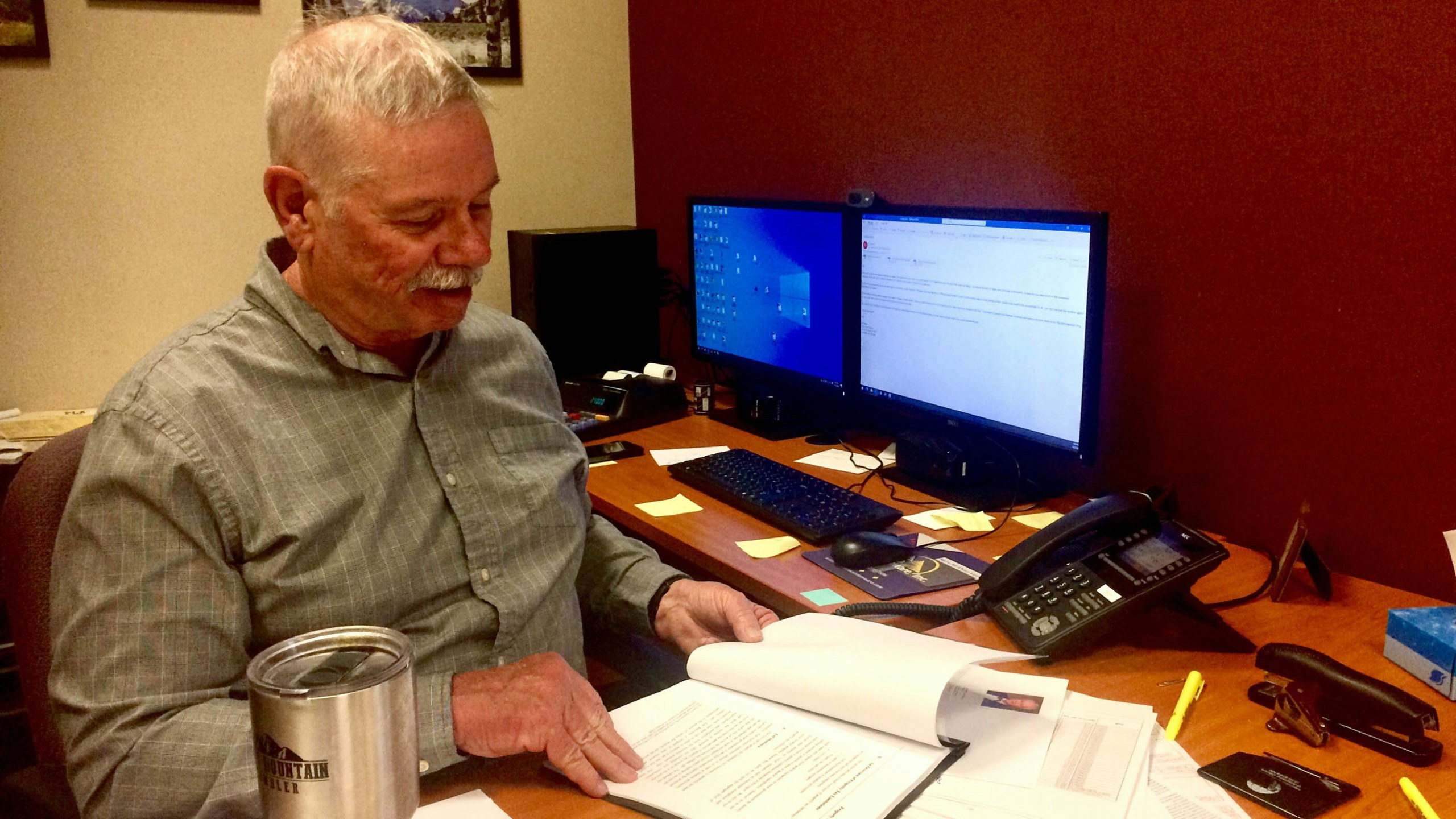

In his 37 years with the Park County Assessor’s Office, county assessor Pat Meyer said he’s never seen anything like it.

This spring, his county experienced the largest increase in property taxes he has ever seen, with spikes of 25% to 45% from the previous year.

A recent visit from an 87-year-old living on a fixed income of $2,029 per month brought home the stark reality of the situation.

“It will take him a month and a half just to pay his (property) taxes off his Social Security,” Meyer said.

Meyer said there have been similar increases occurring throughout the state. In Teton County, around 60% of residents saw property taxes spike by upwards of 30% to 50%. The remaining 40% saw even larger increases of 50% or higher. Similar increases have been reported in Sheridan, Fremont and Lincoln counties.

The dramatic increases have changed Meyer’s mind about efforts to cap property tax growth in Wyoming in the range of 5% to 10% per year.

“I’m not going to sit back and do nothing with this problem,” he said. “When’s the end? I don’t know. But we do not want to turn into a Jackson Hole and we do not want to tax people out of their houses.”

Meyer actually lobbied against a limit on property tax increases in early 2021, mentioning to the Legislature’s Revenue Committee at that time, “when people go to sell their house, they like our values up,” explaining that assessors follow the market in their tax assessments.

