Wyoming’s average regular unleaded gasoline price was unchanged on Tuesday from the previous 24 hours, remaining at $4 per gallon.

The website GasBuddy.com, which tracks national gas prices, reported Wyoming’s average gas price is up 1.2 cents per gallon over one week ago, and up $1.15 per gallon from one year ago.

Wyoming’s average price for gasoline remained below the national average of $4.239 for a gallon of regular.

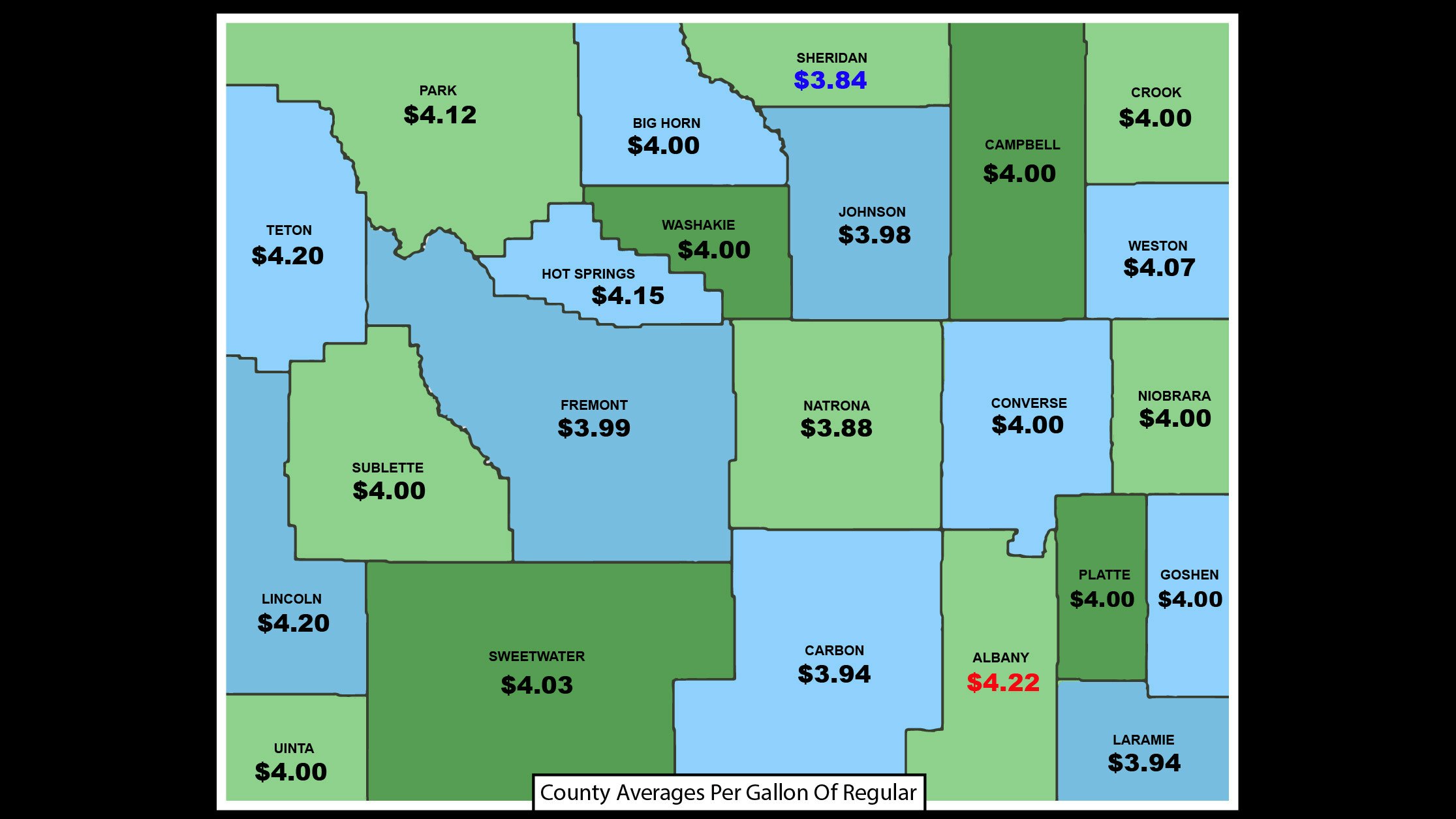

The average price per gallon of regular unleaded in each Wyoming county:

Albany $4.22; Big Horn $4.00; Campbell $4.00; Carbon $3.94; Converse $4.00; Crook $4.00; Fremont $3.99; Goshen $4.00; Hot Springs $4.15; Johnson $3.98; Laramie $3.94; Lincoln $4.20; Natrona $3.88; Niobrara $4.00; Park $4.12; Platte, $4.00; Sheridan $3.84; Sublette $4.00; Sweetwater $4.03; Teton $4.20; Uinta $4.00; Washakie $4.00; and Weston $4.07

The biggest movers were Albany, up 33 cents, and Lincoln, down 36 cents.

The lowest price per gallon reported in major Wyoming cities:

Basin $4.15; Buffalo $3.95; Casper $3.79; Cheyenne $3.85; Cody $4.10; Douglas $3.79; Evanston $4.22; Gillette $3.87; Jackson $4.18; Kemmerer $4.29; Laramie $3.82; Lusk $3.79; New Castle $3.94; Pinedale $4.05; Rawlins $3.86; Riverton $3.97; Rock Springs $3.93; Sheridan $3.80; Sundance $3.99; Thermopolis $4.12; Wheatland $3.98; Worland $4.08.

The lowest reported average price for unleaded regular continues to be $3.78 in Douglas, while the most expensive gas was in Uinta County at $4.34 per gallon of regular gas.

Tim’s Observations:

Before I give you today’s observations, I just want to say that I’m not an expert in gas and oil, and if anyone can shed a brighter light on or correct anything, please do so. It’s only in this way that we can all get the straight scoop.

You might have heard a lot being said about the “9,000 leases” that oil companies are just sitting on. You might have also heard that sitting on these leases and not using them is contributing to the price of oil and the pain at the pump.

After looking into this, I found it’s not just leases at issue. Oil companies look at a parcel of land and through their best geological examination, decide they want to drill on said parcel. Now they lease that land for use at a future date. Awesome huh? What I see that’s not being said in the national accounts is that having leased land doesn’t guarantee it contains oil

Now you have a lease, but what’s next? Next you need to get a permit to drill. Herein lies the oft ignored portion of the equation. Just because you have a lease from the government, that doesn’t necessarily mean you’ll get a permit to drill.

Add to that, the red tape and long wait involved in ever getting a permit, and you can see why having 9,000 leases is not necessarily a good measure of current or future production.

In my opinion, what we need is a streamlining of the permitting process and a fast-tracking of those permits. After all, it’s not like either side hasn’t done this before, so what’s the holdup?

Once faster permitting happens, the taps should flow and our oil production should go up, forcing oil prices down.

Note: Prices in this report are for reference only. They are gathered the evening before posting, and may not reflect prices that have changed since last posted.