By Renée Jean, Business and Tourism Reporter

renee@cowboystatedaily.com

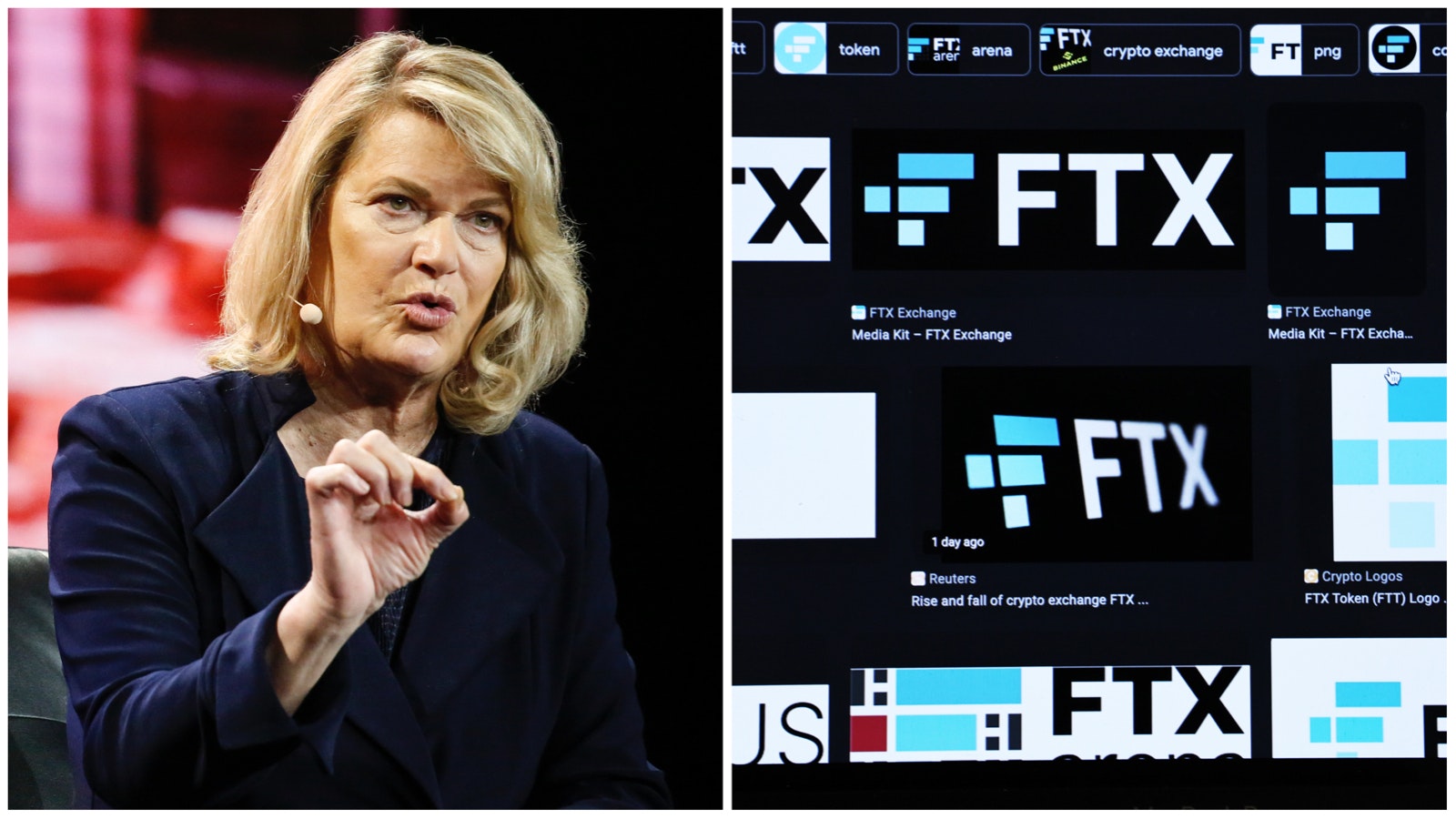

The recent meltdown of cryptocurrency exchange FTX is not something that could have happened in Wyoming, Sen. Cynthia Lummis told Cowboy State Daily.

She believes the demise of FTX — which filed for bankruptcy and reports more than $1 billion of clients’ money is missing — could breathe new life into a federal bill she has cosponsored that models Wyoming’s regulatory system.

“What the nation should do is take stock of what Wyoming has done so well and adopt a regulatory regime that is a lot like Wyoming’s,” Lummis said.

Wyoming laws already forbid the commingling of customer assets that ultimately caused FTX to go belly up, Lummis said.

“Since 2019, we’ve known that affiliate transactions with digital assets are dangerous,” she said. “And that’s why it is illegal in Wyoming.

“In Wyoming, there are strict limits on affiliate transactions such as occurred between FTX and its sister organization called Alameda.”

What Happened With FTX?

What happened to FTX is not something inherent to crytpocurrencies or digital assets.

Instead, it’s fueled by one of the oldest human motivations – greed.

Or, as Steve Lupien, director of University of Wyoming’s Center For Blockchain and Digital Innovation puts it, Enron again.

“We’ve seen the same thing happen with companies like Enron, which commingled funds and went bust,” he told Cowboy State Daily. “Because you can’t. When you commingle funds and you have a situation like we had in crypto — which can happen any time the market goes down.

“What the exchange lost wasn’t their money. It was customer money. And when customers go and want their money back, it’s not there.”

Reminiscent Of Mobsters

Lupien believes many of the leveraged products being offered in the crypto sphere today are nothing less than fraud on a grand scale.

