By Greg Johnson, Cowboy State Daily

greg@cowboystatedaily.com

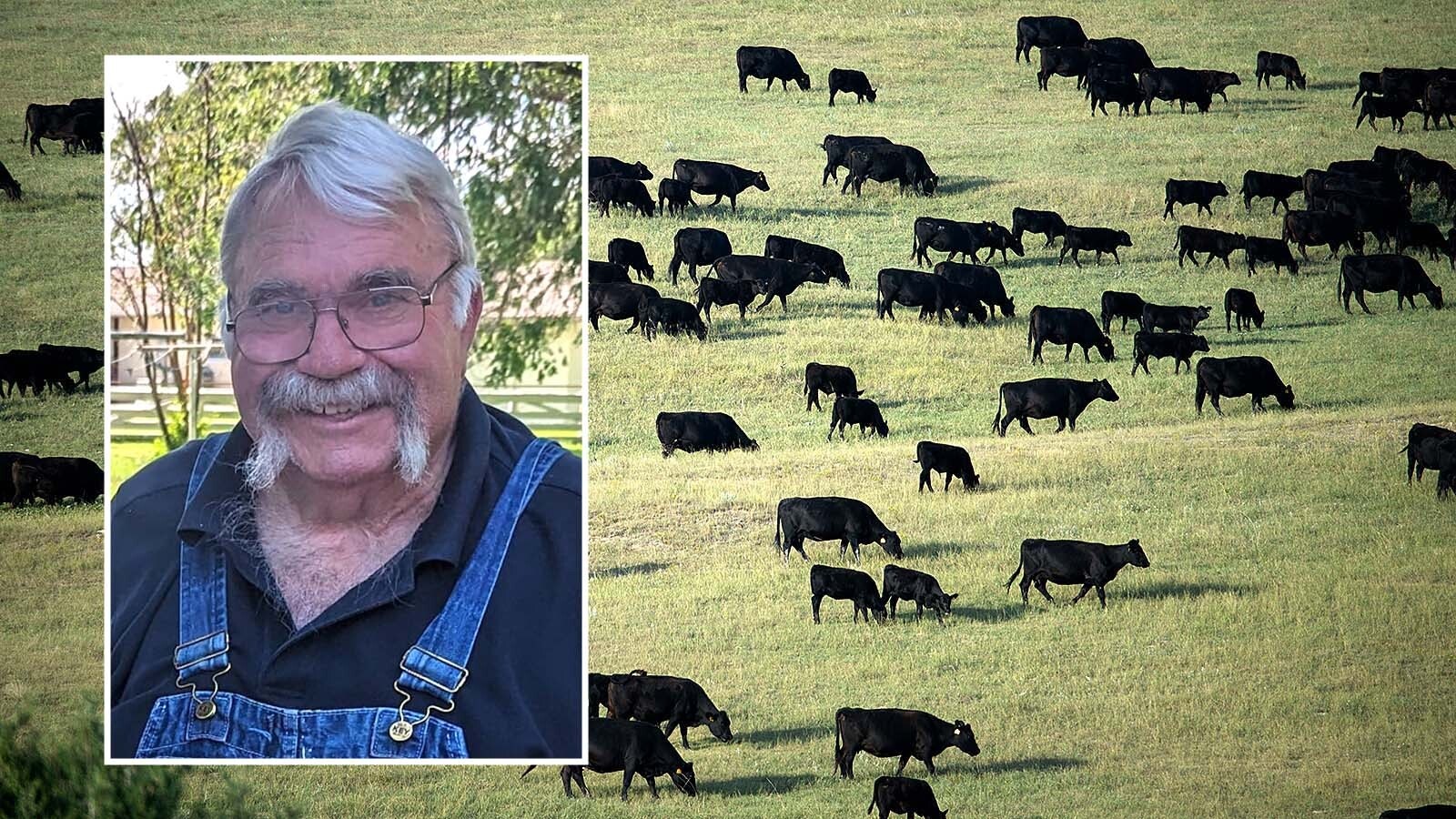

A lifelong Wyoming rancher says a proposal in New Zealand to tax the greenhouse emission of farm animals could set a dangerous and irresponsible precedent of politicizing agriculture policy.

