Combine a Wyoming trust with a Wyoming LLC and the result is one of the world’s most secretive tax havens, one where the movements of wealth are readily hidden from foreign and home governments alike.

This construct, referred to by some as the “Cowboy Cocktail,” has attracted some $31.5 billion in funds that travel through these Wyoming entities.

But after a 2021 leak of offshore filings revealed some eyebrow-raising characters hidden among these tax havens, Wyoming lawmakers began working on a bill that would bring a little more transparency to the structure.

Senate File 93 would have required any limited liability company owned by a trust to identify the trust, as well as the trustees.

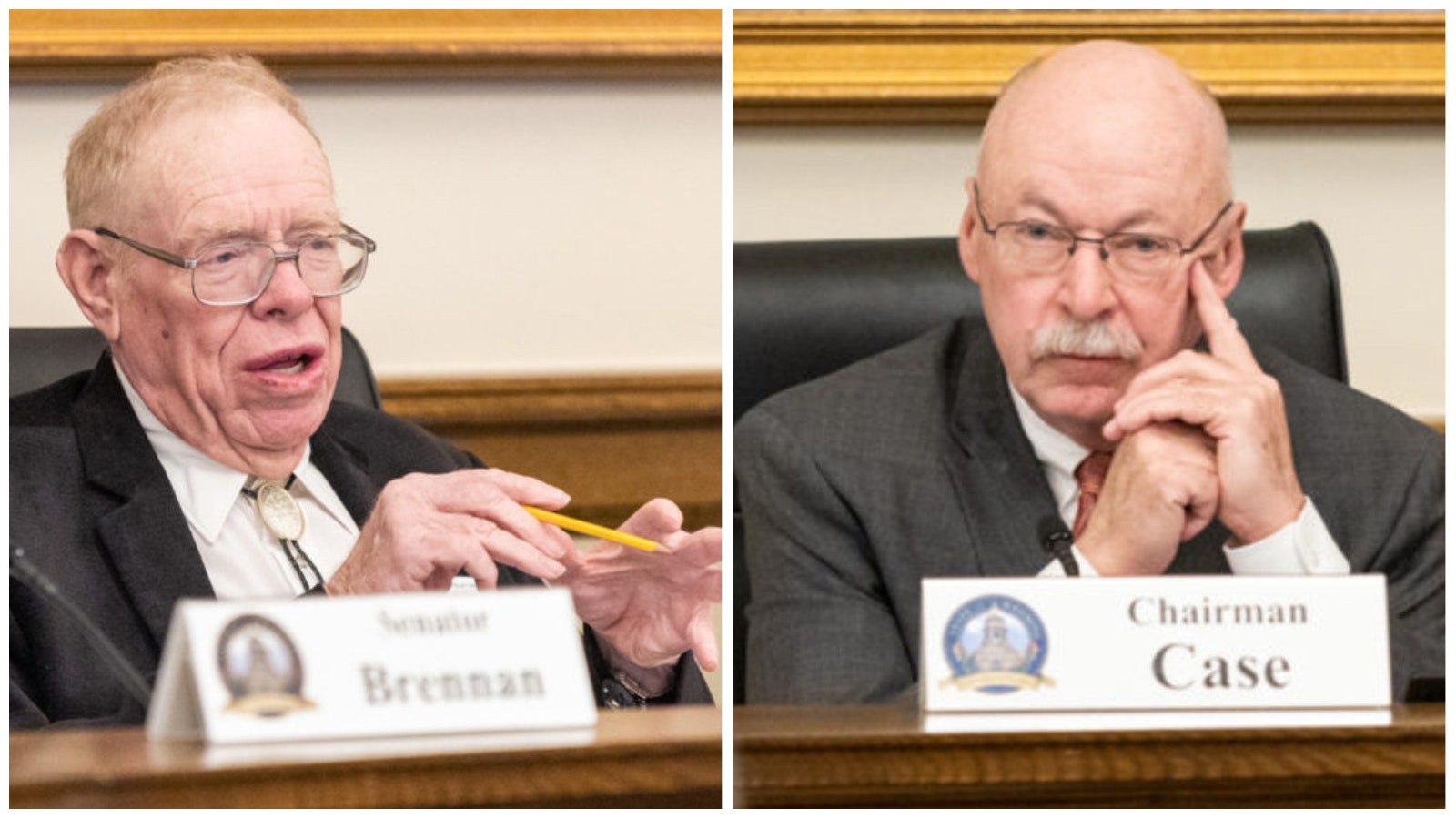

The bill narrowly missed a do-pass recommendation in the Senate Corporations, Elections & Political Subdivisions Committee on Tuesday, after passionate debate from several sides of the issue.

Sen. Charles Scott, R-Casper pointed to the increasingly partisan climate, where legal and legitimate businesses are sometimes getting harassed over political ideology.

