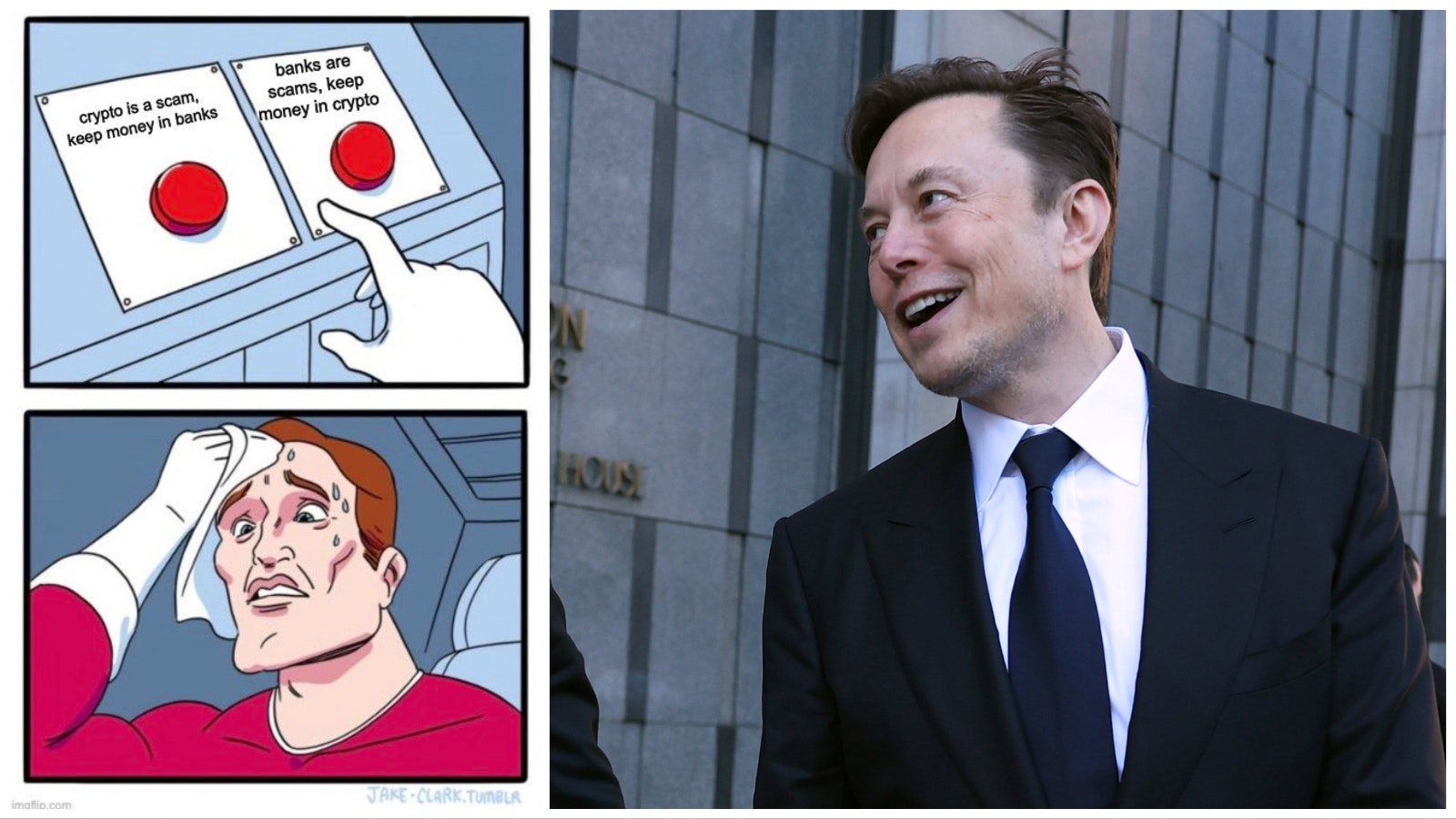

Another day, another Elon musk meme.

This time, catching the attention of 27 million-some Twitter users Monday is a cartoon panel showing a guy sweating it out over which one of two buttons to push.

One button says “Crypto is a scam, keep your money in banks.”

The second says “Banks are a scam, keep your money in crypto.”

The hapless dude in the meme clearly cannot decide which button will nuke his money, and which won’t.

While some suggest the meme trolls crypto haters — maybe, Musk certainly wouldn’t be above that — but others see, coming as it does on the heels of three bank meltdowns in as many days, a very real conundrum.

Where is money actually safe in this new era of technology that keeps moving money faster and faster?

Wall Street veteran Caitlin Long was among those who thought the meme beautiful.

“It encapsulates exactly the issue,” Long said. “People have woken up and realized that the traditional system is not stable.”

Overnight, Long’s direct messages on Linked In, not usually prone to panic, were suddenly blowing up with questions centered around that very dilemma.

“LinkedIn, you know, is more mainstream finance people and lawyers and regulators,” Long said. “It’s not the sort of, you know, freewheeling crypto crowd that is on Twitter.

“So that tells me something. It tells me that the White House’s messaging on (Silicon Valley Bank) and the Fed’s messaging that this wasn’t a bailout, that everything is fine — everything is not fine and people know it.”

