This is not the Jackson of Greg Prugh’s youth.

Driving slowly through a congested downtown neighborhood full of three-story modern, cube-like houses with big windows and decks, Prugh ticked off price tags for the properties that had recently sold — $5 million, $8 million and $10 million listing prices are now the norm.

Finding a house – or condo, for that matter – under $1 million is pretty much unheard of at this point, Prugh said.

As a former developer and current founder and owner of Prugh Real Estate, he’s watched real estate prices double in the past two years as increasing numbers of out-of-state buyers snatch up high-cost properties, siphoning off supply while demand continues to rise.

“Two years ago, everything went crazy.” he said. “Values doubled and really started ripping. Now, we’ve reached a tipping point.”

The soaring cost of houses in Teton County has led to more than just a housing shortage that has caused many to sell their homes or move to neighboring communities more than an hour away.

Record-High Property Taxes

The rising values have also led to record-high property taxes, as evidenced by the tax notices sent out just sent out last week.

Around 60% of Teton County residents saw property taxes spike by upwards of 30% to 50%. The remaining 40% saw even larger increases of 50% or higher.

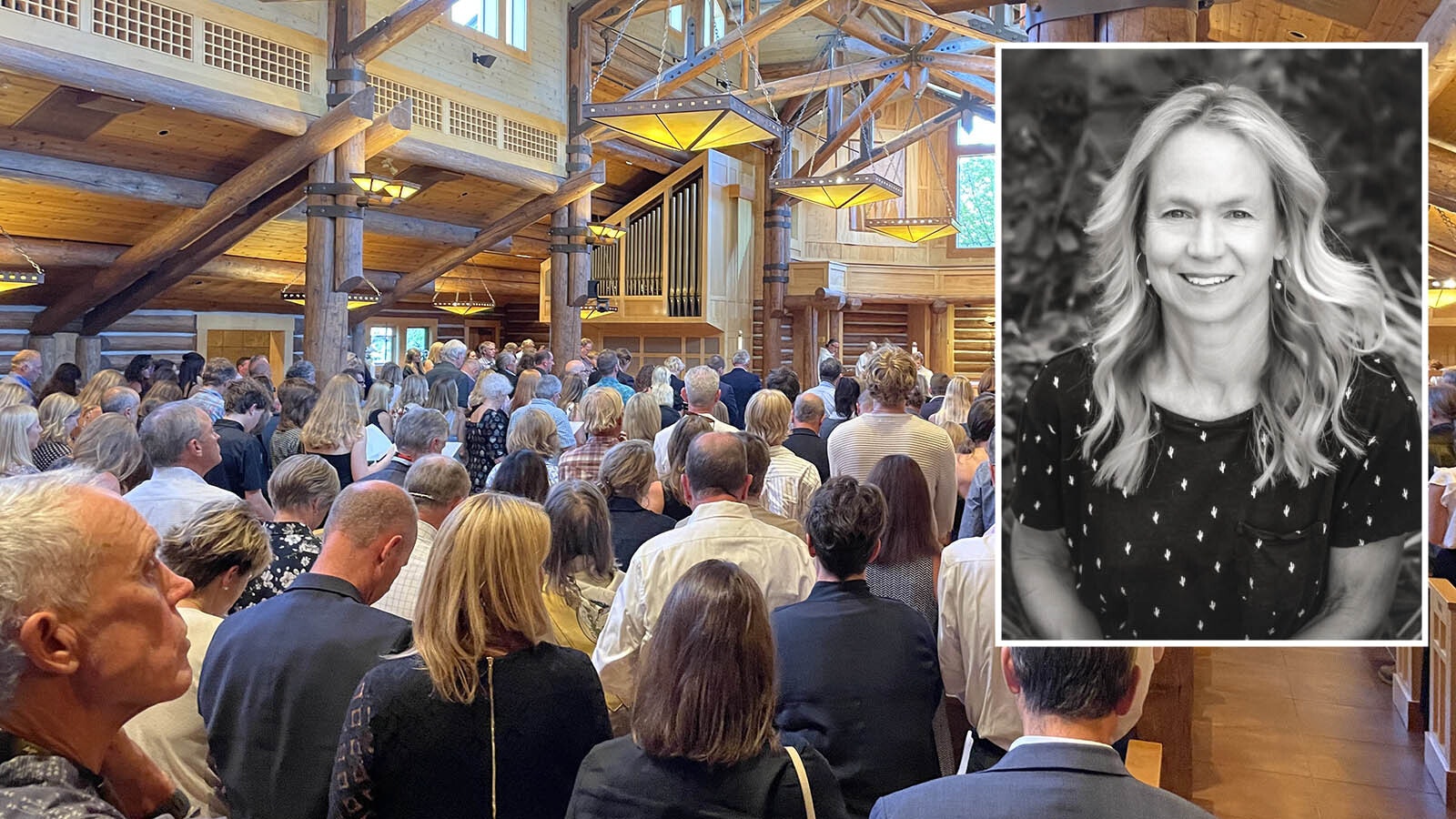

“This is by far the biggest increase I’ve seen in the five years since I’ve been in office,” Teton County Assessor Melissa “Mel” Shinkle told Cowboy State Daily Monday. “It’s been really tough on people and left them with lots of questions.”

