By Leo Wolfson, State Politics Reporter

Leo@Cowboystatedaily.com

The Wyoming State Senate moved forward two bills on Tuesday making it more affordable for Wyoming residents to live in the state if they pass into law.

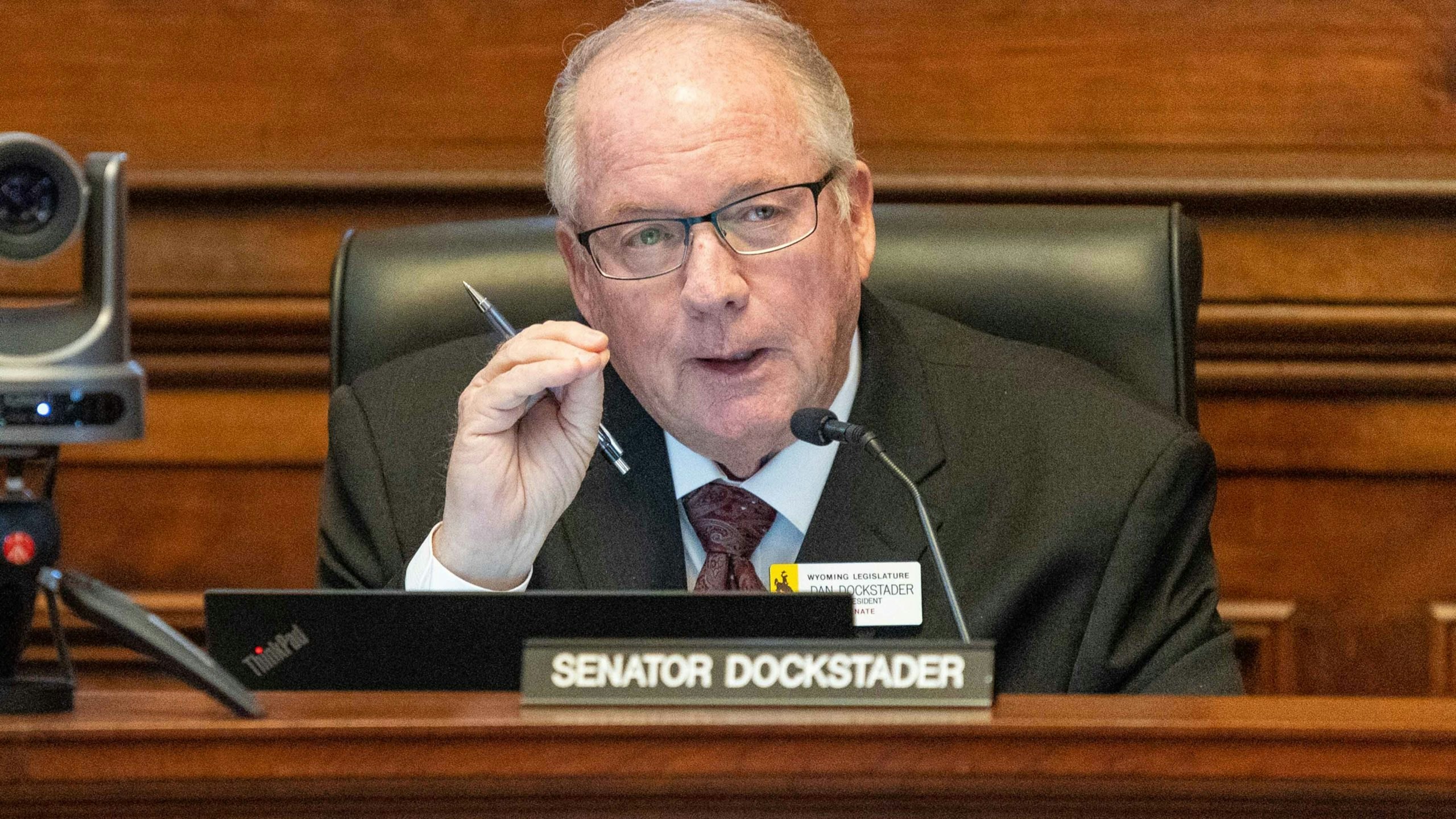

“What we have is not working,” said Sen. Dan Dockstader, R-Afton. “I repetitively hear from people, ‘Our home ownership is in question.’”

Property taxes soared throughout Wyoming in the past year, becoming one of the largest issues on the campaign trail over the summer.

On Tuesday, the Senate passed a bill that would provide property tax relief to seniors and the poor and another bill that would grant a housing allowance to state judges who live in high-cost areas.

The bills were passed on first reading but need to make it through second and third reading before moving on to the House for consideration.

Drawing major contention in the discussions for both bills was who should and who should not be considered eligible for property tax breaks.

Elderly And Infirm

Senate Joint Resolution 3 would amend and create a new section of the Wyoming Constitution for the elderly and infirm.

The Senate passed legislation with a 19-11 vote amending the Wyoming Constitution to add a new section for a homeowner’s property tax exemption for the elderly and infirm.

What exactly is considered elderly and infirm is not delineated in the bill.

