Soon after Russia invaded Ukraine last month, the U.S. and many of its global allies began imposing wide-ranging sanctions that have already resulted in an exodus of international energy industry companies from their Russian holdings and operations.

Although the sanctions announced prior to Tuesday did not directly targeted the export of Russian oil and gas, energy companies stood to be impacted by the sanctions that shut Russia out of global financial markets and restrict technology exports to the country. On Tuesday, President Biden turn further action by announcing a U.S. ban of all imports of Russian oil and gas and coal.

The Exodus

ExxonMobil pledged it will not invest in new developments in Russia and will begin the process to discontinue operations of the Sakhalin-1 project, which it operates on behalf of a consortium of Japanese, Indian and Russian companies.

The oil and gas project is reported to be the one of the single largest international direct investments in Russia, and is based off Sakhalin Island in the Russian Far East. ExxonMobil and Japan each reportedly have a 30% stake in the project, while Russia and India each have 20% interests.

BP announced it would divest of its 20% stake in Russia’s state-owned Rosneft, followed by Shell’s divestment in its 27.5% stake in the Sakhalin-II liquified natural gas facility. Shell has about $3 billion in assets in Russian ventures, while Reuters reports BP has $25 billion invested in the country, and ExxonMobil’s Russian assets were valued at $4 billion.

Oilfield service firms Halliburton, Schlumberger and Baker Hughes all operate in Russia, with their Russian operations reportedly generating from about 2%-20% of each company’s revenues, but the companies have not yet announced their plans in regard to operations in Russia.

Wyoming Expansion

Last fall ExxonMobil announced that after a two-year delay it was initiating the contracting process to expand its carbon capture and storage (CCS) facility in southwestern Wyoming, and last week the company announced it had made a final investment decision to expand CCS at its Shute Creek facility.

The estimated $400 million investment further reduces greenhouse gas emissions, supporting corporate-wide emissions reductions plans, according to the company.

ExxonMobil’s CCS facility near LaBarge currently captures nearly 20% of all human-made CO2 captured in the world each year, the company reported. The expansion project will capture up to 1.2 million metric tons of CO2, in addition to the 6-7 million metric tons captured at LaBarge each year.

“Carbon capture and storage is a readily available technology that can play a critical role in helping society reduce greenhouse gas emissions,” said Joe Blommaert, president of ExxonMobil Low Carbon Solutions. “By expanding carbon capture and storage at LaBarge, we can reduce emissions from our operations and continue to demonstrate the large-scale capability for carbon capture and storage to address emissions from vital sectors of the global economy, including industrial manufacturing.”

ExxonMobil completed front-end engineering and design work for the project in December 2021 and expects to issue the engineering, procurement, and construction contract later this month. Pending regulatory approvals, startup is estimated in 2025, according to a statement from the company.