Shinkle said she’d just finished a phone conversation with a Jackson resident calling to inquire about his bill. Residents have a 30-day period in which to dispute their bills, and Shinkle said she’s heard from many.

The gentleman she spoke with was questioning the $27,000 increase over last year’s property tax bill. Shinkle explained his house was now assessed at $9 million, which came as a big shock to him.

In Wyoming, property taxes are applied to land and anything attached to it, such as homes, buildings and fences, all at fair market value. Currently, industrial properties are taxed based on 11.5% of their value, while residential, agricultural and other property are taxed at 9.5% of their value. Wyoming counties then have the option of charging up to 12 mills, or $12, of tax for every $1,000 in assessed value.

Currently, Teton County levies 8 of its 12 mills, a figure determined by the county commission, which will revisit the topic in August.

Residents Shocked At Increase

Given the soaring property values, some residents have been shocked to learn just how much their properties were now worth, Shinkle said, and how much they can be charged in taxes.

“Most people don’t follow the housing market. They know that prices are up, and they’ve seen the sales, but unless they are looking at what their neighbor’s property sold for, they really have no idea how much property values have gone up,” she said.

For some customers, the conversation ends there. Others, however, respond like deer in headlights as they scramble to make sense of the figure.

These are the people who keep county assessors like Shinkle from sleeping at night.

“There’s always one person who haunts you,” she said.

For her, it’s a 93-year-old woman living in a coveted area of town where values have skyrocketed. The woman, who has lived and worked here for most of her life, is on a fixed income.

Last year, her property taxes were $9,624. This year, however, they rose by almost 100% to total $19,558.

“What does she do?” Shinkle asked. “For people on fixed incomes, this is really hard on them.”

Legislative Action

Teton and other counties are in a real bind to offer solutions for these people, Shinkle said, and to date, there aren’t a lot to offer because changes to property tax policies must be handled at the legislative level.

To that end, Rep. Mike Yin, D-Jackson, a member of the Legislature’s Revenue Committee, helped shepherd a bill through the Legislature’s recent budget session that gives counties the authority as of July 1 to create an optional property tax refund program that takes effect.

Under the program, residents who qualify based on their incomes and assets can apply for a refund of up to 50% of their prior year’s taxes.

Currently, the state has a similar property tax refund program in place, but Yin said the committee brought the bill forward in the event that the Legislature decided not to appropriate funds for the program.

The local property tax refund program will take a year to get up and running, Yin estimated.

Yin also saw a 60% increase in his property taxes on his two-bedroom condo, which has more than doubled in value since he purchased it in 2018.

“Affordability in general is an issue as we experience growth,” he said. “The cost of living is pricing many people out who can’t afford to live here (in Teton County).”

He’s heard about the issue from many of his constituents, he said, and said one measure he plans to bring forth in the Legislature in the future is the homestead exemption, which would lower taxes for property owners who live in a particular county throughout the year.

“I’m hearing a lot from people who want to do more about property taxes and housing issues in general,” he said.

Where Do Property Taxes Go?

Though it’s exhausting, Shinkle said she doesn’t mind all the calls from her constituents questioning the skyrocketing taxes.

Approximately 75% of these taxes go to schools, she said, and this year Teton County will be contributing mightily.

The remainder goes to finance city and county services.

As of today, Teton County has an approximate market value of $33,789,565,552, which would amount to about $25.7 million in property taxes.

As someone moving to Jackson from Torrington, those figures are mind-blowing for Shinkle, who has sympathy for the residents who are struggling to pay their tax bills.

The first half of taxes are due by Nov. 10, and are considered delinquent after that point unless the total figure is paid by Dec. 31. After the first half is paid, residents then have until May 10 to pay off the bill.

As for relief programs, there aren’t many available, Shinkle said. Those who meet income qualifications can apply to defer payment of the second half of up to 50% of their property taxes up to 50%, although interest will be applied to the unpaid portion.

Those who are in default of taxes might also have their homes auctioned off if they fail to pay by the deadline.

“That’s the most disappointing part,” Shinkle said. “We don’t have much property tax relief in Wyoming. It’s tough, and people are not going to be able to live here.”