It’s not often you learn that someone seriously argued a low tax burden is a bad thing. In effect, that’s what some legislators recently heard from a presenter, the Director of Laramie County Community College’s Center for Business and Economic Analysis (“LCCCBEA”) appearing at a hearing before the Wyoming Legislature’s Joint Revenue Committee.

Untethered from any discussion of revenue need, the presenter-witness-expert made a gross generalization in fallaciously asserting that Wyoming citizens have the “capacity” to pay more in state taxes. The stated justification being that a low tax burden, high per capita income and low cost of living provide “capacity” for raising taxes that aren’t, in the opinion of the presenter, high enough.

In an article by Nick Reynolds for WyoFile.com, it was reported the Joint Revenue Committee heard testimony from the LCCBEA and its director, Nick Colsch. “Wyoming residents can afford to pay more in taxes” the article stated, “citing the state’s already low tax burden and relatively inexpensive cost of living”. The clear inference being that because you can pay more in taxes, you must, or at least you should.

If ever there was a flimsy reason, and faulty logic to justify raising your taxes, it would be that, you have the “capacity” to pay more and the tax law and rates of a few other states prove it. How? Because these states raise more revenue.

The LCCBEA report, using statistics mostly from 2019, is stale and therefor irrelevant. You remember 2019: Trump was President and the coal, oil, and gas industries were favored. Inflation was something studied in history books. Thousands of Wyoming residents were employed in the well-paying extractive industries and their satellites. 2019 was pre-pandemic and the economy was roaring. Fuel prices for gasoline and diesel, were the lowest in many years.

Since 2019, we have had an economic catastrophe, a virtual shut-down of economic activity, a change in administrations resulting in increased regulatory burdens and a disfavored mineral industry. And, inflation is now eating away at the take-home pay of every Wyoming citizen.

Did the LCCCBEA account for rising fuel prices in a state dependent on the automobile for transportation across vast distances? No.

If you make your living in agriculture, did the LCCCBEA report account for a drouth that threatens your income? No.

If you are a coal miner or roustabout in the oil patch, did the LCCCBEA report take into consideration that you are out of a job when pontificating about your “capacity” to pay more in taxes? No.

If you work in the hospitality industry and have been suffering economically, did the LCCCBEA report take into consideration the effect of Covid 19 on your capacity to pay more in taxes? No.

The point is that Colsch and the LCCCBEA arrive at a conclusion by use of generalized, outdated statistics that may have little application to the specific situation of individual Wyoming taxpayers in 2021 and beyond.

In the WyoFile article, Colsch was not only quoted as saying, “In our view there is capacity for Wyoming citizens to bear a higher tax burden.” He went on to say that, “the state’s earning potential [emphasis added] is significant.

By adopting South Dakota’s tax structure, Wyoming could generate approximately $1.1 billion in additional revenues per year. If it went ‘full socialist’ and adopted the maximum tax rate for property tax, sales tax, fuel tax and others, the state could generate even higher revenues.” Is raising taxes synonymous with “earning”? Not in my World and I bet not in yours.

The WyoFile report did not state how Colsch defined the term “capacity” but the LCCCBEA report makes it clear the word was being used synonymously with “ability to pay”. Colsch’s generalized conclusion was derived from three factors: the relative cost of living in Wyoming, relative per capita income, and the comparison of other states’ tax burden to Wyoming’s.

However, the cost of living in Wyoming varies from locale to locale. If you don’t believe it, just look at the “Cost of Living Adjustment”, in use for the school finance model. “Cost of living” depends also on the basket of goods and services used to make the calculation. For instance, if fuel is not in the basket there is a distortion, especially in rural states that have little public transportation, like Wyoming. Additionally, there is no correlation, much less causation, between what other state’s collect from their residents in taxes and what Wyoming residents can afford to pay.

And, what Wyoming residents can afford to pay varies from year to year. Has there been a blizzard affecting farmers’ and ranchers’ income? Has a power plant or coal mine shut down adversely affecting a local economy? Has a pandemic caused shut downs and unemployment in retail sales and the tourist industry? These are real life events that have occurred in the recent past, or are occurring now. There are many variables affecting “capacity” to pay taxes and they are constantly changing from family to family, region to region, location to location and year to year. Utilizing statistics from 2019 to justify raising taxes in 2022 is fallacious in and of itself.

Because Wyoming citizens, allegedly enjoy a low cost of living and low taxes, the argument goes, our state government should receive the benefit. To the contrary, the level of taxation should depend on the conservative revenue needs of the state as set forth in the state budget passed by the Legislature and approved by the Governor.

