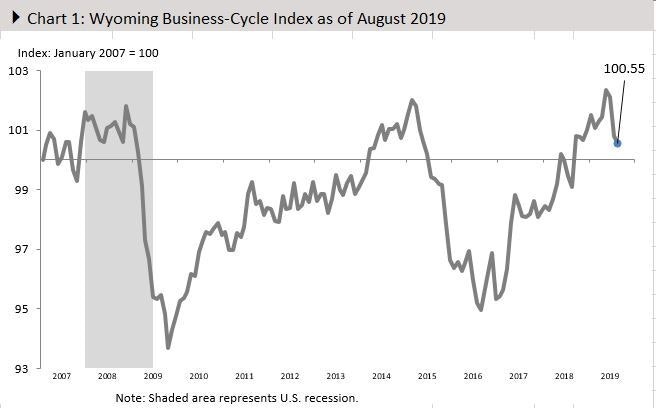

Wyoming’s economy continues to grow, but it’s at a slower pace than in the past – raising the question of whether a recession is in the near future.

Consider this: Wyoming’s number of single-family residential building permits increased by just six in the first eight months of the year over the same period last year.

That’s according to the Wyoming MACRO Report, a quarterly publication looking at economic and revenue data.

Non-farm employment is up only 1.3 percent in August of this year, compared to August 2018, blunted by 1,400 jobs lost in mining – including coal — and virtually no growth in oil and gas jobs, the report states.

Natural gas production was down 11.2 percent in August compared to August 2018, and coal production was down 8.9 percent in the first eight months of the year. On the other hand, oil production was up 17.3 percent in an August year-over-year comparison, the report said.

Generally, a recession is defined as a decrease in gross domestic product over two successive quarters. The data in the MACRO report does not show Wyoming in such a contraction.

However, the economy of the state – and the country – haven’t been in a recession for a decade. They may be overdue for one.

“The average economic expansion is much shorter than this,” said Anne Alexander, a University of Wyoming associate vice provost and economist. “It’s now the longest we’ve had. But it’s called a cycle for a reason. They do turn.”

The reasons Wyoming economic growth is decelerating have to do with the trade wars, the headwinds that coal has faced in recent years and the effects of a slower national economy, Alexander said.

“It’s a combination of national, international and our own state’s circumstances,” she said.

There is no formula for economists to predict a recession with certainty. But Alexander said it’s more likely than not that the economy headed toward a larger slowdown.

“The indicators have been pointing to that way for a while,” she said. “The arrival time might already be here or might be early 2020.”

Across the country, manufacturing is down, U.S. home sales are steady but prices are down and rail freight volumes are down, she said.

Wyoming typically gets an advance warning – sometimes six months — before a recession, said Jim Robinson, principal economist for the Wyoming Department of Administration and Information’s Economic Analysis Division.

That’s because the national economy often heads south before the state’s. For instance, when the demand for factory goods decreases, it takes some time for manufacturing energy demand to also decline, Robinson said, and Wyoming’s primary export is energy.

Robinson, who helps put together the MACRO and other economic reports, said he is keeping an eye on retail sales in a sector known as discount grocery stores and super centers. Think Walmart or Sam’s Club.

“That subsector for Wyoming is down 4.5 percent this year,” he said. “That’s consumer spending. That’s important.”

The decrease may have to do with President Donald Trump’s tax cuts, which boosted consumer spending in 2018.

“That’s not happening to the same degree this year,” he said. “But also, consumers are starting to pull back this year.”