By Renée Jean, Business and Tourism Reporter

renee@cowboystatedaily.com

Wyoming lawmakers will try again to become the first state in the nation with its own stable token, along with a chance at billions in revenue if the Cowboy State can market itself successfully as a highly trusted first-mover.

“As we want to develop a full ecosystem for blockchain-enabled commerce and financial technology innovation, you need a trusted digital asset that everyone can look to and engage with on blockchain for smart contracts and transactions and whatever you want to do in this novel space,” Sen. Chris Rothfuss, D-Laramie, told Cowboy State Daily on Friday.

Risk ‘As Close To Zero As Possible’

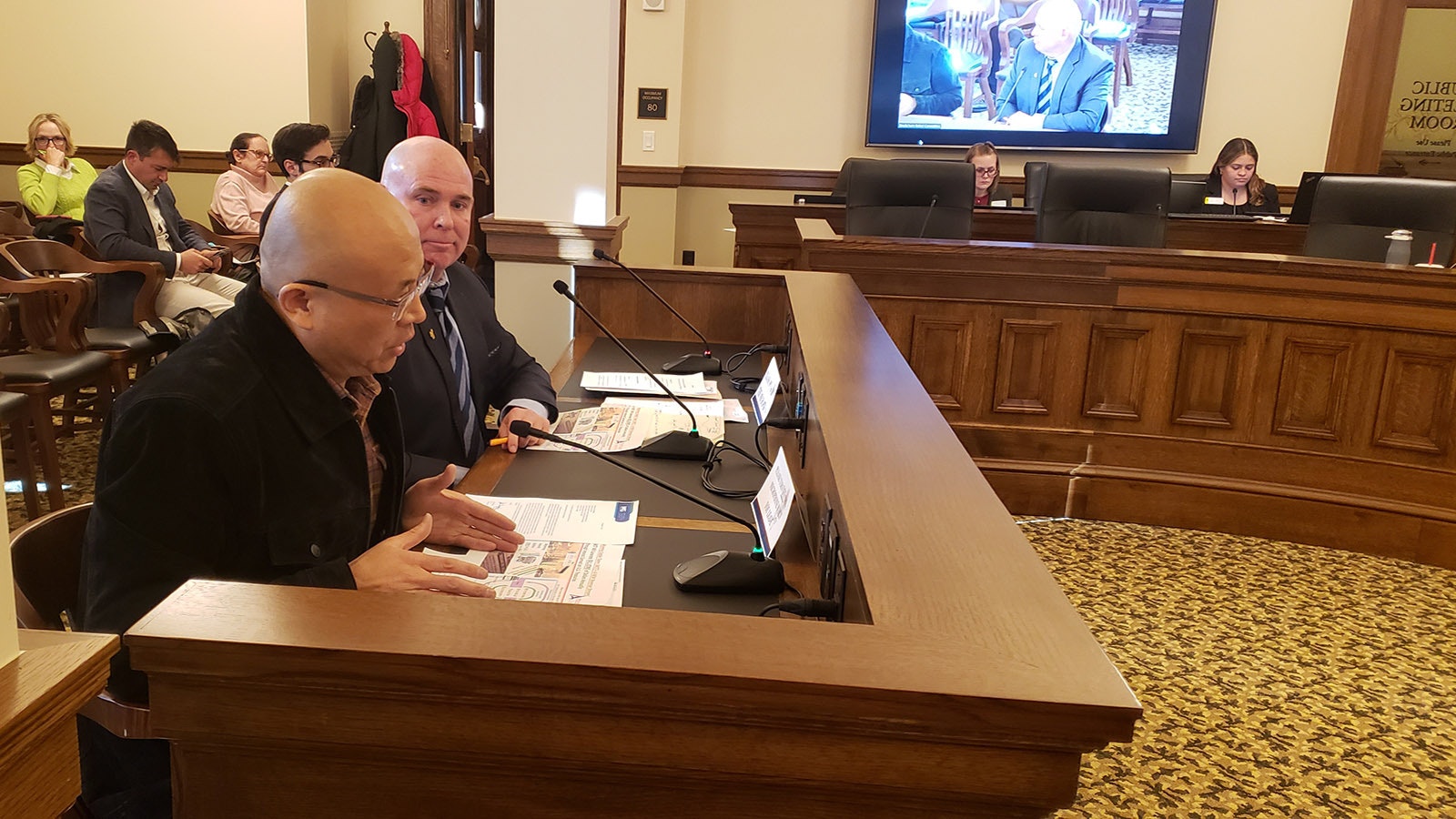

Rothfuss co-chairs the Select Committee on Blockchain, Financial Technology, and Digital Innovation Technology, which approved a bill Friday that will establish a Wyoming Stable Token Authority, modeled after the Wyoming Energy Authority.