Noticeable by its absence was any mention of an amount needed for additional revenue to support a necessary government function, department or program. There apparently was no discussion of that at the committee meeting and there is none in the LCCBEA report. That’s understandable. After all, it is “The Joint Revenue Committee”. But, Colsch’s generalized conclusion based on stale statistics is of great comfort to the appropriators who, if they were listening, were told, “we can get the money, Wyoming citizens have the “capacity” to pay more in taxes”.

From the WyoFile reportage, it seems Colsch and the LCCCBEA took the position at the committee meeting that taxpayers don’t need their money as much as government needs the taxpayers’ money. The unstated corollary is that someone other than you gets to decide what you need and don’t need, i.e., what your “capacity” for more taxes and less of everything else is.

It may be disconcerting to some, this writer included, that the person making the above-mentioned argument, and the entity he leads, is associated with a program dependent on government funding. This suggests there might be bias in the almost giddy assertion of the cornucopia of revenue to be received by state government if Wyoming were to go, “full socialist”.

Putting the “full socialist” comment and the fallacious and generalized conclusion based on irrelevant 2019 statistics aside, a further retort to Colsch’s “capacity” argument is, “who are you to decide what my capacity is; what I can afford; what I need and don’t need”?

The WyoFile article reported that there was pushback at the hearing from at least one legislator. State Senator Tom James (R-Sweetwater) was quoted as saying,” If we really wanted to look at raising revenue, would we not want to look to encourage private-sector business to come to Wyoming instead of raising taxes?”

Later, in an interview with this writer, Senator James expanded on his statement at the committee hearing:

“I believe the government, legislators, lobbyists and bureaucrats, always turn to either new taxes, tax increases, new fees, or fee increases. Instead, we should be looking at new revenue sources like bringing in new jobs, and looking at the actual role of government to ensure the government is not competing with the private sector and not being the number one employer in the state.

“We should also be looking at cutting spending because we have a spending problem, not a revenue problem.”

Senator James’ common-sense observations make a lot more common-sense than does Colsch’s fallacious conclusion.

The proponents of the Colsch argument and LCCCBEA report err in another way. They assume (and want you to assume) that revenue lost from the collapsing mineral industry must be replaced. That assumption is not necessarily valid. This state’s economy has changed. The government that was erected to assist, regulate and oversee the extractive industries also needs to be nimble enough to change in response.

Not only are there government missions and functions that may no longer be necessary given the changes in Wyoming’s economy, there are efficiencies waiting to be implemented for those missions and functions that are still important. A worthwhile task would be to differentiate between what is necessary and what is not and to identify and implement efficiencies that will save precious taxpayer resources. This task should be a condition precedent to any tax increase.

Wyoming is experiencing some tough times but no tougher than others we have lived through. Wyoming doesn’t need to go, “full socialist”. We may not even need to raise taxes if enough outdated or unnecessary government functions are discarded and enough operational efficiencies are identified and implemented.

When considering whether to raise taxes or not, my hope is that the decision will be made based on the conservative revenue needs of a stream-lined, efficient, and frugal state government, not the “capacity” of taxpayers to pay more.

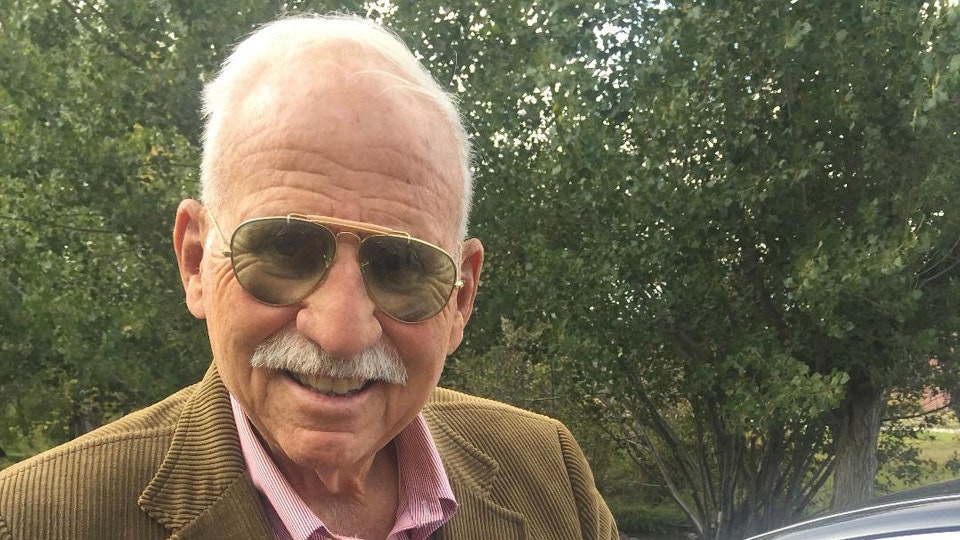

Ray Hunkins is a retired attorney and rancher. He was the Republican nominee for Governor in 2006.