“You know, I appreciate the argument that the anonymous ability could hide ill-gotten gains and that sort of thing,” he said. “But, a fair amount of that is in the eye of the beholder. And we are in a society where various politically correct elements, to be blunt about it, Mr. Chairman, are starting to harass owners of particular kinds of businesses. Including some that I think most of us here in Wyoming would approve of.”

That trend includes various fossil fuel industries, Scott said.

“I’m wondering if the need to give those people some anonymity in what assets they’re owning so they don’t get personally harassed is starting to outweigh the fear that some foreign outfit may come in with something that we all don’t really approve of,” he said.

An Issue Wyoming Should Get A Handle On

Secretary of State Chuck Gray told lawmakers that he saw, during his campaign, that these financial arrangements are an issue the state needs to address.

“We need to not be in denial about the possibility here,” he told lawmakers during the committee hearing, suggesting that some of the rhetoric he’s been hearing around the issue is exactly that. Denial.

“I think we need to acknowledge this could be an issue,” he said.

Remaining pro-business is important for Wyoming, Gray said, “But we should not allow foreign entities to take advantage of our laws for nefarious ends.”

“This office can easily implement Senate File 93,” he said.

Implementation would require some modifications to programming, which Gray estimated would cost his office about $10,000.

Gray asked lawmakers to consider covering those costs in referring the bill.

Stop Being Nosy

Attorney Scott Meier urged lawmakers not to recommend the bill for passage.

“What are we trying to accomplish?” he asked. “Are we just being nosy? Just trying to figure out who owns what? And I’m not sure where all this is going.”

Meier said Wyoming lawmakers had gone to great lengths to protect anonymity with its legal structure to protect businesses in Wyoming.

“You don’t want to have your business secrets, you don’t want have your business plans being shared,” he said. “Just because all of a sudden somebody knows who you are. So, I’m not sure exactly what we’re trying to accomplish.”

Meier was dismissive of the “Pandora Papers,” which had revealed that Wyoming’s tax havens may have attracted some unsavory international figures.

“There was a lot of investigation, but I don’t think there was ever anything proven that anything in Wyoming was done wrong,” he said. “Then we heard about the Cowboy Cocktail in the Pandora Papers. And again, I don’t think there was anything that was showing (anything) was done wrong in Wyoming.”

Just because there may be a few bad actors doesn’t mean Wyoming should undo the protections it’s set up, which were intended to confer some level of anonymity, he said.

“We might hear that some oligarch may have something,” he said. “We might hear that they might have some control of some assets or they put money into Wyoming, but I’m not sure that’s illegal. And I’m not sure why we want to undo that, at the risk of all of our Wyoming citizens and the people that are looking to come to Wyoming to do business in Wyoming.”

One example of the benefits of anonymity, Meier said, is if a company like Walmart wants to buy property. Being able to be a little more anonymous about that helps prevent the price of the property from getting jacked up.

“There’s a lot of reasons for anonymity,” he said. “To turn around and say ‘no, but we really want to know in this case,’ it sounds to me like a very dangerous slope, a very slippery slope.”

Two-edged Swords

But that anonymity can be a two-edged sword, Sen. Cale Case, R-Lander, said. He is the bill’s sponsor.

“I think those people who sold their land might want to know that it was going to be for a large retail establishment,” he said. “And I think they’d feel a little violated by that. So, this anonymity is a two-edged sword.”

The tax havens have also given Wyoming something of a black eye, Case suggested, with the Cowboy State being spotlighted in articles that suggest the tax haven is attracting shady characters, some of whom could be taking advantage of the anonymity for purposes that are not altogether wholesome.

These figures have included names like Igor Makarov, a Russian oligarch, and the Baggio family of Argentina, who have a family member embroiled in a money laundering investigation. There are also Wyoming newspaper reports of locations in the state so frequently sought by people who have been conned out of money that their community’s chamber of commerce is well aware of them.

“Why wouldn’t we want to know that?” Sen. Case asked. “And apparently that’s the direction of the federal law.”

Knee-Jerk Reactions

Meier suggested that the forthcoming federal laws that are circling this issue in states like Wyoming, South Dakota, and Delaware were a “knee-jerk” reaction.

“I’m not sure it’s going to do much with that, because there are a number of exemptions,” he said. “As I recall reading it, about 23 different exceptions, one of which is including the family-owned business.”

Meier disagreed that Wyoming has been given a black eye from its setup.

“I think that’s the press,” he said. “But I think the Secretary of State’s office will show you that we are very popular. And we continue to tweak our laws. It seems like almost annually we come up here with a little tweak.”

Wyoming’s limited liability structure that allows anonymity has brought many businesses to Wyoming, Meier said.

“People do want to come here, and we have companies from all over the world that want to set up a Wyoming LLC,” he said. “I don’t think any of them, at least the ones I’m working with, have (done) anything to be nefarious. I think we just have good laws. And they do protect individual investors.”

Where The Bill Stands

An amendment covering the Secretary of State’s cost of implementing the bill did pass unanimously, but the bill itself failed to get a do-pass recommendation. The vote was 3 to 2 against the bill.