— Elon Musk (@elonmusk) March 11, 2023

The Ripple Effects

In the last four days, major regional banks have lost 30% to 40% of their stock value thanks to the shockwave after the collapse of Silicon Valley, Signature and Silvergate banks in just three days.

Different situations led to the collapse of the three banks, but they all had one thing in common: over-reliance on now devalued treasuries and low-risk mortgages to backstop deposits.

When the banks went to sell those treasuries on the market to meet withdrawal demands, the loss raised all kinds of red flags with depositors, many of whom were keeping more than the FDIC insurance limit of $250,000 in one bank. That sparked old-fashioned bank runs that ran at the speed of modern day Twitter.

But the crisis itself is déjà vu. While bad loans were the trigger that started it, a similar mechanic — those devalued treasuries that banks are encouraged to buy by the Fed — underlay the 2008 banking crisis as well.

“I mean, the Federal Reserve, in the last 50 years, has been boom and bust,” Long said. “They’ll ease too much, interest rates go down too low, then you end up with a bubble. Once the Fed starts hiking, the bubble bursts.”

That, in turn, sparks a big market correction, and the cycle starts all over again, with more easing.

The only thing that’s changed is the speed of technology.

“The amplitude of those cycles has increased meaningfully,” Long said. “They’re getting shorter and shorter in between. This is, what, the fifth correction since the 2008 financial crisis?”

Zero Sum Political Talking Points

Meanwhile, it’s taken no time at all for talking heads to turn the latest banking crisis into a highly politicized debate about why the other guy is wrong.

The argument going now is whether the 2018 roll-back of Dodd Frank went too far, and who is to blame.

True, that effort was led by then President Donald Trump but, in all fairness, it was also supported by a fair number of Democrats whose votes helped it to pass Congress. The roll-back had strong bipartisan support.

Ultimately, it raised the dollar limit where stricter regulations would kick in from $50 billion to $250 billion.

Earlier intervention might have caught the problems at the three banks that failed before they turned into kryptonite for the banking sector. But who is “responsible” is an obvious distraction.

Answering Musk’s Meme

While the debate over who is right and wrong, and what to do about it, plays out over television and radio airwaves, and gets debated in the halls of Congress, many have already skipped to the chase, answering Musk’s meme for themselves. For some, that answer is crypto.

Count Long in that camp. While she first stressed she doesn’t give others investment advice, she told Cowboy State Daly that Bitcoin is doing really well for her.

“I’m glad I have Bitcoin,” she said. “I mean, literally, if you go back to the Satoshi Nakamoto white paper, Satoshi created Bitcoin exactly to solve this problem.”

Nakamoto is a pseudonym attached to the 2008 white paper that outlined the basic structure of the Bitcoin network.

The idea behind it is low-cost transactions that do not use any financial institutions or third parties. Instead, transfers pass through a centralized server that records on many terminals at once, all connected in a peer-to-peer network. This setup makes falsification of transaction details all but impossible — the copies at other terminals would clearly show up falsified information.

The original Nakamoto white paper is still online https://bitcoin.org/bitcoin.pdf for the insomniacs out there, or anyone who wants to do a deep dive into how Bitcoin works.

“He has some choice lines in the white paper about how money is a trust game and that it gets abused periodically,” Long said. “And we just saw it abused yet again. And you know, the average Wyomingite is, of course, skeptical of any Washington program that might be a bailout.

“And guess what? They’re right.”

Wyoming Banks Are Fine

Many others have kept their money in their community banks and credit unions figuring, as Wyoming Banking Association President/CEO Scott Meier told Cowboy State Daily, that Wyoming’s own banks are fine.

The failure of Silvergate, Signature and Silicon Valley Banks were “incredibly unique situations,” Meier said, adding that, “Silicon Valley Bank is a much different bank than what we have here in Wyoming.”

Wyoming banks aren’t concentrated in the tech sector like the three banks that failed are, and FDIC estimates that most deposits in Wyoming banks do not exceed its $250,000 limit for insurance.

Wyoming’s digital banks, meanwhile, called Special Purpose Depository Institutions, have to keep the value of any digital assets 100% on reserve, making them immune to a traditional bank run.

Mattresses In The Age Of Technology

The SVB banking collapse in particular was quite good for Bitcoin on Monday. It broke $26,000, prices not seen since the FTX meltdown in 2022, and the largest gain of the year so far.

“Having Bitcoin is the electronic equivalent of sticking — if you self-custody — your money into a mattress,” Long said. “Because you control it yourself.”

Bitcoin accounts are controlled using a unique, 12-word seed phrase.

“You can literally just memorize that and your money is in your head,” Long said. “You don’t even have to write it down anywhere. I wouldn’t recommend that, but some people do it because they’re afraid if they keep a physical record of it, that they’re at risk of, you know, personal attacks.”

In fact, Long believes keeping money in bitcoin is probably much safer than gold coins or other money in a mattress. There’s nothing physically tangible to get, and, as long as the keyword is kept secure, the money in Bitcoin can’t be hacked.

Given the sharp rise in Bitcoin values Monday, Long’s not the only one making a similar calculation. In fact, it wasn’t just the dollar value of Bitcoin that was up.

“Importantly, the volume was hot,” Long said. “It was well above normal. That tells you people are buying it. People are taking money out of the traditional system and putting into Bitcoin.”