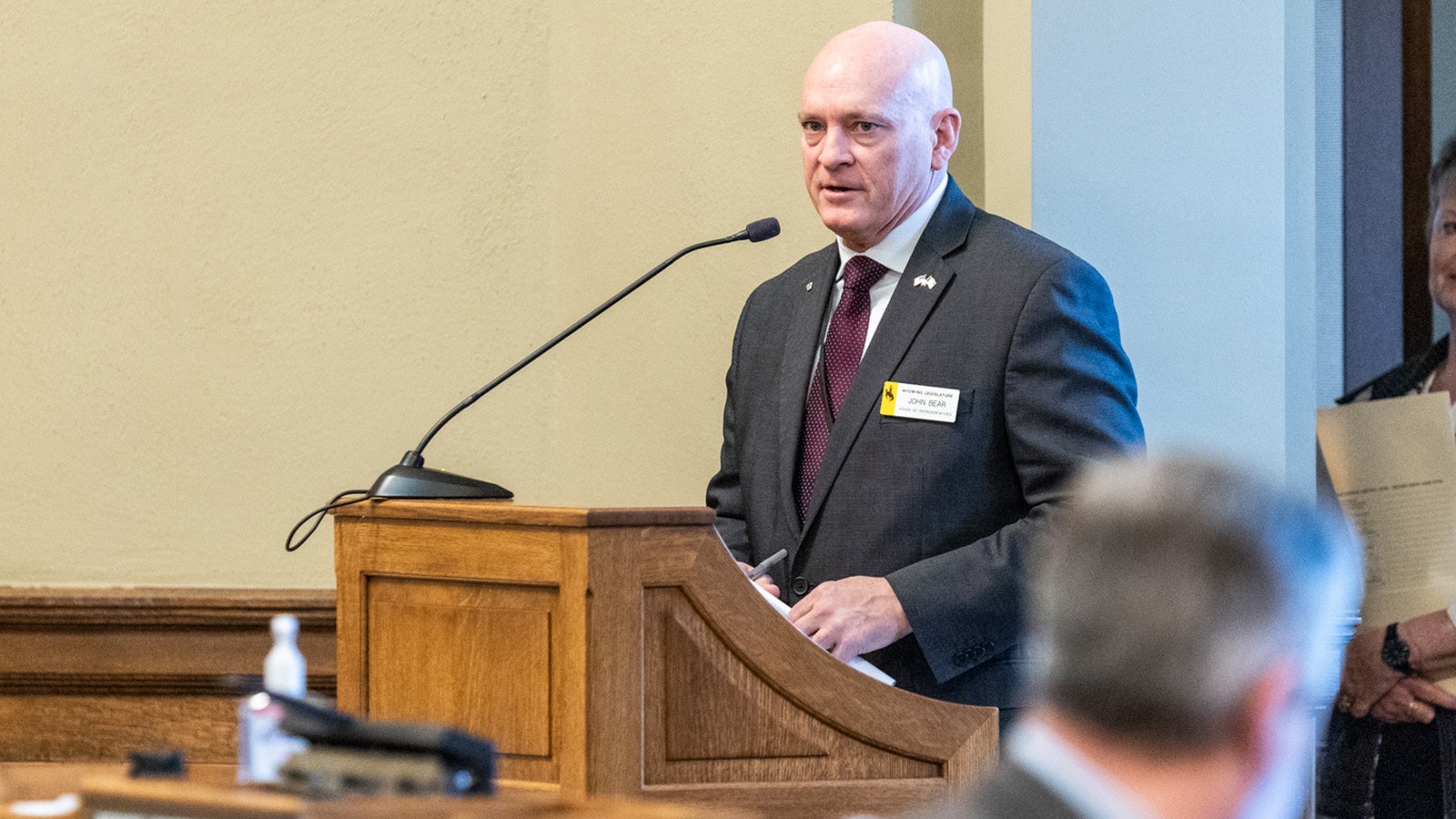

By Rep. John Bear, guest column

Bear represents House District 31 and lives in Gillette

During the 2023 general session the legislature convened knowing that the people of Wyoming were looking for a solution to the issue of rapidly rising property tax bills.