“Who defines age and elderly?” Sen. Bob Ide, R-Casper, asked. “If you have someone in Teton County that is 85-years old, they don’t necessarily need that relief. How do you determine that?”

The Constitution already provides the Legislature power to provide property tax exemptions as it sees fit, but this amendment would specify and separate the elder age demographic.

“By limiting to people who are elderly and poor we can give help where it’s needed,” Sen Cale Case, R-Lander said in favor of the bill. “I think this is just a wonderful, targeted approach to grounding tax relief.”

Land Rich, Cash Poor

Although someone in Teton County may own a home worth more than a million dollars, the value of this fixed asset doesn’t always reflect the amount of money in a homeowner’s bank account.

Sen. Larry Hicks, R-Baggs, said there is verbiage missing from the bill to address these types of situations, a loophole he would like closed.

“They’re basically a millionaire, they just live very frugally on a very small income,” he said. “The loophole there is we’re providing property tax relief to someone who is basically a millionaire.”

Case said guidelines can be established by the Legislature to this effect and disagreed with Hicks on these types of homeowners, saying they lack options.

“If you’re sitting on a $2 million house in Teton County, and you’ve lived in it since the 1960s perhaps, if you were to sell it you can’t afford anything else, there’s no place you can go, are you poor or not?” Case asked. “You’re more on the poor side in Teton County in that type of situation than you are in my county.”

Sen. Mike Gierau, D-Jackson, told the story of a 90-year-old woman he knows in Jackson, who pays $13,000 annual property tax on her $3 million property while living on a fixed income.

“Now, come December, she’s faced with the choice of not buying her medicine, not buying her food, or making sure she has enough laid over to pay her taxes,” he said.

Sen. Charles Scott, R-Casper, said a means test could be used to exclude property value in scenarios like this.

Already Have Programs

The State of Wyoming already has a property tax refund program awarded to applicants with a household income that is 75% or less than the county or state

median household income, whichever is larger. Additionally, their household assets must also be less than $133,651 per adult

household member.

A deferral program also exists where the homeowner is excused from paying property taxes until they sell their home. At that point, the county collects their back-taxes upon the sale of the property. A county must choose to opt-in to this program.

An amendment was proposed to reimburse local governments for the amount of property tax revenue lost as a result of the property tax exemption, but this was rejected.

Hicks said because of the property tax relief already available, he doesn’t believe this legislation is necessary.

Case said there could be issues with making changes that could change the Constitution indirectly.

Property tax rates and the classification for different types of property are determined by the Wyoming Constitution and cannot be changed without an amendment.

Sen. Dave Kinskey, R-Sheridan, questioned what the legislation would change as property tax relief is already granted.

“The only deficiency in it is that the income levels need to be raised and the asset test needs to be raised,” he said. “Or we could eliminate the asset test.”

But Gierau said the funding for this existing program has been inconsistent and the issue of rising home prices won’t be going away for Wyoming.

“The longer the time goes, the more it will affect your counties,” he said. “This is a problem that’s going to be coming to our door in greater and greater extent every year.”

This bill will need to gain at least one more vote before moving on to the House as a ⅔ vote is required from both chambers to make an amendment to the Constitution. If it receives that level of support in both chambers, the question of whether to make the amendment is put on the ballot for the state’s voters to decide.

Judges Allowance

Also on Tuesday, the Senate passed legislation offering housing assistance to Wyoming judges if they reside in a county in Wyoming where the average cost of housing is significantly higher than other parts of the state. The vote was 16-15.

Under Senate File 54, the amount of the monthly allowance would change based on the state’s market analysis but sits now at $1,900. The judges would be eligible for this allowance if the cost of housing in their community is more than 150% of the Wyoming comparative cost of living index for housing in that county.

Teton County, like with the property tax bill, was the focus of the discussion on SB 54, but Sen. Tara Nethercott, R-Cheyenne, the bill’s sponsor, said the legislation was inspired by a situation in Campbell County, where officials struggled to find a judge because of rising housing costs.

District court judges in Wyoming make $160,000 a year while circuit court judges make a $140,000 annual salary.

“I know there’s probably a serious lack of empathy or understanding to this challenge because holy cow, those district court judges make so much money,” Nethercott said.

She mentioned how these wages wouldn’t go very far for a judge with a family in Teton County.

“You too can buy a one bedroom one bath apartment for $650,000- that is the lowest housing opportunity that you can find in that district,” Nethercott said. “Where will the spouse and children live?”

Case disagreed and mentioned how most judges selected by the governor already live in the county they are appointed to.

“They probably already own a house,” Case said. “A house that’s value is going up at the market rate in Teton County.”

Sen. Troy McKeown, R-Gillette, had philosophical issues with the bill, seeing it as giving priority to state employees over other Wyoming citizens.

“I’m a bit confused with what we’re doing here this session. I listen to the first two weeks of how our constituents can’t afford food and we have to help them with this and we have to help them with that, and I empathize with that,” he said. “Yet, here we are, we’re taking care of state employees when people that live in this state can’t eat.”