If it passes the Wyoming Legislature, Senate File 24 would protect banks from being sued for freezing people’s assets briefly if they believe a vulnerable adult is being exploited.

The Senate Judiciary Committee advanced the legislation to the Senate floor Friday with a unanimous vote of approval.

The bill would create a requirement for financial institutions, within five days of a suspected fraud against a vulnerable adult, to file a report with the Wyoming Department of Family Services.

Vulnerable adults under Wyoming law are any adults whose age or disability prevents them from managing themselves or their possessions.

Couple’s Daughter Stole ‘Substantial Sums Of Money’

Cheyenne resident Mary Ellen Hoyt, 86, urged the Senate Judiciary Committee to approve the bill during its Friday meeting.

Hoyt said she gave her older daughter power of attorney over her in light of Hoyt’s age and the age of her husband, who is 93.

The daughter, Hoyt said, used that power to remove “substantial sums of money” from the couple’s bank accounts and was funneling their money into another account they hadn’t authorized.

“If (this law) had been in place it would have allowed the bank to freeze my accounts and find out we had not authorized the tens of thousands of dollars as withdrawals,” said Hoyt.

She said the daughter also nearly skimmed all the proceeds from the pair’s house sale, except that their other three children discovered the attempt and stopped it.

“If not for my other three children locating a filing at the Laramie County Clerk’s office and discovering her activities, she would have been able to take all the proceeds from the sale of our house,” said Hoyt. “Moneys my husband and I need to survive and remain reasonably independent; not being a burden to the taxpayers of Wyoming. This is very important to us.”

Feel Powerless

Hoyt fought back tears, saying she and her husband have struggled with tremendous stress, and with feeling powerless.

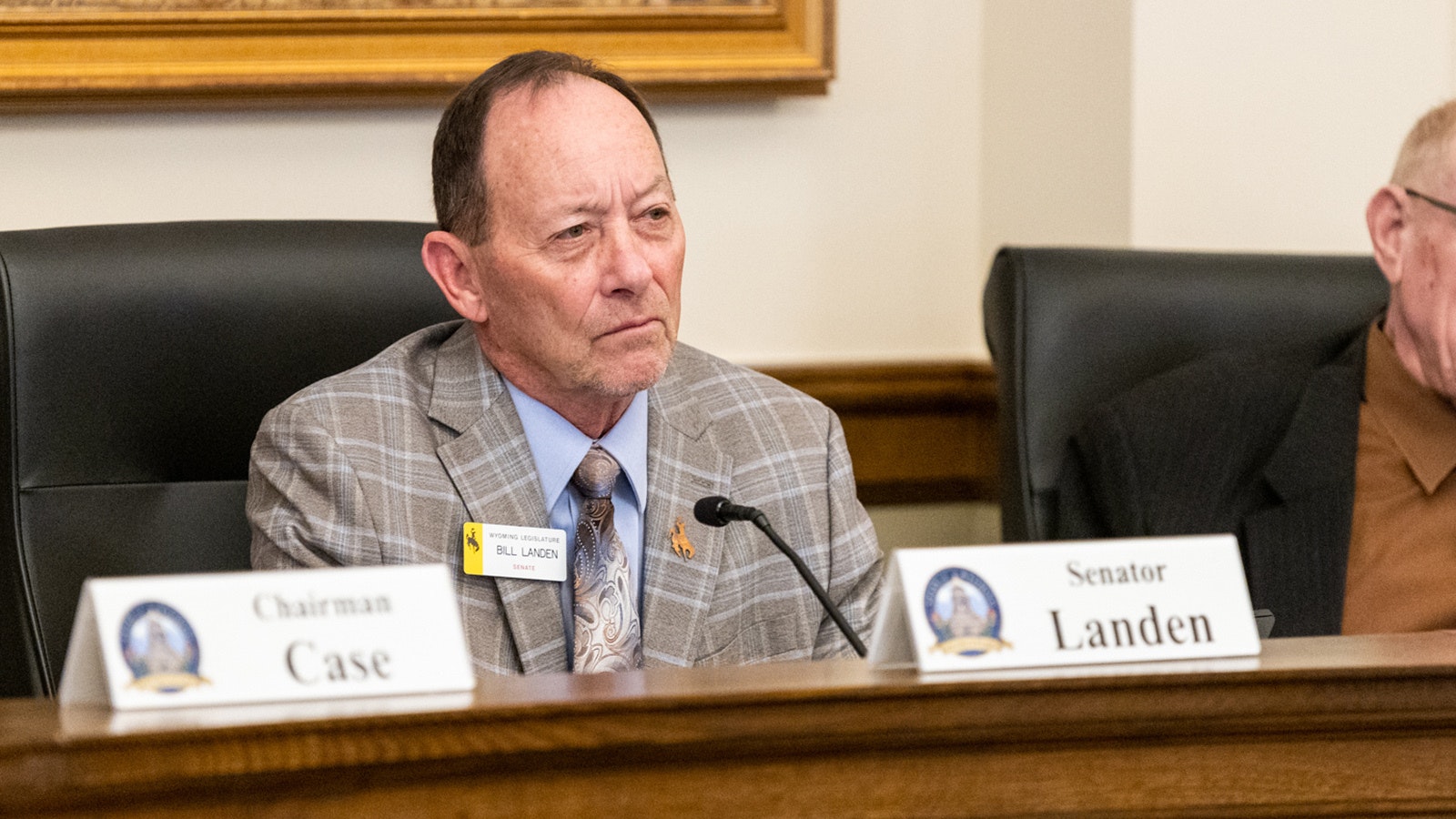

Hearing Hoyt’s testimony, committee Chair Sen. Bill Landen, R-Casper, thanked her for coming forward.

“You’re the very reason for this bill, and please take a little bit of comfort in knowing that you’ve provided some great help to us today,” said Landen.

Sen. Tara Nethercott, R-Cheyenne, who chaired the Senate Judiciary Committee in the past session, emphasized that the bill protects banks that report suspected wrongdoing and freeze assets, and it also protects banks that fail to report if they are acting in good faith.

Scott Meier, president of the Wyoming Bankers Association, told the committee he experienced something concerning when a bank in Fremont County asked for him to clear up an attempted theft against his mother.

In his case, the bank knew the family, Meier said.

“The bank knew my mother, knew me, and we got it all stopped,” he said.

Meier thanked bill sponsor Sen. Cale Case, R-Lander, for his work on the bill, saying its protections for banks will ensure better cooperation from them in such cases.

“It is really important we make sure financial institutions do have the wherewithal and the guidance to make sure we can put whatever holds we can on there to protect our customers,” said Meier.

Five Days To File

People speaking on behalf of the banking industry asked for the right to report suspected fraud within 10 days, rather than the five days required by the bill, but the committee did not make that change.

“That has been a consistent position of the bankers, to request more time,” said Nethercott, adding that the interim committee chose to keep the initial report deadline at five days because, “if you suspect criminal activity is occurring and a vulnerable adult is being exploited, it’s necessary to make it a priority.”

Banks also can freeze an account for five days under the proposed law. After the first five days, they would be able to keep the freeze for another 30 days if requested by law enforcement or if a court permits.

If SF 24 passes, banks would need to conform their policies to it by July 1 of this year.