When Bank of the West announced in 2018 it would no longer invest in companies associated with some fossil fuel activities, Wyoming was vocal in panning the decision and became a leader in criticism of environment, social and governance (ESG) policies.

In the past year, many state treasurers have jumped on board a coordinated opposition to ESG policies, which they say push progressive politics through corporate boardrooms and circumnavigate democratic processes.

This month, Kentucky’s state treasurer released a list of 11 financial institutions engaged in ESG-driven energy company boycotts. The institutions could be subject to complete divestment of Kentucky’s state funds.

Earlier this year, a group of Republican U.S. state treasurers with the State Financial Officers Foundation launched a campaign, Our Money Our Values, to educate people on the impacts of ESG.

While other states are pushing back directly, the official policy of the Wyoming treasurer is “ESG agnostic,” owing to the financial hit the state would take if it refused to do business with fund managers based on their stance on fossil fuels.

Highest Rate Of Return

The ESG movement rates funds on various markers of progressive-friendly policies related to protecting the environment, diversity in the workplace and community relations. Any association with fossil fuel industries quickly gets a fund rated down.

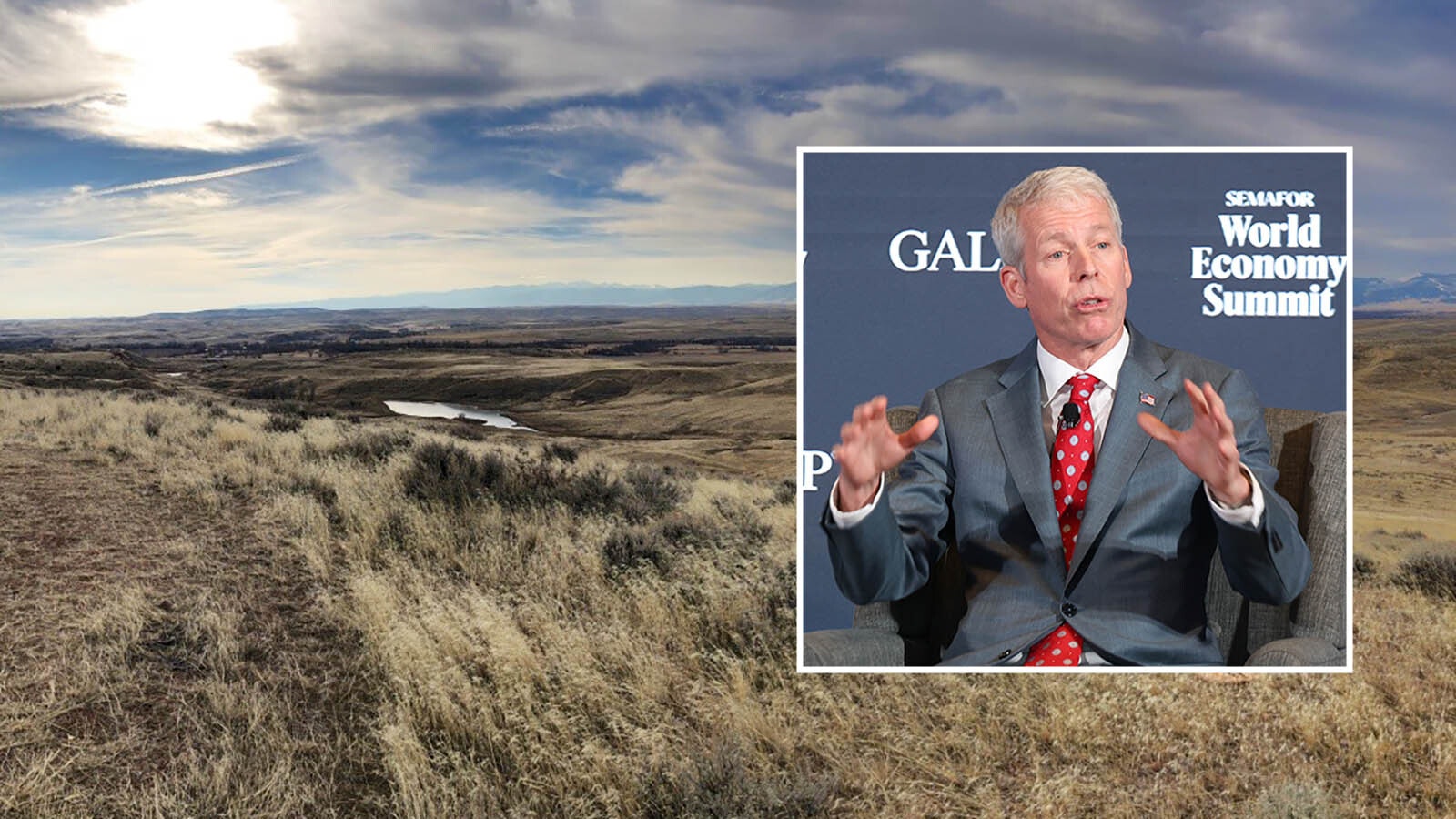

In a February statement, Treasurer Curt Meier said that Wyoming is neutral on ESG.