“I’m gonna be honest with you, some of these leveraged products that companies like FTX are offering would have made Bugsy Siegel jealous,” Lupien said. “I mean, the mobsters of the ’50s weren’t able to run, you know, leverage schemes as big as 150 to or 100 to 1.

“And Bitcoin wasn’t designed to be leveraged. So personally, I think we needed to flush out these margin players.”

Cryptocurrency may feel exotic and unfamiliar to many, but these types of risky investment practices have been happening for a long time, Lupien said.

“It has happened in financial service companies throughout history, and that’s why (Wyoming has) created (its digital asset) regulations, to prevent that from happening,” he said.

Good Riddance To ‘Grifters‘

Caitlin Long, CEO of Custodia, is among those working in the digital asset sphere who believes what happened to FTX could ultimately be good not just for the future of cryptocurrencies, but for Wyoming in particular.

“Where there was no regulatory clarity, a lot of outright criminals filled the vacuum,” she said. “Those of us who are big fans of the technology and hated all the criminals and grifters who have been around it are all saying good riddance to all the criminals and scammers, and we are continuing to focus on implementing the technology that will bring better, faster, cheaper and more secure payments to regular users.”

Custodia is among Wyoming banks working in the digital asset space that have yet to receive a master account from the Federal Reserve.

Paving The Way

The company has sued over the slow-walk, a case that is still working its way through the legal system. That lawsuit on Friday survived a motion to dismiss and now appears set to proceed on what could be precedent setting for all three of Wyoming’s Special Purpose Depository Institutions.

Long, who could not comment specifically on Custodia’s case, said she hopes the FTX meltdown in general will help pave the way for regulatory clarity where there has so far been little.

“The good players who are focused on building technology are trying to get bank and broker dealer licenses to be able to do things in a regulated and safe way,” she said. “Neither the FCC nor the Federal Reserve has allowed those players to achieve those licenses to date.”

National Crypto Framework

Lupien, meanwhile, believes the Lummis-Gillibrand bill, which had been taking a backseat to one pushed by FTX founder Sam Bankman-Fried, will get new life.

“I actually spoke to some folks in Washington about (the Bankman-Fried) bill, and they basically said it’s radioactive now because of FTX,” Lupien said. “It’s so radioactive that it’s glowing on people’s desks. That bill will never, ever see the light of day.”

The bill Bankman-Fried had favored was sponsored by U.S. Sens. Debbie Stabenow, D-Michigan, and John Boozman, R-Arkansas, and contains what Lummis characterizes as “inadequate regulation.”

“I hope to be able to steer the direction of the Senate Ag Committee bill in the direction of the Lummis-Gillibrand bill,” she told Cowboy State Daily. “The Lummis-Gillibrand bill is currently in the Senate Finance Committee.

“It is a large, comprehensive bill dealing with all kinds of digital assets; everything from cryptocurrency to stable coins, and makes mention of a variety of other iterations within the blockchain.”

Lummis said she anticipates the bill could be sent to committees for consideration early in 2023.

The Lummis-Gillibrand bill has been heavily influenced by Wyoming laws, but Lummis said it goes a little further in some areas because of the nature of federal agencies involved.

“The Lummis-Gillibrand bill, for example, requires that an exchange not use customer assets for proprietary trading and maintain 100% of customer assets for withdrawal at all times,” Lummis said. “And it requires use of an independent bank or trust company as custodian, similar to what would happen now with securities under the SEC and the Commodity Futures Trading Commission.”

Crypto Not Dead

Cryptocurrency as a sector is a trillion-dollar asset class and is not going anywhere, Lupien told Cowboy State Daily.

“Bitcoin itself, for example, is still writing a block every 10 minutes,” he said. “Bitcoin is completely unaffected. The technology, the operation of digital assets has not been impacted one bit.”

Banks also can get robbed, Lupien pointed out.

“Do we all go around saying we need to throw away paper money because it’s vulnerable to bank robbery?” he asked. “No, we tighten our regulation. We need to learn from these types of events.”

Long agreed that digital assets are not going away and pointed to Elon Musk as an example of how the sector continues to push forward.

“Last week, in the middle of all the drama, there was a huge announcement, which is that Elon Musk is going to use peer-to-peer payment protocols for allowing payments in Twitter,” she said. “That is an earthquake in the payments industry, because he is going to settle U.S. dollar transactions outside of the traditional payment rails.”

Overshadowed

The furor over FTX obscured Twitter’s move, Long added, dampening blowback that Musk’s announcement would otherwise undoubtedly have attracted.

“I’m sure the banking industry is not happy about Twitter becoming what he called it, the people’s financial institution,” Long said. “And yet that barely made the stories.

“But it’s important (to Wyoming), because that is exactly what Wyoming Special Purpose Depository Institutions are aimed at doing, bringing the new payment technologies into the banking system. And the fact that Elon Musk is proceeding with those payment technologies is Exhibit A for the fact that crypto is not dead.”

It’s also another exhibit in what is a David and Goliath battle for the financial future of Wyoming, Long suggested, one in which thousands of future jobs are at stake.

“South Dakota, our neighbor, did something similar in the early 1980s when they went after the credit card industry,” she said. “They were able to get the credit card companies to move to Sioux Falls, South Dakota, and there are 40,000 jobs in that industry in Sioux Falls right now 40 years later.

“That’s what Wyoming is playing for, to bootstrap our financial services industry. We’ve been blocked by Washington, D.C., and the New York banks are trying to get ahead of us now.”