Shute Creek

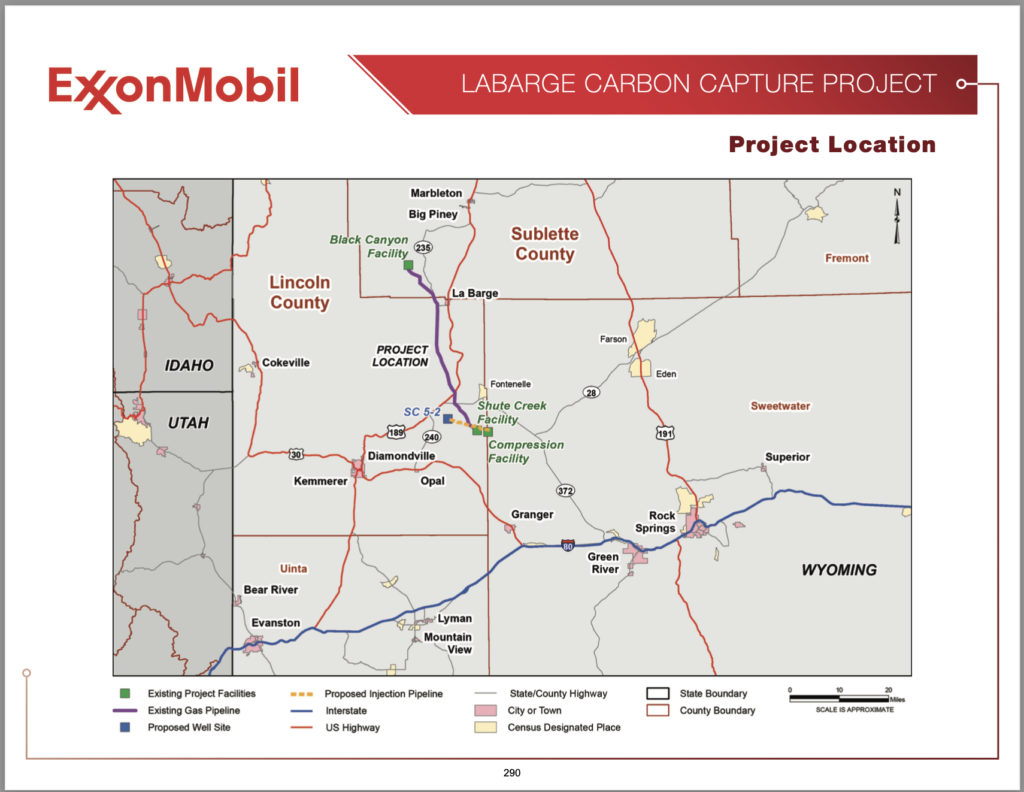

ExxonMobil’s carbon capture project adds new process equipment to the existing Shute Creek facility in Lincoln County and the company’s adjacent carbon dioxide (CO2) compression facility in Sweetwater County, as well as a new CO2 injection well and pipeline in Lincoln County. ExxonMobil’s LaBarge gas wellfield and Black Canyon facility in Sublette County have been operating since 1986, and the Shute Creek facility was constructed in 1984.

