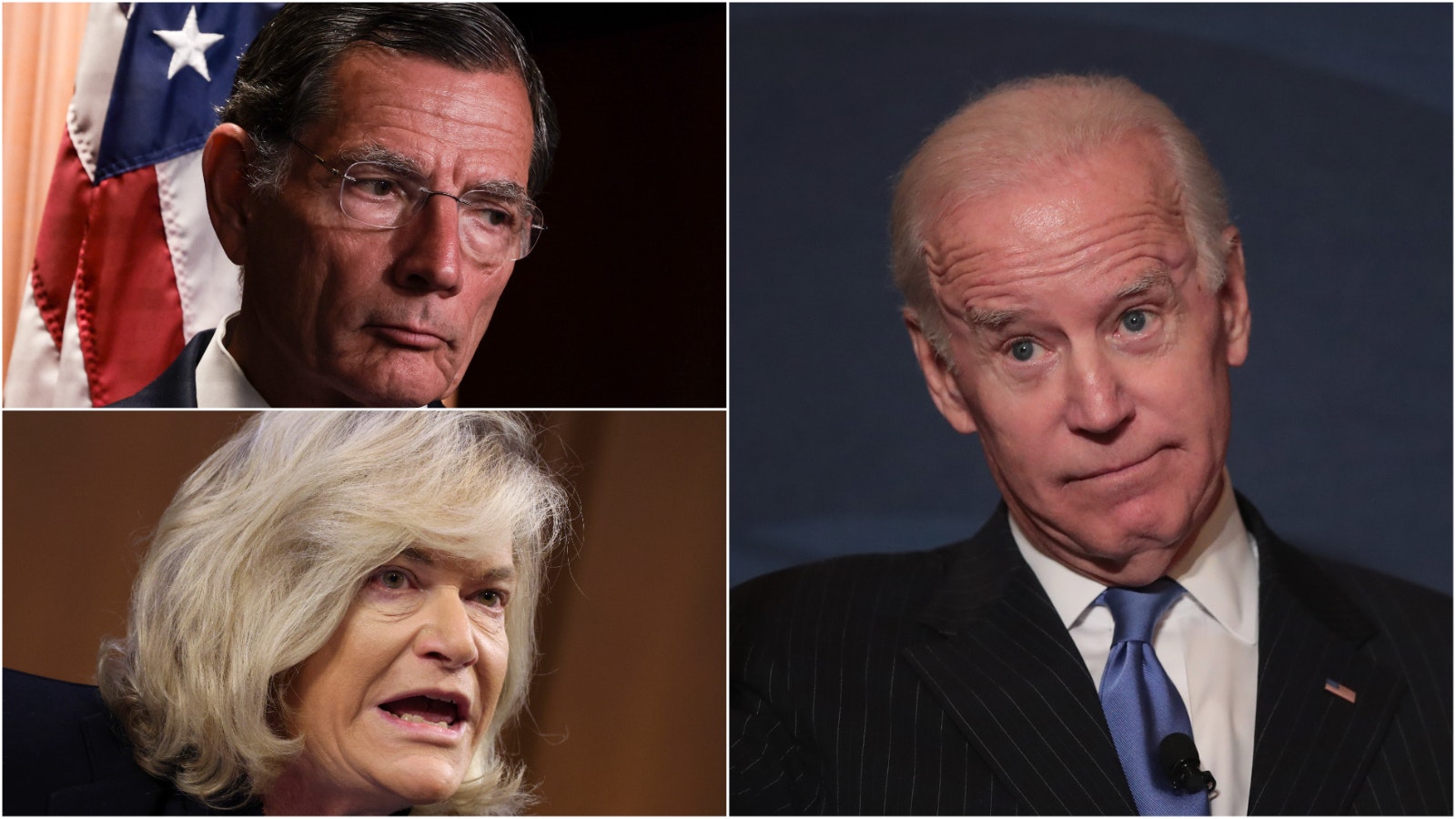

Wyoming Republican Senators John Barrasso and Cynthia Lummis are upset that President Joe Biden has eliminated $10,000 in student loan debt for all federal borrowers making less than $125,000 a year.

“Canceling millions of dollars in student loan debt will make the pain of high prices even worse for Wyoming families,” Barraso said in a Wednesday morning statement in response to Biden’s decision. “Today’s announcement is an insult to every American who played by the rules and worked hard to responsibly pay off their own debt.”

At $1.6 billion, Wyoming has the least student debt in the nation.

The nation’s student loan debt is now around $1.75 trillion, according to the St. Louis Fed, more than the nation’s outstanding debt for car loans, credit cards or any other debt aside from mortgages.

Addressing the rising cost of attending college has been one of the main reasons given for excusing the debt.

According to Federal Student Aid, the typical in-state student at a four-year public institution spends $14,320 without room and board fees per year. Private universities are considerably more expensive, with an average cost of $45,932 per year.

The average yearly income for a 2021 college graduate is $59,919, which implies that the average debt of $30,600 is more than half their yearly earnings.

The average cost for a four-year university was $553 in 1963, which represented 8.9% of the median household income. Average cost for a four-year university degree is now $16,647, which is 20.8% of the median household income of $79,900.

The average student debt has risen considerably since 1995, when it was $9,320. That year, the median household income was $34,076.

The decision to forgive student debt comes after months of speculation and hinting from the Biden administration that such a move might happen.

“In keeping with my campaign promise, my administration is announcing a plan to give working and middle class families breathing room as they prepare to resume federal student loan payments,” Biden said in a Twitter post.

Barrasso said it could be a strategic play from Biden to curry votes with the midterm elections on the near horizon.

“This decision is also a boon for Biden’s wealthy supporters,” Barrasso said. “Once again, the Biden administration is selling out working families to appease the far-left wing of the Democrat party.”

According to Education Data Initiative, middle class borrowers owe on average $43,090 in student loan debt. Americans with income higher than the national average owe an estimated 65% of the nation’s outstanding student loan debt.

Wyoming Democratic Party Chair Joe Barbuto had no comment on Biden’s order, but did say it was a move he believes the president was pushed to make by the left-wing of the party. Sara Burlingame, executive director of Wyoming Equality, said she supports Biden’s move.

“I think it’s good,” she said. “That’s $10,000 more our grads will be putting into our local economies.”

Barrasso and Lummis have both said forgiving the debt will increase inflation. Inflation is currently at a 30-year high, but has dropped slightly over the past month, along with gas prices.

“People in Wyoming know there’s no such thing as a free lunch, and canceling student debt amidst record high inflation will only throw fuel on the fire,” said Lummis. “Any notion that there’s no cost to wiping out billions of dollars of debt is flat out wrong.”

Barrasso, Lummis and other Republican lawmakers attempted to get ahead of the issue, introducing The Debt Cancellation Accountability Act in June, which would require the U.S. Department of Education to obtain an express appropriation from Congress to pay for any federal student loan debts the Department proposes to waive, discharge, or reduce on a mass amount of loans with a total sum greater than $1 million. No action has taken place on this bill since first introduced in June.

The Committee For a Responsible Federal Budget has argued forgiving student loans will undermine the Inflation Reduction Act, which was recently passed. This organization said canceling $10,000 debt per person for households making below $300,000 a year would cost roughly $230 billion.

Biden’s order will only apply to those making less than $125,000 per year.

Biden also said those with undergraduate loans will be able to cap their payments at 5% of their monthly income. He said the pause on federal student loan payments will resume in January. These loans have been on pause since March 2020.