New Zealand’s government moved forward Tuesday with a plan that would make the country the world’s first to enact a tax on the climate impacts from animal emissions, including their methane-infused burps and urination. Arguments in favor of the tax include claims it would be an economic boon for the nation and that the money collected could be funneled into more climate change-related research.

To use a phrase people in the Cowboy State would understand, Wyoming Stock Growers Association Executive Vice President Jim Magagna essentially calls the proposal a pile of meadow muffins.

“It’s not possible,” he said of the New Zealand claims that taxing livestock emissions would be economical. “The mechanics of this are unthinkable and it’s not practical at all.”

He also pooh-poohed claims that cattle and livestock are major contributors to climate change.

“The impact of grazing animals on the environment with carbon and methane, in the United States, it’s really negligible,” Magagna said. “In the U.S., the way we handle our animals, the true data shows in terms of methane (emissions) are somewhere in the neighborhood of 2%.”

‘Competitive Advantage?’

New Zealand Prime Minister Jacinda Ardern touted the tax on farm animals as a “competitive advantage” for her country because consumers are more climate-conscious and will choose to buy products raised in more responsible ways.

“New Zealand’s farmers are set to be the first in the world to reduce agriculture emissions, positioning our biggest export market for the competitive advantage that brings in a world increasingly discerning about the provenance of their food,” Adern said, according to The Associated Press.

The country’s agriculture minister also touted the tax as an incentive for farmers and ranchers to address their industry’s impact on the environment.

“Farmers are already experiencing the impact of climate change with more regular drought and flooding,” said Damien O’Connor via The Associated Press. “Taking the lead on agriculture emissions is both good for the environment and our economy.”

Opposite Impacts For Wyoming

New Zealand’s claims that taxing livestock emissions would be economical don’t hold much water for Wyoming’s ranching families, Magagna said.

“There’s no real profitability in the livestock business today as it is,” he said, adding that an extra tax could put a lot of family operations out of business. “These people are dedicated to their lifestyle and their industry.

“And any tax like that would spell the end of a viable livestock industry in Wyoming.”

Politics vs. Practicality

Not only would a similar move in the United States put a lot of family ranchers out of business, it actually could lead to more greenhouse gas emissions, Magagna said.

That’s because with fewer independent cattle and other livestock producers, more large feedlots would emerge to fill that void, and feedlots are much worse climate offenders than traditional range ranching, he said.

“There are people in this country too who have suggested (what New Zealand is doing),” Magagna said. “They talk about greenhouse gas emissions from cattle more than sheep because of the burping cattle.

“They’re going to emit more in a feed lot than they would in the open range, so the mechanics of this are unthinkable and not practical at all.”

He also said an environment tax on livestock would “exacerbate what already concerns us,” which is retaining future generations of ranchers to continue their family operations. It also would speed up the loss of sustainable ranchland to development.

Responsible Ranching

Because Wyoming ranchers would resist any similar efforts here doesn’t mean they’re anti-environment or don’t care about the impacts of their industry on climate change, Magagna said.

“The focus should be on good grazing practices, not taxing (emissions),” he said. “Grazing animals and properly managed animals are positive contributors to carbon sequestration.

“There are practices in ranching that are more favorable than others. Most people aren’t running their livestock operations the way their grandparents did. We’ve learned a lot about soil management, and all of those things are making ranching and livestock producing more responsible.”

The ‘Fart Tax’

New Zealand’s latest attempt to become the global leader for taxing livestock emissions isn’t its first. A similar effort failed in 2003 when farmers were adamantly opposed and dubbed it a “fart tax,” according to AP.

While disappointed, Magagna said he’s not surprised at New Zealand’s efforts to tax the emissions of its estimated 36 million beef, dairy cattle and sheep.

“There are so many ridiculous ideas being tossed around today,” he said, adding that Wyoming ranchers need to pay attention to global trends like what’s happening in New Zealand.

Aside from genetically engineering a methane-free breed of cattle, local power comes from being informed, he said.

“That would be my advice,” Magagna said. “Always be open to new ideas and innovations that will benefit your operations. Sustainability has to have three elements. It has to be environmentally sustainable, socially sustainable and the third one, which some people ignore, is it has to be economically sustainable.”