“The state of Wyoming strives to achieve the highest total rate of return. To that end, from an investment perspective, we are ESG agnostic. That is to say, our Investment Policy Statement (IPS) is silent on the matter,” Meier says in the statement.

Meier’s statement goes on to explain that if Wyoming were to make investment decisions based on the political positions of fund managers that handle taxpayer money, “our returns would likely take a substantial hit.”

One of the criticisms of ESG is that it puts politics over investment returns. By putting its fiduciary responsibility over politics, Wyoming is basically acting in the spirit of that criticism, even if it’s not acting directly against the ESG movement.

Application Denied

Bank of the West continues to maintain a policy of not financing companies that are engaged in hydraulic fracturing, coal-fired power generation and Arctic drilling.

When these policies first came to light in 2018, then-Treasurer Mark Gordon said he would deny applications from Bank of the West to place some state money into that institution. These funds are part of a program that allowed banks to apply to use Wyoming cash reserves as loans to bank customers.

At the time, Bank of the West had received $63 million in state money through the program.

This was a relatively small pot of money compared to the state’s overall investment portfolio, which totals more than $25 billion. This includes more than $400 million in various Blackrock funds. Blackrock is the biggest ESG asset manager, accounting for 20 of the top 100 ESG funds.

Fiduciary Obligation

Meier told Cowboy State Daily that while the state can’t divest of any fund managers based on their stance on fossil fuels, he personally has grave concerns about the impact of ESG.

“They are spending their time on issues that have nothing to do with shareholder success,” Meier said.

These issues have hit the fossil fuel industry by depriving them of loans and bonds needed to finance operations.

Despite ESG policies being hostile to the state’s biggest industries, Meier said the state’s hands are tied.

“We are fiduciaries. We don’t have a choice,” Meier said.

He said a better way to fight ESG policies is in company boardrooms, by having shareholder proxies vote to keep companies focused on making money for them rather than pushing progressive policies.

“Companies that we invest in have a fiduciary obligation also, and several of them are not honoring that fiduciary responsibility to the shareholders,” Meier said.

That can be seen in last year’s ESG fund performance. According to Pensions & Investments, all but one of the top 100 ESG funds, which have about $441 billion in assets under management, posted losses this year.

Humanitarian Issues

The Wyoming Treasurer’s office follows the direction of the State Loan and Investment Board (SLIB), which sets Wyoming’s Investment Policy Statement (IPS).

The policies make some room for consideration of terrorism and human rights violations.

The portfolio guidelines explain that, “While the Board cannot make investments based on social or political objectives, it does consider the economic effects of social and humanitarian issues in the analysis of investments. The Board seeks to avoid investments that support terrorism or the violation of human rights.”

The IPS makes no other statements about politics, nor does it mention ESG.

State Auditor Kristi Racines told Cowboy State Daily that the policy was developed over years with different boards.

She said it’s rather problematic to sort the funds according to their positions on environmental issues or anything else. Some have nothing to do with energy. There are fund managers that focus solely on real estate investments and some on health care, for example.

“I don’t even know where fossil fuels would come into play in those cases,” Racines said. “For a lot of fund managers we hired, that question wouldn’t make sense.”

Shortsighted

Meier added that despite the environmental aims of ESG, the opposition to North American fossil fuel development ultimately means production happens in countries with less restrictive regulation, where it’s much worse for the environment.

“If you look at Wyoming coal, it’s one of the most environmentally friendly coals out there because of the lower level of sulfur emissions,” Meier said.

China has planned more coal-fired energy capacity than the U.S. now has in its entire fleet, and that’s on top of China’s existing coal-fired capacity.

In 2006, China’s annual carbon dioxide emissions exceeded those of the U.S., and it’s since doubled the annual total. The U.S. has declined about 17%.

Wyoming had hoped to use a proposed coal export terminal in Washington, but officials there blocked the project based on an anti-coal ideology. That left Wyoming with no feasible means to export coal.

“China is going to burn coal, and we’d all be better off if they were burning clean coal,” Meier said.