Conservative legislators went to work when the problem began to present itself in the fall of 2022 by holding town halls seeking the input of constituents.

Liberals, who had maintained control of legislative leadership during the interim, formulated committee bills taking advantage of the growing revenue surplus while failing to provide a long term solution which would require the government to to tighten its own belt.

Many Wyomingites will hear their legislator brag about the tax reform achieved during the 67th; however, it is crucial that we define our terms. Tax reform amends the tax code to allow for long term changes and hopefully lower taxation, while tax relief simply lowers a tax bill temporarily, pushing off future financial pain to a later date.

HJ0001 was the creation of the Joint Revenue Committee. It was a resolution to allow the people of Wyoming to change the state’s constitution to create a fourth property tax category, separating commercial and residential property.

The reason these two types of property have been combined is based on the understanding that corporations and businesses do not pay taxes, but simply pass them onto their customers in the price of goods and services.

During the interim, real property tax reform was added to this resolution when a cap was added, which would limit increases to annual tax assessments. This effort was killed by the chairman of the Revenue Committee as he failed to bring it before the committee.

HJ0002 was brought by the Speaker of the House and was remarkably similar to HJ0001, but absent was the tax reform measure of a cap on annual assessment increases. Multiple attempts were made by conservatives to add the cap back in during the committee hearing and floor debate. Those efforts were killed by the uniparty and the resolution eventually died in the House.

SJ0003 started out as a ballot initiative to allow for a property tax relief program for the elderly and infirm. It was converted into HJ002 during the 3rd reading in the second chamber- a last second effort to provide the appearance of tax reform while not actually doing so.

SF0136 served to provide actual tax reform as it would have lowered the commercial and residential property tax rate by approximately 10%. The bill passed the Senate and the House Revenue Committees, but failed to pass the House Appropriations committee on a 0-7 vote.

Although there were a few other efforts at tax relief, none that would affect the tax bill of every Wyomingite were passed.

The liberal “tax and spend” mantra was alive and well in the legislature this year, with the frequent repetition of the argument “these caps will cut taxes for the rich.”

That mantra was not repeated by Nancy Pelosi, but rather by one of the leaders of the liberal uniparty from the podium in the Wyoming House. This uniparty is made up of the five elected Democrats and approximately 31 very liberal Republicans who prefer the Democrat platform over that of their own party.

One of their most abhorrent moments of “tax and spend” behavior was observed during the spending spree as the supplemental budget was debated on the House floor.

After only two hours of deliberation they were told that they had already added over $35 million to the burgeoning supplement to the previous year’s budget.

In response to this exclamation, they laughed and cheered at their abuse of the taxpayers and continued on to over $70 million before the day’s end. Although they laud their appropriations of $1.4 billion into savings this year, they fail to admit that they added over $112 million per year in ongoing expenses.

That $1.4 billion in savings will, at best, generate about $65 million per year in additional revenue. That adds up to a net loss of $47 million per year.

The revenue that created the nearly $2 billion surplus which funded this year’s supplemental budget was a combination of federal American Rescue Plan funds, higher revenues from coal, oil, and gas, and higher property taxes from our citizens.

Much of the extractive industry revenue came from natural gas prices being over $50 MMBtu. Today’s prices are below $3 per MMBtu.

So, as you can see, this was clearly a one time bump in revenue, but the “tax and spend” uniparty saw fit to not only spend a large chunk of it (greater than 25%), but to spend it in a way that increases future budgets. To add insult to injury, when they were sure that you could not hear them, they laughed and clapped at their own egregious behavior.

Rep. John Bear, Wyoming House District 31

Chairman, Wyoming Freedom Caucus