But that was before Park County and many other Wyoming counties saw large property tax increases in 2021 and an even more dramatic surge this spring.

“I’m allowed to change my mind,” Meyer said. “I was against it before I saw what was going on with Park County.”

Meyer said after that meeting, he started researching questions that had been left unanswered by legislators before. He began comparing local growth on a national level and researching the laws of other states, finding valuable information on property tax limits that exist elsewhere in places like Arizona and Oklahoma.

In Arizona, the state, working from fair market value, caps property value growth at 5% and also mandates that a homeowner’s property value has to increase by more than 15% before the taxes on it can be raised by more than 5%.

Cody resident Tim Lasseter has criticized Meyer for changing his stance on this issue.

“He has been in office a long time and a great deal of weight is placed on his opinion,” Lasseter said. “He could have had a positive impact on that (Revenue) committee for the benefit of the taxpayers of Park County and across the state. He chose instead to help kill the very type of legislation he now claims to support.”

The proposed 2021 bill was HB 99, sponsored by Rep. Chuck Gray, R-Casper. The bill would have capped property tax growth at 3% each year, which Meyer said is an ideal market increase.

The bill died on introduction in the House. A similar bill that would have capped property tax increases at 5% was also introduced in the Senate this year but died in the Revenue Committee by a 5-4 vote.

“We must stop these out-of-control property tax increases,” Gray said in a Friday press release. “The bill I brought in the 2021 Session, HB99, is the gold standard and what should be done in Wyoming.”

Meyer said he’s also looking at homeowner tax exemption programs in other states like Florida. In Wyoming, veterans get a small discount on their property taxes, but there are no such deals for seniors on a fixed income.

The state does offer a property tax refund program for all those making less than $48,075 per year.

Park County Commissioner Lee Livingston said he supported a 2022 bill sponsored by Senate President Dan Dockstader, R-Afton, that would have offered assistance for the elderly and the infirm, but it died in the House.

Livingston spoke on behalf of the Wyoming County Commissioners Association against the 5% cap but told Cowboy State Daily on Friday he supports some type of fix to the property tax spikes.

“Especially for those folks that have owned their homes for a long time and have no desire to sell,” he said. “It is definitely a tricky situation though.”

Meyer said he plans to do more in-depth research and speak with assessors from other states. He will then present his findings and proposals to the Wyoming County Assessor’s Association meeting in Lander in July and to the Legislature’s Revenue Committee in September.

In December 2021, Meyer proposed a 20% property tax increase cap to Sen. Cale Case, R-Lander.

In a phone interview Friday, Case said he is fully aware of the property tax increases, as there have been many reported by his constituents in Dubois, but said any blanket property tax cap would violate the Wyoming Constitution. He did, however, support Dockstader’s bill.

Case said residents need to be concerned about the state’s sources of revenue moving forward, with mineral royalties on the decline over the past five years.

“We have to look at it holistically,” he said. “We might not be able to afford to lose those property taxes.”

Meyer and Case said the one flaw with a flat property tax cap is that it can lead to disparities based on property value. Property values will rise at different rates, which means the tax increases for some will be greater than the tax increases for others — a violation of the state Constitution, according to Case.

But the consistency of growth throughout the area gives Meyer confidence there will be balance as a whole.

Cause And Effect

Meyer said 2020 election data showed around at least 2,000 new residents moving into Park County, a roughly 7% increase since 2010.

Meyer said the influx of wealthy new residents and inflation has led to the rapid tax increases.

“They spent a lot of money, they drove it up,” he said. “But now I can’t blame it on out-of-staters, that’s what you’re going to have to pay.”

Property value increases do help increase a homeowner’s equity in a home when it comes time to sell. But after many years of increasing market value, those property taxes can make a serious dent in whatever profit is made when the home is sold.

“You’ll get a lot more money for your house right now, except you’ve got to move somewhere else or you’re going to be in the same problem buying another one,” Meyer said.

Meyer said he is not sure at this time if he will advocate for extending these caps to commercial property, as they produce income and landlords can compensate for higher property taxes with higher rents.

Wyoming law requires assessors to make a full market analysis before making their tax determinations, and the Department of Revenue and State Board of Equalization performs audits on these assessments to ensure compliance.

“The values we arrive at are most often a conservative estimate of what your property would sell for,” Meyer wrote in a letter he included the 2022 property tax information sent to every Park County property owner. “We do not set the market, we follow it.”

Meyer said he wrote this personal letter to prepare residents for the shocking increase they were likely about to see.

Doug and Debra Rosendahl live in rural Park County and only had a roughly 9% increase on their property taxes. Still, they have great concerns about what the future may hold.

“It’s not terrible but if it happens year after year it will be,” Doug Rosenthal said.

Meyer will research the issues as he is runs for reelection this fall.

“I was afraid if I didn’t run, no one would start going (to handle the problem),” he said.

There are no candidates running against him at this time. Meyer’s office hasn’t received any formal appeals on property taxes so far, but has received hundreds of calls about the increases.

“Why did his mind suddenly change (on property tax caps)?” Lasseter said. “Perhaps because it’s an election year and people are very upset with the tax hike.”