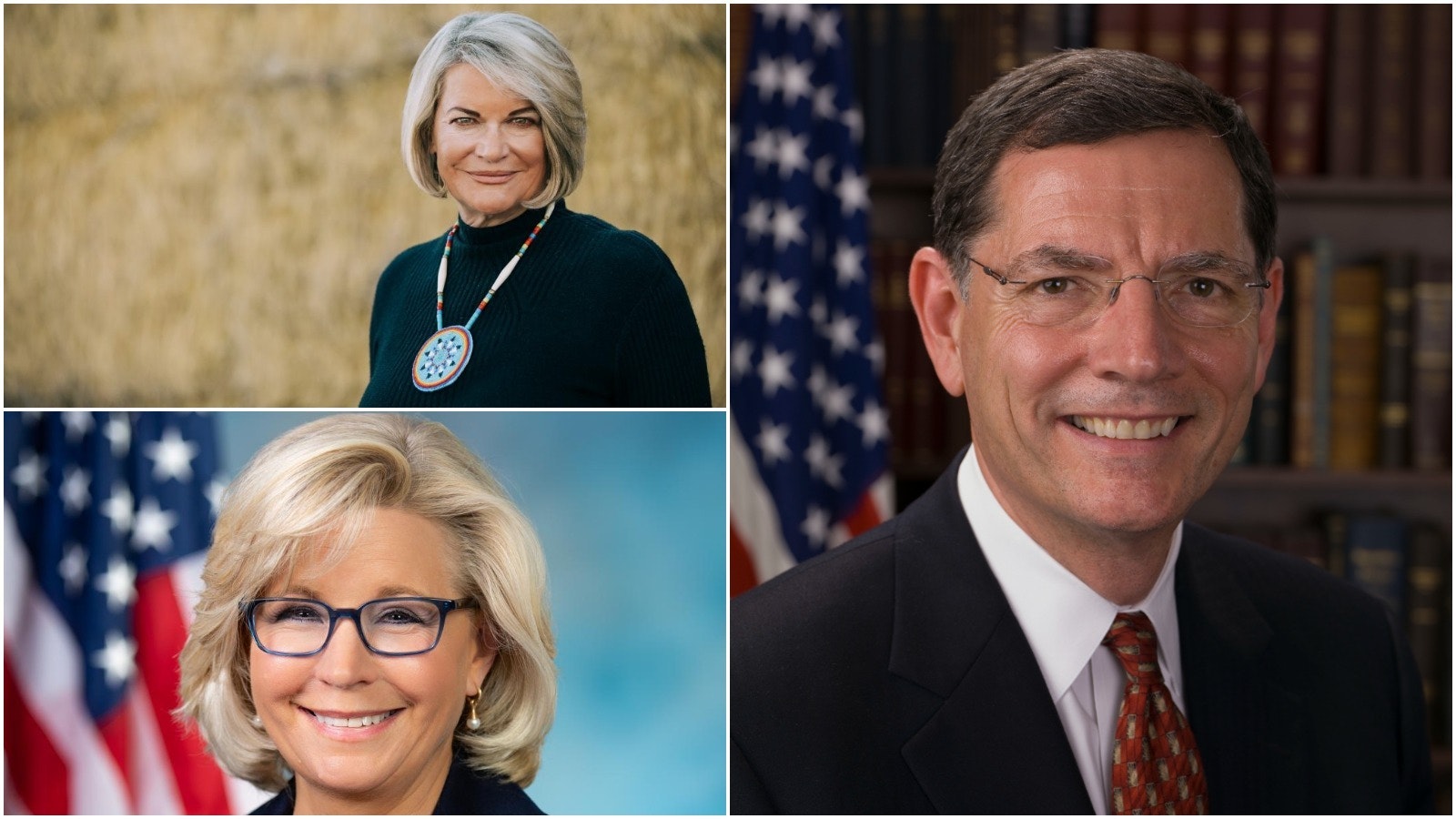

Both U.S. Sen. John Barrasso and U.S. Rep. Liz Cheney on Wednesday took swings at House Speaker Nancy Pelosi for failing to act on an economic program designed to help small businesses.

The two shared a similar criticism of Pelosi: by failing to act on a bill that expands the Paycheck Protection Program, millions of people employed by small businesses won’t receive paychecks.

“You [Pelosi] are blocking money for American families facing economic devastation, and you refuse to call the House into session or let us operate remotely in a time of national crisis. Dump the partisan invective and do your job,” Cheney tweeted.

Earlier in the day, the congresswoman told KFBC radio’s Reese Monaco that Pelosi was dragging her feet because Democrats wanted to fund additional pet projects in the bill.

“We watched, for example, when they delayed the $2.2 trillion CARES Act because they wanted to make sure there was language in there for things like the Kennedy Center and the National Endowment for the Arts,” she said.

“What they’re doing is trying to block legislation that we need for the American people so they can get some of their pet projects adopted. In this case, the only piece of the CARES Act that is on the verge of running out of money is this loan program for small businesses,” she added.

Barrasso said Republican senators are ready to go back to work immediately if Pelosi calls the House into session.

Lamenting that the original Paycheck Protection Program was passed 96-0 in the U.S. Senate, Barrasso said he couldn’t understand why Pelosi was dragging her feet as the need for expansion of the program, he said, was urgent.

“Pelosi is blocking these paychecks to the American people,” Barrasso said on FOX News. “It is just unconscionable that Pelosi has no urgency.”

“Nancy Pelosi, with her liberal wish list, is saying we aren’t going to approve it unless we spend money on other things that right now aren’t focused on the American public,” he said.

Barrasso said the U.S. is allocating $30 billion per day under the existing Paycheck Protection Program and funds would be depleted by the end of the week.

The Paycheck Protection Program assists small businesses obtain loans to cover eight weeks of payroll, benefits, rent and other expenses.

Loans, under this program, will be changed to grants and later forgiven if 75% of the loan is used to keep employees on the payroll. It was created as part of the CARES Act that passed in March.