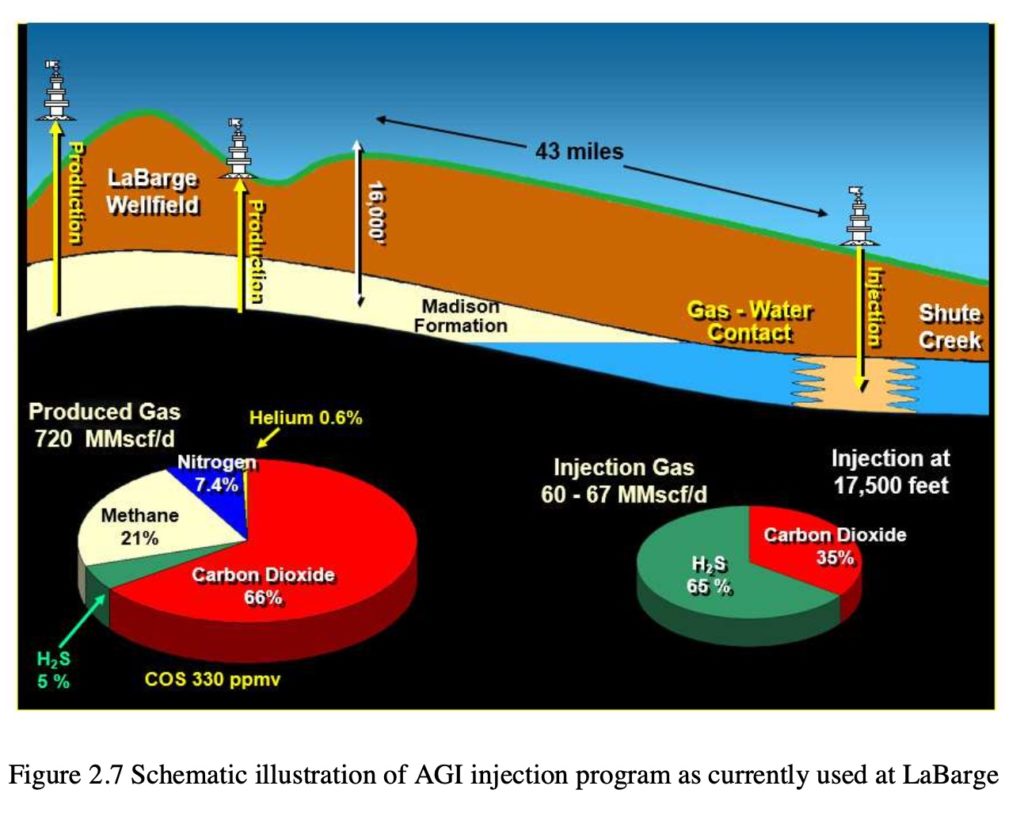

The Shute Creek Treatment Facility (SCTF) processes gas produced from the LaBarge field, handling the lowest hydrocarbon content natural gas commercially produced in the world, according to a 2011 report in Energy Procedia. The company reported: “The gas composition entering Shute Creek is 65% CO2, 21% methane, 7% nitrogen, 5% hydrogen sulfide (H2S) and 0.6% helium. The SCTF separates CO2, methane, and helium for sale and removes hydrogen sulfide for disposal.”

Most of the CO2 captured at Shute Creek is used for enhanced oil recovery (EOR) projects, which the company notes, “has been clearly recognized as an approach to mitigating greenhouse gas emissions while offering the important benefit of providing incremental production of oil and gas.”

Some environmental advocates take issue with EOR projects being viewed as climate friendly. “Going forward, even if it could come close to its target, selling CO2 to produce more oil out of the ground (EOR) is ‘passing the buck’ in terms of managing the release of emissions – it is not a net-zero solution,” says the Institute for Energy Economics and Financial Analysis, which seeks “to accelerate the transition to a diverse, sustainable and profitable energy economy.”

Injection wells

ExxonMobil has operated two acid gas injection wells in the Madison Formation since 2005, taking the H2S and some of the CO2 removed from the produced raw gas and injecting it back into the Madison reservoir. The process provides for acid gas disposal while sequestering CO2. The gas is injected at a depth of 17,500 feet below the surface and approximately 43 miles away from the main producing areas of LaBarge, according to the company’s monitoring report filed with regulatory officials.

Wyoming Governor Mark Gordon released a statement supporting ExxonMobil’s expansion project: “Our state has always been a leader in carbon capture, utilization and sequestration and we are pleased to see projects like this that bring that technology forward. Wyoming and our industries do more than talk about carbon capture technologies. We help develop and deploy them. This announcement is a great example of what industry can do to reduce greenhouse emissions and develop resources.”

In addition to producing natural gas, ExxonMobil’s LaBarge facility is one of the world’s largest sources of helium, producing approximately 20% of global supply. Helium is an essential component for health care equipment such as magnetic resonance imaging, high-tech products including fiber optics and semiconductors, and materials for space travel, according to the company.

Community Benefits

ExxonMobil estimates that the expansion project will involve an average of 162 construction jobs over 29 months, with a peak workforce of 388, and creation of 11 new permanent positions added to its existing 200-person workforce in the area. Sales and use taxes during construction are estimated at $3.9 million for Lincoln County, and $3.2 million in Sweetwater County. The company’s 25-year estimate of ad valorem taxes total $18 million for Lincoln County, and $10 million for Sweetwater County.

Impact Assistance

As part of the permitting process for the project, the Wyoming Industrial Siting Council granted ExxonMobil’s permit to construct and operate the CCS facility in May 2020, and agreed that local communities should receive state impact assistance payments.

Impact assistance funds help to cover costs associated with a project’s impact to local communities due to the short-term increase in population during construction, such as impacts to roads, and emergency and medical services. Communities in Lincoln and Sweetwater counties will receive a total of about $2.5 million in impact assistance payments over a two-year period.