Wyoming’s stable token will not be a new cryptocurrency, Rothfuss also stressed, but rather a digital representation of a U.S. dollar held in trust by the state and invested only in short-term treasuries.

“You know that it’s going to be there when you need to pay your bills and when you cash it,” he said. “We’re trying to get the risk as close to zero as possible.”

‘Holy Grail’ Could Mean Billions For State

The potential payoff for the state of Wyoming if it’s successful in implementing this type of system for payments is huge, American CryptoFed CEO Scott Moeller testified to lawmakers Friday as the select committee considered the second go-round for the Wyoming Stable Token.

“With the passing of the Wyoming Stable Token Act, we believe it will be possible to deliver the Holy Grail for merchants,” he testified. “Zero cost, real-time, secure retail payment transactions while simultaneously providing a huge financial benefit to the state of Wyoming and its citizens.”

He practically begged lawmakers on the committee to “please get this bill passed,” and that if successful, “we can generate billions of dollars in new revenue.”

In 2019, Moeller said the Merchant Advisory Group represented 10 of the nation’s largest U.S. merchants, which accounted for more than $4.8 trillion worth of annual sales at more than 580,000 locations.

Adds Up Fast

Doing the math, if Wyoming successfully captures just 5% of those transactions, with one-month treasury bills at 3.86% return, the revenue potential is $9.3 billion annually, Moeller said.

Wyoming now has a “first-mover advantage,” Moeller said, adding that “other states will follow.”

Already Behind?

Rep. Clark Stith, R-Rock Springs, however, wondered if the first-mover advantage doesn’t already belong to Circle, which has backed its stable coin with cash and short-dated U.S. Treasuries. On its website, Circle advertises that its stable coin will always be redeemable 1-for-1 for U.S. dollars.

“Is it possible that if we adopt this it won’t work, because people will get used to using Circle?” Stith asked.

A Buffer For Fraud

Xiaomeng Zhou, American CryptoFed’s chief operating officer, suggested Wyoming has something unique that Circle lacks – trust.

Examples also were given of other companies that thought they had a true stable coin, but ultimately turned out to have unexpected volatility for one reason or another.

Rothfuss, meanwhile, told Cowboy State Daily that it’s clear there’s a demand for some kind of stable coin. He fears failing to provide a better option is likely to mean people will put their assets at risk.

“We don’t want anything to happen to our citizens like what you see with FTX or with TerraLuna, or any of the other problems we have observed,” he said. “We also don’t want people to be subjected to credit fraud and stolen credit cards and a lot of other abuses that we currently see.

“So, if we can move forward with this puzzle piece in our overall fabric of blockchain-enabled technologies, it’d be a real service and a real benefit to the people of Wyoming, as well as the country and potentially the world.”

Fewer Fees A Win For Consumers

The Merchant Advisory Group, meanwhile, has submitted its own testimony supporting Wyoming’s Stable Token.

“The bill will increase competition in the payments system by introducing payments options and reducing total payments acceptance costs for merchants,” MAG CEO John Drechny wrote in a letter to the select committee. “It will also increase revenues for the state of Wyoming.”

What Mag hopes to see is a mechanism to redeem Wyoming Stable Tokens for U.S. dollars in real time, without any costs and limitations through the Wyoming Treasurer’s Office.

The elimination of credit card merchant fees, which are generally passed on to consumers, is something Rothfuss and other committee members see as another win for Wyoming businesses and consumers.

“This is a more advanced system that is effectively equivalent to cash,” Rothfuss explained. “So, do credit cards go away? Oh no. But do merchant fees go down? Heck yes.”